June 18, 2024

Miramar Resources Limited (ASX:M2R, “Miramar” or “the Company”) is pleased to provide an update on exploration activities at the Company’s 100%-owned Whaleshark Project, in the Gascoyne region of WA, where the Company has outlined a significant magnetite Exploration Target of 411Mt - 2,353Mt at 25-30% Fe in proximity to substantial mining, processing, power, transport and shipping infrastructure.

- Significant magnetite Exploration Target outlined at Whaleshark in proximity to substantial mining, processing, power, transport and shipping infrastructure

- Project-wide passive seismic survey maps basement topography

Miramar’s Executive Chairman, Mr Allan Kelly, said that along with significant copper and gold potential, the Whaleshark Project had the potential to host a substantial “green iron” project.

“There is strong demand for magnetite from steel producers looking to reduce their carbon emissions through production of Direct Reduced Iron (DRI), which requires the higher grades obtained from magnetite iron ore to be effective,” Mr Kelly said.

“Whaleshark has several large magnetite-rich banded iron formations that have not been previously targeted or explored for magnetite iron mineralisation,” he said.

“Data from the passive seismic survey recently completed confirms that these magnetite-rich banded iron formation lie under relatively shallow cover,” he added

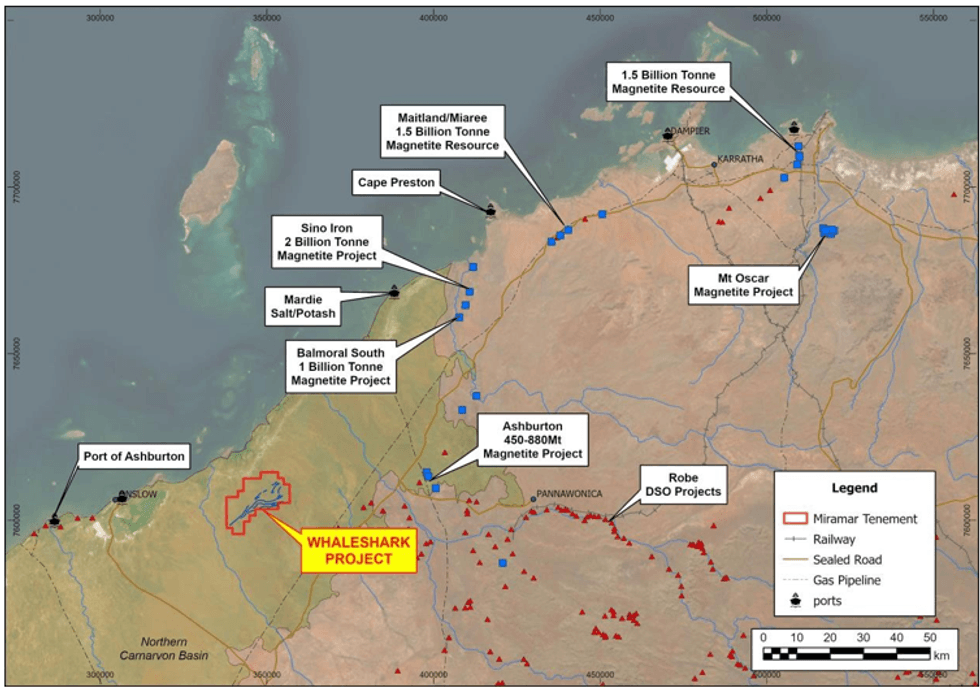

“Importantly, the Whaleshark Project is located in proximity to substantial existing and proposed mining, processing, power, transport and shipping infrastructure,” he said.

Magnetite Exploration Target

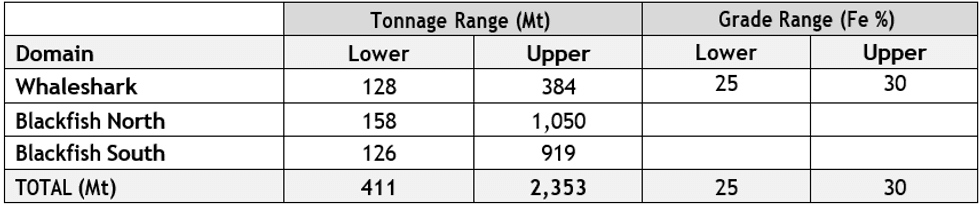

The Company has estimated an initial magnetite “Exploration Target” for the Whaleshark Project as summarised in Table 1.

By using modelled geophysical data, geological logging and assay results from historical drilling within the Whaleshark magnetic anomaly and extrapolating those results to the two banded iron formations south of the Whaleshark Granodiorite, the Company has outlined a significant potential volume of magnetite iron ore, with the midpoint in the order of 1 Billion tonnes.

The scale of the potential magnetite iron mineralisation at Whaleshark compares favourably with several large magnetite projects within WA (Figure 2).

Cautionary Statement:

The above Exploration Target has been prepared and reported in accordance with the 2012 edition of the JORC Code. The potential quantity and grade are conceptual in nature and there has been insufficient exploration to estimate a Mineral Resource. It is uncertain if further exploration will result in the estimation of a JORC-compliant Mineral Resource.

Click here for the full ASX Release

This article includes content from Miramar Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

gold-explorationnickel-explorationresource-stockscopper-stocksasx-m2rasx-stocksnickel-stockscopper-explorationcopper-investinggold-stocks

M2R:AU

The Conversation (0)

06 February 2024

Miramar Resources

Aiming to create shareholder value through the discovery of world-class mineral deposits

Aiming to create shareholder value through the discovery of world-class mineral deposits Keep Reading...

04 February

Glencore Signs MOU with Orion Consortium on Potential US$9 Billion DRC Asset Deal

Glencore (LSE:GLEN,OTCPL:GLCNF) has entered into preliminary talks with a US-backed investment group over the potential sale of a major stake in two of its flagship copper and cobalt operations in the Democratic Republic of Congo (DRC).In a joint statement, Glencore and the Orion Critical... Keep Reading...

03 February

Drilling Ramping-up Following Oversubscribed Fundraise

Critical Mineral Resources plc (“CMR”, “Company”) is pleased to report that following the recently completed and heavily oversubscribed fundraise, diamond drilling with two rigs is ramping-up over the coming weeks as the weather improves. Drilling during H1 is designed to produce Agadir... Keep Reading...

02 February

Rick Rule: Oil/Gas Move is Inevitable, but Copper is Next Bull Market

Rick Rule, proprietor at Rule Investment Media, is positioning in the oil and gas sector, but thinks a bull market is two or two and a half years away. In his view, copper is likely to be the next commodity to begin a bull run.Click here to register for the Rule Symposium. Don't forget to follow... Keep Reading...

02 February

BHP Expands 2026 Xplor Program with Record 10 Companies

Mining major BHP (ASX:BHP,NYSE:BHP,LSE:BHP) has named the early stage explorers selected for its 2026 Xplor program, expanding the intake to a record 10 companies.According to a Monday (February 2) press release, the latest cohort is the largest since the initiative launched in 2023, surpassing... Keep Reading...

30 January

Top 5 Canadian Mining Stocks This Week: Vangaurd Mining Gains 141 Percent

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian and US news impacting the resource sector.Statistics Canada released November’s gross domestic product (GDP) data on Friday (January... Keep Reading...

30 January

Quarterly Activities and Cashflow Report

Redstone Resources (RDS:AU) has announced Quarterly Activities and Cashflow ReportDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00