March 05, 2025

Australian Rare Earths Limited (ASX: AR3) is pleased to announce highly encouraging results from its ongoing exploration drilling program at the Overland Uranium Project.

Highlights:

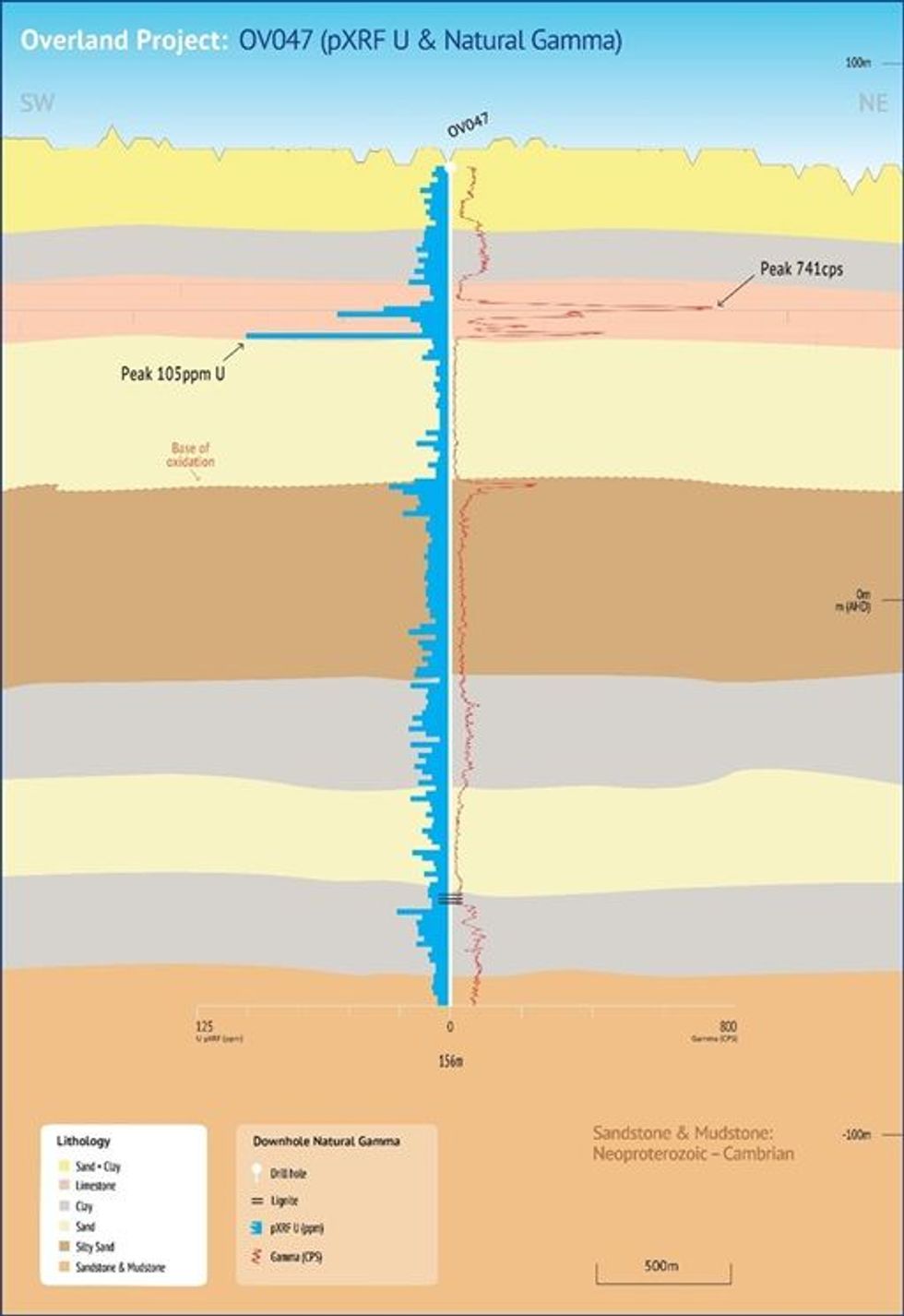

- New shallow Uranium occurrence identified: Drill hole OV047 encountered a 6 meter interval of carbonate-cemented sediments from 27 meters, with anomalous gamma and pXRF uranium readings.

