January 30, 2025

Altair Minerals Limited (ASX: ALR) (‘Altair or ‘the Company’) is pleased provide an update in relation to the activities carried out during the December 2024 quarter.

Key Developments & Exploration Progress

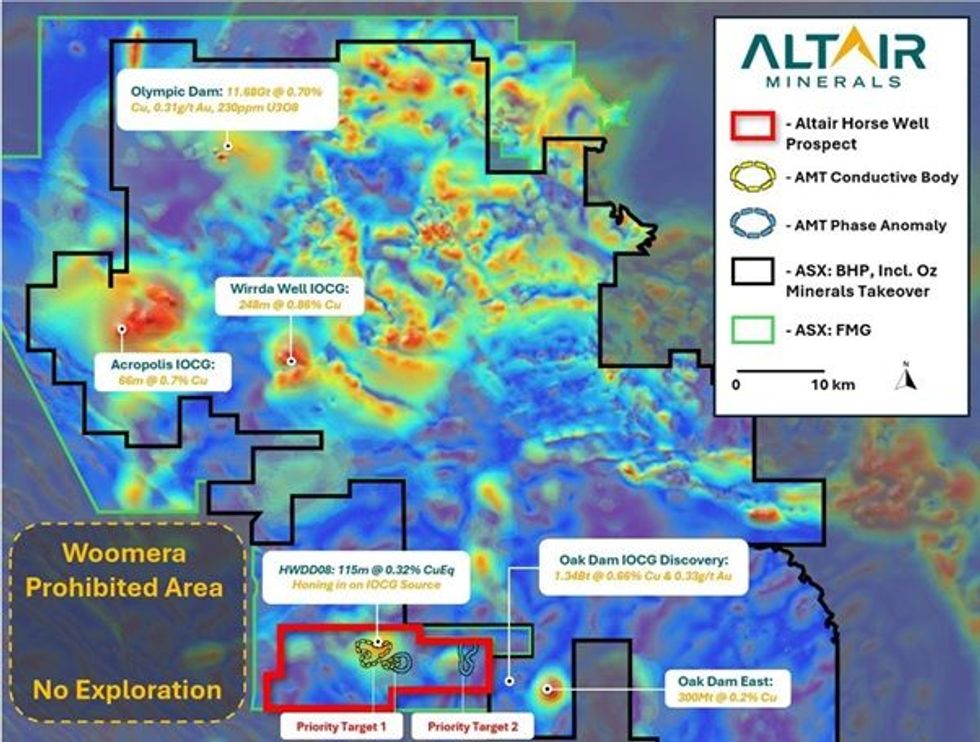

- Major untested conductive and phase anomaly were both identified proximal to each other within Altair’s Olympic Domain Project which is highly prospective for IOCG style mineralisation.1

- The newly uncovered conductive and phase anomaly body1 located ~5km Northwest of BHP Oak Dam Deposit (1.34Bt @ 0.66% Cu & 0.33g/t Au)2

- Ovoid conductive anomalous body shares parallels to those of Khamsin and Carrapateena deposits, with a follow up with TEM survey that can precisely identify the depth of the body for drill targeting1

- Previous drilling appears to have narrowly missed the newly identified phase anomaly with impressive results on the mineralised halo surrounding the target anomaly1, 5, 6, 7:

- HWDD08: 115m @ 0.32% CuEq from 1040m (Drilled ~2km North of main phase anomaly)

- HWD1: 61m @ 0.33% CuEq from 901m

- HWDD05: 115m @ 0.62% CuEq from 1095m (Drilled ~700m North of conductive high)

- HWDD05W1: 70m @ 0.67% CuEq from 962m

- Altair executive team continued reviewing multiple complimentary business opportunities in the resources sector globally.

