- NORTH AMERICA EDITIONAustraliaNorth AmericaWorld

February 26, 2025

A junior explorer with projects in tier-one jurisdictions, Adavale Resources (ASX:ADD) focuses on gold and copper alongside valuable uranium and nickel licences. The transformative acquisition of assets in the prolific Lachlan Fold Belt in New South Wales puts the company on a growth trajectory, presenting a compelling investment opportunity for savvy investors.

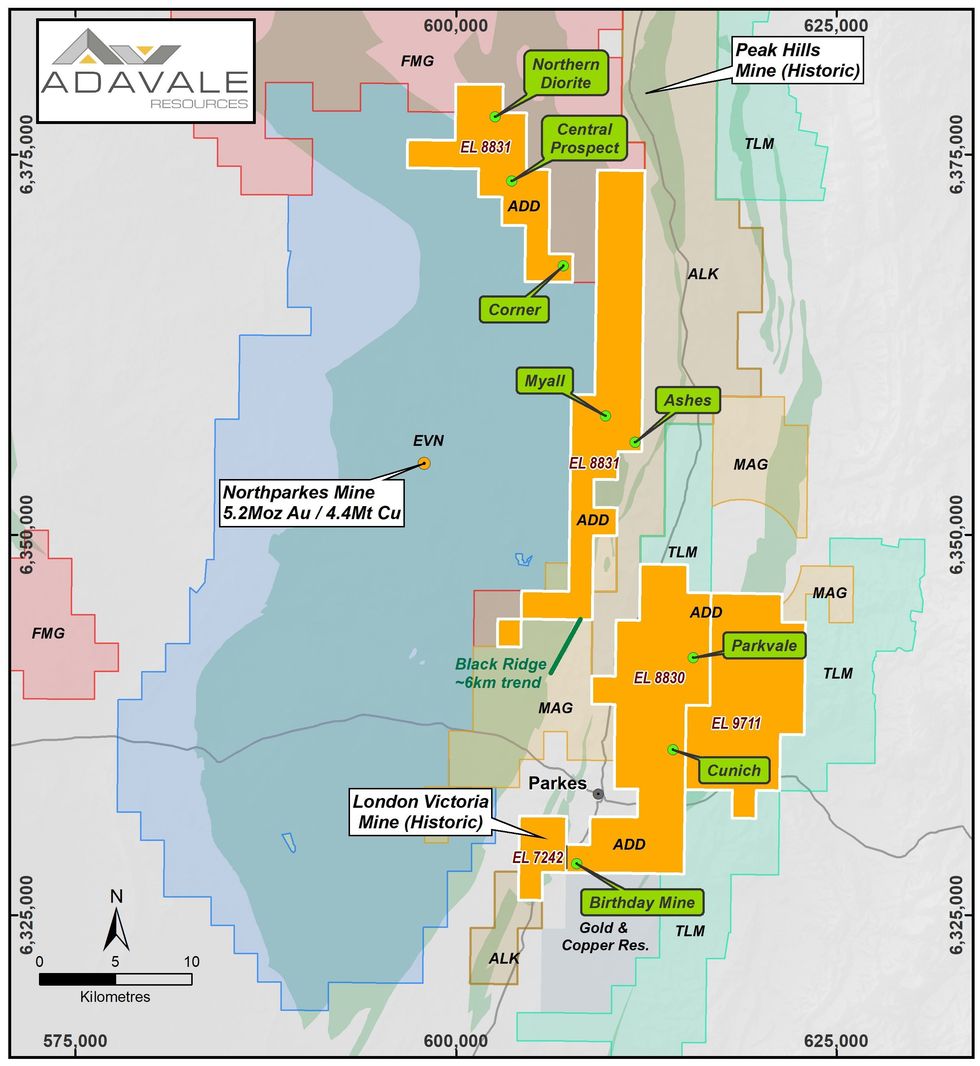

The company's portfolio spans 354.15 sq km and comprises four tenements: EL7242, EL8830, EL8831 and EL9711. The acquisition of these assets represents a transformational opportunity, strategically positioning Adavale Resources in one of the world’s richest gold and copper belts.

Adavale Resources recently acquired a 72.5 percent interest in the Parkes project, located in the highly prospective Lachlan Fold Belt of New South Wales. Adavale’s flagship project encompasses 354.15 sq km across four tenements in the Lachlan Fold Belt, a region that has produced over 80 million ounces (Moz) of gold and 13 million tonnes (Mt) of copper historically. The London-Victoria gold mine (EL7242) is a cornerstone of this portfolio, with historical production of 200,000 ounces of gold at an average grade of 2 grams per ton (g/t). London-Victoria (EL7242) also recently received a successful renewal until November 2030.

Company Highlights

- A junior explorer, with projects in tier-one jurisdictions; focused on gold and copper, Adavale also holds valuable uranium and nickel licences .

