March 09, 2025

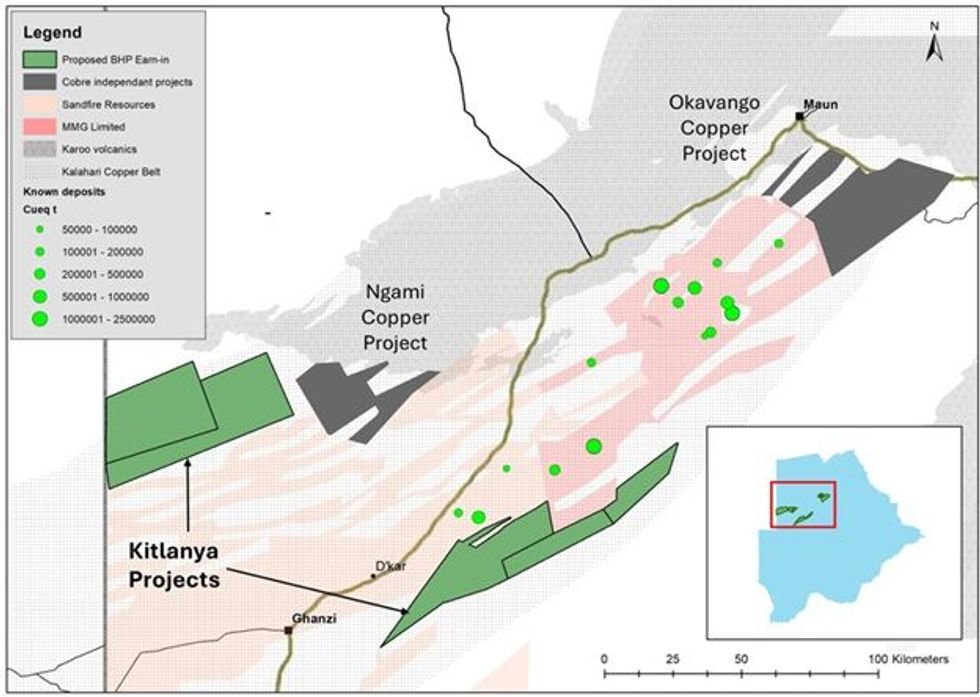

Cobre Limited (ASX: CBE, Cobre or Company) is pleased to announce that CBE, and certain wholly owned subsidiaries (also Cobre), have executed an Earn-In Agreement (Transaction) with a wholly owned subsidiary of BHP Group Ltd (BHP) under which BHP will provide up to US$25 million (~A$40m) for exploration expenditure for Cobre's Kitlanya East and Kitlanya West Copper Projects (Kitlanya Projects) and be granted the right to earn a 75% interest in the Kitlanya Projects, located on the northern and southern basin margins respectively of the Kalahari Copper Belt (KCB) in Botswana. The Transaction is a result of Cobre's successful participation in the 2024 BHP Xplor program which also provided funding for the recently completed seismic survey on the Kitlanya West Project (see ASX announcement 22 August 2024).

Highlights

- The Transaction comprises the following key funding terms (detailed in Schedule 1):

- A minimum of US$5 million of committed funding to be paid to Cobre within 2 years of the commencement date with a planned budget of US$7m (A$11m) for exploration expenditure for the Kitlanya Projects starting in April 2025; and

- BHP can earn a 75% interest in the Kitlanya Projects by funding US$25 million (inclusive of the initial US$5 million) for exploration expenditure for the Kitlanya Projects.

- Cobre Botswana will be appointed operator during the earn-in phase and will be entitled to a management fee of no less than US$250,000 per annum.

- Upon commencement of the 75:25 joint venture, BHP may provide a loan to Cobre to fund Cobre's portion of joint venture expenditure up until the final investment decision.

- An additional payment of up to US$10 million, calculated at $5/tonne contained copper, is payable to Cobre upon the declaration of a maiden JORC Compliant Mineral Resource (JORC) at the Kitlanya Projects.

- If the Transaction is terminated during the Earn-In Phase and BHP has funded at least US$20 million for exploration expenditure, BHP will be entitled to a 2.0% net smelter royalty in respect of the Kitlanya Projects. Cobre may, in certain circumstances, buy back 50% of this royalty for an amount equal to the aggregate of exploration expenditure funded by BHP at the time of electing to exercise the buy-back.

