November 24, 2024

Processing of Audio Magneto-Telluric Data reveals substantial IOCG potential

Altair Minerals Limited (ASX: ALR) (‘Altair or ‘the Company’) is pleased to report results from reprocessing AMT Data at its Olympic Domain IOCG project, immediately west of BHP’s Oak Dam IOCG project, which has been 3D forward modelled for the first time.

- Acquisition, compilation and reprocessing of Audio Magneto-Telluric (AMT) Data has unveiled a new conductive target body with IOCG discovery potential.

- Major untested conductive and phase anomaly have both been identified proximal to each other within Altair’s Olympic Domain Project which is highly prospective for IOCG style mineralisation.

- The newly uncovered conductive and phase anomaly body located ~5km Northwest of BHP Oak Dam Deposit (1.34Bt @ 0.66% Cu & 0.33g/t Au)1

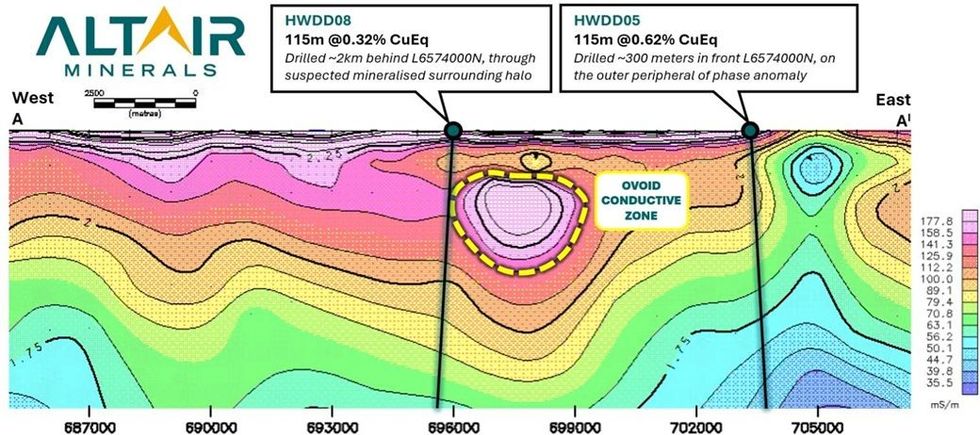

- Previous drilling appears to have narrowly missed the newly identified phase anomaly with impressive results from the mineralised halo surrounding the target anomaly4,5,6:

- HWDD08: 115m @ 0.32% CuEqi from 1040m (Drilled ~2km North of main phase anomaly)

- HWD1: 61m @ 0.33% CuEq from 901m

- HWDD05: 115m @ 0.62% CuEq from 1095m (Drilled ~700m North of conductive high)

- HWDD05W1: 70m @ 0.67% CuEq from 962m

- Reprocessing for Horse-Well geophysics and interpretation has been led by Jim Hanneson and Chris Anderson, who’s geophysics work has led to world-class discoveries, most notably Carrapateena (BHP acquired asset via AU $9.6 Billion takeover of Oz Minerals)2 and Havieron (AU ~$1Billion takeover valuation from Greatland Gold buying Newmont’s stake in Havieron & Tefler)3

- Ovoid conductive anomalous body shares parallels to those of Khamsin and Carrapateena deposits, with a follow up with TEM survey that can precisely identify the depth of the body for drill targeting

Dr. Hanneson has applied proprietary code to forward-model the AMT data readings from the original data files as previous efforts to model the data have been incomplete and smoothened out.

The forward modelling of AMT data has identified two distinct conductive and phase anomalies within Altair’s Olympic Domain Project which adjoins BHP’s Oak Dam Project. The anomalous bodies which have been identified are located just ~5km Northwest of BHP Oak Dam Deposit (1.34Bt @ 0.66% Cu & 0.33g/t Au)1 and provides a clear target for future drilling with an aim to make a second major IOCG discovery within the prolific region.

Olympic Domain Geophysics – 100% Owned, South Australia

Altair has finalised compilation and reprocessing AMT data for its Olympic Domain Project which for the first time within Olympic Domain has formed a 3D forward geophysics model. The 3D forward geophysics model has defined major conductive and phase anomalous bodies which has shown significant scale to host a potential large IOCG deposit which is analogous to the genesis of the Oak Dam Deposit.

