May 23, 2024

Aurum Resources Limited (ASX: AUE) (Aurum) is pleased to report further shallow, wide gold intercepts from diamond holes at BD Target 2 as part of ongoing diamond drilling at its Boundiali Gold Project in Côte d'Ivoire, West Africa.

Highlights

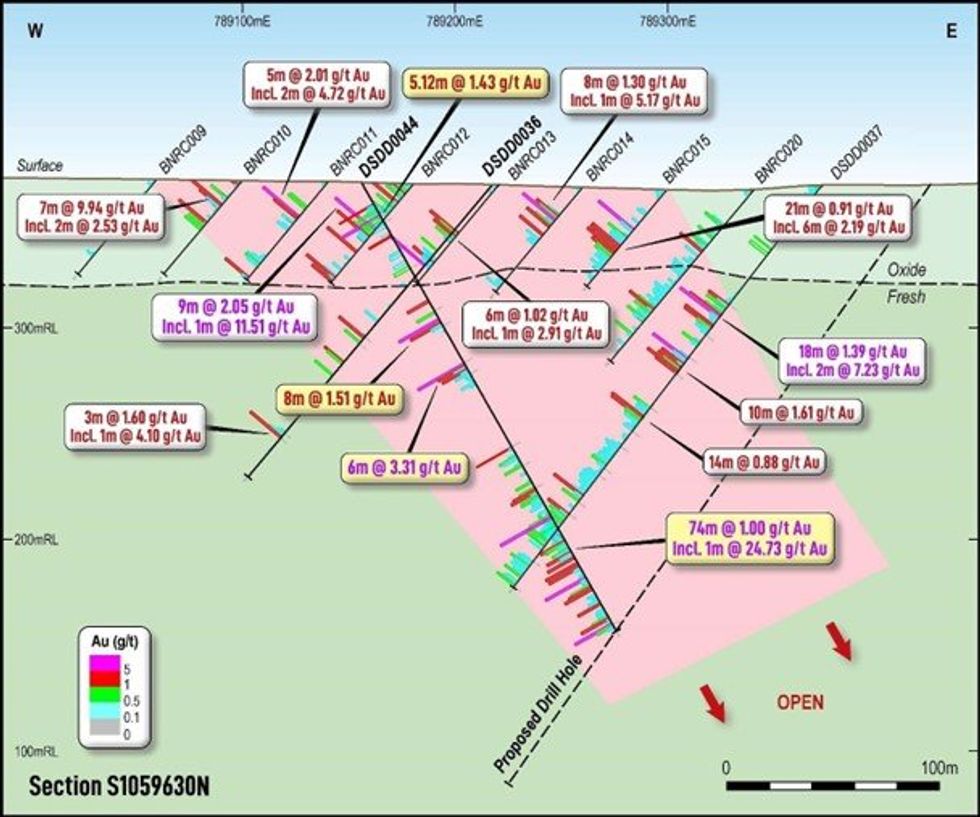

- Assay results for scout and step-back diamond drilling (18 holes for 3070m) drilled at BD Target 2 on the Boundiali BD tenement report multiple shallow, wide gold hits1 including:

- 74m @ 1.00 g/t Au from 167m inc. 1m @ 24.73 g/t Au (DSDD0044) & 6m @ 3.31 g/t Au from 99m & 8m @ 1.51 g/t Au from 71m

- 33m @ 0.84 g/t Au from 146m inc. 1m @ 9.95 g/t Au (DSDD0046)

- 1m @ 10.01 g/t Au from 71m (DSDD0024)

- BD Target 2 is a 1.7km long by 1km wide gold prospect with artisanal workings (~6km north of BD Target 1)

- More assay results from drilling at BD Target 1 expected over the coming weeks

- Drill program is ongoing with 30,000m of diamond drilling planned for this year

- Aurum currently has three diamond drill rigs, drilling at ~4,000m per month and will soon increase to four diamond drill rigs drilling ~6,000m per month

- Aurum is targeting an initial Mineral Resource Estimate for Boundiali in late CY2024

- Aurum has a strong cash balance of ~A$5M (unaudited) to support its aggressive drill program.

Aurum’s Managing Director Dr. Caigen Wang said: “We are very pleased to see BD Target 2 is shaping up nicely with good, wide intercepts from 100m line spacing diamond holes confirming the gold system is open along strike and continues at depth. These new shallow, wide gold intercepts prove the gold system continues in fresh rock underneath shallow oxide RC drilling (30 holes for 2,057m) drilled by previous explorers.

