December 21, 2022

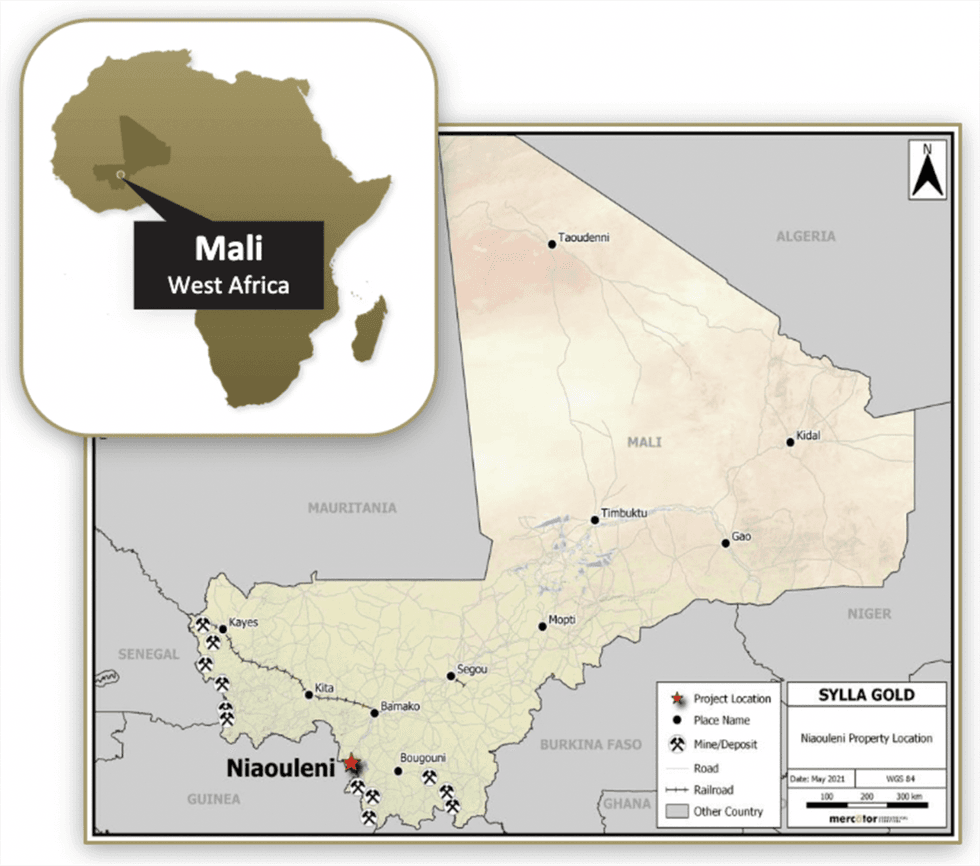

Sylla Gold (TSX.V:SYG) explores and acquires gold properties throughout West Africa through an experienced management team with a track record of success. The company’s flagship asset, the Niaouleni gold project, covers over 17,200 hectares within an emerging gold camp in the prolific Birimian greenstones of southwest Mali.

Niaouleni project runs continuously south along Niaouleni-Kobada-Sanankora Corridor, on strike with Toubani Resource’s Kobada Gold Deposit. The Kobada deposit contains a Measured and Indicated Mineral Resource of 61.5 million tonnes (Mt) at 0.86 g/t gold (Au) for a total of 1.71 million ounces (oz) of contained gold, and includes mineral reserves. Additionally, to the north of Toubani within the same corridor is Cora Gold’s Sanankoro Project, which has an Indicated Resource of 16.1 Mt at 1.27 g/t Au for 657,000 oz of contained gold and an Inferred Resource of 8.7 Mt at 0.94 g/t Au for 263,000 oz of contained gold. These significant resource estimates on adjacent properties indicate the blue sky potential of the Niaouleni project as exploration continues on all three.

Sylla Gold recently completed its maiden drilling campaign, which included 6,754 metres of reverse circulation (RC) drilling and an additional 10,600 metres of aircore drilling. Assays from the RC drilling indicated 48 out of 57 holes hit high-grade gold mineralization up to 5.17 g/t over 25 metres. The aircore drilling was used as a first-pass reconnaissance style drilling and identified multiple additional gold targets for follow-up RC drilling.