- Potential for the presence of an additional uranium model: Hole OVO47 demonstrates potential for near-surface, calcrete-hosted mineralisation (see Figure 1) - similar to uranium deposits1 mined in Namibia2 - in addition to AR3’s initial palaeochannel hosted ISR amenable uranium deposit targets.

- Accelerated follow-up drilling: Drilling program will re-commence in the week beginning 10 March 2025 to follow up the shallow uranium occurrence intersected in hole OV047.

- Rapid assay and minerology analysis: Samples generated from hole OV047 are being prioritised for assay and mineralogical determinations.

- Palaeovalley extension confirmed with multiple Uranium targets: Drilling has successfully defined the southern extension of a key palaeovalley within the southern portion of EL7001 and extending into EL6678 (See Figure 2).

- Engage with this announcement at the AR3 investor hub.

AR3 Managing Director and CEO, Travis Beinke, said:

“The intersection of a shallow uranium occurrence in OV047 is a significant step forward in our exploration program at Overland. The identification of shallow mineralisation, coupled with the confirmation of the palaeovalley's southern extension, underscores and reinforces the - potential of this project.

Our systematic approach to exploration and targeted drilling, continues to deliver results. We are excited to accelerate our follow up drilling to further delineate the extent of this new uranium occurrence and test the numerous high-priority targets we have identified. We look forward to reporting further results as we continue our drilling program through to the end of April."

The 2025 program, which began 30 January 2025, has focused on mapping the newly defined palaeovalley (refer ASX release 21 January 2025) further south within EL7001 and onto the Sheer Gold Farm-In tenure, EL66783. A total of 22 drillholes has been completed, totaling 3,010 meters, illustrated in Figure 2.

Target 1 of EL6678, drillhole OV047 has intersected a 6 meter interval containing anomalous gamma and pXRF Uranium (U) responses. Gamma responses peaked at 741 counts per second (cps), with maximum pXRF uranium response of 105ppm U. This surficial uranium occurrence is similar to uranium mineralisation found in Namibia’s surficial uranium deposits, like Paladin Energy’s Langer Heinrich Mine. Similar calcrete-hosted deposits are also found in Western Australia4 at Cameco Corporation’s Yeelirrie deposit and Toro Energy’s Wiluna project.

The identification of another potential uranium occurrence model at Overland highlights the region’s fertility, where uranium in solution enters the basin and is captured at various geochemical interfaces within the sedimentary sequences. Drillhole OV047 shows anomalous uranium responses over a 6 meter interval from 27 meters and displayed the highest gamma response yet seen at the base of oxidation interface with reduced sediments. These findings suggest potential for both deeper palaeochannel hosted, in-situ recoverable (ISR) deposits and shallow surficial deposits in this setting.

Click here for the full ASX Release

This article includes content from Australian Rare Earths, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

21h

Ranger Uranium Mine Rehabilitation Gets Green Light from Australia

Minister for Resources and Northern Australia Madeleine King has issued a new rehabilitation authority to Energy Resources Australia (ASX:ERA) for the continuation of rehabilitation activities at the Ranger uranium mine in the Northern Territory.“This new authority means that Energy Resources... Keep Reading...

04 February

Uranium Bull Market Isn’t Over, but Volatility Lies Ahead

Uranium’s resurgence has been one of the resource sector's most durable stories of the past five years, but as prices hover near multi-year highs, investors are increasingly asking the same question: How late is it?At the Vancouver Resource Investment Conference (VRIC), panelists Rick Rule, Lobo... Keep Reading...

02 February

Eagle Energy Metals Corp. and Spring Valley Acquisition Corp. II Announce Effectiveness of Registration Statement and Record and Meeting Dates for Extraordinary General Meeting of Shareholders to Approve Proposed Business Combination

Eagle, a next-generation nuclear energy company with rights to the largest open pit-constrained measured and indicated uranium deposit in the United States, and SVII, a special purpose acquisition company, today announced that the SEC has declared effective the Registration Statement, which... Keep Reading...

30 January

Spot Uranium Passes US$100, Extends Year-Long Rally

Uranium prices surged back above US$100 a pound this week, extending a year-long rally that is reshaping the uranium market after more than a decade of underinvestment.Spot price of uranium climbed US$7.75 to US$101 a pound after the Sprott Physical Uranium Trust... Keep Reading...

29 January

Quarterly Activities/Appendix 5B Cash Flow Report

Basin Energy (BSN:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

29 January

Quarterly Appendix 5B Cash Flow Report

Basin Energy (BSN:AU) has announced Quarterly Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00