Follow-up drilling is required to chase the system along strike and at depth as well as areas where our team has identified artisanal workings. BD Target 2 is about 6km to the north of BD Target 1, where we intercepted 73m @ 2.15g/t Au from 172m (DSDD0012) (Refer to Figure 3). These prospects sit within a 13km by 3km gold mineralised corridor the majority of which has not yet been tested by drilling.

We are well funded and supported by our shareholders and with our three diamond rigs targeting around 4,000m of drilling per month. Given the encouraging results to date, we are confident to add new targets on the BD and BM tenements whilst we drill towards our target of delivering inaugural JORC resources for the Boundiali project by late 2024.”

Latest BD Target 2 Drill Results

Assay results for drilling reported in this release are for wide line spaced (100m) diamond holes (18 holes for 3070m) drilled at BD Target 2. These new results are in addition to the assays previously released on 23 April 2024 (15 holes for 2,815m), with a total of 33 holes for 5,885.48m reported to date.

Aurum is performing diamond drilling using its own drill rigs and personnel to evaluate a 1.6km long by 1km wide gold prospect, which was defined by earlier explorers from soil samples, trenching and RC drilling. The prospect sits within a larger 13km by 3km gold mineralised corridor (which includes three gold prospects currently being drill tested), the majority of which is still to be drill tested.

Diamond drilling has intersected the same volcano sedimentary package seen at BD Target 1 and mineralisation is characterised by broad alteration rich in hematite + chlorite + tourmaline + quartz + albite and carbonate. Mineralisation at both BD Target 1 and BD Target 2 appear to be controlled by N-S trending structures and there has also been an intense activity of artisanal miners targeting oxide mineralisation.

Diamond drilling is conducted with NTW drill core and collared at the surface with HQ sized equipment. All drill holes were field logged by company geologists with lithological, alteration, mineralogical as well as sulphide content recorded. Geotechnical and structural data has been recorded and photography and recovery measurements were conducted by assistants under a geologist’s supervision.

NTW core is cut in half using a core saw and the core was sampled to major geological intervals as defined by the geologist at 1m sample intervals, although some niche sampling of quartz veins associated with visible gold has been undertaken. Typically diamond core samples are prepared, sub sample and assayed by Intertek in Ghana using fire assay techniques on a 50g sample.

Click here for the full ASX Release

This article includes content from Aurum Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Sign up to get your FREE

Aurum Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

04 September 2025

Aurum Resources

Game-changing gold exploration at prolific Côte d’Ivoire, West Africa.

Game-changing gold exploration at prolific Côte d’Ivoire, West Africa. Keep Reading...

18h

Aurum Hits High-Grade Gold at Napie, Cote d'Ivoire

Aurum Resources (AUE:AU) has announced Aurum Hits High-Grade Gold at Napie, Cote d'IvoireDownload the PDF here. Keep Reading...

19h

Precious Metals Price Update: Gold, Silver, PGMs Fall on Escalating US-Iran War

Precious metals prices are down on potential for economic fallout from escalating US-Iran War.Volatility has returned to the precious metals market this past week. All eyes are on the breakout of a full-scale war across the Middle East prompted by a coordinated assault on Iran by the United... Keep Reading...

04 March

SSR Mining to Sell Çöpler Gold Mine Stake in US$1.5 Billion Deal

SSR Mining (NASDAQ:SSRM,TSX:SSRM,OTCPL:SSRGF) has agreed to sell its majority stake in the Çöpler gold mine in Turkey for US$1.5 billion in cash, shifting the company’s portfolio towards the Americas as the yellow metal continues to surge amid rising geopolitical tensions.The Denver-based miner... Keep Reading...

04 March

Blackrock Silver Announces the Appointment of Bernard Poznanski and Susan Mathieu to the Board of Directors

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce the appointment of Bernard Poznanski and Susan Mathieu as independent directors to the Board of Directors of the Company (the "Board of Directors").In conjunction with... Keep Reading...

03 March

Fortune Bay: Exploration Underway, Fully Funded Program at the Goldfields Project in Saskatchewan

While Saskatchewan has long been recognized for uranium, its geology and historical exploration also make it a promising place for gold. Canadian company Fortune Bay (TSXV:FOR,OTCQB:FTBYF) seeks to maximize this potential with its flagship Goldfields project. Fortune Bay’s 100 percent owned... Keep Reading...

03 March

RUA GOLD Files 43-101 Technical Reports for the Reefton and Glamorgan Projects in New Zealand

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZX: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce the filing on SEDAR+ of independent Technical Reports for its Reefton Project ("Reefton Technical Report") on the South Island and Glamorgan Project ("Glamorgan Technical Report") on... Keep Reading...

Latest News

Sign up to get your FREE

Aurum Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00