The AMT data model includes 220 different sounding stations covering an area of 146km2, with conductivity and phase readings across a spectrum of 90 frequencies at each sounding station with additional repeat soundings for both Conductivity and Phase, leading to a model formed from analysing ~40,000 data points.

Conductive Anomaly

AMT surveys read multi-frequency EM fields within the subsurface, whereby a conductive zone beneath the surface, such as an IOCG mineralised body induces a current which alter the ratio of electric (E) and magnetic (H) fields, which is detected by the AMT device, and measures of the overall strength of the electric field.

Within the Horse-Well prospect at Olympic Domain, a discrete untested conductive anomaly has been defined by Altair through a 3D forward model of the AMT data occurring at cross section L6574000N.

The larger conductive anomaly spans 4.2km strike along SW-NE. A second higher priority and more distinct ovoid conductive body that spans 1.7km strike SW-NE, which is suspected to be related to IOCG mineralisation and presents a clear drill target. The conductive ovoid body defined by AMT readings in the context of IOCG mineralisation is generally a response from the accumulation of Copper & Iron Sulphides (Chalcopyrite, Pyrite), Iron Oxides (Magnetite) and/or alteration zones which consists of Chlorites, Sericite and hydrothermal alteration.

The conductive response measured by the AMT survey indicate potential for a large chargeable sulphide bearing IOCG unit located beneath sedimentary cover. The distinctive ovoid conductive anomaly presents a clear untested and high-priority drill target.

Click here for the full ASX Release

This article includes content from Altair Minerals Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Sign up to get your FREE

AuKing Mining Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

09 February

AuKing Mining

Advancing a diversified portfolio of uranium, copper and critical minerals projects across Australia, Tanzania and North America, with current priorities including the proposed tin acquisition in north-west Tasmania, the Koongie Park copper-zinc project in Western Australia, and the Mkuju uranium project in southern Tanzania.

Advancing a diversified portfolio of uranium, copper and critical minerals projects across Australia, Tanzania and North America, with current priorities including the proposed tin acquisition in north-west Tasmania, the Koongie Park copper-zinc project in Western Australia, and the Mkuju uranium project in southern Tanzania. Keep Reading...

10 February

Flow Metals to Acquire the Monster IOCG Project in Yukon

Flow Metals Corp. (CSE: FWM) ("Flow Metals" or the "Company") is pleased to report that it has entered into an option agreement dated February 9, 2026 (the "Option Agreement") with Go Metals Corp. ("Go Metals") to acquire the Monster IOCG project (the "Monster Project"), located approximately 90... Keep Reading...

09 February

Investor Presentation

Aurum Resources (AUE:AU) has announced Investor PresentationDownload the PDF here. Keep Reading...

09 February

Dr. Adam Trexler: Physical Gold Market Broken, Crisis Unfolding Now

Dr. Adam Trexler, founder and president of Valaurum, shares his thoughts on gold, identifying a key issue he sees developing in the physical market. "There's a crisis in the physical gold market," he said, explaining that sector participants need to figure out how to serve investors who want to... Keep Reading...

09 February

Trevor Hall: Bull Markets Don’t Always Mean Big Returns

Clear Commodity Network CEO and Mining Stock Daily host Trevor Hall opened his talk at the Vancouver Resource Investment Conference (VRIC) with a strong message: It is still possible to go broke in a bull market.“I want to start with the simple but uncomfortable truth: most investors don't lose... Keep Reading...

09 February

How Near-term Production is Changing the Junior Gold Exploration Model

Junior gold companies have traditionally been defined by exploration: identifying prospective ground, drilling to delineate a resource and, ideally, monetising that discovery through a sale or joint venture with a larger producer. While this model has delivered success in the past, changing... Keep Reading...

09 February

Gold Exploration in Guinea: An Emerging Opportunity in West Africa

While much of West Africa’s gold exploration spotlight has historically fallen on countries like Ghana and Mali, Guinea is increasingly emerging as a quiet outlier — a country with proven gold endowment, expansive underexplored terrain and a growing number of active exploration programs. Despite... Keep Reading...

Latest News

Sign up to get your FREE

AuKing Mining Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00