The Board of Directors of SilverCrest unanimously recommends that Securityholders vote FOR the Arrangement Resolution.

Securityholders are encouraged to vote in advance of the proxy cutoff of 10:00 a.m. ( Vancouver time) on February 4, 2025 .

TSX: SIL | NYSE American: SILV

SilverCrest Metals Inc. ("SilverCrest" or the "Company") announced today that it has filed its notice of meeting, management information circular (the "Circular") and related documents (collectively, the "Meeting Materials") with securities regulators in connection with the special meeting (the "Meeting") of the holders (the "Shareholders") of common shares of the Company (the "SilverCrest Shares") and the holders of stock options of the Company (the "Optionholders", and collectively with the Shareholders, the "Securityholders"). The Meeting Materials have also been mailed to Securityholders and can also be accessed at the Company's website at https:silvercrestmetals.comtransaction .

The Meeting is to be held on February 6, 2025 at 10:00 a.m. ( Vancouver time) at the offices of Cassels Brock & Blackwell LLP at Suite 2200, RBC Place, 885 West Georgia Street, Vancouver, British Columbia . The Meeting can also be accessed via live webcast at meetnow.global/MHZWLAD. Only holders of SilverCrest Shares and stock options of record as of the close of business on December 19, 2024 , the record date for the Meeting, are entitled to receive notice of, attend and vote at, the Meeting. Any Securityholder attending the live webcast will not be able to vote during the Meeting. Only Securityholders who are present in person and entitled to vote at the Meeting are able to vote during the Meeting.

At the Meeting, Securityholders will be asked to pass a special resolution (the "Arrangement Resolution") approving an arrangement (the "Arrangement") with Coeur Mining, Inc. ("Coeur"), whereby SilverCrest shareholders will receive 1.6022 shares of Coeur common stock for each SilverCrest Share held (the "Exchange Ratio") pursuant to the terms of an arrangement agreement entered into between SilverCrest and Coeur on October 3, 2024 (the "Arrangement Agreement"). The Exchange Ratio represents an implied value of US$11.34 per SilverCrest common share, based on the closing price of Coeur on the New York Stock Exchange ("NYSE") on October 3, 2024 . This represents an 18% premium based on 20-day volume-weighted average prices of Coeur and SilverCrest each as at October 3, 2024 on the NYSE and NYSE American, respectively, and a 22% premium to the October 3, 2024 closing price of SilverCrest on the NYSE American. The Exchange Ratio implies a total equity value of approximately US$1.7 billion based on SilverCrest Shares outstanding. Upon completion of the Arrangement, existing Coeur stockholders and SilverCrest shareholders will own approximately 63% and 37% of the outstanding common stock of the combined company, respectively, based on the outstanding securities of both companies as at October 3, 2024 .

Benefits to SilverCrest Securityholders

- Immediate and significant premium of approximately 18% based on the 20-day volume-weighted average prices of Coeur and SilverCrest respectively (as at October 3, 2024 on the NYSE and NYSE American, respectively), and 22% based on the October 3, 2024 closing prices of both companies

- Substantial equity participation in Coeur's high quality and diversified portfolio consisting of four robust operating mines in U.S. and Mexico and an exploration property in Canada , while maintaining meaningful exposure to the Company's high-grade, low-cost and high-margin Las Chispas operation

- Potential for the combined company to generate significant 2025 silver production with the addition of Las Chispas to Coeur's growing silver production from its recently expanded Rochester mine in Nevada and its Palmarejo underground mine in northern Mexico

- Approximately US$700 million 1 of EBITDA 2 and US$350 million 1 of free cash flow 2 are expected to be generated by the combined company in 2025 at lower overall costs and higher overall margins for Coeur, with more robust cash flow as a result of multiple producing mines in a diversified portfolio and augmented by SilverCrest's strong balance sheet and no debt

- The combination of SilverCrest's strong balance sheet and its strong cash flow profile are expected to accelerate Coeur's debt reduction initiative and result in an immediate 40% expected reduction in Coeur's leverage ratio upon closing of the Arrangement

- The Arrangement with Coeur is the culmination of a comprehensive strategic review process overseen by the Company's board of directors (the "Board") initially, and subsequently, the special committee of independent directors (the "Special Committee"), as further described in the Circular

- The combined company will be better positioned to pursue a growth and value maximizing strategy as compared with SilverCrest on a standalone basis, as a result of the combined company's larger market capitalization, asset and geographical diversification, elimination of singe asset risk, technical expertise, greater trading liquidity, enhanced access to capital over the long term and the likelihood of increased investor interest and access to business development opportunities due to the combined company's larger market presence

Board Recommendation

The Board, based on its considerations, investigations and deliberations, including a thorough review of the Arrangement Agreement, the fairness opinions of Cormark Securities Inc. and Raymond James Ltd. and other relevant matters, and taking into account the best interests of the Company, and after consultation with management and its financial and legal advisors and having received the unanimous recommendation of the Special Committee, which takes into account, among other things, the fairness opinion that the Special Committee received from Scotiabank, has unanimously determined, that the Arrangement and the entering into of the Arrangement Agreement are in the best interests of the Company, has unanimously approved the Arrangement and recommends that the Securityholders vote FOR the Arrangement Resolution. The determination of the Special Committee and the Board is based on various factors set forth above and described more fully in the Circular.

YOUR VOTE IS IMPORTANT. CAST YOUR VOTE WELL IN ADVANCE OF THE PROXY VOTING DEADLINE.

Securityholders are encouraged to read the Circular in its entirety and vote their SilverCrest Shares and stock options as soon as possible, in accordance with the instructions accompanying the form of proxy or voting instruction form mailed to Securityholders together with the Circular.

