December 21, 2022

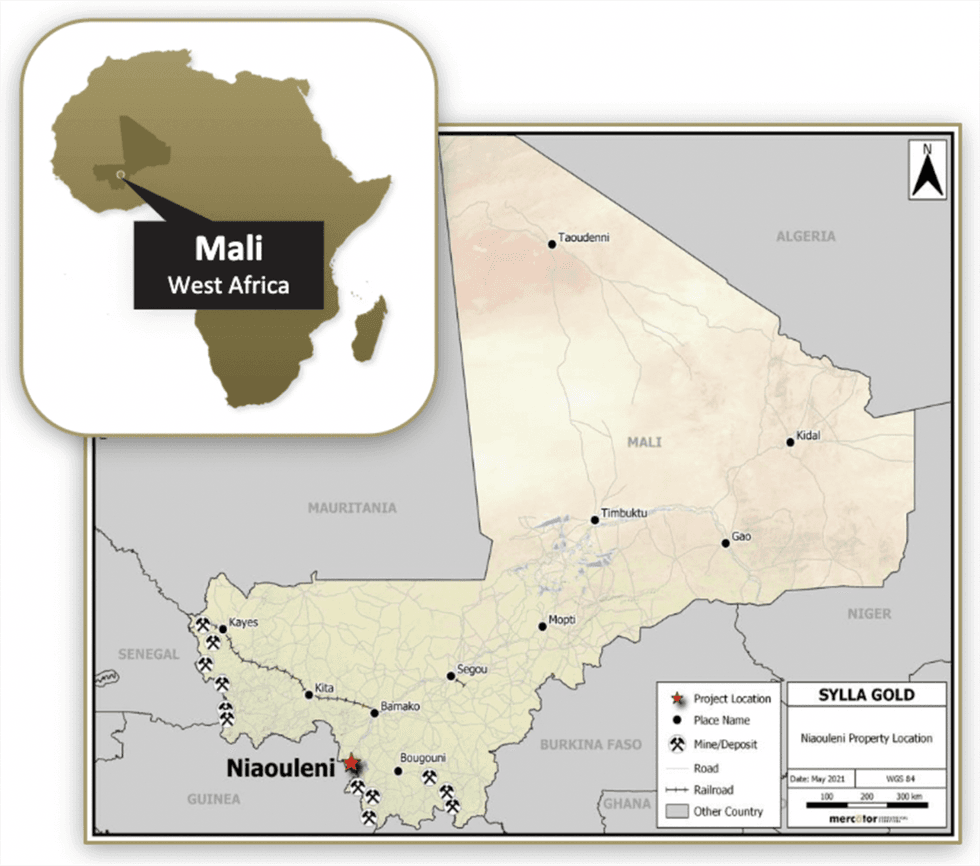

Sylla Gold (TSX.V:SYG) explores and acquires gold properties throughout West Africa through an experienced management team with a track record of success. The company’s flagship asset, the Niaouleni gold project, covers over 17,200 hectares within an emerging gold camp in the prolific Birimian greenstones of southwest Mali.

Niaouleni project runs continuously south along Niaouleni-Kobada-Sanankora Corridor, on strike with Toubani Resource’s Kobada Gold Deposit. The Kobada deposit contains a Measured and Indicated Mineral Resource of 61.5 million tonnes (Mt) at 0.86 g/t gold (Au) for a total of 1.71 million ounces (oz) of contained gold, and includes mineral reserves. Additionally, to the north of Toubani within the same corridor is Cora Gold’s Sanankoro Project, which has an Indicated Resource of 16.1 Mt at 1.27 g/t Au for 657,000 oz of contained gold and an Inferred Resource of 8.7 Mt at 0.94 g/t Au for 263,000 oz of contained gold. These significant resource estimates on adjacent properties indicate the blue sky potential of the Niaouleni project as exploration continues on all three.

