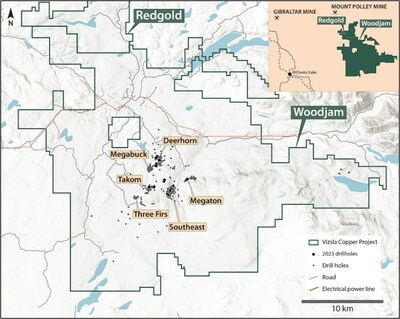

Vizsla Copper Corp. (TSXV: VCU) (OTCQB: VCUFF) ( FRANKFURT : 97E0) (" Vizsla Copper " or the " Company ") is pleased to report additional assay results from its summer core drilling program at the Woodjam copper-gold project (the " Woodjam Project " or " Woodjam ") in central BC (Figure 1). Highlights include significant extensions to the Deerhorn and Takom deposits and the strongest copper mineralization to date at the Megaton zone.

HIGHLIGHTS

Mineralization Extended at the Deerhorn and Takom Deposits.

- Drill hole DH23-107 (Deerhorn):

- Intersected 37.5m averaging 0.64% CuEq (0.12% Cu, 0.78 g/t Au)

- includes a higher-grade sub-interval of 22.5m averaging 0.84% CuEq (0.13% Cu, 1.07 g/t Au)

- Drill hole DH23-104 (Deerhorn):

- Intersected 90.7m averaging 0.36% CuEq (0.10% Cu, 0.38 g/t Au)

- Drill hole TK23-111 (Takom):

- Intersected 20.0m averaging 0.69% CuEq (0.50% Cu, 0.27 g/t Au)

- Intersected a second zone of 97.60m averaging 0.20% CuEq (0.15% Cu, 0.08 g/t Au)

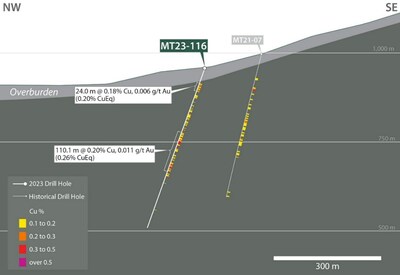

Megaton Drilling

- Drill hole MT23-116 (Megaton):

- Intersected 110.1m averaging 0.26% copper equivalent (CuEq) (0.20% Cu, 0.01 g/t Au)

| Note: Copper equivalent values are based on metal prices of $4.00/lb Cu, $1,800/oz Au, $22/oz Ag and $15/lb Mo. |

" I'm very pleased with the results of our first drilling program at Woodjam, " commented Craig Parry , Executive Chairman. " Our strategy of acquiring under-appreciated assets in top-tier jurisdictions and adding value through aggressive exploration is progressing nicely. We will continue to pursue this strategy with more exploration at Woodjam and our other highly prospective projects. "

"Thanks to our field crews, led by Senior Geologist Ian Borg and Project Geologist Colin Bateman, the summer drilling program at Woodjam has been a resounding success," commented Steve Blower , Vice President of Exploration . "We safely and effectively explored several different target areas. Mineralization at the Deerhorn and Takom deposits was expanded and gaps in the drilling at the large Southeast deposit were successfully filled. However, I'm most excited about the result at the Megaton zone, where drill hole MT23-116 intersected the strongest mineralization there to date and has established a clear vector for further exploration. There are strong indications that Megaton is another porphyry center at Woodjam."