OLYMPIC DOMAIN PROJECT

The Olympic Domain Project consists of three prospects (Horse Well, Pernatty C, Lake Torrens) situated in one of the largest copper provinces in the world – the Gawler Craton, which hosts mega-IOCG discoveries such as Oak Dam West, Olympic Dam, Prominent Hill and Carrapateena.

The Horse-Well Project represents a strategic opportunity for Altair, being the only project held by a junior exploration company in the vicinity (merely 2km away) of BHP’s Oak Dam West discovery with a recently defined inferred resource of 1.34Bt @ 0.66% Cu and 0.33g/t Au, including 220Mt @ 1.96% Cu and 0.68g/t Au2. The Horse-Well Project consists of EL’s 6122 and 6183 spanning a large area of 147km2 with initial drill results within geophysical anomalies having returned very positive levels of Cu-Au mineralisation associated with IOCG style alteration, with the possibility that these represent intersections peripheral to major targets.

During the quarter, Geophysical Audio Magnetotelluric (AMT) data acquired across Horse-Well in 2019 reprocessing was finalised as part of Altair’s strategy for the next step in targeted work plans. The 3D forward geophysics model has defined major conductive and phase anomalous bodies which has shown significant scale to host a potential large IOCG deposit which is analogous to the genesis of the Oak Dam Deposit.

The AMT data model includes 220 different sounding stations covering an area of 146km2, with conductivity and phase readings across a spectrum of 90 frequencies at each sounding station with additional repeat soundings for both Conductivity and Phase, leading to a model formed from analysing ~40,000 data points. For further detail see announcement dated 4th of December 20241

Click here for the full ASX Release

This article includes content from Altair Minerals Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Sign up to get your FREE

Metro Mining Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

02 March

Metro Mining

Pure-play low-cost producer of high-grade Australian bauxite

Pure-play low-cost producer of high-grade Australian bauxite Keep Reading...

16h

Aurum Hits High-Grade Gold at Napie, Cote d'Ivoire

Aurum Resources (AUE:AU) has announced Aurum Hits High-Grade Gold at Napie, Cote d'IvoireDownload the PDF here. Keep Reading...

18h

Precious Metals Price Update: Gold, Silver, PGMs Fall on Escalating US-Iran War

Precious metals prices are down on potential for economic fallout from escalating US-Iran War.Volatility has returned to the precious metals market this past week. All eyes are on the breakout of a full-scale war across the Middle East prompted by a coordinated assault on Iran by the United... Keep Reading...

22h

SSR Mining to Sell Çöpler Gold Mine Stake in US$1.5 Billion Deal

SSR Mining (NASDAQ:SSRM,TSX:SSRM,OTCPL:SSRGF) has agreed to sell its majority stake in the Çöpler gold mine in Turkey for US$1.5 billion in cash, shifting the company’s portfolio towards the Americas as the yellow metal continues to surge amid rising geopolitical tensions.The Denver-based miner... Keep Reading...

04 March

Blackrock Silver Announces the Appointment of Bernard Poznanski and Susan Mathieu to the Board of Directors

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce the appointment of Bernard Poznanski and Susan Mathieu as independent directors to the Board of Directors of the Company (the "Board of Directors").In conjunction with... Keep Reading...

03 March

Fortune Bay: Exploration Underway, Fully Funded Program at the Goldfields Project in Saskatchewan

While Saskatchewan has long been recognized for uranium, its geology and historical exploration also make it a promising place for gold. Canadian company Fortune Bay (TSXV:FOR,OTCQB:FTBYF) seeks to maximize this potential with its flagship Goldfields project. Fortune Bay’s 100 percent owned... Keep Reading...

03 March

RUA GOLD Files 43-101 Technical Reports for the Reefton and Glamorgan Projects in New Zealand

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZX: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce the filing on SEDAR+ of independent Technical Reports for its Reefton Project ("Reefton Technical Report") on the South Island and Glamorgan Project ("Glamorgan Technical Report") on... Keep Reading...

Latest News

Sign up to get your FREE

Metro Mining Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00