January 18, 2024

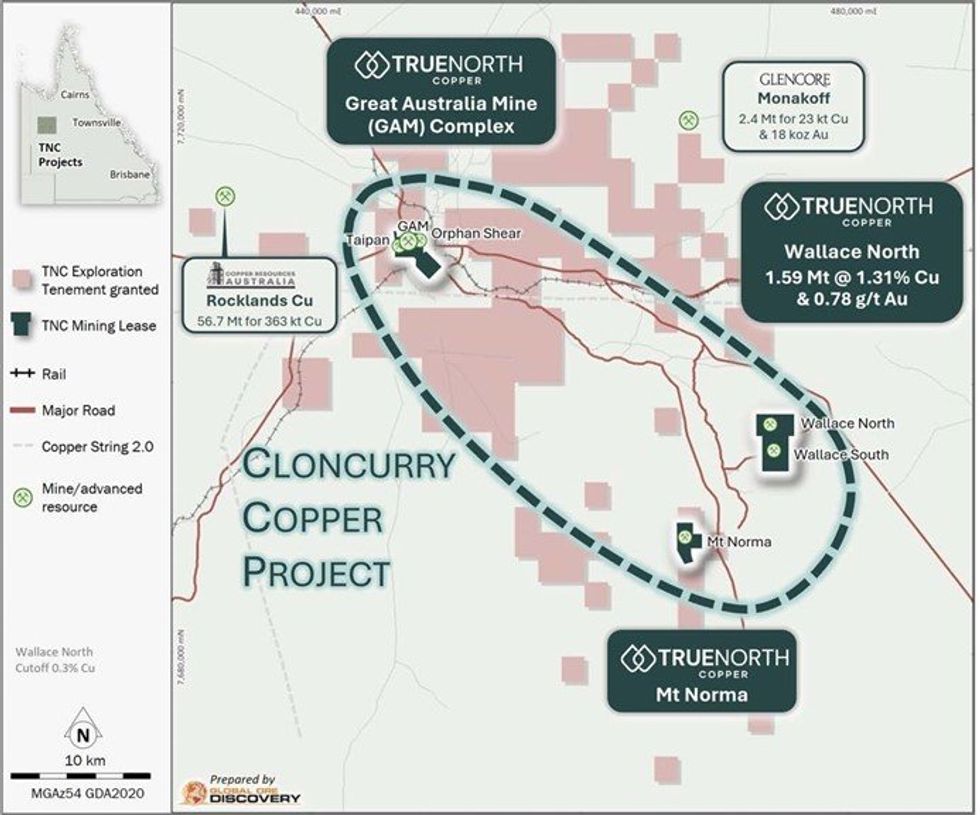

True North Copper Limited (ASX:TNC) (True North, TNC or the Company) is pleased to announce an update to the Mineral Resource at Wallace North, part of its Cloncurry Copper Project (Queensland), following the completion of an Advanced Grade Control (AGC) drilling and historic core re-assay program.

HIGHLIGHTS

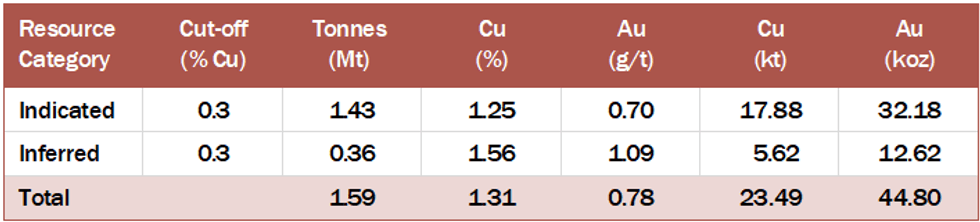

Summary of JANUARY 2024 Wallace North JORC 2012 Resource:

- Re-estimation using results from AGC drilling and re-assayed historic core has resulted in:

- A significant increase from 23% (October 2023) to 90% (January 2024) in Indicated Resource proportion.

- A 300% increase in Indicated Resources (0.36 Mt to 1.43 Mt) and increase in Indicated contained Cu metal of +280% (from 4.70 kt Cu to 17.88 kt Cu) and in Indicated Au ounces of +224% (from 9.93 koz Au to 32.18 koz Au) from the October 2023 Resource.

- A ~15% increase in contained copper tonnes from 20.55 kt Cu (October 2023) to 23.49 kt Cu.

- The January 2024 Resource is currently being used in the development of the initial Wallace North Mine Reserve, which will form part of the Cloncurry Copper Project.

- Recent positive exploration and development outcomes across the Great Australia Mine Reserve (GAM) and the Wallace North Resource resulted in the decision to combine both projects as part of the Cloncurry Copper Project mine plan (refer to TNC ASX Announcement, 12 December 2023, TNC green-lights Cloncurry mining restart plan).

COMMENT

True North Copper’s Managing Director, Marty Costello said:

“The recently completed Wallace North grade control drilling program has resulted in a significant 300% increase in Indicated mineral resources.

Having most of the mineral inventory (90%) now classified as Indicated Resources, greatly increases our confidence and allows for a conversion to Probable Reserves of the economically viable material following mine-design.

We look forward to announcing the Wallace North Reserve shortly and subsequently the finalised Cloncurry Copper Project mine plans.”

Wallace North Resource Update Summary

TNC engaged Encompass Mining Pty Ltd (Encompass), to update the geological model and mineral resource for the Wallace North (Cu /Au) deposit to include 142 advanced grade control reverse circulation (RC) holes for 7,594m completed by TNC in September 2023 (refer to TNC ASX Announcement, 7 November 2023, Wallace North AGC drilling hits 14.05% Cu, 25.70g/t Au; and Figure 2 & Figure 3) and 14 historic holes for 731 samples where results had been received for a TNC resampling program of historical diamond drillholes with QAQC issue (see JORC Table 1 for more details; Figure 2 & Figure 3).

The updated Wallace North Copper Project Mineral Resource (Table 1) has been classified and reported in accordance with the JORC Code, 2012 edition. Resource classification is based on confidence in the geological domaining, drill spacing and geostatistical measures. The Resource has been reported with Indicated and Inferred levels of confidence mainly based on robustness of mineralisation, data density and an overall Cu mineralisation envelope.

Click here for the full ASX Release

This article includes content from True North Copper, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

TNC:AU

The Conversation (0)

11 October 2024

True North Copper

On the path to becoming Australia’s next responsible copper producer

On the path to becoming Australia’s next responsible copper producer Keep Reading...

1h

Copper Prices Rally on Tariff Fears, Weak US Dollar

Copper prices continue to make gains, driven by supply and demand fundamentals and further boosted by tariff fears.The price reached a record high on January 29, and while it has since moderated somewhat, several factors have injected fresh concerns and volatility into the market.Among them has... Keep Reading...

24 February

Faraday Copper Signs LOI to Acquire BHP’s San Manuel Property in Arizona

Faraday Copper (TSX:FDY,OTCQX:CPPKF) has signed a letter of intent (LOI) to acquire BHP's (ASX:BHP,NYSE:BHP,LSE:BHP) San Manuel property, which sits next to its Copper Creek project in Arizona. The company says the move will combine the two adjacent assets into a single US-focused copper... Keep Reading...

23 February

ASX Copper Mining Stocks: 5 Biggest Companies in 2026

Copper prices have been volatile throughout 2025 and into 2026, fueled by economic uncertainty from an ever-changing US trade policy and strong supply and demand fundamentals. The International Copper Study Group, the leading copper market watcher, reported an apparent refined copper surplus of... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00