April 01, 2025

Cartier Resources (TSXV:ECR,FSE:6CA) is a Quebec-based gold exploration company driving a high-potential growth story in the prolific Abitibi Greenstone Belt, one of Canada’s premier gold-producing regions. The company is steadily expanding its gold resource base while advancing its flagship Cadillac project into an emerging mining camp east of Val-d’Or.

The Cadillac project is an emerging gold camp with multiple deposits, advanced resource modeling, and a clear development path. Located in a mining-friendly jurisdiction with existing infrastructure, the Cadillac project is ideally positioned to attract development partners, strategic investments or acquisition interest from senior producers.

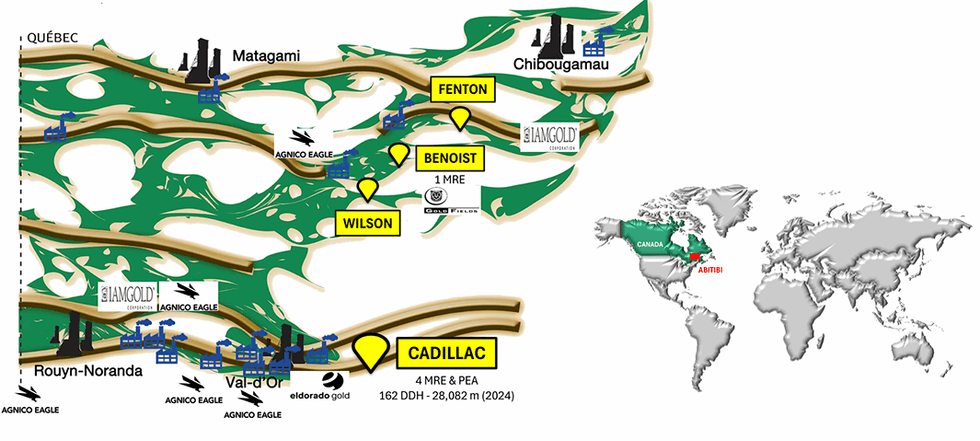

Cartier projects in the Abitibi Greenstone Belt in Quebec

Cartier projects in the Abitibi Greenstone Belt in QuebecThe Cadillac Project exhibits all the key attributes of a high-potential, development-stage gold asset—strong grade, significant scale, a favorable jurisdiction, established infrastructure, and strategic backing. In addition, Cartier is actively exploring parallel value-creation opportunities, such as reprocessing legacy tailings at the Chimo site and unlocking value from non-core assets like Wilson, Fenton, and Benoist.

Company Highlights

- Cartier Resources’ core asset, the Cadillac project, consolidates the former Chimo Mine and East Cadillac properties into a high-potential district-scale land package on the prolific Larder Lake-Cadillac Fault — host to over 100 million ounces of historic gold production.

- A 2023 PEA outlined robust project fundamentals with 116,900 oz/year production over 9.7 years, a post-tax NPV of C$388 million, and IRR of 20.8 percent at US$1,750/oz gold.

- Cartier is launching a 100,000 meter drill program in 2025, one of the largest exploration campaigns in the region, to expand its already substantial gold resources and demonstrate Cadillac’s camp-scale potential.

- Cartier is at the forefront of innovation, deploying AI-assisted mineral discovery tools in partnership with VRIFY to enhance drill targeting and accelerate new discoveries.

- With a 28 percent equity stake, Agnico Eagle is Cartier’s largest shareholder and an active financial partner — a clear vote of confidence in Cartier’s assets and strategy.

- A newly introduced low-capex, ESG-friendly initiative to assess reprocessing of 600,000 tons of historic mine tailings — representing a potential near-term revenue stream.

- Cartier boasts a clean share structure with a market cap of just C$47 million, presenting strong re-rating potential as catalysts are delivered.

This Cartier Resources profile is part of a paid investor education campaign.*

Click here to connect with Cartier Resources (TSXV:ECR) to receive an Investor Presentation

ECR:CC

Sign up to get your FREE

Cartier Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

26 October 2025

Cartier Resources

Advancing Cadillac Project: An emerging gold camp east of Val-d’Or in the prolific Abitibi Greenstone Belt

Advancing Cadillac Project: An emerging gold camp east of Val-d’Or in the prolific Abitibi Greenstone Belt Keep Reading...

06 March

Adrian Day: Gold Dips Bought Quickly, Price Run Not Over Yet

Adrian Day, president of Adrian Day Asset Management, shares his latest thoughts on what's moving the gold price, emphasizing that its bull run isn't over yet. "It's monetary factors that are driving gold — that's what's fundamentally driving gold," he said. "Monetary factors, lack of trust in... Keep Reading...

06 March

Brien Lundin: Gold, Silver Stock Run Just Starting, Get in Now

Brien Lundin, editor of Gold Newsletter and New Orleans Investment Conference host, shares his stock-picking strategy at a time when high metals prices are beginning to lift all boats. In his view, gold and silver equities may still only be in the second inning. Don't forget to follow us... Keep Reading...

06 March

Venezuela Gold Set for US Market in Brokered Deal

A new US-Venezuela gold deal could soon channel hundreds of kilograms of bullion from the South American nation into American refineries.Venezuela’s state-owned mining company, Minerven, has agreed to sell between 650 and 1,000 kilograms of gold dore bars to commodities trading house Trafigura... Keep Reading...

05 March

Rick Rule: Gold Price During War, Silver Strategy, Oil Stock Game Plan

Rick Rule, proprietor at Rule Investment Media, shares updates on his current strategy in the resource space, mentioning gold, silver, oil and agriculture. He also reminds investors to pay more attention to gold's underlying drivers than to current events.Click here to register for the Rule... Keep Reading...

05 March

Lobo Tiggre: Gold, Oil in Times of War, Plus My Shopping List Now

Lobo Tiggre of IndependentSpeculator.com shares his thoughts on how gold, silver and oil could be impacted by the developing situation in the Middle East. He cautioned investors not to chase these commodities if prices run. Don't forget to follow us @INN_Resource for real-time updates!Securities... Keep Reading...

05 March

TomaGold: New High-grade Deep Discovery at Berrigan Mine

TomaGold (TSXV:LOT) President, CEO and Director David Grondin said the company is focusing on its flagship Berrigan mine in Chibougamau, Québec, following a large, significant discovery at depth.Berrigan is 4 kilometers northwest of the city of Chibougamau and has existed for about 50 years.... Keep Reading...

Latest News

Sign up to get your FREE

Cartier Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00