April 23, 2025

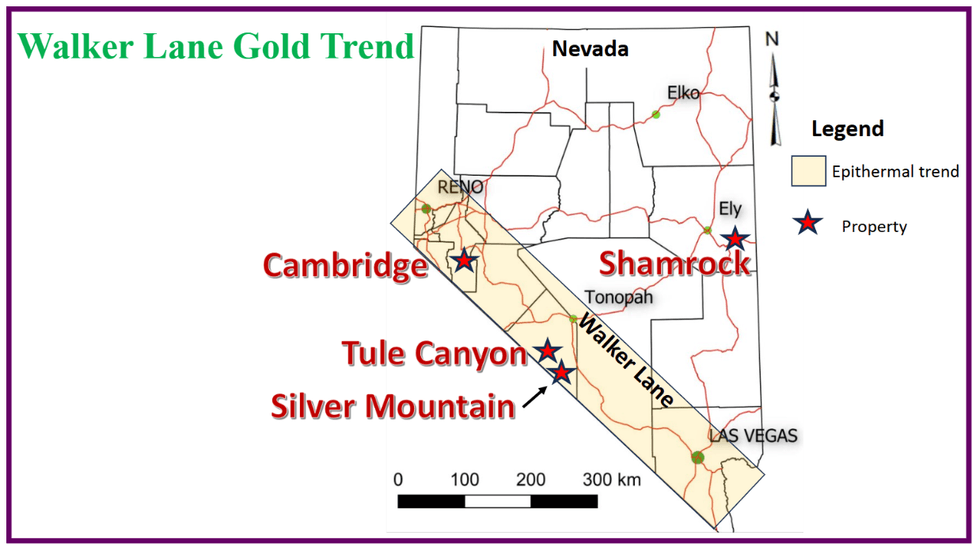

Walker Lane Resources (TSXV:WLR) is executing an exploration strategy focused on advancing high-impact projects across premier North American mining jurisdictions. The company’s portfolio spans the prolific Walker Lane Gold Trend in Nevada, as well as key exploration assets in British Columbia, the Yukon, and Newfoundland.

Near-term efforts are centered on two high-priority, drill-ready targets — Tule Canyon in Nevada and Amy in British Columbia — supported by the continued advancement of Silver Hart, Walker Lane’s flagship silver-lead-zinc asset in the Yukon, toward a development decision. All projects are accessible by road, enabling cost-effective exploration and streamlined logistics.

With a lean capital structure, high-grade and scalable assets, and a clear path from discovery through to early-stage development, Walker Lane is well-positioned to unlock significant value and deliver strong returns for shareholders. The company represents a compelling growth opportunity in the junior mining sector.

Company Highlights

- Walker Lane Resources is focused on high-grade gold, silver and polymetallic exploration, with a balanced project pipeline across multiple Canadian and US jurisdictions.

- Two flagship drill-ready projects – Amy (British Columbia) and Tule Canyon (Nevada) – are scheduled for 2025 drilling, each with compelling surface results, historical workings, and high-impact resource potential.

- The Silver Hart project in the Yukon is being positioned for near-term production through innovative ore-sorting and small-scale open pit development, designed to generate early-stage cash flow.

- Walker Lane holds approximately 1.3 billion shares in North Bay Resources (OTC:NBRI) and is entitled to option payments related to the sale of the Bishop Mill in California.

- The Silverknife project in British Columbia is subject to an option agreement with Coeur Mining, with potential milestone payments and expenditures totaling over $6 million through 2028.

- The company has an established pipeline of prospective exploration stage assets at Cambridge and Silver Mountain (Walker Lane, Nevada) and Logjam (Yukon).

This Walker Lane Resources profile is part of a paid investor education campaign.*

Click here to connect with Walker Lane Resources (TSXV:WLR) to receive an Investor Presentation

WLR:CC

Sign up to get your FREE

Walker Lane Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

01 October

Walker Lane Resources

Advancing high-grade gold and silver assets in prolific Nevada, British Columbia and Yukon

Advancing high-grade gold and silver assets in prolific Nevada, British Columbia and Yukon Keep Reading...