- The Transaction does not cover Cobre’s flagship Ngami and Okavango Copper Projects which Cobre will continue to operate and advance independently.

The Transaction underscores Cobre's confidence in the potential for its projects to host Tier 1 copper- silver deposits. A partnership with BHP provides the exploration funding, scale and expertise to maximise Cobre's chances of making significant new discoveries on our basin margin exploration ground while retaining 100% ownership of its Ngami and Okavango Copper Projects.

The planned work programme for the initial US$7m includes several deep (~1km) diamond holes combined with active 2D seismic survey designed to assess key components of the Mineral System required for Tier 1 copper deposit formation. Mobilisation for the first phase of drilling, which will test targets identified in the 2024 seismic programme at Kitlanya West, is scheduled for April 2025.

Tim O’Connor, BHP Group Exploration Officer said:

"We are thrilled to continue our partnership with one of the BHP Xplor alumni, Cobre Limited, through this agreement. This collaboration reflects our excitement for the exploration potential in Botswana and underscores the high standard of partnerships we see coming out of the BHP Xplor program. The Kitlanya Projects in Botswana represent an exciting opportunity to uncover Tier 1 copper-silver deposits, and we are pleased to contribute our expertise and resources to this venture.”

Commenting on the Transaction, Adam Wooldridge, Cobre’s Chief Executive Officer, said:

“This significant transaction with BHP, one of the world’s leading mining companies, is a major moment in time for Cobre as a company as well as a testament to the success of BHP’s Xplor programme. The partnership with BHP will provide us with the funding and support necessary to implement a technology-driven work programme designed to discover the Tier 1 deposits we believe may be hosted in our Kitlanya East and West Projects.

Independently, Cobre will continue advancing its Ngami and Okavango copper Projects.This combined strategy provides exposure to potential Tier 1 discoveries, a development opportunity at Ngami and short-term discoveries on our Okavango project.”

Commenting on the transaction, Martin Holland Chairman of the Cobre board, said:

“First and foremost, I would like to extend my gratitude to BHP for their exceptional efforts in the 2024 BHP Xplor program, which aims to foster bold thinking and elevate global exploration to new heights.

I would also like to thank the Cobre Board and team, especially our CEO Adam Wooldridge and Technical Lead Thomas Krebs, for their tireless dedication throughout the year-and-a-half-long process that has led us to this point and for their efforts in successfully finalising this transaction with BHP.”