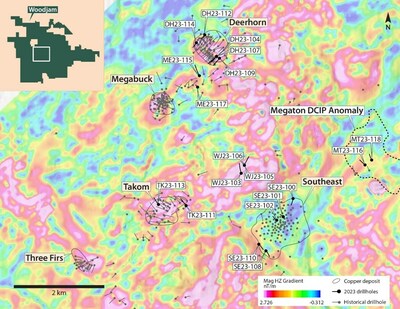

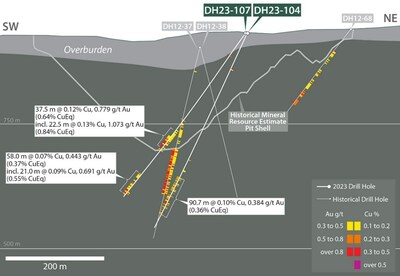

DEERHORN

Drill holes DH23-104 and DH23-107 were completed to evaluate down-dip and up-dip extensions, respectively, on the southernmost section of historical drilling at the Deerhorn Zone. Historical drill hole DH12-37 had previously intersected a long interval of copper and gold mineralization ( 100.0 m @ 0.97 g/t Au and 0.13 % Cu from 211.0 m ) on this section. Drill holes DH23-104 and DH23-107 extended the mineralization in both the down-dip and up-dip directions (Table 1 and Figures 2 and 3) and demonstrate that the system is robust at the south end of the zone and remains open for expansion in this direction. Drill hole DH23-109 was completed as a 100m step-out further south and while it did not intersect significant copper or gold mineralization, the drill hole was strongly altered and is interpreted to have intersected an altered envelope around the plunging zone of mineralization. More drilling is required at the south end of Deerhorn.

TAKOM

Drilling at the Takom deposit successfully extended mineralization on the east side of the deposit with drill hole TK23-111 (Table 1 and Figures 2 and 4). TK23-111 intersected 20m averaging 0.69% CuEq and a second interval of 97.60 m averaging 0.20% CuEq.

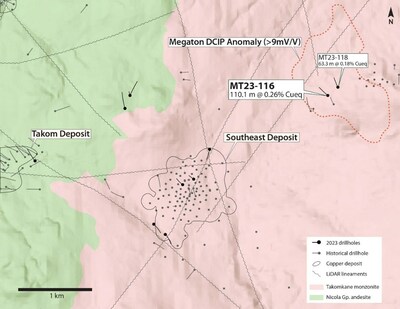

MEGATON

Wide spaced, historical drilling at the Megaton zone, located approximately 2km northeast of the large Southeast Deposit has commonly intersected long intervals of low-grade copper mineralization over a large area. The geology at Megaton is similar to that at the Southeast zone, with mineralization hosted by several phases of altered monzonite, including potassium feldspar porphyry, along the northern edge of the Takomkane batholith. New Direct Current Induced Polarization (DCIP) geophysical survey data collected earlier this year indicated greater concentrations of sulphide mineralization may be present north of previous drilling. Drill hole MT23-116, collared 150m north of historical drill hole MT21-07 intersected the strongest mineralization to date at Megaton, 110.1m averaging 0.26% Cueq (Figures 5 and 6). Drill hole MT23-118, completed 180m northeast of MT23-116 intersected 63.3m averaging 0.18% Cueq. Much of the large DCIP anomaly remains undrilled to the north of drill holes MT23-116 and MT23-118, where interpreted structures extend from the Southeast deposit.

Table 1 – Woodjam 2023 Drilling Highlights

| Hole-ID | Area | Cutoff | Significant Intersections 2,3 | |||||||

| From (m) | To (m) | Length (m) | Cu (%) | Mo (%) | Au (g/t) | Ag (g/t) | Cueq (%) | |||

| SE23-101 1 | SE | 0.2% Cu | 177.0 | 308.5 | 131.5 | 0.49 | 0.012 | 0.07 | 1.43 | 0.60 |

| includes | | 0.5% Cu | 185.0 | 245.0 | 60.0 | 0.64 | 0.011 | 0.10 | 1.75 | 0.76 |

| and | | 0.2% Cu | 398.0 | 448.0 | 50.0 | 0.29 | 0.046 | 0.04 | 1.99 | 0.50 |

| and | | 0.2% Cu | 487.0 | 497.0 | 10.0 | 0.79 | 0.215 | 0.37 | 10.25 | 1.92 |

| SE23-102 1 | SE | 0.2% Cu | 136.9 | 430.1 | 293.2 | 0.54 | 0.005 | 0.05 | 1.84 | 0.61 |

| includes | | 0.5% Cu | 157.0 | 223.1 | 66.1 | 0.81 | 0.005 | 0.08 | 1.89 | 0.90 |

| and includes | | 0.5% Cu | 260.0 | 327.1 | 67.1 | 0.54 | 0.005 | 0.05 | 1.43 | 0.60 |

