November 19, 2023

Rock chip results confirm anomalous lithium soils G pegmatite mapping observations

Lithium, gold and base metals exploration company Golden State Mining Limited (ASX code: “GSM” or the “Company”) is pleased to provide rock chip assay results following a geochemical program conducted at its Paynes Find lithium project in Western Australia.

Paynes Find (Li) Project

- Paynes Find North - Significant lithium-rubidium-caesium assay results

- First pass reconnaissance rock chips demonstrate encouraging pegmatites with LCT affinity over an area of broad anomalous geochemistry

- Rock chip results include: 0.9% Li₂O, 0.3% Rb₂O K 178ppm Cs

- Paynes Find Central

- Widespread rubidium anomalism in rock chips up to 0.12% Rb₂O

- Follow-up field work campaign to orientate and sample prospective pegmatites for drill planning

Golden State’s Managing Director, Michael Moore commented: “Despite the very limited fieldwork coverage thus far, GSM has already validated its original targeting criteria at the Paynes Find lithium project – a self-generated asset in the greater Murchison region of Western Australia.

These encouraging results come from a recent field trip which identified outcropping pegmatites and further enhanced the prospectivity of the project. This data provides the basis for a robust drilling campaign in 2024.

GSM looks forward to carrying out further fieldwork during this quarter, assisting drill-hole placement, target vectoring and updating shareholders as work progresses.”

Paynes Find (Li) Project

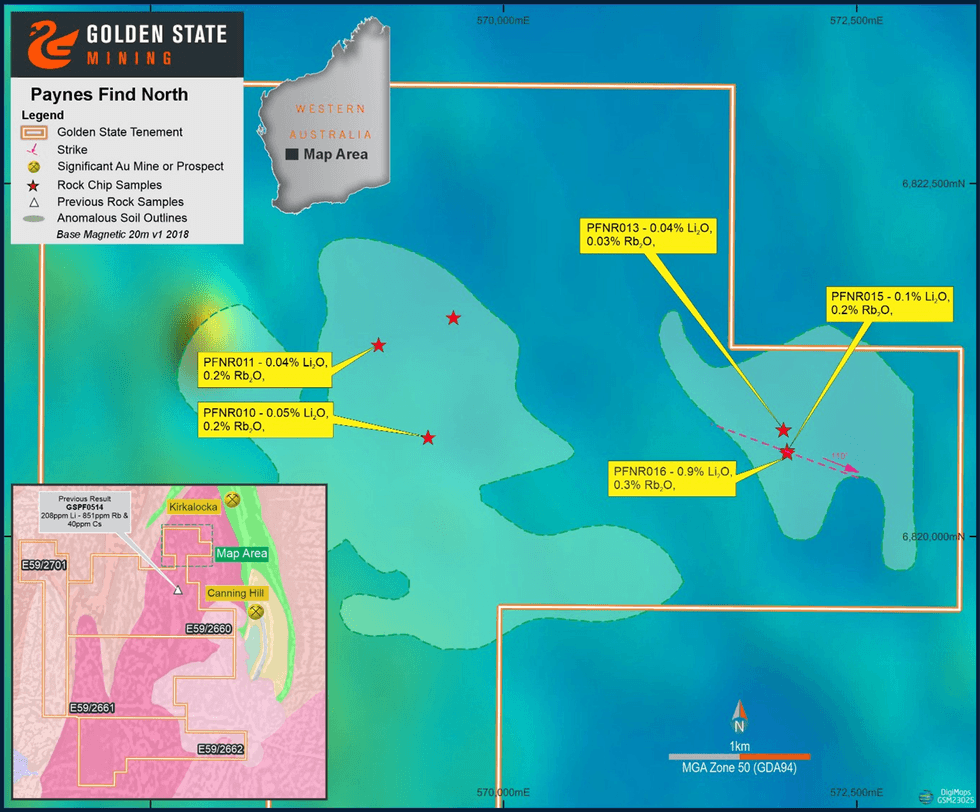

GSM has received assay results for 18 rock chip samples collected from a range of pegmatite outcrops at the Paynes Find North (Figure 1) and Paynes Find Central project areas (refer to ASX announcement dated 8 November 2023). These results were taken from a preliminary reconnaissance field mapping exercise only with no comprehensive sampling undertaken. The sampled rock chip locations were selected within areas previously highlighted by soils anomalous in lithium (Li), rubidium (Rb), caesium (Cs) and other lithium pathfinder elements (refer to ASX announcement dated 13 June 2023). A results table of significant elements and key element ratios is provided in Appendices 1 E 2.