Company Highlights

- Sylla Gold is a Canadian exploration and development mining company focusing on highly prospective assets within Mali, a West African country known for its gold deposits.

- Despite a long gold mining history, Mali still contains underexplored assets that have received little to no exploration using modern technologies and techniques.

- The flagship Niaouleni asset covers 17,200 hectares within the newly discovered Birimian greenstone gold belt, which runs along southwest Mali.

- The company’s Niaouleni asset is adjacent to Toubani Resource’s Kobada Gold Project which contains a Measured and Indicated Mineral Resource of 61.5 million tonnes (Mt) at 0.86 g/t gold (Au) for a total of 1.71 million ounces (oz) of contained gold, and includes mineral reserves.

- The Niaouleni's close proximity to prolific gold discoveries indicates the potential for future discoveries and development.

- Sylla Gold recently completed its maiden drilling campaign, results of which indicate that 48 out of 57 holes intersected high-grade gold mineralization up to 5.17 g/t gold over 25m.

- An experienced management team with a track record of success in West Africa leads the company towards fully exploring its blue-sky gold asset.

This Sylla Gold profile is part of a paid investor education campaign.*

Click here to connect with Sylla Gold (TSX.V:SYG) to receive an Investor Presentation

SYG:CA

The Conversation (0)

11 August 2023

Sylla Gold

Exploring West Africa’s Underexplored Highly Prospective Gold Greenstone Belt

Exploring West Africa’s Underexplored Highly Prospective Gold Greenstone Belt Keep Reading...

4h

FOKUS MINING CORP. ANNOUNCES RECEIPT OF INTERIM ORDER AND UPDATE REGARDING PROPOSED ACQUISITION BY GOLD CANDLE LTD.

(All amounts expressed in Canadian Dollars unless otherwise noted)Fokus Mining Corporation ("Fokus" or the "Company") (TSXV: FKM,OTC:FKMCF) (OTCQB: FKMCF) announced today the filing of its management information circular (the "Circular") and related materials for the special meeting (the... Keep Reading...

4h

Visible Gold Intersected at Roy, Sunbeam

First Class Metals PLC ("First Class Metals", "FCM" or the "Company") the UK listed company focused on the discovery of economic metal deposits across its exploration properties in Ontario, Canada, is pleased to provide an update on the ongoing drilling programme at the Roy prospect on the... Keep Reading...

7h

Galway Metals Enters into Letter of Engagement with Eskar Capital Corporation for Investor Relations Services

TORONTO, ON / ACCESS Newswire / March 12, 2026 / Galway Metals Inc. (TSX-V:GWM)(OTCQB:GAYMF) ("Galway Metals" or the "Company") is pleased to announce that it has entered into a six (6) month Capital Markets Advisory Agreement (the "Agreement") with Eskar Capital Corporation ("Eskar Capital"),... Keep Reading...

12h

Peruvian Metals Announces Private Placement

Peruvian Metals Corp. (TSXV: PER,OTC:DUVNF) ("Peruvian Metals" or the "Company") is pleased to announce that it has arranged a non-brokered private placement for gross proceeds of up to $750,000 which will be used to make improvements and additions for expansion to its Aguila Norte processing... Keep Reading...

17h

Additional Strong Assays Results Extend High-Grade Antimony Mineralisation at Oaky Creek

Red Mountain Mining Limited (ASX: RMX, US CODE: RMXFF, or “Company”) a Critical Minerals exploration and development company with an established portfolio in Tier-1 Mining Districts in the United States and Australia, is pleased to announce that it has received continued strong assay results... Keep Reading...

11 March

Jeffrey Christian: Gold, Silver Prices to Rise, Risk Highest Since WWII

Jeffrey Christian, managing partner at CPM Group, sees gold and silver prices continuing to rise as global political and economic risks persist. "We look at the world right now and we see a world where the risks and uncertainties are greater now than at any time since Pearl Harbor. December... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00