| and | | 0.2% Cu | 442.0 | 481.1 | 39.1 | 0.34 | 0.013 | 0.03 | 1.50 | 0.42 |

| DH23-104 | Deerhorn | 0.2 g/t Au | 308.3 | 399.0 | 90.7 | 0.10 | 0.001 | 0.38 | 0.86 | 0.36 |

| DH23-107 | Deerhorn | 0.2 g/t Au | 256.0 | 293.5 | 37.5 | 0.12 | 0.001 | 0.78 | 0.57 | 0.64 |

| includes | | 0.5 g/t Au | 265.0 | 287.5 | 22.5 | 0.13 | 0.001 | 1.07 | 0.63 | 0.84 |

| and | | 0.2 g/t Au | 356.0 | 414.0 | 58.0 | 0.07 | 0.001 | 0.44 | 0.54 | 0.37 |

| includes | | 0.5 g/t Au | 386.0 | 407.0 | 21.0 | 0.09 | 0.001 | 0.69 | 0.59 | 0.55 |

| SE23-110 | SE | 0.1 % Cu | 214.5 | 252.0 | 37.5 | 0.19 | 0.001 | 0.02 | 0.71 | 0.21 |

| includes | | 0.2 % Cu | 222.0 | 235.7 | 13.7 | 0.24 | 0.002 | 0.02 | 0.92 | 0.28 |

| and | | 0.1 % Cu | 276.0 | 296.0 | 20.0 | 0.18 | 0.003 | 0.02 | 0.56 | 0.21 |

| TK23-111 | Takom | 0.1% Cu | 133.0 | 153.0 | 20.0 | 0.50 | 0.001 | 0.27 | 2.38 | 0.69 |

| and | | 0.1 % Cu | 164.4 | 262.0 | 97.6 | 0.15 | 0.000 | 0.08 | 0.46 | 0.20 |

| MT23-116 | Megaton | 0.1 % Cu | 48.0 | 72.0 | 24.0 | 0.18 | 0.002 | 0.01 | 1.20 | 0.20 |

| and | | 0.1 % Cu | 123.0 | 155.0 | 32.0 | 0.14 | 0.003 | 0.00 | 1.11 | 0.17 |

| and | | 0.1 % Cu | 197.0 | 307.1 | 110.1 | 0.20 | 0.011 | 0.01 | 1.38 | 0.26 |

| includes | | 0.2 % Cu | 206.0 | 228.0 | 22.0 | 0.32 | 0.017 | 0.01 | 1.00 | 0.40 |

| includes | | 0.2 % Cu | 285.1 | 297.1 | 12.0 | 0.40 | 0.039 | 0.03 | 7.66 | 0.63 |

| MT23-118 | Megaton | 0.1 % Cu | 136.0 | 151.0 | 15.0 | 0.14 | 0.002 | 0.01 | 0.68 | 0.16 |

| and | | 0.1 % Cu | 271.1 | 334.4 | 63.3 | 0.15 | 0.006 | 0.01 | 0.99 | 0.18 |

| and | | 0.1 % Cu | 416.2 | 430.2 | 14.0 | 0.13 | 0.017 | 0.01 | 1.03 | 0.21 |

| | | | | | | | | | | |

| Notes: | | |

| | 1. | Previously disclosed and included here for completeness. |

| | 2. | Composite intervals are calculated above noted cutoffs and may include a maximum of 10m of internal waste. |

| | 3. | Copper equivalent values are based on metal prices of $4.00/lb Cu, $1,800/oz Au, $22/oz Ag and $15/lb Mo. |

The drill program is now complete. A total of 7,599m was drilled in 18 drill holes. Assay results have now been received for all of the drill holes.

