October 03, 2024

Description:

Australian market analyst firm Vested Equities has estimated a 194 percent upside over the current share price of oil producer and explorer Jupiter Energy (ASX:JPR), citing the company’s large reserve and plans for sustainable growth.

“Jupiter Energy's resilient financial performance, strategic positioning, and significant reserves potential make it an attractive prospect for investors seeking exposure to the energy sector,” wrote Vested analyst Stuart McClure in a June 2024 report.

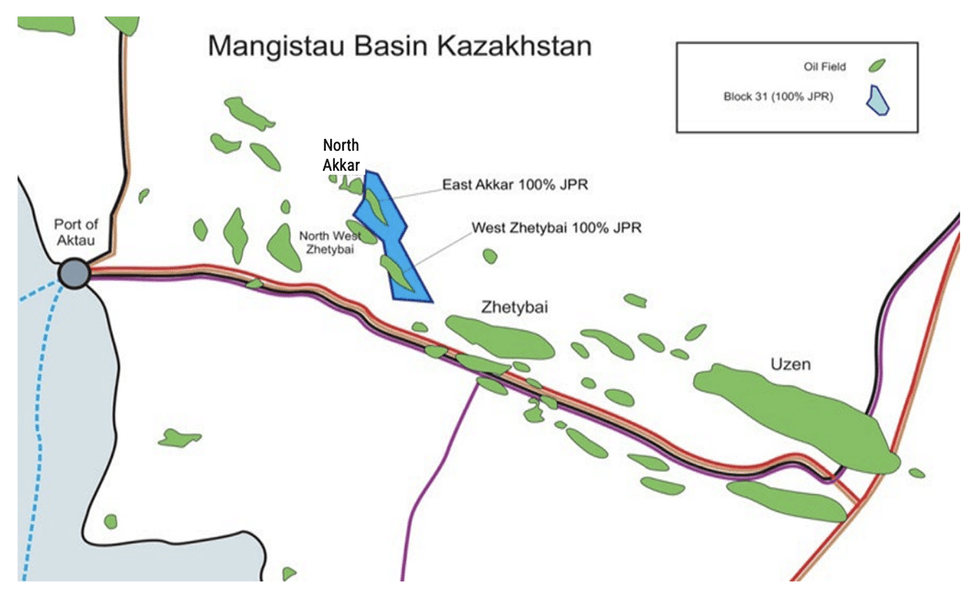

Jupiter Energy is an oil exploration and production company operating in Kazakhstan, with three licenced oil fields producing approximately 640 barrels per day from four wells, with plans to increase to approximately 1,000 barrels per day by the end of 2024.

The Vested report also cited Kazakhstan's supportive regulatory environment with policies and programs aimed at strengthening its energy sector, by facilitating the increase of production capacity, attracting new investments and supporting industry growth.

“Jupiter Energy’s operations benefit from these favourable policies, the most recent being the support offered to the company by the Kazakh Ministry of Energy in addressing its gas utilisation requirements. These initiatives have provided access to essential resources and infrastructure, enhancing the company’s operational stability and capacity for growth,” the report said.

Highlights of the report:

- Vested determined Jupiter’s valuation through a blended approach of both the discounted cash flow method and market approach, which is most suited for the company with its large reserve and strategic plans to increase future incomes.

- The discounted cash flow analysis suggests a per-share value of AU$0.029 assuming a terminal growth rate of 4 percent and discounts future cash flows at a weighted average cost of capital of 13.6 percent.

- The market approach is calculated by taking peer companies’ EV/2P reserves value and arriving at a target price of AU$0.14.

- The valuation methodology assigns 60 percent weight to the income approach and 40 percent to the market approach, resulting in a weighted average target price of AU$0.074 per share, reflecting a 194.1 percent premium over its current market price of AU$0.025.

For the full analyst report, click here.

This content is intended only for persons who reside or access the website in jurisdictions with securities and other applicable laws which permit the distribution and consumption of this content and whose local law recognizes the scope and effect of this Disclaimer, its limitation of liability, and the legal effect of its exclusive jurisdiction and governing law provisions [link to Governing Law section of the Disclaimer page].

