May 23, 2024

Aurum Resources Limited (ASX: AUE) (Aurum) is pleased to report further shallow, wide gold intercepts from diamond holes at BD Target 2 as part of ongoing diamond drilling at its Boundiali Gold Project in Côte d'Ivoire, West Africa.

Highlights

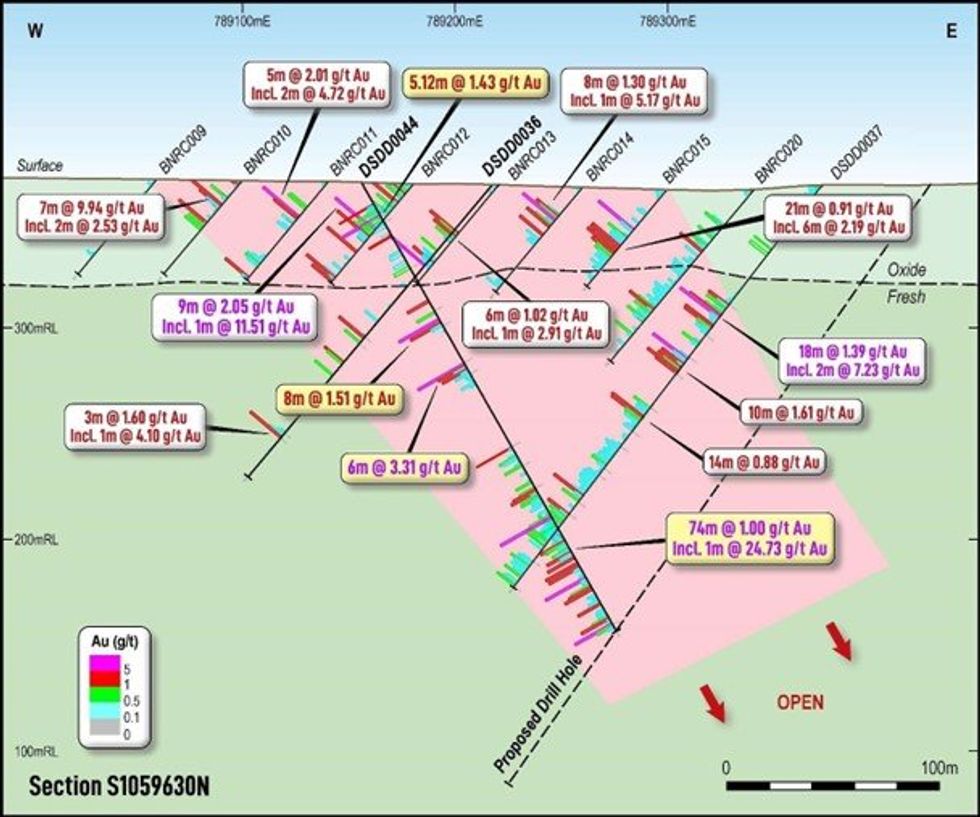

- Assay results for scout and step-back diamond drilling (18 holes for 3070m) drilled at BD Target 2 on the Boundiali BD tenement report multiple shallow, wide gold hits1 including:

- 74m @ 1.00 g/t Au from 167m inc. 1m @ 24.73 g/t Au (DSDD0044) & 6m @ 3.31 g/t Au from 99m & 8m @ 1.51 g/t Au from 71m

- 33m @ 0.84 g/t Au from 146m inc. 1m @ 9.95 g/t Au (DSDD0046)

- 1m @ 10.01 g/t Au from 71m (DSDD0024)

- BD Target 2 is a 1.7km long by 1km wide gold prospect with artisanal workings (~6km north of BD Target 1)

- More assay results from drilling at BD Target 1 expected over the coming weeks

- Drill program is ongoing with 30,000m of diamond drilling planned for this year

- Aurum currently has three diamond drill rigs, drilling at ~4,000m per month and will soon increase to four diamond drill rigs drilling ~6,000m per month

- Aurum is targeting an initial Mineral Resource Estimate for Boundiali in late CY2024

- Aurum has a strong cash balance of ~A$5M (unaudited) to support its aggressive drill program.

Aurum’s Managing Director Dr. Caigen Wang said: “We are very pleased to see BD Target 2 is shaping up nicely with good, wide intercepts from 100m line spacing diamond holes confirming the gold system is open along strike and continues at depth. These new shallow, wide gold intercepts prove the gold system continues in fresh rock underneath shallow oxide RC drilling (30 holes for 2,057m) drilled by previous explorers.

