September 01, 2024

Condor Energy Ltd (ASX: CND) (Condor or the Company) has completed targeted reprocessing of legacy 3D seismic data on its 4,585km2 Tumbes Basin Technical Evaluation Agreement (TEA or block) offshore Peru.

Highlights

- Reprocessing of a total of 1,000km2 of legacy 3D seismic data across three leading prospects completed

- Data quality vastly improved, significantly enhancing oil and gas prospectivity

- Resource estimation of main prospects underway

- More than 20 prospects and leads located outside of the reprocessing areas have been identified - prospect screening and ranking process commenced

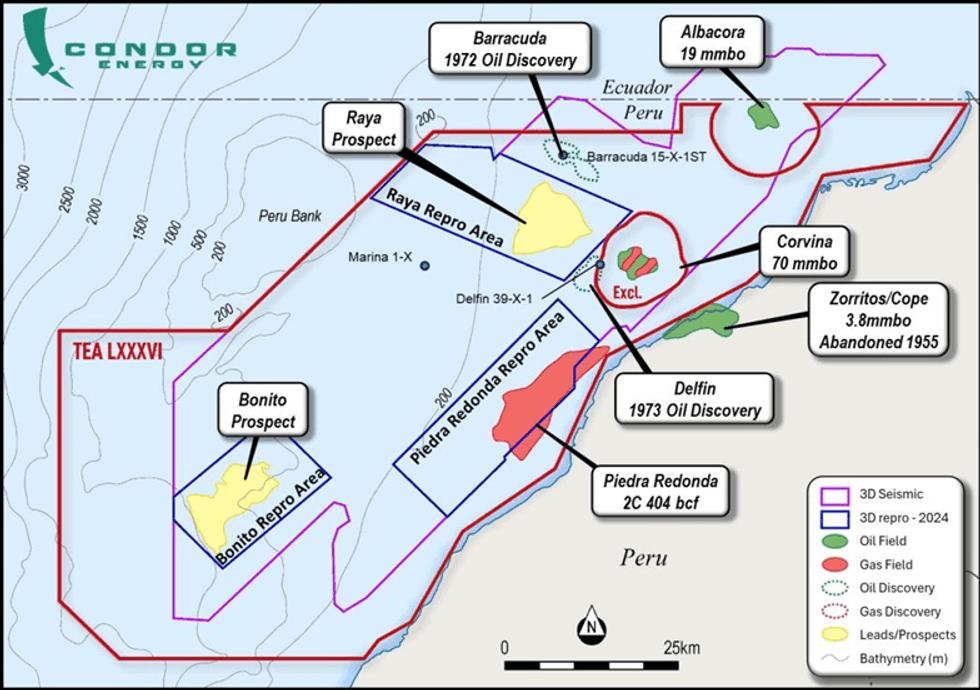

The block contains over 3,800km2 of legacy 3D seismic data, with Condor reprocessing an aggregate of 1,000km2 covering the two high potential oil prospects (Raya and Bonito) and the Piedra Redonda gas field (Figure 1).

The contract for reprocessing was awarded to Advanced Geophysical Technology (“AGT”) of Houston who have now delivered final products including Pre-Stack Time Migration and Pre-Stack Depth Migration volumes as well as derivative products used for Quantitative Interpretation (“QI”) workflows. These workflows provide enhanced insights into the lithology of subsurface rocks and the fluids they may contain.

