September 07, 2021

Balkan Mining and Minerals (ASX:BMM) has launched its campaign on the Investing News Network.

Balkan Mining and Minerals (ASX:BMM) focuses on an early-stage exploration through the full development of lithium and boron mining in the Balkan region. The company's current market cap is AU$36 million with 45 million shares on issue and is backed by Sandfire Resources (ASX:SFR) .

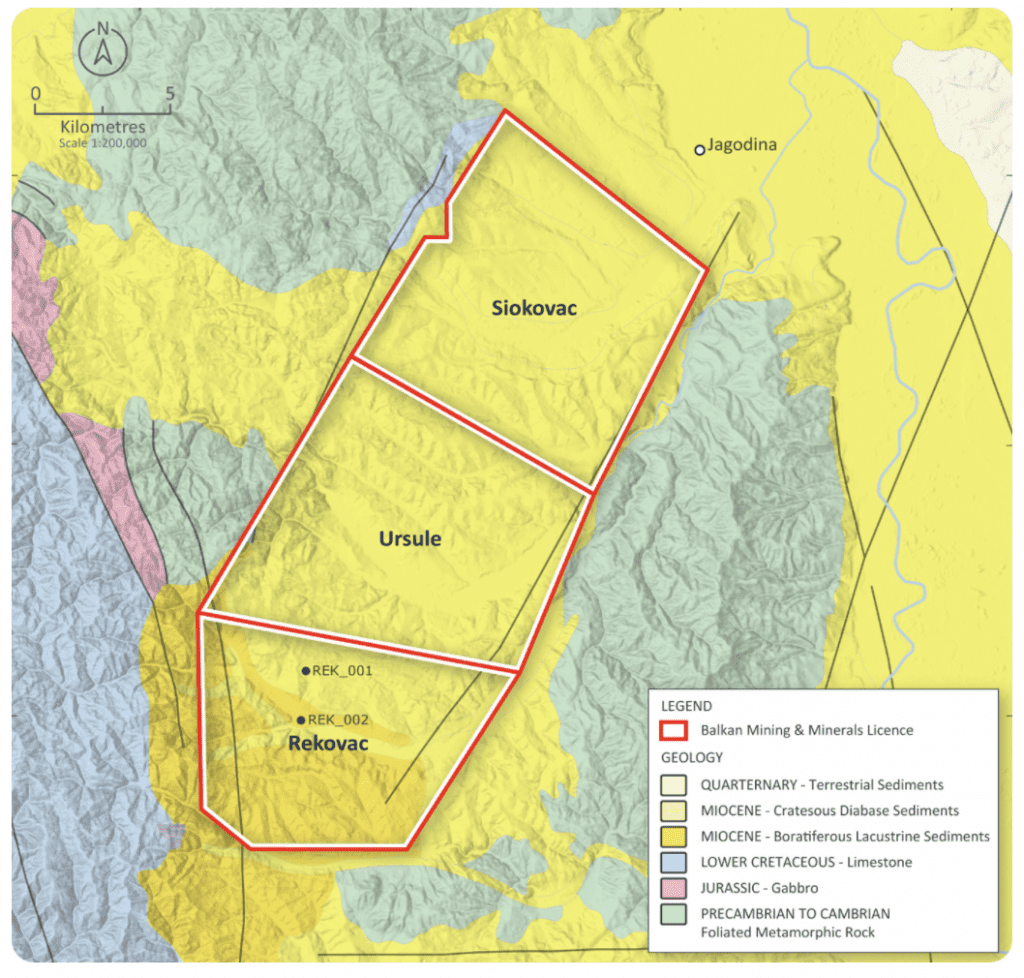

Balkan Mining and Minerals' flagship Rekovac lithium-borate project demonstrated two successful diamond drill holes discovering preserved lithium and borate mineralization. The project has easy access to the motorway and modern rail corridor, thus providing a solid infrastructure to Central and Western Europe.

Balkan Mining and Minerals' Company Highlights

- Balkan Mining and Minerals is a publicly-listed exploration and development company focused on lithium and boron mining in the Balkan region.

- The Rekovac project has demonstrated promising results in its early exploration phase and is on track for additional explorations and assessments within the Ursule and Siokovac licensed areas.

- The Cacak project provides new access to underexplored areas of the Vardar Zone, an emerging tier 1 lithium-borate jurisdiction. The company is looking to expand beyond the Rekovac project and region.

- The company is backed by leaders in the space and has performed well since its IPO. An experienced board and regional management expertise equip Balkan Mining and Mineral to be a leader in the lithium-borate space and are in the right space at the right time.

[subscribe_company_profile use_post=101680863]

BMM:AU

The Conversation (0)

05 September 2021

Bayan Mining and Minerals

Mining Critical Minerals from the Balkan Region

Mining Critical Minerals from the Balkan Region Keep Reading...

19 January 2025

Further Exploration Targets Identified at Bayan Springs

Bayan Mining and Minerals (BMM:AU) has announced Further Exploration Targets Identified at Bayan SpringsDownload the PDF here. Keep Reading...

31 October 2024

Quarterly Activities/Appendix 5B Cash Flow Report

Balkan Mining and Minerals (BMM:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

08 January

Top 5 US Lithium Stocks (Updated January 2026)

The global lithium market enters 2026 after a punishing 2025 marked by oversupply, weaker-than-expected EV demand and sustained price pressure, although things began turning around for lithium stocks in Q4. Lithium carbonate prices in North Asia fell to four-year lows early in the year,... Keep Reading...

07 January

5 Best-performing ASX Lithium Stocks (Updated January 2026)

Global demand for lithium presents a significant opportunity for Australia and Australian lithium companies.Australia remains the world’s largest lithium miner, supplying nearly 30 percent of global output in 2024, though its dominance is easing as other lithium-producing countries such as... Keep Reading...

05 January

CEOL Application for Laguna Verde Submitted

CleanTech Lithium PLC ("CleanTech Lithium" or "CleanTech" or the "Company") (AIM: CTL, Frankfurt:T2N), an exploration and development company advancing sustainable lithium projects in Chile, is pleased to announce it has submitted its application (the "Application") for a Special Lithium... Keep Reading...

29 December 2025

SQM, Codelco Seal Landmark Lithium Joint Venture in Salar de Atacama

Sociedad Quimica y Minera (SQM) (NYSE:SQM) and Codelco have finalized their long-awaited partnership, forming a new joint venture that will oversee lithium production in Chile’s Salar de Atacama through 2060.SQM announced on Saturday (December 27) that it has completed its strategic partnership... Keep Reading...

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00