March 20, 2024

Brightstar Resources Limited (ASX: BTR) (Brightstar) is pleased to announce that following on from the maiden and second gold pours announced 07/03/20241 and 12/02/20242, all processing of the ore from the Selkirk joint venture has successfully been completed at Genesis Minerals’ Gwalia processing plant.

HIGHLIGHTS

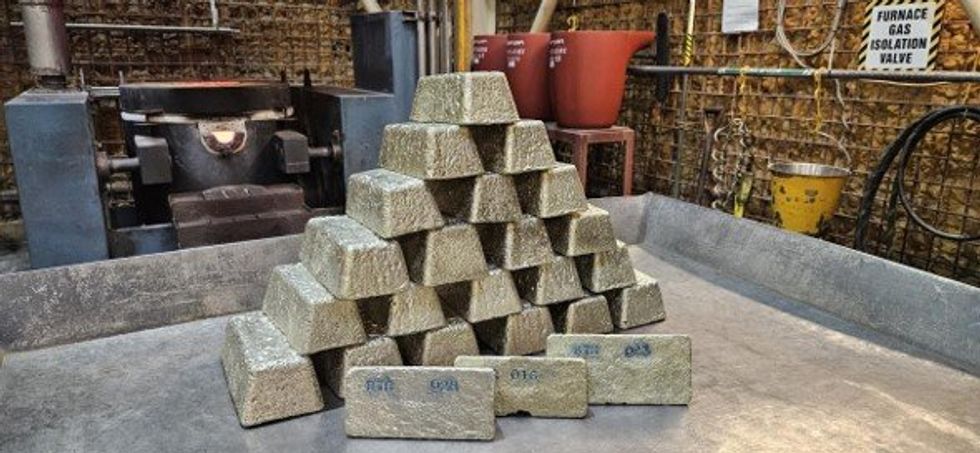

- Brightstar has successfully finalised its gold pours from ore processing of Selkirk material from the Menzies Gold Project, with a total of 430.7kg of gold doré poured

- Total preliminary unreconciled ounces produced of 8,049.6oz exceeds the modelled JV budget for Selkirk and highlights the quality of Brightstar’s Menzies Gold Project

- Positive reconciliations of ore mined, head grade and metallurgical recoveries exceeded Brightstar’s expectations

- Total joint venture costs are being finalised and are expected to be approximately $12 - $13 million

- Refining of the gold doré is ongoing at the Perth Mint, after which all metals refined will be sold and the revenue will be generated to the JV on a 50/50 Profit Share

- The first 28 gold doré bars have been refined and sold at the Perth Mint, with 5,546 ounces sold at A$3,306/oz for $18M revenue generated under the joint venture

Brightstar advises that processing of the remainder of the ore from the Selkirk mining joint venture has successfully completed, with total unreconciled gold production of 8,049.6oz from 43 gold doré bars produced in the campaign.

Final reconciliations of the gold-in-circuit are underway between Brightstar’s independent metallurgists and Genesis Minerals Ltd. With the current AUD gold price trading at approximately A$3,300/oz, the revenue to be generated from the Selkirk mining campaign significantly exceeds the joint ventures model (done at A$2,850/oz) and BTR management expectations due to additional recovered ounces at a higher gold price.

To date, 5,546oz have been sold to the Perth Mint after refining at an average realised sale price of A$3,306/oz.

Final costs for the joint venture are still being finalised and reconciled, and once approved by the joint venture, the net project income will be split 50/50 between Brightstar and our joint venture partner BML Ventures Pty Ltd. Total project costs are expected to be approximately A$12 - $13 million.

Brightstar’s Managing Director, Alex Rovira, commented “We are pleased to announce that gold processing of our Selkirk Mining JV material has safely and successfully concluded by the team at Genesis Minerals Ltd’s Gwalia operation. Their assistance, along with JT Metallurgists acting on behalf of the joint venture, has seen the successful processing of ore from the Menzies Gold project into doré bars poured at record high AUD gold prices.