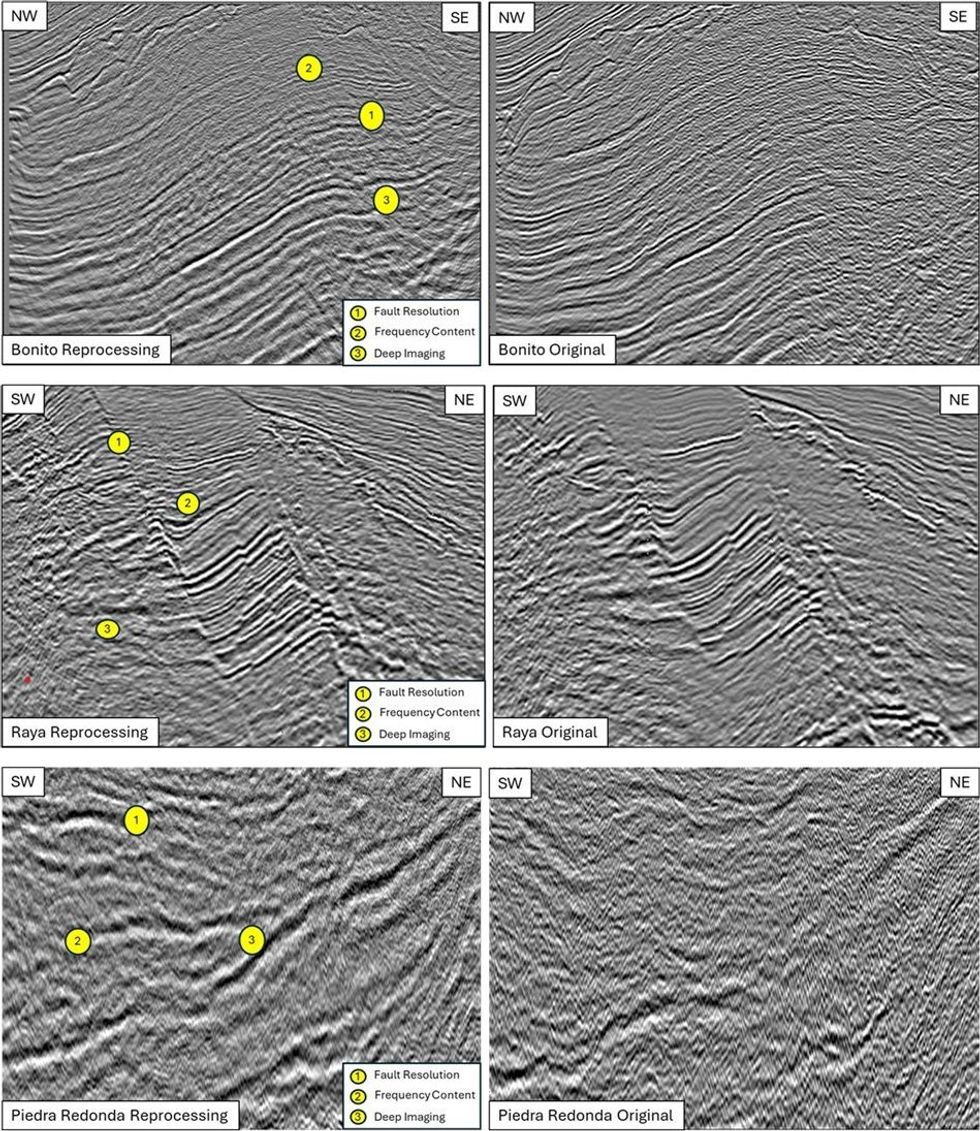

Condor is pleased with the results of the reprocessed volumes which have improved both the quality of the seismic image and the frequency content (Figure 2). These improvements greatly enhance the quality of seismic interpretation.

Significantly, the production of Pre-Stack Depth Migrated volumes offers a valuable tool which allows for more accurate structural imaging and enables interpreters to work in depth compared to the original data which had only been provided in Two Way Time (“TWT”).

Condor has commenced a review of the Raya and Bonito prospects and the Piedra Redonda discovered gas field using the new reprocessed seismic and is confident that the improved 3D seismic data will enable the formulation of Resource estimates.

The Company has also identified more than 20 additional prospects and leads which lie outside of the areas selected for reprocessing, with the objective of selecting the most prospective features through a final prospect screening and ranking process.

About the Tumbes Basin TEA

A Technical Evaluation Agreement (TEA) is an oil and gas contract that provides the holder with the exclusive right to negotiate a Licence Contract over the TEA area.

In August 2023 the Company, with its partner Jaguar Exploration, Inc. (Jaguar), entered into the 4,858km2 TEA offshore Peru with Perupetro. The TEA area covers almost all of the Peruvian offshore Tumbes Basin in shallow to moderate water depths of between 50m and 1,500m.

