February 28, 2025

Castle Minerals (ASX:CDT) is dedicated to advancing its Kpali and Kandia gold projects in Ghana’s Upper West region, a significantly under-explored yet highly prospective geological setting within the West African gold belt. The company is committed to identifying, exploring, and developing economically viable gold deposits by leveraging the region’s rich mineral endowment and proven mining history.

Castle’s portfolio is anchored by its flagship Kpali and Kandia gold projects, both demonstrating significant potential for resource expansion and economic development. Castle aims to delineate and grow its resource base, positioning itself as a key player in Ghana’s emerging gold sector. The company’s dedication to sustainable exploration practices and strong community partnerships further strengthens its ability to operate effectively and responsibly in the region.

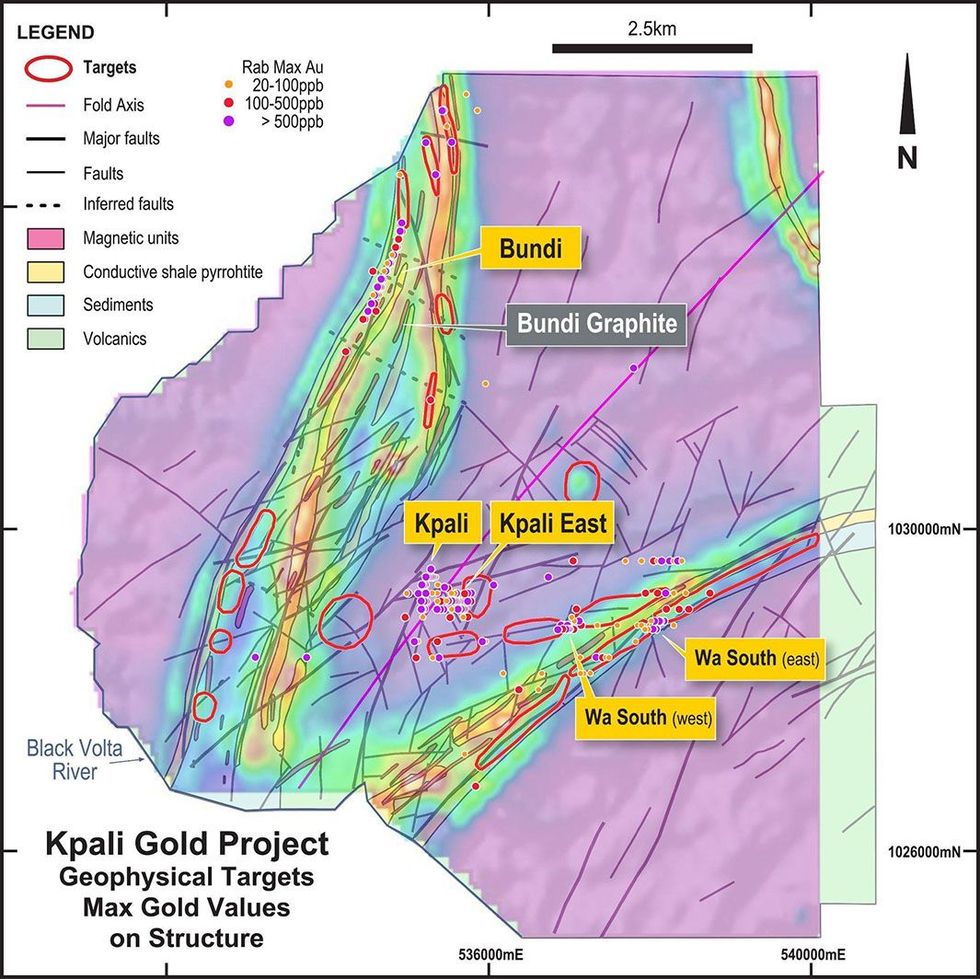

The Kpali gold project, a key focus of Castle Minerals, is located 30 km west of Sawla in Ghana’s Upper West region. It includes the Kpali and Bundi prospects within the 170 sq km Degbiwu prospecting license (PL 10/26), surrounded by the 1,033 sq km Gbiniyiri retention license (RL 8/27). The licenses’ western boundaries follow the Black Volta River, bordering Burkina Faso.

