March 20, 2024

Brightstar Resources Limited (ASX: BTR) (Brightstar) is pleased to announce that following on from the maiden and second gold pours announced 07/03/20241 and 12/02/20242, all processing of the ore from the Selkirk joint venture has successfully been completed at Genesis Minerals’ Gwalia processing plant.

HIGHLIGHTS

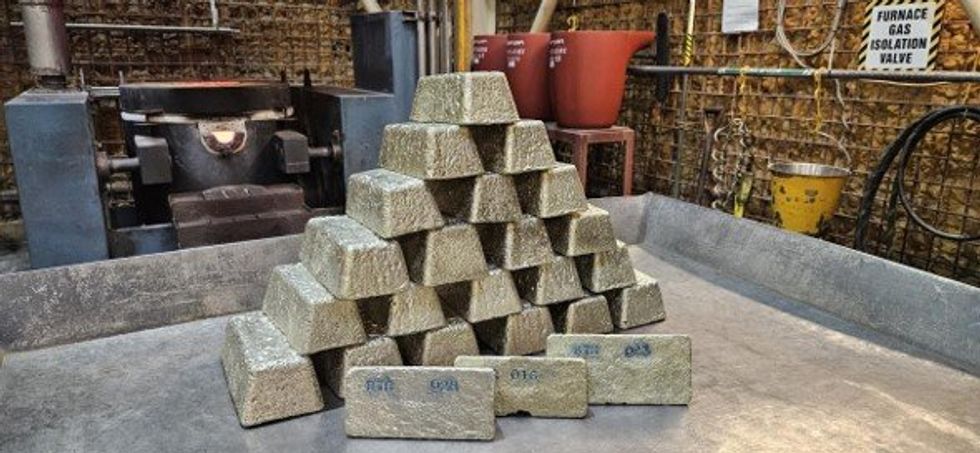

- Brightstar has successfully finalised its gold pours from ore processing of Selkirk material from the Menzies Gold Project, with a total of 430.7kg of gold doré poured

- Total preliminary unreconciled ounces produced of 8,049.6oz exceeds the modelled JV budget for Selkirk and highlights the quality of Brightstar’s Menzies Gold Project

- Positive reconciliations of ore mined, head grade and metallurgical recoveries exceeded Brightstar’s expectations

- Total joint venture costs are being finalised and are expected to be approximately $12 - $13 million

- Refining of the gold doré is ongoing at the Perth Mint, after which all metals refined will be sold and the revenue will be generated to the JV on a 50/50 Profit Share

- The first 28 gold doré bars have been refined and sold at the Perth Mint, with 5,546 ounces sold at A$3,306/oz for $18M revenue generated under the joint venture

Brightstar advises that processing of the remainder of the ore from the Selkirk mining joint venture has successfully completed, with total unreconciled gold production of 8,049.6oz from 43 gold doré bars produced in the campaign.

Final reconciliations of the gold-in-circuit are underway between Brightstar’s independent metallurgists and Genesis Minerals Ltd. With the current AUD gold price trading at approximately A$3,300/oz, the revenue to be generated from the Selkirk mining campaign significantly exceeds the joint ventures model (done at A$2,850/oz) and BTR management expectations due to additional recovered ounces at a higher gold price.

To date, 5,546oz have been sold to the Perth Mint after refining at an average realised sale price of A$3,306/oz.

Final costs for the joint venture are still being finalised and reconciled, and once approved by the joint venture, the net project income will be split 50/50 between Brightstar and our joint venture partner BML Ventures Pty Ltd. Total project costs are expected to be approximately A$12 - $13 million.

Brightstar’s Managing Director, Alex Rovira, commented “We are pleased to announce that gold processing of our Selkirk Mining JV material has safely and successfully concluded by the team at Genesis Minerals Ltd’s Gwalia operation. Their assistance, along with JT Metallurgists acting on behalf of the joint venture, has seen the successful processing of ore from the Menzies Gold project into doré bars poured at record high AUD gold prices.

