May 05, 2024

Flynn Gold Limited (ASX: FG1, “Flynn” or “the Company”) is pleased to announce that the renounceable rights issue announced on 4 April 2024 has closed on 30 April 2024 with significant excess demand, raising the full amount of $2,462,114 (before costs).

Highlights

- Rights Issue seeking to raise $2.5 million closes with significant excess demand

- Strong support from existing shareholders and new investors introduced by Mahe Capital

- Funds to be used primarily to advance the Company’s Trafalgar high-grade gold discovery at Golden Ridge in Northeast Tasmania

- Phase 3 drilling at the Trafalgar prospect commenced in April 2024

- 1,500m diamond drill program has been planned

- For further information or to post questions go to the Flynn Gold Investor Hub at https://investorhub.flynngold.com.au/link/7PRD0e

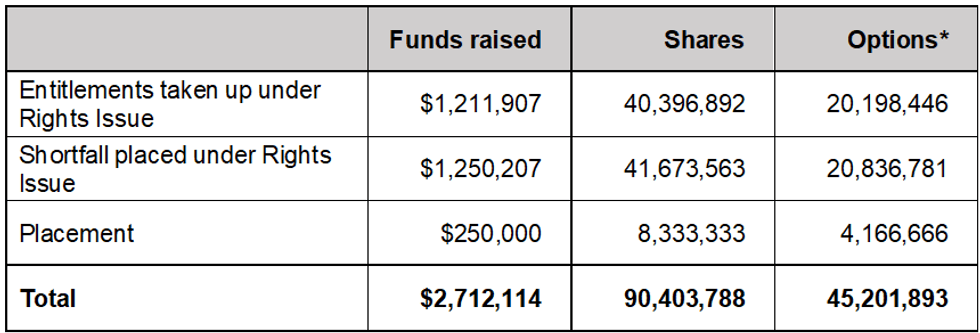

The total includes $1,211,907 received by way of acceptances from shareholders and $1,250,207 received from the shortfall shares placed to existing shareholders and by the lead manager and Underwriter, Mahe Capital Pty Ltd (Mahe Capital).

The Company will issue 82,070,455 new fully paid ordinary shares (Shares) and 41,035,227 new options (subject to rounding) exercisable at $0.075 and expiring on 7 November 2026 (Options). The Company will seek quotation of the Options on the ASX.

The new securities are expected to be issued on Tuesday, 7 May 2024, in accordance with the timetable in the Prospectus and will commence trading on the ASX on a normal settlement basis from Wednesday, 8 May 2024.

The Company would like to thank all its shareholders for their support and welcomes new shareholders introduced by Mahe Capital to the register.

The Board has also exercised its discretion to accept a portion of the excess demand to the value of $250,000. Accordingly, the Company will issue an additional 8,333,333 Shares and 4,166,666 Options, on the same terms as the securities issued under the rights issue, from the company’s current listing rule 7.1 placement capacity.

A supplementary prospectus will be lodged with ASIC and released to ASX in respect of the additional shares and options.

The final capital raising results are set out below:

* The number of new Shares and Options issued is subject to rounding.

A further 5,424,227 Options will be issued to the underwriter.

Managing Director and CEO, Neil Marston commented,

“On behalf of the Board, I would like to thank all our shareholders who have participated in this Rights Issue and to also welcome new shareholders to the Flynn Gold register. This is a very good outcome, particularly in these difficult markets and demonstrates enthusiasm for our future. The Company now has sufficient funds to embark on growing our gold opportunities in Northeast Tasmania with drilling already underway.“

Click here for the full ASX Release

This article includes content from Flynn Gold, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

FG1:AU

The Conversation (0)

12 August 2024

Flynn Gold

Advancing three high-grade gold projects in Tasmania

Advancing three high-grade gold projects in Tasmania Keep Reading...

20 February 2025

Exploration Update - Golden Ridge Project, NE Tasmania

Flynn Gold (FG1:AU) has announced Exploration Update - Golden Ridge Project, NE TasmaniaDownload the PDF here. Keep Reading...

18 February 2025

High-Grade Silver-Lead at Henty Project, Western Tasmania

Flynn Gold (FG1:AU) has announced High-Grade Silver-Lead at Henty Project, Western TasmaniaDownload the PDF here. Keep Reading...

30 January 2025

December 2024 Quarterly Activities Report and Appendix 5B

Flynn Gold (FG1:AU) has announced December 2024 Quarterly Activities Report and Appendix 5BDownload the PDF here. Keep Reading...

12 January 2025

Flynn Expands Key Gold Targets at Golden Ridge, NE Tasmania

Flynn Gold (FG1:AU) has announced Flynn Expands Key Gold Targets at Golden Ridge, NE TasmaniaDownload the PDF here. Keep Reading...

08 December 2024

Exploration Licence Granted at Beaconsfield in NE Tasmania

Flynn Gold (FG1:AU) has announced Exploration Licence Granted at Beaconsfield in NE TasmaniaDownload the PDF here. Keep Reading...

18h

Rick Rule: Gold Price During War, Silver Strategy, Oil Stock Game Plan

Rick Rule, proprietor at Rule Investment Media, shares updates on his current strategy in the resource space, mentioning gold, silver, oil and agriculture. He also reminds investors to pay more attention to gold's underlying drivers than to current events.Click here to register for the Rule... Keep Reading...

18h

Lobo Tiggre: Gold, Oil in Times of War, Plus My Shopping List Now

Lobo Tiggre of IndependentSpeculator.com shares his thoughts on how gold, silver and oil could be impacted by the developing situation in the Middle East. He cautioned investors not to chase these commodities if prices run. Don't forget to follow us @INN_Resource for real-time updates!Securities... Keep Reading...

19h

TomaGold: New High-grade Deep Discovery at Berrigan Mine

TomaGold (TSXV:LOT) President, CEO and Director David Grondin said the company is focusing on its flagship Berrigan mine in Chibougamau, Québec, following a large, significant discovery at depth.Berrigan is 4 kilometers northwest of the city of Chibougamau and has existed for about 50 years.... Keep Reading...

19h

Oreterra Metals Fully Financed for Maiden Discovery Drilling at Trek South

Oreterra Metals (TSXV:OTMC) is set to launch its first-ever discovery drill program at the Trek South porphyry copper-gold prospect in BC, Canada, a pivotal moment following a corporate restructuring that culminated in the company emerging under its new name on February 2.Speaking at the... Keep Reading...

04 March

Aurum Hits High-Grade Gold at Napie, Cote d'Ivoire

Aurum Resources (AUE:AU) has announced Aurum Hits High-Grade Gold at Napie, Cote d'IvoireDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00