27 October

Walker Lane Resources Ltd. Announces An Aeromagnetic and Radiometric Airborne Survey will be Completed on its Tule Canyon Project, Walker Lane Gold Trend, Nevada

TSX-V: WLRFrankfurt: 6YL Walker Lane Resources Ltd. (TSXV: WLR,OTC:CMCXF) (Frankfurt: 6YL); "Walker Lane") is pleased to announce that Precision Geosurveys Inc. has been contracted to complete an airborne total magnetic field and radiometric survey on its Tule canyon Project located in the... Keep Reading...

24 July

Walker Lane Resources Ltd. Announces Closing of Private Placement

Walker Lane Resources Ltd. (TSX - V: WLR) (F r ankfurt:6YL ) ("WLR" o r t h e " Comp a ny") is pleased to announce, further to its news releases of June 10, 2025, that it has received TSX Venture Exchange approval to close the non-brokered private placement (the " Private Placement "). On July... Keep Reading...

03 July

Walker Lane Resources Ltd. Receives Positive Results from Airborne Geophysical Surveys and Geological Mapping Completed by Coeur on the Silverknife Property, BC and also are Clarifying Details Related to their recent Nevada Transactions

Walker Lane Resources Ltd. (TSX-V:WLR, FRA: 6YL) (the "Company" or "Walker Lane") is pleased to announce that is has received results from Coeur Silvertip Holdings Ltd. ("Coeur") on field geophysical and geological studies completed in late 2024 on the Silverknife Property, British Columbia.... Keep Reading...

10 June

Walker Lane Resources Announces Terms for Private Placement Units to Raise C$1,320,000

Walker Lane Resources Ltd. (TSX-V: WLR) (Frankfurt:ZM5P) ("WLR" or the "Company") is pleased to announce the terms to its best efforts non-brokered private placement. The proposed terms are to issue 4,000,000 non-flow through units at a price of C$0.12 per unit (the NFT Units") and 6,000,000... Keep Reading...

09 June

Walker Lane Resources Ltd. Receives TSX Approval for the Acquisition of Three Mineral Properties in the Walker Lane Gold Trend in Nevada from Silver Range Resources Ltd. and Auburn Gold

Walker Lane Resources Ltd. (TSX-V: WLR, "Walker Lane") announces that it has received approval from the TSX Venture Exchange on its option agreements on three mineral properties (i.e., Tule Canyon, Cambridge and Silver Mountain see location map Figure 1) located in the prolific Walker Lane Gold... Keep Reading...

8h

John Feneck: Gold, Silver, "Special Situations" — 7 Stocks to Play These Metals

John Feneck, portfolio manager and consultant at Feneck Consulting, shares his outlook for gold and silver prices and stocks. He also speaks "special situation" companies. "(There's) a change of behavior away from, 'Hey, we're never going to permit your mine.' To, 'Hey, we're really thinking... Keep Reading...

07 November

Top 5 Canadian Mining Stocks This Week: Quarterback Resources Scores with 160 Percent Gain

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian and US news impacting the resource sector.Statistics Canada released October’s job numbers on Friday (November 7). The data showed a... Keep Reading...

07 November

Goldgroup Files Updated Technical Report on Cerro Prieto Project

Goldgroup Mining Inc. ("Goldgroup" or the "Company") (TSXV:GGA)(OTCQX:GGAZF) is pleased to announce that it has filed an updated NI 43-101 technical report on the Cerro Prieto gold project located in Sonora State, Mexico. The report is entitled "Cerro Prieto Project, Heap Leach Project,... Keep Reading...

06 November

Adrian Day: Gold Far from Top, Two Triggers for Next Price Move

Adrian Day, president of Adrian Day Asset Management, shares his thoughts on gold's price pullback, saying he currently sees no evidence of a top. "It's perfectly normal in middle of a bull market to have a significant correction. This really isn't even a correction yet, let's not forget that.... Keep Reading...

06 November

Rick Rule: Gold Strategy, Oil Stocks I Own, "Sure Money" in Uranium

Rick Rule, proprietor at Rule Investment Media, recently sold 25 percent of his junior gold stocks, redeploying the funds into physical gold, as well as Franco-Nevada (TSX:FNV,NYSE:FNV), Wheaton Precious Metals (TSX:WPM,NYSE:WPM) and Agnico Eagle Mines (TSX:AEM,NYSE:AEM). In addition to those... Keep Reading...

Latest News

Sign up to get your FREE

Walker Lane Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00