March 11, 2024

Spartan targets further significant growth in high-grade resources and value in 2024, supported by recent successful extensional drilling

Spartan Resources Limited (ASX: SPR) (Spartan or the Company) is pleased to advise that it has calculated a new JORC-compliant Exploration Target for the high-grade Never Never Gold Deposit, part of its Dalgaranga Gold Project in Western Australia.

Highlights:

- New JORC-compliant “Exploration Target” completed for the Never Never Gold Deposit, part of Spartan’s flagship 1.69Moz @ 2.49g/t gold Dalgaranga Gold Project (100%-owned), located in the Murchison Region of Western Australia.

- The new Never Never Exploration Target set out here is inclusive of the recent Never Never Mineral Resource Estimate (“MRE”), updated in December 2023 to:

- 5.16Mt at 5.74g/t Au for 952,900oz gold

- Spartan remains focused on delivering increased shareholder value through high-impact exploration and high-grade resource growth, with:

- Never Never being one of the highest-grade and fastest growing new gold discoveries in Western Australia;

- Never Never sitting immediately adjacent to a 100% owned, well maintained, 6-year- old 2.5Mtpa CIL gold processing plant and associated infrastructure;

- Plus, a technically strong and focused management team with a proven track- record of rapidly growing asset value, rejuvenating existing mines, extending mine lives through exploration success and delivering on targets.

- An extensive 28,500m drilling program is currently underway, with four diamond rigs and one Reverse Circulation rig currently on site.

Exploration Target

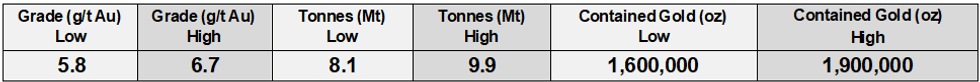

The new Exploration Target comprises:

The potential quantity and grade of the Exploration Target is conceptual in nature and, as such, there has been insufficient exploration drilling conducted to estimate a Mineral Resource. At this stage it is uncertain if further exploration drilling will result in the estimation of a Mineral Resource. The Exploration Target has been prepared in accordance with the JORC Code (2012).

Note: The Exploration target is inclusive of the December 2023 Mineral Resource Estimate released for the Never Never Gold Deposit of 5.16Mt at 5.74g/t Au for 0.95Moz gold1

Exploration Target Basis

During 2023, Spartan drilled 232 holes for 63,943m at Dalgaranga, with 111 holes (48%) for 38,328m (60%) completed at Never Never, growing the MRE from 303.1koz to 952.9koz (214%). To date, Spartan has spent A$14.7M on drilling at Never Never, resulting in a very low discovery cost of A$15.43 per resource ounce.

Click here for the full ASX Release

This article includes content from Spartan Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

SPR:AU

The Conversation (0)

03 April 2024

Spartan Resources

Focused on Growing High-grade Gold Ounces in front of established infrastructure in Prolific Western Australia

Focused on Growing High-grade Gold Ounces in front of established infrastructure in Prolific Western Australia Keep Reading...

27 February

Lahontan Gold Eyes Resource Update as Production Nears

Lahontan Gold (TSXV: LG,OTCQB:LGCXF) is drawing investor attention as it advances toward renewed production at its historic Santa Fe Mine in Nevada. A revised mineral resource estimate is expected soon, offering a potential catalyst, according to a recent report by News Financial.... Keep Reading...

27 February

Peruvian Metals Invites Shareholders and Investment Community to Visit Them at Booth 2624B at PDAC 2026 in Toronto, March 3-4

Peruvian Metals Corp (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals" or the "Company") is pleased to invite investors and shareholders to Booth #2624B at the Prospectors & Developers Association of Canada's (PDAC) Convention at the Metro Toronto Convention Centre (MTCC) from Tuesday,... Keep Reading...

27 February

OTC Markets Group Welcomes RUA GOLD INC. to OTCQX

OTC Markets Group Inc. (OTCQX: OTCM), operator of regulated markets for trading 12,000 U.S. and international securities, today announced Rua Gold INC. (TSX: RUA,OTC:NZAUF; OTCQX: NZAUF), an exploration company, has qualified to trade on the OTCQX® Best Market. Rua Gold INC. upgraded to OTCQX... Keep Reading...

27 February

RUA GOLD Begins Trading on the OTCQX Best Market in the United States

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZ: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce that that its common shares have begun trading today on the OTCQX® Best Market under the symbol 'NZAUF'. U.S. investors can find current financial disclosure and Real-Time Level 2... Keep Reading...

27 February

American Eagle Expands South Zone 750 Metres to the East and Further Demonstrates Continuity Within High-Grade Core, Intersecting 618 Metres of 0.77% CuEq from Surface

Highlights: 618 m of 0.77% CuEq from surface in NAK25-80, linking high grade, at-surface gold rich mineralization to high-grade core at depth. Continuity from surface to depth: NAK25-80 builds on prior long-intervals, including NAK25-78: 802 m of 0.71% CuEq from surface, and strengthens... Keep Reading...

26 February

Pause in Trading

Zeus Resources Limited (ZEU:AU) has announced Pause in TradingDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00