Any investment information contained on this website, including third party research reports, are provided strictly for informational purposes, are general in nature and not tailored for the specific needs of any person, and are not a solicitation or recommendation to purchase or sell a security or intended to provide investment advice. Readers are cautioned to seek the advice of a registered investment advisor regarding the appropriateness of investing in any securities or investment strategies mentioned on this website.

JPR:AU

The Conversation (0)

21 October 2025

Sep25 Quarterly Activities Report

Jupiter Energy (JPR:AU) has announced Sep25 Quarterly Activities ReportDownload the PDF here. Keep Reading...

21 October 2025

Sep25 Appendix 5B

Jupiter Energy (JPR:AU) has announced Sep25 Appendix 5BDownload the PDF here. Keep Reading...

13 July 2025

Jun25 Appendix 5B

Jupiter Energy (JPR:AU) has announced Jun25 Appendix 5BDownload the PDF here. Keep Reading...

13 July 2025

Jun25 Quarterly Activities Report

Jupiter Energy (JPR:AU) has announced Jun25 Quarterly Activities ReportDownload the PDF here. Keep Reading...

22 May 2025

Variation to Noteholder Agreements

Jupiter Energy (JPR:AU) has announced Variation to Noteholder AgreementsDownload the PDF here. Keep Reading...

15h

Oil Prices Surge as Iran Conflict Halts Tanker Traffic Through Hormuz

Oil and gas prices extended their sharp climb this week as the escalating conflict between the US, Israel and Iran disrupts shipping through one of the world’s most critical energy chokepoints.Crude oil futures surged again on Thursday (March 5), with the US benchmark climbing roughly 3.5... Keep Reading...

03 March

Syntholene Energy Corp. Closes Oversubscribed $3.75 Million Non-Brokered Private Placement

Proceeds to be used to Accelerate Procurement and Component Assembly for Demonstration Facility Deployment in IcelandSyntholene Energy CORP. (TSXV: ESAF,OTC:SYNTF) (FSE: 3DD0) (OTCQB: SYNTF) (the "Company" or "Syntholene") is pleased to announce that it has closed its previously announced... Keep Reading...

02 March

Oil, LNG Prices Climb on Fears of Prolonged Hormuz Shutdown

Oil and gas prices surged Monday (March 2) after fresh military strikes between the US, Israel, and Iran rattled energy markets and brought shipping through the Strait of Hormuz close to a halt, raising fears of a wider supply shock.Brent crude, the global oil benchmark, jumped as much as 10... Keep Reading...

02 March

Angkor Resources Announces Stock Option Grant

(TheNewswire) GRANDE PRAIRIE, ALBERTA TheNewswire - March 2, 2026 - Angkor Resources Corp. (TSXV: ANK,OTC:ANKOF) ("ANGKOR" OR "THE COMPANY") wishes to announce that it has granted, effective today, an aggregate of 4,275,000 stock options (each an "Option) to certain Directors, management and... Keep Reading...

27 February

US-Iran Tensions Put Europe’s Gas Storage Plans at Risk

Escalating tensions between the United States and Iran are reviving a risk energy markets have long feared: a potential closure of the Strait of Hormuz, the narrow Gulf passage that carries roughly 20 percent of global LNG trade and 25 percent of seaborne oil.New modelling from energy analytics... Keep Reading...

25 February

QIMC Intersects Major Subsurface Fault Corridor with Elevated H2 Readings at 142m Depth

Pressurized Formation Water and Visible Gas Bubbling Confirm Active Structural System in First of Five-Hole Systematic Drill Program

Quebec Innovative Materials Corp. (CSE: QIMC) (OTCQB: QIMCF) (FSE: 7FJ) ("QIMC" or the "Company") is pleased to report significant initial results from the first 300 metres of its planned 650-metre diamond drill hole DDH-26-01 at its West Advocate Eatonville Project, Nova Scotia. Drilling... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00