October 30, 2024

Latest results to underpin the Resource update proposed for next quarter

Andean Silver Limited (ASX: ASL) is pleased to announce further spectacular drilling results which will form part of the next Resource update at its Cerro Bayo Silver-Gold Project in Chile.

- Latest drilling has delivered more bonanza-grade intersections, continuing to expand the Pegaso 7 and Cristal extensions of mineralisation at Cerro Bayo

- New drill assays from Pegaso 7 include:

- 3.2m @ 864g/t AgEq (511g/t Ag & 4.3g/t Au)

- Incl. 1.4m @ 1,871g/t AgEq (1,140g/t Ag and 8.8g/t Au)

- 5.2m @ 259g/t AgEq (115g/t Ag & 1.7g/t Au)

- Incl. 1.5m @ 582g/t AgEq (235g/t Ag & 4.2g/t Au)

- 0.4m @ 1,683g/t AgEq (1,099g/t Ag & 7.0g/t Au)

- 3.2m @ 864g/t AgEq (511g/t Ag & 4.3g/t Au)

- At Cristal, drilling has defined the target horizon of mineralisation to an ~80m vertical extent that incorporates previous bonanza-grade veins observed on surface

- New drill assays from Cristal include:

- 4.5m @ 584g/t AgEq (380g/t Ag & 2.5g/t Au)

- 2.6m @ 600g/t AgEq (120g/t Ag & 5.8g/t Au)

- 3.4m @ 478g/t AgEq (13g/t Ag & 5.6g/t Au)

- Incl. 1.2m @ 1,252g/t AgEq (27g/t Ag & 14.8g/t Au)

- Drilling also continues to define a large halo surrounding the Cristal veins with results of:

- 153.8m @ 62g/t AgEq (8g/t Ag & 0.6g/t Au)

- A third drill rig to be mobilised to site in November to begin targeting extensions of the main lodes within the Laguna Verde Mine Complex at Cerro Bayo

Andean Chief Executive Tim Laneyrie said: “These are spectacular results, not just because of the bonanza grades but also because of the significant extensions they add to the known mineralisation.

“These results also provide more evidence of the compelling exploration upside at Cerro Bayo with the mineralisation still open in so many areas and vast vein systems yet to be tested.

“Our ongoing drilling at both the Pegaso 7 and Cristal targets has yielded impressive results, further refining our geological model of the high-grade mineralisation controls. These findings not only underscore the quality of the mineralisation but also enhance our understanding of the core high-grade zones within the Pegaso 7 veining corridor.

“Similarly, our initial shallow drilling at the Cristal target, being the first in 10 years, has been equally encouraging, highlighting key lithological controls to the high-grade mineralisation currently defined over an approximately 80m vertical interval. This aligns with previous interpretations of super high- grade veins throughout the Cristal project.

“To further capitalise on this momentum, we are mobilising a third drill rig to the site in November. This will target the main lodes within the Laguna Verde Mine Complex through extensional drilling.

“This strategic expansion of our drilling program is aimed at maximising our discovery rate and driving substantial resource growth”.

Drilling and Exploration Update

The drilling at Pegaso 7 and Cristal continues to expand and refine the key mineralising controls within the broader systems. The current drill rig at Cristal has a further 1,200m of drilling planned as part of the initial scout drilling program and is targeting 40m above the previous drill fan. Pegaso 7 drilling has a further 3,500m of drilling remaining on the current program.

Cristal Prospect

The main Cristal structures have been intercepted up to 80m below the outcropping veins (Figure 2) within the prospective Temer Formation. The Cristal Prospect is interpreted to represent a highly prospective juncture of a number of major district scale structures (Figure 4) that control the mineralised orientations at the LVMC including the Coyita, Dagny, Yasna deposits and resource areas.

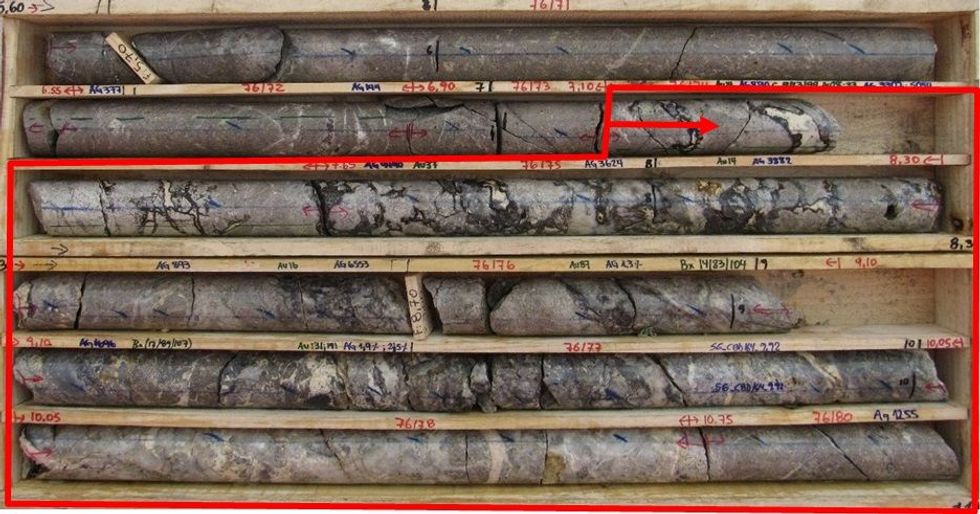

The current drilling at Cristal is ~40m above the previously drilled central structure. This drilling has intercepted a previous unknown part of the Cristal West structure (see Figures 1 and 3) sitting ~5m below the surface and below the historic Cristal west underground workings. This vein extension was unknown as it has been covered by a 1m thick backfill layer for >20 years.

Click here for the full ASX Release

This article includes content from Andean Silver, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

6h

Stefan Gleason: Silver Wakeup in the West — What's Happening, What's Next

Stefan Gleason, CEO of Money Metals, breaks down recent silver and gold dynamics, discussing trends in the US retail market, as well as backups at refineries. While the situation has begun to normalize, he sees potential for further disruptions in the future. Don't forget to follow us... Keep Reading...

19 February

Mercado Minerals Provides Exploration Update on Copalito; Reveals New Vein Discoveries

Mercado Minerals Ltd. (CSE: MERC) ("Mercado" or the "Company") is pleased to report continued progress from ongoing exploration activities at its flagship Copalito Project ("Copalito" or the "Project"). The Company's technical team in Mexico has been actively mapping, sampling, and advancing... Keep Reading...

16 February

How Rick Rule Reinvested His Silver Gains: 5 Silver Stocks He Owns

Over the past year, the spot price of silver has surged past a 40 year record and into triple-digit territory, reaching a high of US$121 per ounce this past January.For silver investors who bought into the physical market when the price was low, this first leg of the silver bull market has... Keep Reading...

16 February

Silver Institute: Market Heading for Sixth Straight Deficit in 2026

Silver surged past US$100 per ounce for the first time in January before retreating below the US$80 level, marking a volatile start to 2026 as the precious metal faces renewed investor appeal.In its latest annual outlook, published on February 10, the Silver Institute notes that the rally comes... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00