- The January 2025 acquisition of the Parkes project in the Lachlan Fold Belt, spanning 354.15 sq km, strategically positions Adavale to expand on the historic orogenic gold resource (124 koz gold) and make a major epithermal and/or porphyry gold and copper discovery in this tier-1 mining jurisdiction. The Lachlan Fold Belt assets are strategically located near world-class mining operations, including Cadia, Northparkes and Cowal.

- The company’s extensive uranium tenements span 4,959 sq km across the Flinders Ranges and Eyre Peninsula, regions known for hosting tier-one uranium deposits.

- Adavale’s nickel projects in Tanzania’s East African Nickel Belt are strategically located adjacent to the Kabanga nickel project — the world’s largest undeveloped high-grade nickel sulphide deposit.

- Drilling and resource-definition programs in 2025 will target key gold, copper and uranium assets, building on the company’s diversified growth strategy.

This Adavale Resources profile is part of a paid investor education campaign.*

Click here to connect with Adavale Resources (ASX:ADD) to receive an Investor Presentation

ADD:AU

Sign up to get your FREE

Adavale Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

22 September

Adavale Resources

Unlocking gold and copper in a Tier-1 mining jurisdiction, alongside a portfolio of uranium and nickel projects well positioned for the future.

Unlocking gold and copper in a Tier-1 mining jurisdiction, alongside a portfolio of uranium and nickel projects well positioned for the future. Keep Reading...

31 October

Quarterly Activities and Cashflow Report

Adavale Resources (ADD:AU) has announced Quarterly Activities and Cashflow ReportDownload the PDF here. Keep Reading...

26 October

Transformational Appointment to Drive Gold & Copper Growth

Adavale Resources (ADD:AU) has announced Transformational Appointment to Drive Gold & Copper GrowthDownload the PDF here. Keep Reading...

21 October

100% Native Title Consent for Marree Project Achieved

Adavale Resources (ADD:AU) has announced 100% Native Title Consent for Marree Project AchievedDownload the PDF here. Keep Reading...

24 September

Wide Gold Intercepts Confirm Open Mineralisation

Adavale Resources (ADD:AU) has announced Wide Gold Intercepts Confirm Open MineralisationDownload the PDF here. Keep Reading...

10 September

Options Prospectus

Adavale Resources (ADD:AU) has announced Options ProspectusDownload the PDF here. Keep Reading...

3h

Brien Lundin: Gold, Silver Waiting for Next Leg, What's the Catalyst?

Brien Lundin, editor of Gold Newsletter and New Orleans Investment Conference host, shares his outlook for gold and silver as prices continue to consolidate. "At the end of this cycle, I've long predicted that we're going to get to a US$6,000 to US$8,000 (per ounce) price range, whenever that... Keep Reading...

04 November

WGC: Investment Key Driver of Gold Demand in Q3 2025

Investor appetite for safe-haven assets resulted in a record quarter for gold demand in Q3 2025, according to the World Gold Council’s (WGC) latest report.The WGC published its Gold Demand Trends Q3 report on October 30, which clearly demonstrates that investor demand for gold is exploding as... Keep Reading...

04 November

Gold Miners Ride Record Prices to Strong Q3 Results

Global gold producers reported robust third-quarter earnings on the back of record bullion prices. The yellow metal surged to its all-time high of US$4,379.13 on October 17, 2025, coming off the back of rising geopolitical and economic tensions that reignited safe-haven demand.The metal broke... Keep Reading...

04 November

LAURION Starts defining Gold Mineralization North and Northeast of the Brenbar Shaft, Highlighting 2.68 g/t Au over 1.05 m from 117.6 m to 118.65 m

(TheNewswire) Toronto, Ontario November 4, 2025 TheNewswire - Laurion Mineral Exploration Inc. (TSX.V: LME | OTC: LMEFF) ("LAURION" or the "Corporation") is pleased to announce encouraging results from its 7,700-metre Summer 2025 drill exploration program at the 100%-owned Ishkõday Project,... Keep Reading...

04 November

Significant Gold Discoveries Continue at Golden Gate - Drilling Hits 253.0m @ 1.5 g/t Au from Surface and Open in all Directions Ending in Mineralisation

Drilling Confirms Discovery Status at Horse Heaven’s Golden Gate Target with Three Consecutive Holes Ending in Mineralisation, Identifying the Large Intrusion-Related Gold System Only 16km from the Stibnite Gold Project (PPTA.NAS)

Resolution Minerals Ltd (ASX: RML; OTCQB: RLMLF) (“Resolution” or “Company”) is pleased to report that its maiden drill program at its 100% owned Horse Heaven Gold-Antimony-Tungsten- Silver Project (“Horse Heaven” or the “Project”), Idaho, USA (Figure 1) has delivered additional broad intervals... Keep Reading...

Latest News

Sign up to get your FREE

Adavale Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00