Company Highlights

- 100 percent ownership of a 2,686 sq km strategic landholding in Ghana’s highly prospective Upper West region.

- Flagship Kpali and Kandia gold projects with high-grade gold mineralization and significant resource expansion potential.

- Strong management team with a proven track record in West African gold discoveries and project development.

- Proximity to the multi-million-ounce Black Volta gold project, enhancing economic potential and development synergies.

- Robust exploration pipeline with systematic drilling programs aimed at resource expansion and near-term development.

- Commitment to sustainable and responsible exploration practices, with strong community and government engagement.

- Positioned to capitalize on the growing global demand for gold through disciplined exploration and strategic partnerships.

This Castle Minerals profile is part of a paid investor education campaign.*

Click here to connect with Castle MInerals (ASX:CDT) to receive an Investor Presentation

CDT:AU

The Conversation (0)

01 October 2025

Cote D'Ivoire Soils Underway and Ghana Auger Well Advanced

Castle Minerals (CDT:AU) has announced Cote D'Ivoire Soils Underway and Ghana Auger Well AdvancedDownload the PDF here. Keep Reading...

01 September 2025

Target Defining Auger Campaign Commenced at Kandia

Castle Minerals (CDT:AU) has announced Target Defining Auger Campaign Commenced at KandiaDownload the PDF here. Keep Reading...

31 August 2025

CDT moves to 100% Mineralis to secure Cote d'Ivoire Earn-In

Castle Minerals (CDT:AU) has announced CDT moves to 100% Mineralis to secure Cote d'Ivoire Earn-InDownload the PDF here. Keep Reading...

21 August 2025

Castle to Acquire Extensive Cote d'Ivoire Footprint

Castle Minerals (CDT:AU) has announced Castle to Acquire Extensive Cote d'Ivoire FootprintDownload the PDF here. Keep Reading...

19 August 2025

Trading Halt

Castle Minerals (CDT:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

4h

Flow Metals to Acquire the Monster IOCG Project in Yukon

Flow Metals Corp. (CSE: FWM) ("Flow Metals" or the "Company") is pleased to report that it has entered into an option agreement dated February 9, 2026 (the "Option Agreement") with Go Metals Corp. ("Go Metals") to acquire the Monster IOCG project (the "Monster Project"), located approximately 90... Keep Reading...

16h

Investor Presentation

Aurum Resources (AUE:AU) has announced Investor PresentationDownload the PDF here. Keep Reading...

17h

Dr. Adam Trexler: Physical Gold Market Broken, Crisis Unfolding Now

Dr. Adam Trexler, founder and president of Valaurum, shares his thoughts on gold, identifying a key issue he sees developing in the physical market. "There's a crisis in the physical gold market," he said, explaining that sector participants need to figure out how to serve investors who want to... Keep Reading...

18h

Trevor Hall: Bull Markets Don’t Always Mean Big Returns

Clear Commodity Network CEO and Mining Stock Daily host Trevor Hall opened his talk at the Vancouver Resource Investment Conference (VRIC) with a strong message: It is still possible to go broke in a bull market.“I want to start with the simple but uncomfortable truth: most investors don't lose... Keep Reading...

18h

How Near-term Production is Changing the Junior Gold Exploration Model

Junior gold companies have traditionally been defined by exploration: identifying prospective ground, drilling to delineate a resource and, ideally, monetising that discovery through a sale or joint venture with a larger producer. While this model has delivered success in the past, changing... Keep Reading...

18h

Gold Exploration in Guinea: An Emerging Opportunity in West Africa

While much of West Africa’s gold exploration spotlight has historically fallen on countries like Ghana and Mali, Guinea is increasingly emerging as a quiet outlier — a country with proven gold endowment, expansive underexplored terrain and a growing number of active exploration programs. Despite... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00