Geology, Mineralisation and Exploration Target

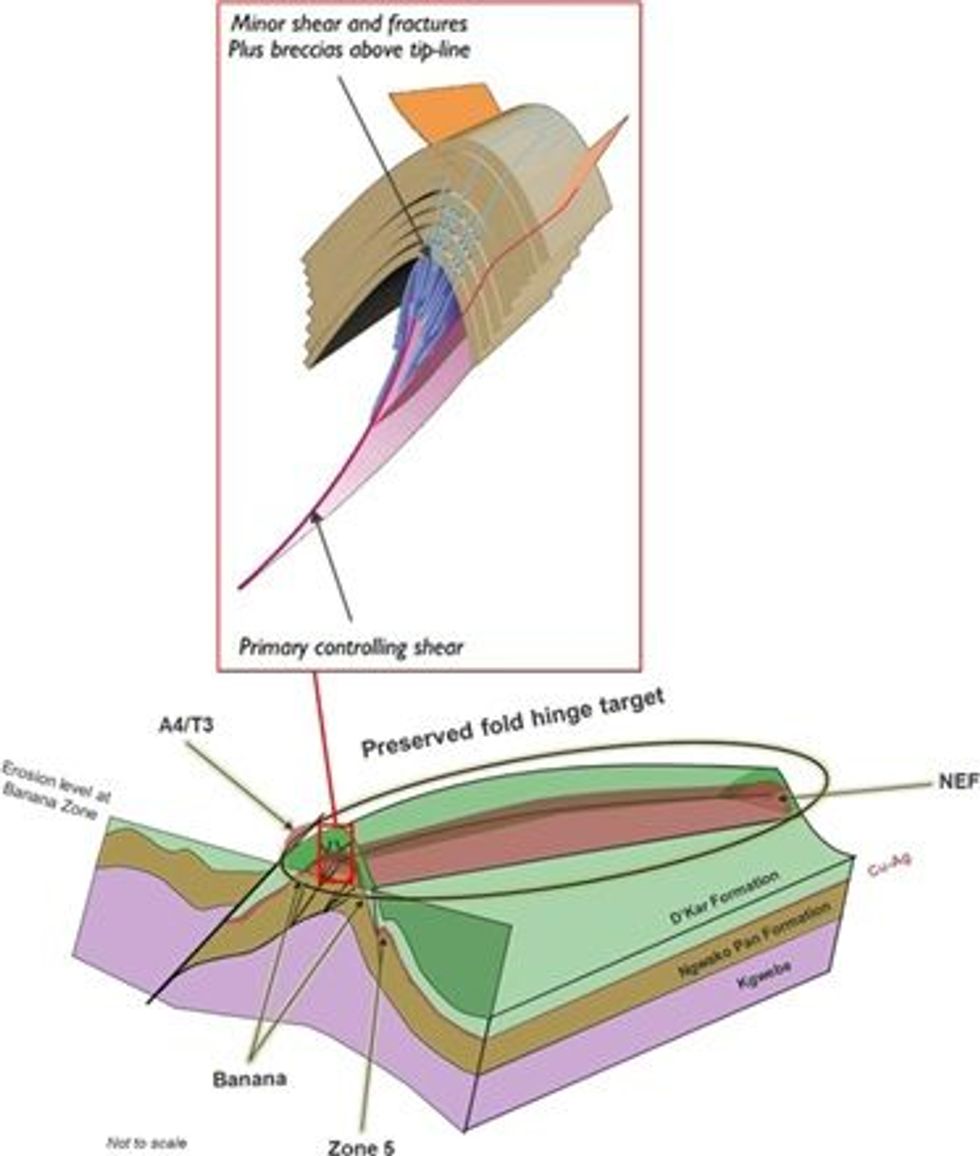

Mineralisation in the KCB is sediment-hosted and structurally controlled, with copper-silver mineralisation most frequently hosted along the redox contact between the basal units of the reduced marine sedimentary rocks of the D’Kar Formation and oxidised clastic sedimentary red bed units of the Kuke and Ngwako Pan Formations and the underlying volcanosedimentary Kgwebe Formation. Of particular interest for Tier 1 deposits are the tight, upright folds which offer ideal trap-sites for upgrading of copper-silver mineralisation and formation of large deposits. These folds are typically bounded by district-scale shears (often with evidence of copper anomalism) which would provide the necessary plumbing architecture for movement of copper-rich fluids during basin formation and subsequent closure and deformation. A schematic illustration of the preserved fold hinge model is illustrated in Figure 2. The upcoming exploration programme will focus on testing these buried anticline hinge zones along with assessing primary basin architecture, source rocks, fluid pathways and trap-site mechanisms.

Click here for the full ASX Release

This article includes content from Cobre Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

4h

T2 Metals Acquires High-Grade Aurora Gold-Silver Project in the Yukon from Shawn Ryan

Past Drilling Results Include 3.4m @ 24.45 g/t Au at AJ Prospect

T2 Metals Corp. (TSXV: TWO) (OTCQB: TWOSF) (WKN: A3DVMD) ("T2 Metals" or the "Company") is pleased to announce signing of an Option Agreement (the "Option") with renowned explorer Shawn Ryan ("Ryan") and Wildwood Exploration Inc. (together with Ryan, the "Optionor") to earn a 100% interest in... Keep Reading...

22h

Copper Prices Rally on Tariff Fears, Weak US Dollar

Copper prices continue to rise, driven by supply and demand fundamentals and boosted by tariff fears.Prices for the red metal reached a record high on January 29, and while they have since moderated somewhat, several factors have injected fresh concerns and volatility into the market.Among them... Keep Reading...

22h

Top 10 Copper-producing Companies

Copper miners with productive assets have much to gain as supply and demand tighten. The price of copper reached new all-time highs in 2026 on both the COMEX in the United States and the London Metals Exchange (LME) in the United Kingdom. In 2025, the copper price on the COMEX surged during the... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00