Figure 1 – Woodjam Property Map

Figure 2 – Drilling Target Area Locations

Figure 3 – Deerhorn Drill Holes DH23-104 and 107 Cross Section

Figure 4 – Takom Drill Hole TK23-111 Cross Section

Figure 5 – Megaton Area Drilling Plan

Figure 6 – Megaton Drill Hole MT23-116 Cross Section

Table 2 – 2023 Drill Hole Details

| Hole-ID | Length (m) | Azm | Dip | Northing | Easting | Elevation |

| SE23-100 | 603 | 170 | -75 | 5788697 | 613288 | 960 |

| SE23-101 | 506 | 315 | -80 | 5788288 | 613082 | 981 |

| SE23-102 | 509 | 310 | -75 | 5788210 | 612934 | 991 |

| WJ23-103 | 452 | 345 | -60 | 5789223 | 612130 | 1095 |

| DH23-104 | 429 | 220 | -65 | 5791793 | 611532 | 924 |

| WJ23-105 | 111 | 345 | -60 | 5789399 | 612193 | 1083 |

| WJ23-106 | 452 | 20 | -60 | 5789400 | 612194 | 1083 |

| DH23-107 | 414 | 220 | -55 | 5791797 | 611525 | 924 |

| SE23-108 | 360 | 130 | -65 | 5787532 | 612714 | 1024 |

| DH23-109 | 439 | 220 | -65 | 5791751 | 611608 | 924 |

| SE23-110 | 411 | 130 | -65 | 5787668 | 612555 | 1013 |

| TK23-111 | 359 | 310 | -55 | 5788486 | 610928 | 992 |

| DH23-112 | 251 | 215 | -65 | 5792258 | 611256 | 916 |

| TK23-113 | 302 | 310 | -55 | 5788499 | 610318 | 953 |

| DH23-114 | 221 | 210 | -60 | 5792079 | 611074 | 918 |

| ME23-115 | 419 | 320 | -55 | 5791352 | 611156 | 925 |

| MT23-116 | 476 | 310 | -70 | 5789461 | 614872 | 958 |

| ME23-117 | 434 | 310 | -80 | 5791096 | 611126 | 942 |

| MT23-118 | 452 | 330 | -70 | 5789576 | 615006 | 965 |

| Note: Coordinates are North American Datum 1983, Universal Transverse Mercator Zone 10 North (NAD83 z 10N) |

Sampling, Chain of Custody, Quality Assurance and Quality Control

All sampling was conducted under the supervision of Vizsla's geologists and the chain of custody from the sampling facility in Horsefly to the sample preparation facility, ALS Laboratories in Kamloops, BC , was continuously monitored.

Core samples were taken as ½ core, from a minimum of 0.3 m to a maximum of 2 m core length to account for lithological or alteration boundaries. Samples were then crushed, pulverised and sample pulps were analysed using industry standard analytical methods including a 4-Acid, ICP-MS multielement package (ALS code ME-MS61) and an ICP-AES method for high-grade copper samples (ALS code ME-OG62). Gold was analysed using a 30 g aliquot by fire assay with an ICP-AES finish (ALS code Au-ICP21).

Certified reference material was inserted every 10 th sample. Coarse blank was inserted every 20 th sample. For approximately 2.5% of core samples, the remaining ½ core was taken as a field duplicate. For 2.5% of core samples a preparation duplicate is taken after coarse crushing is complete at the laboratory.

In addition to Vizsla's QA/QC program, additional blanks, reference materials and duplicates were inserted by ALS according to their internal procedures. Data verification of the analytical results included a statistical analysis of the standards and blanks that must pass certain parameters for acceptance to ensure accurate and verifiable results.

Repricing of Warrants

The Company intends to reprice and extend the expiry date of a total of 3,072,061 share purchase warrants exercisable at $0.65 per common share expiring on April 14, 2024 (the " Warrants "). The Warrants were issued pursuant to a private placement which closed on April 14, 2022 . The Company proposes to reprice the Warrants to $0.35 per share and extend the expiry date by an additional year to April 14, 2025 .

All other terms and conditions of the Warrants remain unchanged. The extension of the Warrants is subject to acceptance by the TSX Venture Exchange.

About Vizsla Copper

Vizsla Copper is a Cu-Au-Mo focused mineral exploration and development company headquartered in Vancouver, Canada . The Company is primarily focused on its flagship Woodjam project, located within the prolific Quesnel Terrane, 55 kilometers east of the community of Williams Lake, British Columbia . It has four additional copper exploration properties; Copperview, Redgold, Blueberry and Carruthers Pass , all well situated amongst significant infrastructure in British Columbia . The Company's growth strategy is focused on the exploration and development of its copper properties within its portfolio in addition to value accretive acquisitions. Vizsla Copper's vision is to be a responsible copper explorer and developer in the stable mining jurisdiction of British Columbia, Canada and is committed to socially responsible exploration and development, working safely, ethically and with integrity.

