April 01, 2025

Cartier Resources (TSXV:ECR,FSE:6CA) is a Quebec-based gold exploration company driving a high-potential growth story in the prolific Abitibi Greenstone Belt, one of Canada’s premier gold-producing regions. The company is steadily expanding its gold resource base while advancing its flagship Cadillac project into an emerging mining camp east of Val-d’Or.

The Cadillac project is an emerging gold camp with multiple deposits, advanced resource modeling, and a clear development path. Located in a mining-friendly jurisdiction with existing infrastructure, the Cadillac project is ideally positioned to attract development partners, strategic investments or acquisition interest from senior producers.

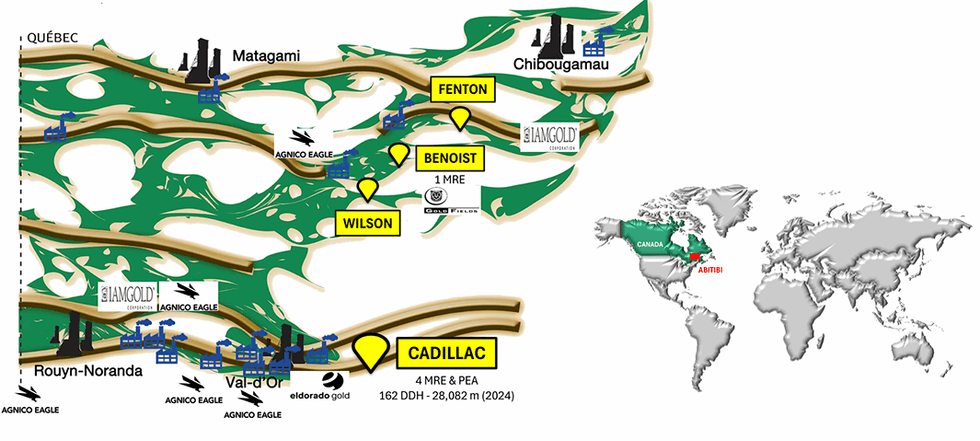

Cartier projects in the Abitibi Greenstone Belt in Quebec

Cartier projects in the Abitibi Greenstone Belt in QuebecThe Cadillac Project exhibits all the key attributes of a high-potential, development-stage gold asset—strong grade, significant scale, a favorable jurisdiction, established infrastructure, and strategic backing. In addition, Cartier is actively exploring parallel value-creation opportunities, such as reprocessing legacy tailings at the Chimo site and unlocking value from non-core assets like Wilson, Fenton, and Benoist.

Company Highlights

- Cartier Resources’ core asset, the Cadillac project, consolidates the former Chimo Mine and East Cadillac properties into a high-potential district-scale land package on the prolific Larder Lake-Cadillac Fault — host to over 100 million ounces of historic gold production.

- A 2023 PEA outlined robust project fundamentals with 116,900 oz/year production over 9.7 years, a post-tax NPV of C$388 million, and IRR of 20.8 percent at US$1,750/oz gold.

- Cartier is launching a 100,000 meter drill program in 2025, one of the largest exploration campaigns in the region, to expand its already substantial gold resources and demonstrate Cadillac’s camp-scale potential.

- Cartier is at the forefront of innovation, deploying AI-assisted mineral discovery tools in partnership with VRIFY to enhance drill targeting and accelerate new discoveries.

- With a 28 percent equity stake, Agnico Eagle is Cartier’s largest shareholder and an active financial partner — a clear vote of confidence in Cartier’s assets and strategy.

- A newly introduced low-capex, ESG-friendly initiative to assess reprocessing of 600,000 tons of historic mine tailings — representing a potential near-term revenue stream.

- Cartier boasts a clean share structure with a market cap of just C$47 million, presenting strong re-rating potential as catalysts are delivered.

This Cartier Resources profile is part of a paid investor education campaign.*

Click here to connect with Cartier Resources (TSXV:ECR) to receive an Investor Presentation

ECR:CC

Sign up to get your FREE

Cartier Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

26 October 2025

Cartier Resources

Advancing Cadillac Project: An emerging gold camp east of Val-d’Or in the prolific Abitibi Greenstone Belt

Advancing Cadillac Project: An emerging gold camp east of Val-d’Or in the prolific Abitibi Greenstone Belt Keep Reading...

06 February

Editor's Picks: Is Gold and Silver's Price Correction Over?

It's been a wild couple of weeks for gold and silver. After surging to record highs at the end of January, prices for both precious metals saw significant corrections, creating turmoil for market participants.This week brought some relief, with gold bouncing back from its low point and even... Keep Reading...

06 February

Blackrock Silver to Present at the Precious Metals and Critical Minerals Virtual Investor Conference on February 10th 2026

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce that Andrew Pollard, President & Chief Executive Officer of the Company, will present live at the Precious Metals & Critical Minerals Virtual Investor Conference hosted... Keep Reading...

05 February

Experts: Gold's Fundamentals Intact, Price Could Hit US$7,000 in 2026

Gold took center stage at this year's Vancouver Resource Investment Conference (VRIC), coming to the fore in a slew of discussions as the price surged past US$5,000 per ounce. Held from January 25 to 26, the conference brought together diverse experts, with a focus point being the "Gold... Keep Reading...

05 February

Barrick Advances North American Gold Spinoff After Record 2025 Results

Barrick Mining (TSX:ABX,NYSE:B) said it will move ahead with plans to spin off its North American gold assets after a strong finish to 2025.The Toronto-based miner said its board has authorized preparations for an IPO of a new entity that would house its premier North American gold operations,... Keep Reading...

05 February

Peruvian Metals Secures 6 Year Agreement with Community at Mercedes Project

Peruvian Metals Corp. (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals or the "Company") is pleased to announce that the agreement between San Maurizo Mines Ltd. ("San Maurizo"), a private Manitoba company which holds a 100% direct interest in the Mercedes Property, and Comunidades... Keep Reading...

05 February

TomaGold Borehole EM Survey Confirms Berrigan Deep Zone

Survey also validates significant mineralization and unlocks new targets Highlights Direct correlation with mineralization : The modeled geophysical plates explain the presence of semi-massive to massive sulfides intersected in holes TOM-25-009 to TOM-25-015. Priority target BER-14C :... Keep Reading...

Latest News

Sign up to get your FREE

Cartier Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Equity Metals Exhibiting at the 2026 PDAC

06 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00