In parallel with the finalisation of gold-in-circuit calculations, which is expected to occur shortly, we are also finalising the joint venture accounts and making provisions for rehabilitation and waste dump seeding to achieve best practice environmental outcomes.

With the Selkirk Mining JV all but concluded, we continue our focus on building Brightstar into a meaningful gold producer and look forward to updating the market with finalised accounts and announcing the reconciled 50% Profit Share value attributable to Brightstar.”

Click here for the full ASX Release

This article includes content from Brightstar Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

BTR:AU

Sign up to get your FREE

Brightstar Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

08 January

Brightstar Resources

Emerging gold producer and district-scale resource developer in Western Australia

Emerging gold producer and district-scale resource developer in Western Australia Keep Reading...

03 March

Brightstar Secures US$120M Bond to Fund Goldfields Project

Brightstar Resources (BTR:AU) has announced Brightstar Secures US$120M Bond to Fund Goldfields ProjectDownload the PDF here. Keep Reading...

02 March

Results of Oversubscribed Share Purchase Plan

Brightstar Resources (BTR:AU) has announced Results of Oversubscribed Share Purchase PlanDownload the PDF here. Keep Reading...

22 February

High-grade Assays incl 4m @ 26.7g/t Au in Sandstone Drilling

Brightstar Resources (BTR:AU) has announced High-grade assays incl 4m @ 26.7g/t Au in Sandstone drillingDownload the PDF here. Keep Reading...

16 February

GNG: Preferred Contractor - Laverton Processing Plant

Brightstar Resources (BTR:AU) has announced GNG: Preferred Contractor - Laverton Processing PlantDownload the PDF here. Keep Reading...

04 February

High grade assays continue from Sandstone RC drilling

Brightstar Resources (BTR:AU) has announced High grade assays continue from Sandstone RC drillingDownload the PDF here. Keep Reading...

19h

Aurum Hits High-Grade Gold at Napie, Cote d'Ivoire

Aurum Resources (AUE:AU) has announced Aurum Hits High-Grade Gold at Napie, Cote d'IvoireDownload the PDF here. Keep Reading...

20h

Precious Metals Price Update: Gold, Silver, PGMs Fall on Escalating US-Iran War

Precious metals prices are down on potential for economic fallout from escalating US-Iran War.Volatility has returned to the precious metals market this past week. All eyes are on the breakout of a full-scale war across the Middle East prompted by a coordinated assault on Iran by the United... Keep Reading...

04 March

SSR Mining to Sell Çöpler Gold Mine Stake in US$1.5 Billion Deal

SSR Mining (NASDAQ:SSRM,TSX:SSRM,OTCPL:SSRGF) has agreed to sell its majority stake in the Çöpler gold mine in Turkey for US$1.5 billion in cash, shifting the company’s portfolio towards the Americas as the yellow metal continues to surge amid rising geopolitical tensions.The Denver-based miner... Keep Reading...

04 March

Blackrock Silver Announces the Appointment of Bernard Poznanski and Susan Mathieu to the Board of Directors

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce the appointment of Bernard Poznanski and Susan Mathieu as independent directors to the Board of Directors of the Company (the "Board of Directors").In conjunction with... Keep Reading...

03 March

Fortune Bay: Exploration Underway, Fully Funded Program at the Goldfields Project in Saskatchewan

While Saskatchewan has long been recognized for uranium, its geology and historical exploration also make it a promising place for gold. Canadian company Fortune Bay (TSXV:FOR,OTCQB:FTBYF) seeks to maximize this potential with its flagship Goldfields project. Fortune Bay’s 100 percent owned... Keep Reading...

03 March

RUA GOLD Files 43-101 Technical Reports for the Reefton and Glamorgan Projects in New Zealand

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZX: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce the filing on SEDAR+ of independent Technical Reports for its Reefton Project ("Reefton Technical Report") on the South Island and Glamorgan Project ("Glamorgan Technical Report") on... Keep Reading...

Latest News

Sign up to get your FREE

Brightstar Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00