Vizsla Copper is a spin-out of Vizsla Silver Corp. (TSX.V: VZLA) (NYSE: VZLA) and is backed by Inventa Capital Corp., a premier investment group founded in 2017 with the goal of discovering and funding opportunities in the resource sector. Additional information about the Company is available on SEDAR ( www.sedarplus.ca ) and the Company's website ( www.vizslacopper.com ).

Qualified Person

The Company's disclosure of technical or scientific information in this press release has been reviewed and approved by Ian Borg , P.Geo., Senior Geologist for Vizsla Copper. Mr. Borg is a Qualified Person as defined under the terms of National Instrument 43-101.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

FORWARD LOOKING STATEMENTS

The information contained herein contains "forward-looking statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995 and "forward-looking information" within the meaning of applicable Canadian securities legislation. "Forward-looking information" includes, but is not limited to, statements with respect to the activities, events or developments that the Company expects or anticipates will or may occur in the future, including, without limitation, planned exploration activities. Generally, but not always, forward-looking information and statements can be identified by the use of words such as "plans", "expects", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates", or "believes" or the negative connotation thereof or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved" or the negative connotation thereof. Forward-looking statements in this news release include, among others, statements relating to: the exploration and development of the Company's projects, including Woodjam; the release of exploration results; and the Company's growth and business strategies.

Forward‐looking statements and forward‐looking information relating to any future mineral production, liquidity, enhanced value and capital markets profile of the Company, future growth potential for the Company and its business, and future exploration plans are based on management's reasonable assumptions, estimates, expectations, analyses and opinions, which are based on management's experience and perception of trends, current conditions and expected developments, and other factors that management believes are relevant and reasonable in the circumstances, but which may prove to be incorrect. Assumptions have been made regarding, among other things, the price of silver, gold, and other metals; no escalation in the severity of public health crises; costs of exploration and development; the estimated costs of development of exploration projects; the Company's ability to operate in a safe and effective manner and its ability to obtain financing on reasonable terms.

These statements reflect the Company's respective current views with respect to future events and are necessarily based upon a number of other assumptions and estimates that, while considered reasonable by management, are inherently subject to significant business, economic, competitive, political and social uncertainties and contingencies. Many factors, both known and unknown, could cause actual results, performance, or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward‐looking statements or forward-looking information and the Company has made assumptions and estimates based on or related to many of these factors. Such factors include, without limitation: precious metals price volatility; risks associated with the conduct of the Company's mining activities; regulatory, consent or permitting delays; risks relating to reliance on the Company's management team and outside contractors; the Company's inability to obtain insurance to cover all risks, on a commercially reasonable basis or at all; currency fluctuations; risks regarding the failure to generate sufficient cash flow from operations; risks relating to project financing and equity issuances; risks and unknowns inherent in all mining projects, including the inaccuracy of reserves and resources, metallurgical recoveries and capital and operating costs of such projects; contests over title to properties, particularly title to undeveloped properties; laws and regulations governing the environment, health and safety; the ability of the communities in which the Company operates to manage and cope with the implications of public health crises; the economic and financial implications of public health crises to the Company; operating or technical difficulties in connection with mining or development activities; employee relations, labour unrest or unavailability; the Company's interactions with surrounding communities; the Company's ability to successfully integrate acquired assets; the speculative nature of exploration and development, including the risks of diminishing quantities or grades of reserves; stock market volatility; conflicts of interest among certain directors and officers; lack of liquidity for shareholders of the Company; litigation risk; the ongoing military conflict in Ukraine ; general economic facts; and the factors identified under the caption "Risk Factors" in the Company's management discussion and analysis and other public disclosure documents.

Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in the forward-looking information or implied by forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking information and statements will prove to be accurate, as actual results and future events could differ materially from those anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking statements or information. The Company undertakes no obligation to update or reissue forward-looking information as a result of new information or events except as required by applicable securities laws.

SOURCE Vizsla Copper Corp.

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/December2023/05/c4237.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/December2023/05/c4237.html