Follow-up drilling is required to chase the system along strike and at depth as well as areas where our team has identified artisanal workings. BD Target 2 is about 6km to the north of BD Target 1, where we intercepted 73m @ 2.15g/t Au from 172m (DSDD0012) (Refer to Figure 3). These prospects sit within a 13km by 3km gold mineralised corridor the majority of which has not yet been tested by drilling.

We are well funded and supported by our shareholders and with our three diamond rigs targeting around 4,000m of drilling per month. Given the encouraging results to date, we are confident to add new targets on the BD and BM tenements whilst we drill towards our target of delivering inaugural JORC resources for the Boundiali project by late 2024.”

Latest BD Target 2 Drill Results

Assay results for drilling reported in this release are for wide line spaced (100m) diamond holes (18 holes for 3070m) drilled at BD Target 2. These new results are in addition to the assays previously released on 23 April 2024 (15 holes for 2,815m), with a total of 33 holes for 5,885.48m reported to date.

Aurum is performing diamond drilling using its own drill rigs and personnel to evaluate a 1.6km long by 1km wide gold prospect, which was defined by earlier explorers from soil samples, trenching and RC drilling. The prospect sits within a larger 13km by 3km gold mineralised corridor (which includes three gold prospects currently being drill tested), the majority of which is still to be drill tested.

Diamond drilling has intersected the same volcano sedimentary package seen at BD Target 1 and mineralisation is characterised by broad alteration rich in hematite + chlorite + tourmaline + quartz + albite and carbonate. Mineralisation at both BD Target 1 and BD Target 2 appear to be controlled by N-S trending structures and there has also been an intense activity of artisanal miners targeting oxide mineralisation.

Diamond drilling is conducted with NTW drill core and collared at the surface with HQ sized equipment. All drill holes were field logged by company geologists with lithological, alteration, mineralogical as well as sulphide content recorded. Geotechnical and structural data has been recorded and photography and recovery measurements were conducted by assistants under a geologist’s supervision.

NTW core is cut in half using a core saw and the core was sampled to major geological intervals as defined by the geologist at 1m sample intervals, although some niche sampling of quartz veins associated with visible gold has been undertaken. Typically diamond core samples are prepared, sub sample and assayed by Intertek in Ghana using fire assay techniques on a 50g sample.

Click here for the full ASX Release

This article includes content from Aurum Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Sign up to get your FREE

Aurum Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

04 September 2025

Aurum Resources

Game-changing gold exploration at prolific Côte d’Ivoire, West Africa.

Game-changing gold exploration at prolific Côte d’Ivoire, West Africa. Keep Reading...

06 March

Adrian Day: Gold Dips Bought Quickly, Price Run Not Over Yet

Adrian Day, president of Adrian Day Asset Management, shares his latest thoughts on what's moving the gold price, emphasizing that its bull run isn't over yet. "It's monetary factors that are driving gold — that's what's fundamentally driving gold," he said. "Monetary factors, lack of trust in... Keep Reading...

06 March

Brien Lundin: Gold, Silver Stock Run Just Starting, Get in Now

Brien Lundin, editor of Gold Newsletter and New Orleans Investment Conference host, shares his stock-picking strategy at a time when high metals prices are beginning to lift all boats. In his view, gold and silver equities may still only be in the second inning. Don't forget to follow us... Keep Reading...

06 March

Venezuela Gold Set for US Market in Brokered Deal

A new US-Venezuela gold deal could soon channel hundreds of kilograms of bullion from the South American nation into American refineries.Venezuela’s state-owned mining company, Minerven, has agreed to sell between 650 and 1,000 kilograms of gold dore bars to commodities trading house Trafigura... Keep Reading...

05 March

Rick Rule: Gold Price During War, Silver Strategy, Oil Stock Game Plan

Rick Rule, proprietor at Rule Investment Media, shares updates on his current strategy in the resource space, mentioning gold, silver, oil and agriculture. He also reminds investors to pay more attention to gold's underlying drivers than to current events.Click here to register for the Rule... Keep Reading...

05 March

Lobo Tiggre: Gold, Oil in Times of War, Plus My Shopping List Now

Lobo Tiggre of IndependentSpeculator.com shares his thoughts on how gold, silver and oil could be impacted by the developing situation in the Middle East. He cautioned investors not to chase these commodities if prices run. Don't forget to follow us @INN_Resource for real-time updates!Securities... Keep Reading...

05 March

TomaGold: New High-grade Deep Discovery at Berrigan Mine

TomaGold (TSXV:LOT) President, CEO and Director David Grondin said the company is focusing on its flagship Berrigan mine in Chibougamau, Québec, following a large, significant discovery at depth.Berrigan is 4 kilometers northwest of the city of Chibougamau and has existed for about 50 years.... Keep Reading...

Latest News

Sign up to get your FREE

Aurum Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00