Sylla Gold recently completed its maiden drilling campaign, which included 6,754 metres of reverse circulation (RC) drilling and an additional 10,600 metres of aircore drilling. Assays from the RC drilling indicated 48 out of 57 holes hit high-grade gold mineralization up to 5.17 g/t over 25 metres. The aircore drilling was used as a first-pass reconnaissance style drilling and identified multiple additional gold targets for follow-up RC drilling.

Company Highlights

- Sylla Gold is a Canadian exploration and development mining company focusing on highly prospective assets within Mali, a West African country known for its gold deposits.

- Despite a long gold mining history, Mali still contains underexplored assets that have received little to no exploration using modern technologies and techniques.

- The flagship Niaouleni asset covers 17,200 hectares within the newly discovered Birimian greenstone gold belt, which runs along southwest Mali.

- The company’s Niaouleni asset is adjacent to Toubani Resource’s Kobada Gold Project which contains a Measured and Indicated Mineral Resource of 61.5 million tonnes (Mt) at 0.86 g/t gold (Au) for a total of 1.71 million ounces (oz) of contained gold, and includes mineral reserves.

- The Niaouleni's close proximity to prolific gold discoveries indicates the potential for future discoveries and development.

- Sylla Gold recently completed its maiden drilling campaign, results of which indicate that 48 out of 57 holes intersected high-grade gold mineralization up to 5.17 g/t gold over 25m.

- An experienced management team with a track record of success in West Africa leads the company towards fully exploring its blue-sky gold asset.

This Sylla Gold profile is part of a paid investor education campaign.*

Click here to connect with Sylla Gold (TSX.V:SYG) to receive an Investor Presentation

SYG:CA

The Conversation (0)

11 August 2023

Sylla Gold

Exploring West Africa’s Underexplored Highly Prospective Gold Greenstone Belt

Exploring West Africa’s Underexplored Highly Prospective Gold Greenstone Belt Keep Reading...

18h

Aurum Hits High-Grade Gold at Napie, Cote d'Ivoire

Aurum Resources (AUE:AU) has announced Aurum Hits High-Grade Gold at Napie, Cote d'IvoireDownload the PDF here. Keep Reading...

19h

Precious Metals Price Update: Gold, Silver, PGMs Fall on Escalating US-Iran War

Precious metals prices are down on potential for economic fallout from escalating US-Iran War.Volatility has returned to the precious metals market this past week. All eyes are on the breakout of a full-scale war across the Middle East prompted by a coordinated assault on Iran by the United... Keep Reading...

04 March

SSR Mining to Sell Çöpler Gold Mine Stake in US$1.5 Billion Deal

SSR Mining (NASDAQ:SSRM,TSX:SSRM,OTCPL:SSRGF) has agreed to sell its majority stake in the Çöpler gold mine in Turkey for US$1.5 billion in cash, shifting the company’s portfolio towards the Americas as the yellow metal continues to surge amid rising geopolitical tensions.The Denver-based miner... Keep Reading...

04 March

Blackrock Silver Announces the Appointment of Bernard Poznanski and Susan Mathieu to the Board of Directors

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce the appointment of Bernard Poznanski and Susan Mathieu as independent directors to the Board of Directors of the Company (the "Board of Directors").In conjunction with... Keep Reading...

03 March

Fortune Bay: Exploration Underway, Fully Funded Program at the Goldfields Project in Saskatchewan

While Saskatchewan has long been recognized for uranium, its geology and historical exploration also make it a promising place for gold. Canadian company Fortune Bay (TSXV:FOR,OTCQB:FTBYF) seeks to maximize this potential with its flagship Goldfields project. Fortune Bay’s 100 percent owned... Keep Reading...

03 March

RUA GOLD Files 43-101 Technical Reports for the Reefton and Glamorgan Projects in New Zealand

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZX: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce the filing on SEDAR+ of independent Technical Reports for its Reefton Project ("Reefton Technical Report") on the South Island and Glamorgan Project ("Glamorgan Technical Report") on... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00