- WORLD EDITIONAustraliaNorth AmericaWorld

April 28, 2024

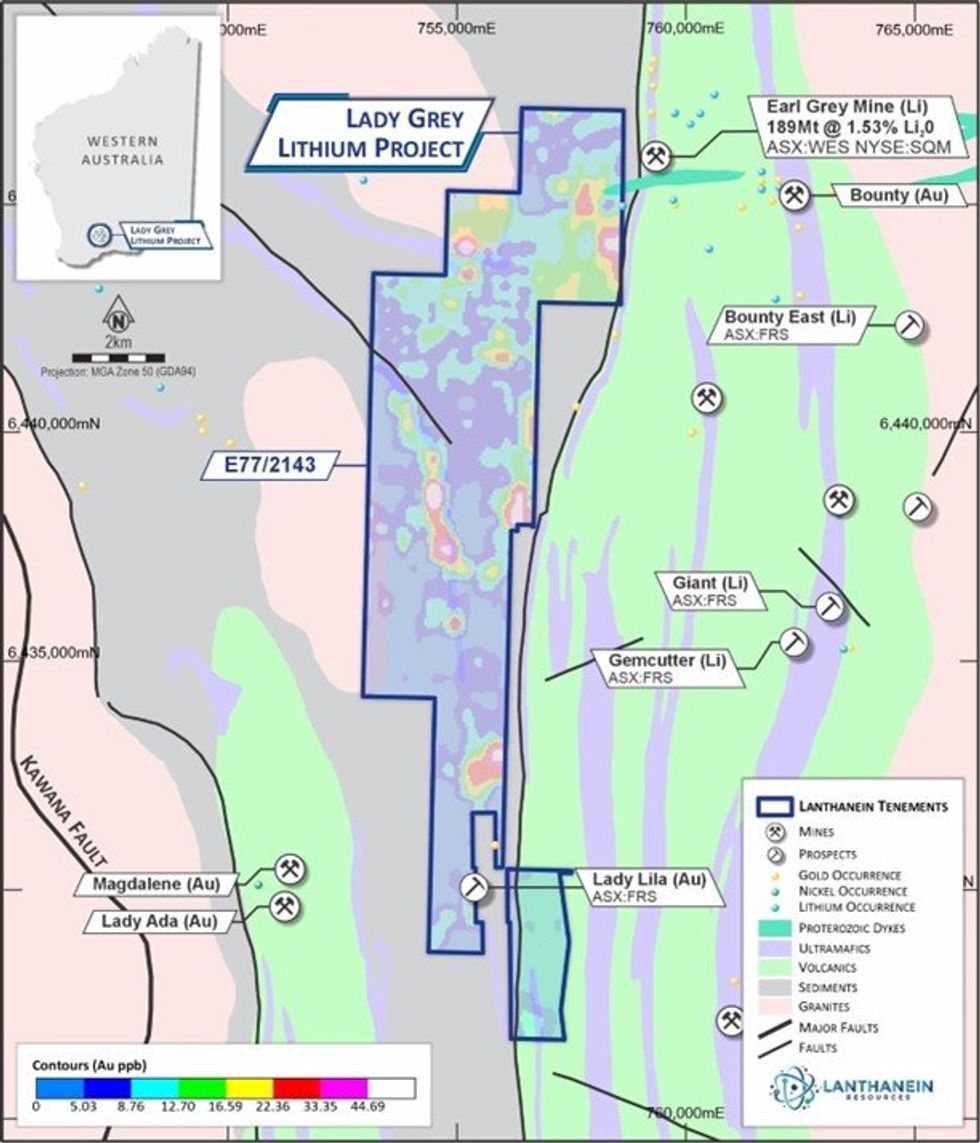

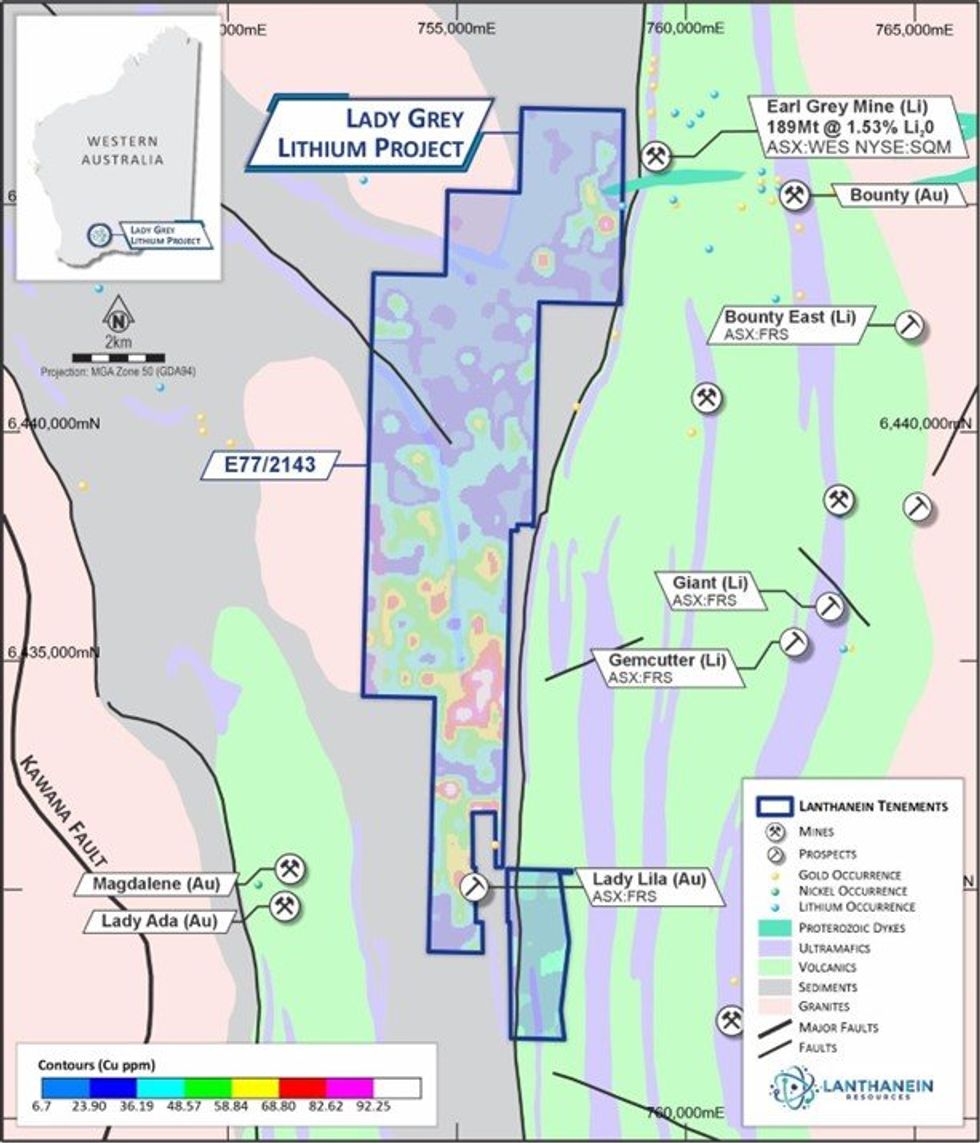

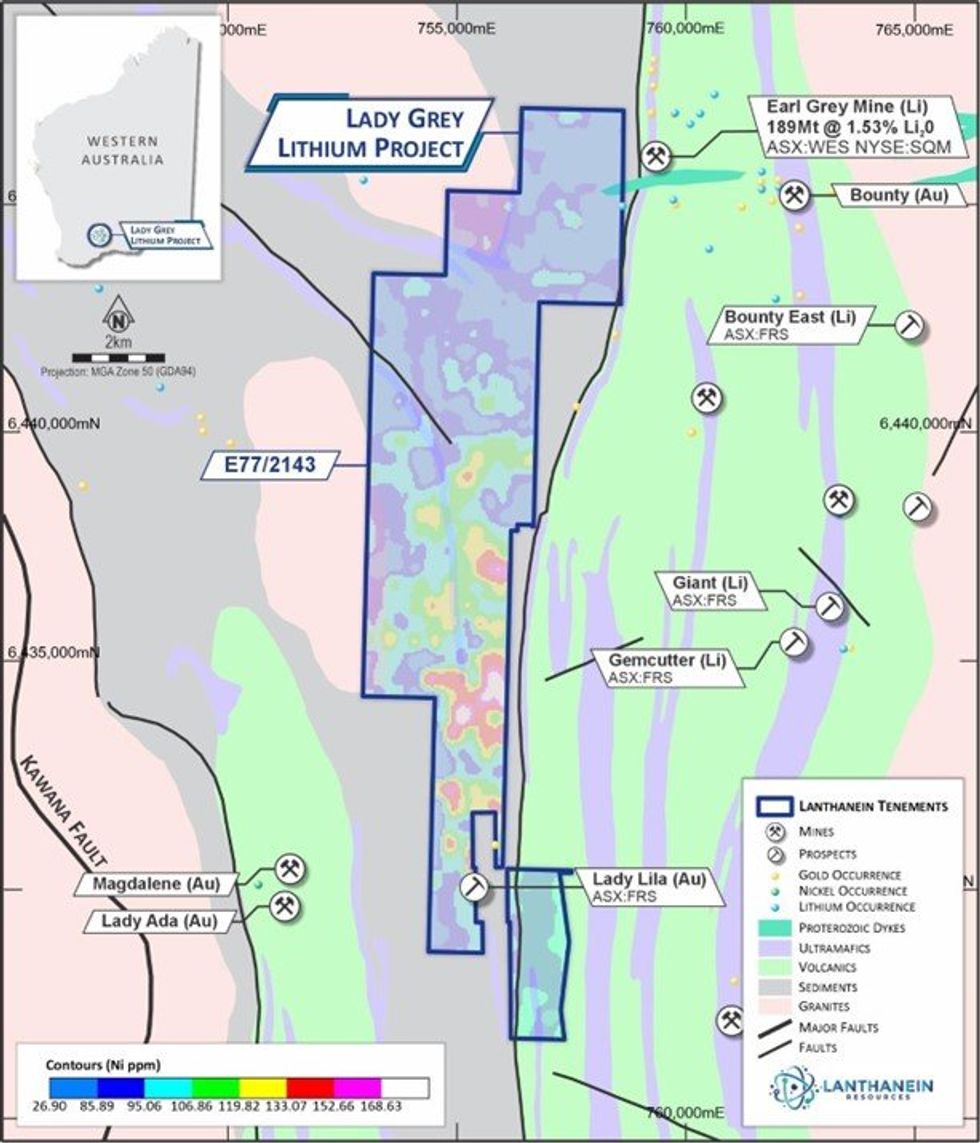

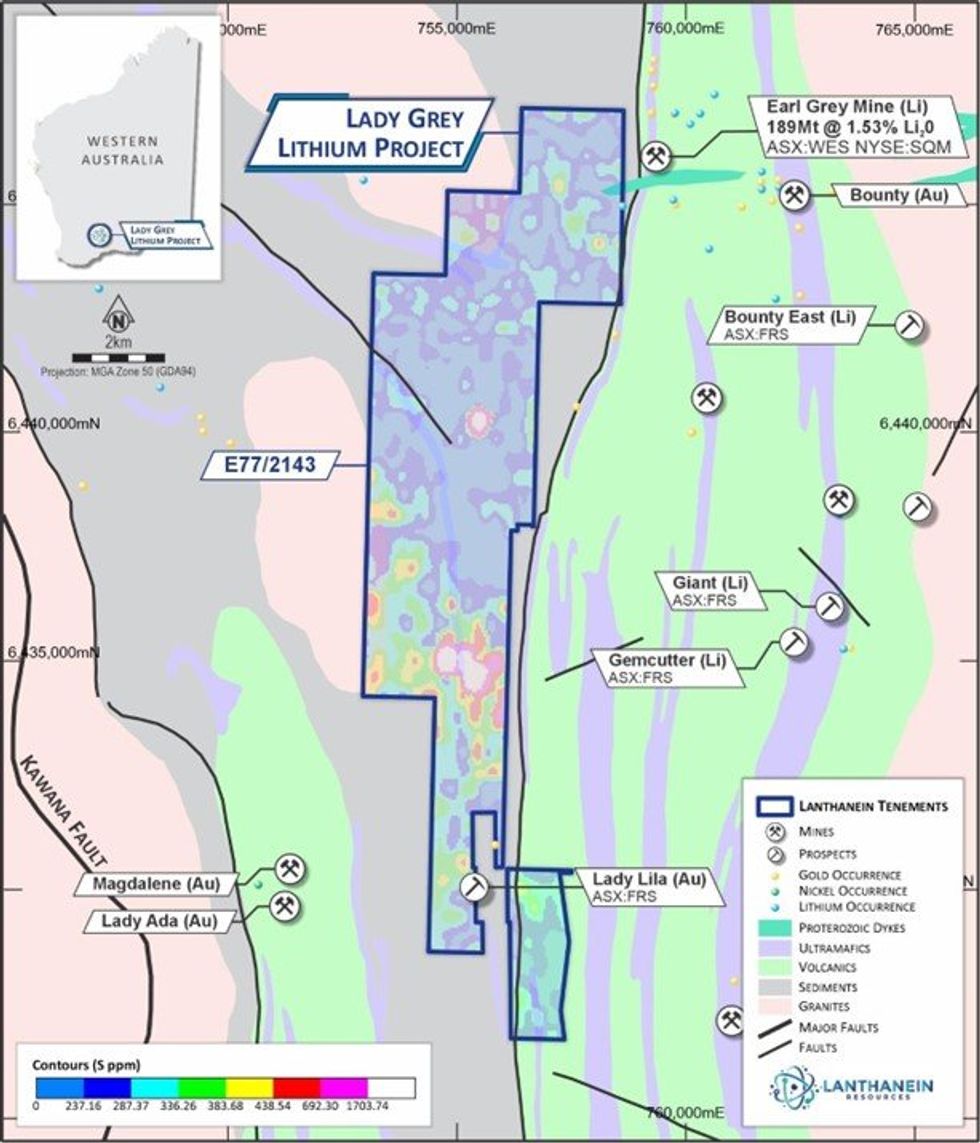

Lanthanein Resources Limited (ASX: LNR) (“Lanthanein” or the “Company”) is pleased to announce the gold and base metal results from the recent tenement wide soil sampling programme at the Lady Grey Lithium Project (“Lady Grey”) directly adjacent to Covalent Lithium’s (SQM & Wesfarmers) Earl Grey Mine, 189Mt @1.53% Li2O¹ at Mount Holland in the Forrestania Greenstone Belt. The programme collected 1,893 samples and has identified multiple coincident gold, copper and nickel anomalies (Figure 1, 2 and 3).

- New Gold, Copper and Nickel soil anomalies identified in the recently completed soil sampling programme

- >2km long gold anomaly coincident with structural flexure

- Peak result of 256ppb Au, with a total of 87 samples returning ≥25ppb Au

- Historic Bounty Gold Mine which produced ~1.3moz Au on Covalent Lithium’s (SQM & Wesfarmers, 50/50) Earl Grey Mine, 189Mt @1.53% Li2O¹ Mount Holland mine site located adjacent to Lady Grey Project

- Peak result of 170ppm Cu, with a total of 300 samples returning ≥50ppm Cu

