June 23, 2022

Avalon Advanced Materials (TSX:AVL)) targets multiple critical minerals necessary for manufacturing clean technology. With over 25 years of experience working in the critical minerals sector, the company has first-to-market advantage, in addition to the years of expertise in the field.

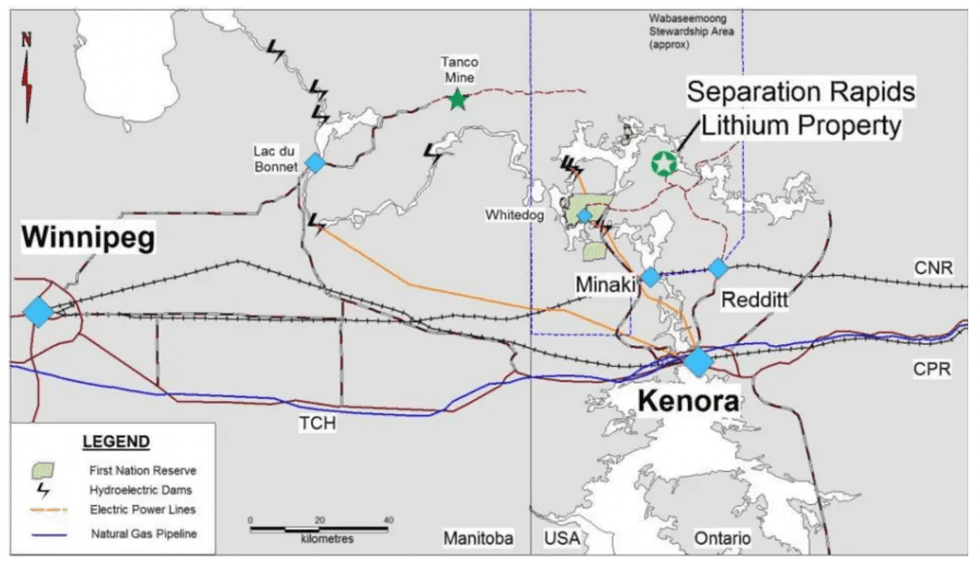

The Separation Rapids Lithium Project, the company’s current flagship project, is in the preliminary stages of economic assessment and feasibility study. The project is in advanced exploration stages, but new studies are required per its new agreement with Essar Group to fund and build a new lithium refinery. However, an accurate economic assessment can now be completed since Avalon Advanced Materials has a specific refinery agreement.

Company Highlights

- Avalon Advanced Materials is a Canadian-based mineral exploration and development company with assets targeting multiple critical minerals, including lithium and tin.

- The company’s entire portfolio consists of assets located in stable jurisdictions throughout Canada.

- The company’s flagship project, Separation Rapids, is poised to supply Ontario’s first lithium refinery and create a domestic supply chain for the critical mineral. It strategically aligns with the Ontario Critical Minerals strategy, leading sustainability solutions with its unique lithium petalite deposit in Northwestern Ontario.

- The petalite deposit can potentially serve both the global glass-ceramics industry and the electrification sector.

- Don Bubar, president and CEO, had the foresight to acquire assets covering multiple critical minerals. As a result, while the race to carbon neutrality heats up, the company is ready to supply the essential minerals that manufacturers need.

- Avalon Advanced Materials is a Canadian enterprise that has been in business for over 25 years, specializing in the critical minerals sector.

This Avalon Advanced Materials profile is part of a paid investor education campaign.*

AVL:CA

The Conversation (0)

06 June 2022

Avalon Advanced Materials

Critical Minerals for Clean Technologies

Critical Minerals for Clean Technologies Keep Reading...

27 February

UK Enters Commercial Lithium Production with Geothermal Plant Launch

The UK has entered commercial lithium production for the first time as Geothermal Engineering Ltd (GEL) began operations in its plant at Cornwall, anchoring the government's hopes of a domestic battery metals supply chain.The Redruth-based facility marks the country’s first commercial-scale... Keep Reading...

26 February

Zimbabwe Imposes Immediate Ban on Raw Mineral and Lithium Exports

Zimbabwe has imposed an immediate ban on exports of all raw minerals and lithium concentrates, halting shipments already in transit as the government tightens control over the country’s mining sector.Mines and Mining Development Minister Polite Kambamura announced Wednesday that the suspension... Keep Reading...

19 February

Top Australian Mining Stocks This Week: Lithium Valley Results Boost Gold Mountain

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.Mining giant BHP (ASX:BHP,NYSE:BHP,LSE:BHP) reported strong half-year copper results, saying that its copper operations accounted for... Keep Reading...

17 February

Howard Klein Doubles Down on Strategic Lithium Reserve as Project Vault Takes Shape

Before the Trump administration revealed plans for Project Vault, Howard Klein, co-founder and partner at RK Equity, proposed the idea of a strategic lithium reserve. “The goal of a strategic lithium reserve is to stabilize prices and allow the industry to develop,” he told the Investing News... Keep Reading...

17 February

Sigma Lithium Makes New Lithium Fines Sale, Unlocks US$96 Million Credit Facility

Sigma Lithium (TSXV:SGML,NASDAQ:SGML) has secured another large-scale sale of high-purity lithium fines and activated a production-backed revolving credit facility as it ramps up operations in Brazil.The lithium producer announced it has agreed to sell 150,000 metric tons (MT) of high-purity... Keep Reading...

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00