The under-explored block is surrounded by multiple historic and currently producing oil and gas fields and contains the undeveloped shallow water Piedra Redonda gas field which contains ‘Best Estimate’ Contingent Resources of 404 Bcf (100% gross) and ‘Best Estimate’ Prospective Resources of 2.2 Tcf# (gross unrisked) of natural gas.

Condor is 80% holder of the TEA, with Jaguar and its nominees holding the remaining 20%.

#Cautionary Statement: The estimated quantities of gas that may potentially be recovered by the application of a future development project(s) relate to undiscovered accumulations. These estimates have both a risk of discovery and a risk of development. Further exploration appraisal and evaluation is required to determine the existence of a significant quantity of potentially recoverable hydrocarbons.

Click here for the full ASX Release

This article includes content from Condor Energy, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

CND:AU

The Conversation (0)

26 September 2024

Condor Energy

Rare world-class hydrocarbon exploration opportunity

Rare world-class hydrocarbon exploration opportunity Keep Reading...

29 January 2025

Quarterly Activities/Appendix 5B Cash Flow Report

Condor Energy (CND:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

22 January 2025

A$3M Placement to Advance High-Impact Workplan for Peru

Condor Energy (CND:AU) has announced A$3M Placement to Advance High-Impact Workplan for PeruDownload the PDF here. Keep Reading...

20 January 2025

Trading Halt

Condor Energy (CND:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

15 January 2025

Piedra Redonda Gas Field Best Estimate Resource of 1 Tcf

Condor Energy (CND:AU) has announced Piedra Redonda Gas Field Best Estimate Resource of 1 TcfDownload the PDF here. Keep Reading...

13 January 2025

Trading Halt

Condor Energy (CND:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

21h

Syntholene Energy Corp. Announces Completion of Conceptual Design Report and Technoeconomic Analysis

Report Validates Pathway to Industrial Scale Synthetic Fuel Production Targeting Cost Competitiveness with Fossil FuelsSyntholene Energy Corp. (TSXV: ESAF,OTC:SYNTF) (OTCQB: SYNTF) ("Syntholene" or the "Company") announces the completion of its Conceptual Design Report ("CDR") and integrated... Keep Reading...

22h

Angkor Resources Announces Closing of Evesham Oil and Gas Sale

(TheNewswire) GRANDE PRAIRIE, ALBERTA TheNewswire - March 6, 2026 - Angkor Resources Corp. (TSXV: ANK,OTC:ANKOF) ("ANGKOR" OR "THE COMPANY") announces the completion of all final payments and closing of the sale of its 40% participating interest (the "Assets") in the Evesham Macklin oil and gas... Keep Reading...

05 March

Oil Prices Surge as Iran Conflict Halts Tanker Traffic Through Hormuz

Oil and gas prices extended their sharp climb this week as the escalating conflict between the US, Israel and Iran disrupts shipping through one of the world’s most critical energy chokepoints.Crude oil futures surged again on Thursday (March 5), with the US benchmark climbing roughly 3.5... Keep Reading...

03 March

Syntholene Energy Corp. Closes Oversubscribed $3.75 Million Non-Brokered Private Placement

Proceeds to be used to Accelerate Procurement and Component Assembly for Demonstration Facility Deployment in IcelandSyntholene Energy CORP. (TSXV: ESAF,OTC:SYNTF) (FSE: 3DD0) (OTCQB: SYNTF) (the "Company" or "Syntholene") is pleased to announce that it has closed its previously announced... Keep Reading...

02 March

Oil, LNG Prices Climb on Fears of Prolonged Hormuz Shutdown

Oil and gas prices surged Monday (March 2) after fresh military strikes between the US, Israel, and Iran rattled energy markets and brought shipping through the Strait of Hormuz close to a halt, raising fears of a wider supply shock.Brent crude, the global oil benchmark, jumped as much as 10... Keep Reading...

02 March

Angkor Resources Announces Stock Option Grant

(TheNewswire) GRANDE PRAIRIE, ALBERTA TheNewswire - March 2, 2026 - Angkor Resources Corp. (TSXV: ANK,OTC:ANKOF) ("ANGKOR" OR "THE COMPANY") wishes to announce that it has granted, effective today, an aggregate of 4,275,000 stock options (each an "Option) to certain Directors, management and... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00