June 11, 2025

Asara Resources Limited (ASX: AS1; Asara or Company)) is pleased to announce that following the conclusion of litigation (Civil Claim) against the Company in Chile, it has received a cash payment of USD$100,000 (A$153,725)1in relation to its US$17.6m Option and Joint Venture Agreement (Agreement) with Teck Resources Chile Limitada (Teck Chile)2 on its Loreto Copper Project (Loreto) located in Northern Chile.

Transaction Terms

Pursuant to the Agreement, Teck Chile has been granted options, to earn up to a 75% interest in Loreto by making US$600,000 in staged cash payments and spending US$17m on exploration.

First Option

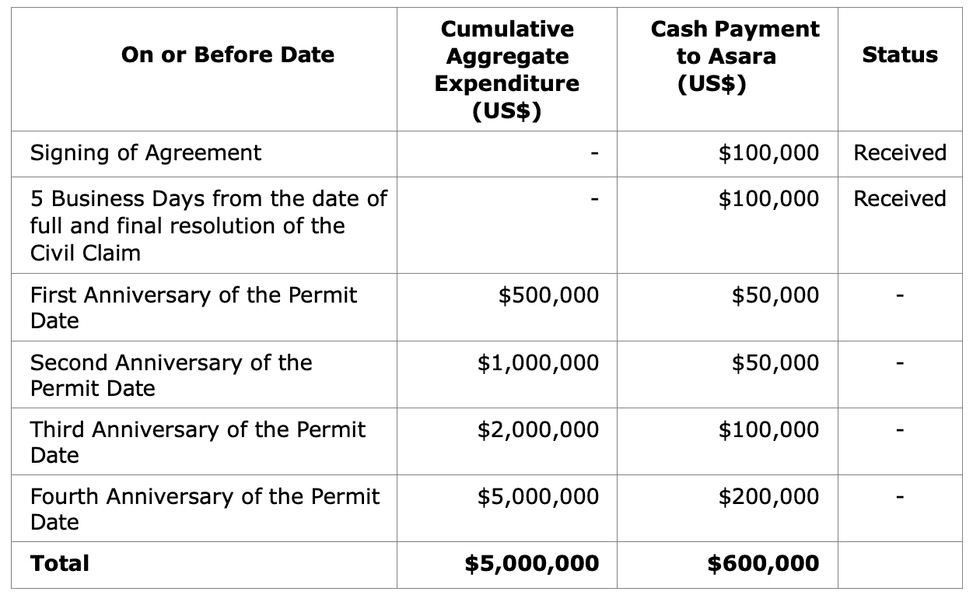

Asara has granted Teck Chile an option to acquire a 55% interest in Loreto (the First Option). Teck Chile may exercise the First Option by incurring an aggregate of US$5,000,000 in expenditures on Loreto and by making US$600,000 in cash payments to Asara as set out in the schedule below. The dates for remaining payments, are tied to the Permit Date.

Second Option

If Teck Chile exercises the First Option, Teck Chile shall have a further option to acquire an additional 20% interest in Loreto, by incurring an additional US$12,000,000 in expenditures over the ensuing four-year period (the Second Option).

Loreto Project Litigation

As announced on 8 May 2025, Asara successfully concluded legal proceedings brought against the Company as outlined in its ASX Announcement dated 15 November 2023. As part of the settlement, Asara was required to sell 25.26% of its interest in the Loreto Project to Costa Rica Dos SpA (Costa Rica Dos) for approximately A$87,122 with payment to be made through future profits generated in the context of the Agreement with Teck Chile. Accordingly, Asara is not required to remit the requisite portion of the recent payment to Costa Rica Dos.

Click here for the full ASX Release

This article includes content from Asara Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

AS1:AU

Sign up to get your FREE

Asara Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

07 July 2025

Asara Resources

Advancing the next West African gold camp from the heart of Guinea’s prolific Siguiri Basin

Advancing the next West African gold camp from the heart of Guinea’s prolific Siguiri Basin Keep Reading...

26 January

Drilling confirms grade continuity at depth and along strike

Asara Resources (AS1:AU) has announced Drilling confirms grade continuity at depth and along strikeDownload the PDF here. Keep Reading...

22 January

Quarterly Activities and Cashflow Report - December 2025

Asara Resources (AS1:AU) has announced Quarterly Activities and Cashflow Report - December 2025Download the PDF here. Keep Reading...

04 January

Ongoing Drilling Continues to Return Broad Gold Intercepts

Asara Resources (AS1:AU) has announced Ongoing drilling continues to return broad gold interceptsDownload the PDF here. Keep Reading...

08 December 2025

Asara Expands Kada Gold Project

Asara Resources (AS1:AU) has announced Asara Expands Kada Gold ProjectDownload the PDF here. Keep Reading...

01 December 2025

Massan Resource Infill and Extension Drilling Delivers More Positive Results

West African gold explorer Asara Resources Limited (ASX: AS1; Asara or Company) is pleased to announce the second set of results from 11 drill holes (totalling 2,455m) from the Phase 1 Reverse Circulation (RC) drilling program within the Massan deposit Mineral Resource Estimate (MRE) area at its... Keep Reading...

Latest News

Sign up to get your FREE

Asara Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00