Paynes Find North (E59/2660, 2661, 2662 E E59/2701)

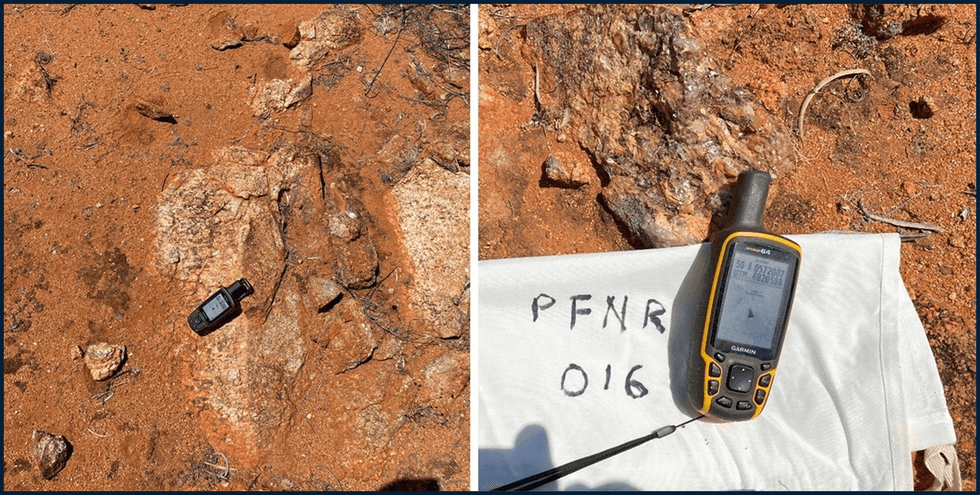

At Paynes Find North, assay results for seven rock chip samples returned several highly encouraging results with significant lithium, rubidium and caesium values along with elevated tantalum and niobium. The best result was reported from rock chip sample PFNR016, which recorded a lithium assay approaching an ore grade of 4,170ppm Li (0.9% Li₂O), 2,650ppm Rb (0.29% Rb₂O) and 178ppm Cs. This sample (Figure 2) was collected from a weathered pegmatite sub-crop approximately 3 metres wide with a very coarse-grained K-feldspar-muscovite with opaque quartz pegmatitic mineral assemblage trending approximately 110 degrees east-southeast.

Click here for the full ASX Release

This article includes content from Golden State Mining, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

08 January

Top 5 US Lithium Stocks (Updated January 2026)

The global lithium market enters 2026 after a punishing 2025 marked by oversupply, weaker-than-expected EV demand and sustained price pressure, although things began turning around for lithium stocks in Q4. Lithium carbonate prices in North Asia fell to four-year lows early in the year,... Keep Reading...

07 January

5 Best-performing ASX Lithium Stocks (Updated January 2026)

Global demand for lithium presents a significant opportunity for Australia and Australian lithium companies.Australia remains the world’s largest lithium miner, supplying nearly 30 percent of global output in 2024, though its dominance is easing as other lithium-producing countries such as... Keep Reading...

05 January

CEOL Application for Laguna Verde Submitted

CleanTech Lithium PLC ("CleanTech Lithium" or "CleanTech" or the "Company") (AIM: CTL, Frankfurt:T2N), an exploration and development company advancing sustainable lithium projects in Chile, is pleased to announce it has submitted its application (the "Application") for a Special Lithium... Keep Reading...

29 December 2025

SQM, Codelco Seal Landmark Lithium Joint Venture in Salar de Atacama

Sociedad Quimica y Minera (SQM) (NYSE:SQM) and Codelco have finalized their long-awaited partnership, forming a new joint venture that will oversee lithium production in Chile’s Salar de Atacama through 2060.SQM announced on Saturday (December 27) that it has completed its strategic partnership... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00