November 10, 2024

Aurum Resources Limited (ASX: AUE) (Aurum) is pleased to report further high-grade gold intercepts from exploration diamond drilling at multiple prospects on the BM Tenement, part of its 1037km2 Boundiali Gold Project in Côte d'Ivoire, West Africa.

Highlights

- Exploration diamond drilling (26 holes for 5,049.5m) from the expanded diamond program targeting multiple prospects on the Boundiali BM tenement returns shallow, wide and high- grade gold hits1 including:

- 1m @ 35.86 g/t Au from 82m & 4.25m @ 3.75 g/t Au from 120m (MBDD070)

- 17m @ 1.60 g/t Au from 230m inc. 10.05m @ 2.02 g/t Au (MBDD057)

- 13m @ 2.07 g/t Au from 139m inc. 4m @ 3.29 g/t Au (MBDD054)

- 6m @ 3.57 g/t Au from 118m inc. 2m @ 10.14 g/t Au (MBDD065)

- Gold mineralisation remains open along strike and down dip at BM Targets 1 (up to 2.5km strike), 2 & 3

- Diamond drilling continues at both Boundiali tenements with assays pending for ~60 holes (13,000m), next batch expected end of November

- Aurum has six self-owned diamond rigs at Boundiali Gold Project with up to ~10,000m drilling capacity per month and will complete more than 45,000m in CY2024

- Results from metallurgical test work overseen by MACA Interquip Mintrex (MIM) and ALS (Perth) expected by year end

- Inaugural Mineral Resource Estimate for Boundiali Gold Project targeted for late CY2024

- Aurum’s takeover of Mako Gold (ASX: MXG)2 progressing well – the merged company will achieve greater scale and market presence, creating a stronger platform for future growth and success in the industry

- Aurum is well-funded (~$19M cash at bank at 30 Sept) for continued aggressive exploration.

Aurum’s Managing Director Dr. Caigen Wang said: “Our exploration drilling at BM continues to grow the known extent of gold mineralisation, which is now up to 2.5km at BM Target 1. Our expanded drilling program at BM is hitting multiple intercepts downhole including shallow high-grade hits such as 1m @ 35.86 g/t Au from 82m and 4.25m @ 3.75 g/t Au from 120m in MBDD070.

Our six rigs are systematically ramping up production and with our new camp coming online, we expect to see increased operational efficiencies to demonstrate the full potential of the Boundiali gold project. We're well-funded with $19 million cash at bank, allowing us to accelerate drilling and build on these encouraging results. We're targeting an inaugural JORC resource for Boundiali by late 2024.”

BM Target 1 - Latest Drill Results

Aurum reports results for 26 holes for 5,049.5m of diamond core drilled at BM Target 1 (19 holes for 3,445m), BM Target 2 (two holes for 314.5m) and BM Target 3 (five holes for 1,290m) on the BM Tenement, part of an expanded drill program on the BM Tenement where Aurum is working toward and 80% project interest3. Best results for these holes4 include:

BM Target 1

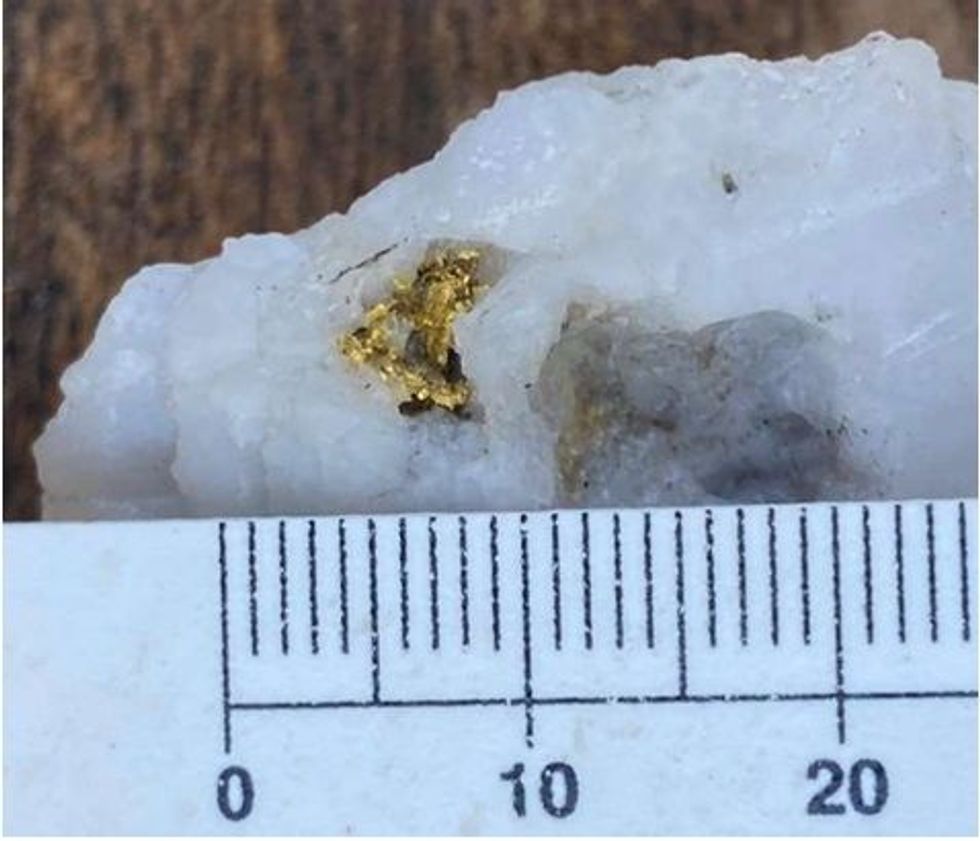

- 1m @ 35.86 g/t Au from 82m (Figure 1) & 4.25m @ 3.75 g/t Au from 120m (MBDD070)