- Peak result of 263ppm Ni, with a total of 464 samples returning ≥100ppm Ni

- Strong spatial correlation between Gold, Copper, Nickel and Sulphur anomalism

- Exploration work programmes targeting drilling mid year

Mr Brian Thomas, Technical Director of Lanthanein commented: “We are greatly encouraged by the identification of multiple new gold, copper and nickel anomalies picked up by the recent tenement wide soil sampling programme which adds another dimension to the project wide prospectivity following the recent discovery of two large Lithium anomalies, Godzilla and Avenger. The Forrestania region is well known historically for its significant gold production with the old Bounty Mine producing ~1.3moz Au, plus the region has proven nickel endowment with the IGO’s, Forrestania Operations ~30km to the south. We will now accelerate our work programmes and approvals processes to be drilling these targets by mid-year.”

UltraFine+TM Soil Sampling Programme

The survey was completed on a minimum spacing of 400m x 100m, with a total of 1,893 soil samples collected.

Figures 1 through 4 show the soil anomalies delineated from the sampling results. The five gold soil anomalies in Figure 1, represent areas with >50ppb Au – considered highly anomalous using this soil sampling technique. The largest gold anomaly is extends over 2km of strike and is located in a highly favourable structural setting. The copper and nickel anomalies are spatially adjacent to each other along with the high sulphur with a peak value of 5.33% and 50 samples >0.05% which would indicate the presence of weathered sulphides. Exploration reconnaissance and further geochemical sampling is planned to investigate the potential for magmatic sulphides and the presence of gossanous outcrop or subcrop.

Click here for the full ASX Release

This article includes content from Lanthanein Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

LNR:AU

The Conversation (0)

02 March

Nine Mile Metals Announces Phase 1 Bulk Sample Update at Nine Mile Brook High Grade Lens of 13.71% CuEq over 15.10m

Nine Mile Metals LTD. (CSE: NINE,OTC:VMSXF) (OTC Pink: VMSXF) (FSE: KQ9) (the "Company" or "Nine Mile") is pleased to announce that it is conducting Bulk Sample Metallurgical Analysis on the Nine Mile Brook VMS High Grade Lens with SGS Canada and Glencore Canada. Glencore and SGS will be... Keep Reading...

26 February

T2 Metals Acquires High-Grade Aurora Gold-Silver Project in the Yukon from Shawn Ryan

Past Drilling Results Include 3.4m @ 24.45 g/t Au at AJ Prospect

T2 Metals Corp. (TSXV: TWO) (OTCQB: TWOSF) (WKN: A3DVMD) ("T2 Metals" or the "Company") is pleased to announce signing of an Option Agreement (the "Option") with renowned explorer Shawn Ryan ("Ryan") and Wildwood Exploration Inc. (together with Ryan, the "Optionor") to earn a 100% interest in... Keep Reading...

25 February

Copper Prices Rally on Tariff Fears, Weak US Dollar

Copper prices continue to rise, driven by supply and demand fundamentals and boosted by tariff fears.Prices for the red metal reached a record high on January 29, and while they have since moderated somewhat, several factors have injected fresh concerns and volatility into the market.Among them... Keep Reading...

25 February

Top 10 Copper-producing Companies

Copper miners with productive assets have much to gain as supply and demand tighten. The price of copper reached new all-time highs in 2026 on both the COMEX in the United States and the London Metals Exchange (LME) in the United Kingdom. In 2025, the copper price on the COMEX surged during the... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00