The deadline for voting SilverCrest Shares and stock options by proxy is 10:00 a.m. ( Vancouver time) on February 4, 2025 .

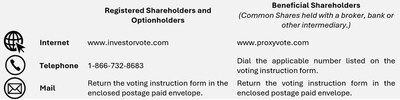

How to Vote

| | ___________________________________________________________ |

| | 1 Based on analyst consensus for 2025. |

| | 2 This is a non-GAAP performance measure. See "Non-GAAP and Non-IFRS Financial Measures" at the end of this press release, and "Non-GAAP Financial Performance Measures" on page 54 of Coeur's 2023 Annual Report.

|

Questions & Voting Assistance

Securityholders who have questions about the Meeting or require assistance in voting may contact the Company's proxy solicitation agent:

Laurel Hill Advisory Group

North American Toll Free | 1-877-452-7184

Outside North America | 1-416-304-0211

By Email | assistance@laurelhill.com

ABOUT SILVERCREST METALS INC.

SilverCrest is a Canadian precious metals producer headquartered in Vancouver, British Columbia . SilverCrest's principal focus is its Las Chispas Operation in Sonora, Mexico . SilverCrest has an ongoing initiative to increase its asset base by expanding current resources and reserves, acquiring, discovering, and developing high value precious metals projects and ultimately operating multiple silver-gold mines in the Americas. SilverCrest is led by a proven management team in all aspects of the precious metal mining sector, including taking projects through discovery, finance, on time and on budget construction, and production.

Non-GAAP and Non-IFRS Financial Measures

This press release contains certain non-GAAP and non-IFRS financial measures, which management believes may enable investors to better evaluate Coeur's and SilverCrest's performance, liquidity and ability to generate cash flow. These measures do not have any standardized definition under U.S. GAAP or IFRS, and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with U.S. GAAP or IFRS, as applicable. Other companies may calculate these measures differently.

Free Cash Flow

Free cash flow subtracts sustaining capital expenditures from net cash provided by operating activities, serving as an indicator of the capacity to generate cash from operations post-sustaining capital investments.

EBITDA

EBITDA represents net earnings or loss for the period before income tax expense or recovery, depreciation and amortization, and finance costs.

Forward-Looking Statements

This news release contains "forward-looking statements" and "forward-looking information" (collectively "forward-looking statements") within the meaning of applicable Canadian and United States securities legislation. The words "potential", "expected" and similar expressions or other words of similar meaning, and the negatives thereof, are intended to identify forward-looking statements. These include, without limitation, statements with respect to: statements regarding SilverCrest and the combined company's plans and expectations with respect to the proposed Arrangement and the anticipated impact of the proposed Arrangement on the combined company's results of operations, financial position, growth opportunities and competitive position.

These forward-looking statements involve significant risks and uncertainties that could cause actual results to differ materially from those anticipated, including, but not limited to, the possibility that securityholders of SilverCrest may not approve the Arrangement or stockholders of Coeur may not approve the stock issuance or the charter amendment; the risk that any other condition to closing of the Arrangement may not be satisfied; the risk that the closing of the Arrangement might be delayed or not occur at all; the risk that the either Coeur or SilverCrest may terminate the Arrangement Agreement and either Coeur or SilverCrest is required to pay a termination fee to the other party; potential adverse reactions or changes to business or employee relationships of Coeur or SilverCrest, including those resulting from the announcement or completion of the Arrangement; the diversion of management time on transaction-related issues; the ultimate timing, outcome and results of integrating the operations of Coeur and SilverCrest; the effects of the business combination of Coeur and SilverCrest, including the combined company's future financial condition, results of operations, strategy and plans; the ability of the combined company to realize anticipated synergies in the timeframe expected or at all; changes in capital markets and the ability of the combined company to finance operations in the manner expected; the risk that Coeur or SilverCrest may not receive the required stock exchange and regulatory approvals of the Arrangement; the expected listing of shares on the NYSE; the risk of any litigation relating to the proposed Arrangement; the risk of changes in governmental regulations or enforcement practices; the effects of commodity prices, life of mine estimates; the timing and amount of estimated future production; the risks of mining activities; and the fact that operating costs and business disruption may be greater than expected following the public announcement or consummation of the Arrangement. Expectations regarding business outlook, including changes in revenue, pricing, capital expenditures, cash flow generation, strategies for the combined company's operations, gold and silver market conditions, legal, economic and regulatory conditions, and environmental matters are only forecasts regarding these matters.

Additional factors that could cause results to differ materially from those described above can be found in SilverCrest's annual information form for the year ended December 31, 2023 , which is on file with the SEC and on SEDAR+ and available from SilverCrest's website at www.silvercrestmetals.com under the "Investors" tab, and in other documents SilverCrest files with the SEC or on SEDAR+. All forward-looking statements speak only as of the date they are made and are based on information available at that time. SilverCrest does not assume any obligation to update forward-looking statements to reflect circumstances or events that occur after the date the forward-looking statements were made or to reflect the occurrence of unanticipated events except as required by applicable securities laws. As forward-looking statements involve significant risks and uncertainties, caution should be exercised against placing undue reliance on such statements.

![]() View original content to download multimedia: https://www.prnewswire.com/news-releases/silvercrest-announces-mailing-and-filing-of-meeting-materials-for-special-meeting-of-securityholders-to-approve-proposed-plan-of-arrangement-with-coeur-mining-302349751.html

View original content to download multimedia: https://www.prnewswire.com/news-releases/silvercrest-announces-mailing-and-filing-of-meeting-materials-for-special-meeting-of-securityholders-to-approve-proposed-plan-of-arrangement-with-coeur-mining-302349751.html

SOURCE SilverCrest Metals Inc.

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/January2025/13/c7206.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/January2025/13/c7206.html