- 17m @ 1.60 g/t Au from 230m inc. 10.05m @ 2.02 g/t Au (MBDD057)

BM Target 3

- 13m @ 2.07 g/t Au from 139m inc. 4m @ 3.29 g/t Au (MBDD054)

- 6m @ 3.57 g/t Au from 118m inc. 2m @ 10.14 g/t Au (MBDD065).

These new results are in addition to diamond holes previously drilled by Aurum at BM Target 1 and reported on 22 January 2024, 1 March 2024 and 18 September 2024, which included:

- 11.46m @ 6.67 g/t Au from 162.54m incl. 1.46m @ 45.04 g/t Au (MBDD049)

- 45m @ 0.93 g/t Au from 78m incl. 8m @ 1.18 g/t Au from 78m & 25m @ 1.15 g/t Au from 98m (MBDD0045)

- 16m @ 1.24 g/t Au from 117m incl. 6m @ 2.44 g/t Au (MBDD0010)

- 7.39m @ 1.94 g/t Au from 139.34m incl. 5.35m @ 2.53 g/t Au (MBDD017)

- 16.3m @ 1.02 g/t Au from 86.7m incl. 8m @ 1.71 g/t Au (MBDD019)

- 16.64m @ 1.45 g/t Au from 56.26m incl. 10.40m @ 2.11 g/t Au (MBDD007)

- 5m @ 4.73 g/t Au from 53.5m incl. 1.10m @ 20.35 g/t Au (MBDD004).

Click here for the full ASX Release

This article includes content from Aurum Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

AUE:AU

Sign up to get your FREE

Aurum Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

04 September 2025

Aurum Resources

Game-changing gold exploration at prolific Côte d’Ivoire, West Africa.

Game-changing gold exploration at prolific Côte d’Ivoire, West Africa. Keep Reading...

04 February

High-Grade Extensions at BD Deposits for Resource Growth

Aurum Resources (AUE:AU) has announced High-Grade Extensions at BD Deposits for Resource GrowthDownload the PDF here. Keep Reading...

28 January

Quarterly Activities/Appendix 5B Cash Flow Report

Aurum Resources (AUE:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

27 January

Further high-grade intercepts at BMT3 in Boundiali

Aurum Resources (AUE:AU) has announced Further high-grade intercepts at BMT3 in BoundialiDownload the PDF here. Keep Reading...

14 January

Boundiali Gold Project produces more good drilling results

Aurum Resources (AUE:AU) has announced Boundiali Gold Project produces more good drilling resultsDownload the PDF here. Keep Reading...

06 January

Aurum advances Boundiali development with 3 ML Applications

Aurum Resources (AUE:AU) has announced Aurum advances Boundiali development with 3 ML ApplicationsDownload the PDF here. Keep Reading...

14h

Armory Mining To Conduct a Series of Airborne Geophysics Surveys at the Ammo Gold-Antimony Project

(TheNewswire) Vancouver, B.C. TheNewswire - February 9, 2026 Armory Mining Corp. (CSE: ARMY) (OTC: RMRYF) (FRA: 2JS) (the "Company" or "Armory") a resource exploration company focused on the discovery and development of minerals critical to the energy, security and defense sectors, is pleased to... Keep Reading...

06 February

Editor's Picks: Is Gold and Silver's Price Correction Over?

It's been a wild couple of weeks for gold and silver. After surging to record highs at the end of January, prices for both precious metals saw significant corrections, creating turmoil for market participants.This week brought some relief, with gold bouncing back from its low point and even... Keep Reading...

06 February

Blackrock Silver to Present at the Precious Metals and Critical Minerals Virtual Investor Conference on February 10th 2026

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce that Andrew Pollard, President & Chief Executive Officer of the Company, will present live at the Precious Metals & Critical Minerals Virtual Investor Conference hosted... Keep Reading...

05 February

Experts: Gold's Fundamentals Intact, Price Could Hit US$7,000 in 2026

Gold took center stage at this year's Vancouver Resource Investment Conference (VRIC), coming to the fore in a slew of discussions as the price surged past US$5,000 per ounce. Held from January 25 to 26, the conference brought together diverse experts, with a focus point being the "Gold... Keep Reading...

05 February

Barrick Advances North American Gold Spinoff After Record 2025 Results

Toronto-based company Barrick Mining (TSX:ABX,NYSE:B) said it will move ahead with plans to spin off its North American gold assets after a strong finish to 2025.The company's board has authorized preparations for an initial public offering (IPO) of a new entity that would house its premier... Keep Reading...

05 February

Peruvian Metals Secures 6 Year Agreement with Community at Mercedes Project

Peruvian Metals Corp. (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals or the "Company") is pleased to announce that the agreement between San Maurizo Mines Ltd. ("San Maurizo"), a private Manitoba company which holds a 100% direct interest in the Mercedes Property, and Comunidades... Keep Reading...

Latest News

Sign up to get your FREE

Aurum Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00