October 05, 2021

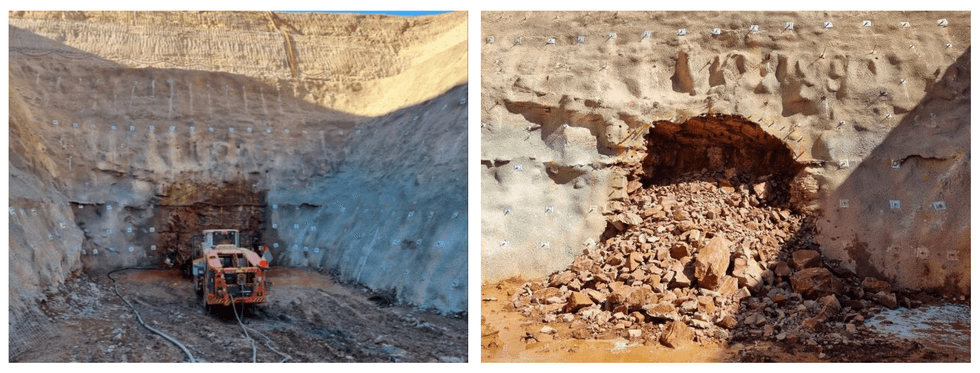

GALENA MINING LTD. ("Galena" or the "Company") (ASX: G1A) announces that mining of the underground decline has commenced at its Abra Base Metals Project ("Abra" or the "Project").

Managing Director, Tony James commented, "Taking the first cut in the portal to start the underground decline at Abra is very exciting. This keeps us on track for first commercial production of our high-value, high-grade lead-silver concentrate at the start of 2023. It is also the historical beginning of mining in the very prospective Edmund Sedimentary Basin. Special appreciation is given to Byrnecut and the Abra team on site for the extremely professional approach taken to achieve the official commencement of underground mining at Abra".

Byrnecut Australia Pty Ltd ("Byrnecut"), the mining contractor for Abra, commenced operations for the underground decline on Tuesday 5 October following the deployment of people and equipment to the mine site, and completion of final box-cut preparation works and services installation.

Primary decline works are expected to continue for approximately 14-months to gain access to the orebody and with their commencement on-time, the Abra Base Metals Project remains on-track for first commercial ore production at the start of 2023.

Read the full article here.

G1A:AU

The Conversation (0)

12 September 2022

Galena Mining

Galena Mining CEO Tony James said, “People have been just sitting and watching how we would perform this year, a perceived difficult construction period. But we've done a great job."

Galena Mining CEO Tony James said, “People have been just sitting and watching how we would perform this year, a perceived difficult construction period. But we've done a great job." Keep Reading...

06 March

Peter Krauth: Silver Cycle Still Early, Big Money Ready to Buy

Peter Krauth, editor of Silver Stock Investor and Silver Advisor, shares his thoughts on silver price activity and where the white metal is in the cycle. He believes the awareness phase is just beginning, with mania still relatively far in the future. Don't forget to follow us @INN_Resource for... Keep Reading...

05 March

Chen Lin: Key Silver Date to Watch, My Favorite 2026 Commodities

Chen Lin of Lin Asset Management weighs in on silver and gold, as well as the critical minerals market, which is his favorite sector for 2026. He also discusses how conflict in the Middle East could impact the resource sector. Don't forget to follow us @INN_Resource for real-time... Keep Reading...

05 March

Prince Silver: Fully Funded and Targeting 100 Million Ounces Silver Equivalent in Nevada

Ranking first in the world in the Fraser Institute’s 2025 Annual Survey of Mining Companies, Nevada remains a top choice for companies. Prince Silver’s (CSE:PRNC,OTCQB:PRNCF) flagship Prince silver project stands to benefit from its outstanding permitting process and geology.Prince Silver CEO... Keep Reading...

04 March

What's Next for the Silver Price After $100 Per Ounce?

First Majestic Silver (TSX:AG,NYSE:AG) CEO Keith Neumeyer’s silver price prediction of over US$100 per ounce came true in 2026. When will silver prices make a more lasting hold in triple digit territory?The silver price was up over 189 percent year-on-year as of March 2, 2026, on the back of... Keep Reading...

27 February

Obonga Project: Wishbone VMS Update

Panther Metals Plc (LSE: PALM), the exploration company focused on mineral projects in Canada, is pleased to provide an update for the Obonga Project's Wishbone Prospect which is an emerging and highly prospective base metal volcanogenic massive sulphide ("VMS") system in Ontario,... Keep Reading...

26 February

Agadir Melloul Mining Licence

Critical Mineral Resources is pleased to announce that a Mining Licence has been awarded for Agadir Melloul, marking an important step forward as the Company accelerates development towards production.The Mining License is 14.6km 2 and covers Zone 1 North and Zone 2, which remain the focus of... Keep Reading...

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00