In parallel with the finalisation of gold-in-circuit calculations, which is expected to occur shortly, we are also finalising the joint venture accounts and making provisions for rehabilitation and waste dump seeding to achieve best practice environmental outcomes.

With the Selkirk Mining JV all but concluded, we continue our focus on building Brightstar into a meaningful gold producer and look forward to updating the market with finalised accounts and announcing the reconciled 50% Profit Share value attributable to Brightstar.”

Click here for the full ASX Release

This article includes content from Brightstar Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

BTR:AU

Sign up to get your FREE

Brightstar Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

08 January

Brightstar Resources

Emerging gold producer and district-scale resource developer in Western Australia

Emerging gold producer and district-scale resource developer in Western Australia Keep Reading...

03 March

Brightstar Secures US$120M Bond to Fund Goldfields Project

Brightstar Resources (BTR:AU) has announced Brightstar Secures US$120M Bond to Fund Goldfields ProjectDownload the PDF here. Keep Reading...

02 March

Results of Oversubscribed Share Purchase Plan

Brightstar Resources (BTR:AU) has announced Results of Oversubscribed Share Purchase PlanDownload the PDF here. Keep Reading...

22 February

High-grade Assays incl 4m @ 26.7g/t Au in Sandstone Drilling

Brightstar Resources (BTR:AU) has announced High-grade assays incl 4m @ 26.7g/t Au in Sandstone drillingDownload the PDF here. Keep Reading...

16 February

GNG: Preferred Contractor - Laverton Processing Plant

Brightstar Resources (BTR:AU) has announced GNG: Preferred Contractor - Laverton Processing PlantDownload the PDF here. Keep Reading...

04 February

High grade assays continue from Sandstone RC drilling

Brightstar Resources (BTR:AU) has announced High grade assays continue from Sandstone RC drillingDownload the PDF here. Keep Reading...

18h

Byron King: Gold, Silver, Oil/Gas — Stock Ideas and Strategy Now

Byron King, editor at Paradigm Press, shares his approach to the gold and silver sectors as tensions in the Middle East intensify, also touching on oil and gas. Overall he sees hard assets becoming increasingly key as global uncertainty escalates."Own gold, own silver — physically own the metal... Keep Reading...

18h

Jaime Carrasco: Gold Going "Much Higher," Silver Force Majeure Inevitable

Jaime Carrasco, senior portfolio manager and senior financial advisor at Harbourfront Wealth Management, shares his outlook for gold and silver, saying prices must rise much higher. He also talks about how to build a strong precious metals portfolio. "We're moving from a credit-based economy, a... Keep Reading...

18h

Garrett Goggin: Gold, Silver in New Era, My Stock Strategy Now

Garrett Goggin, founder of Golden Portfolio, says although gold and silver haven't gone mainstream yet, the metals — and the mining sector overall — have entered a new era. "It's a real mind shift — it's a new era in mining right here," he said.Don't forget to follow us @INN_Resource for... Keep Reading...

09 March

Nicola Mining Provides Update on NASDAQ Listing

Nicola Mining Inc. (TSXV: NIM,OTC:HUSIF) (OTCQB: HUSIF) (FSE: HLIA) (the "Company" or "Nicola") is pleased to provide an update on its proposed NASDAQ listing, which it originally disclosed in its news release of October 27, 2025. There are approximately 220 Canadian companies trading via cross... Keep Reading...

06 March

Adrian Day: Gold Dips Bought Quickly, Price Run Not Over Yet

Adrian Day, president of Adrian Day Asset Management, shares his latest thoughts on what's moving the gold price, emphasizing that its bull run isn't over yet. "It's monetary factors that are driving gold — that's what's fundamentally driving gold," he said. "Monetary factors, lack of trust in... Keep Reading...

06 March

Brien Lundin: Gold, Silver Stock Run Just Starting, Get in Now

Brien Lundin, editor of Gold Newsletter and New Orleans Investment Conference host, shares his stock-picking strategy at a time when high metals prices are beginning to lift all boats. In his view, gold and silver equities may still only be in the second inning. Don't forget to follow us... Keep Reading...

Latest News

Sign up to get your FREE

Brightstar Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00