March 18, 2025

RocketBoots (ASX:ROC) presents a compelling high-growth investment opportunity with its AI-driven, scalable SaaS model, targeting a $2.4 billion+ market across retail and banking. Backed by strong enterprise adoption, a robust pipeline of customer sites, and a track record of delivering proven cost-saving solutions, ROC is primed for global expansion and sustained recurring revenue growth.

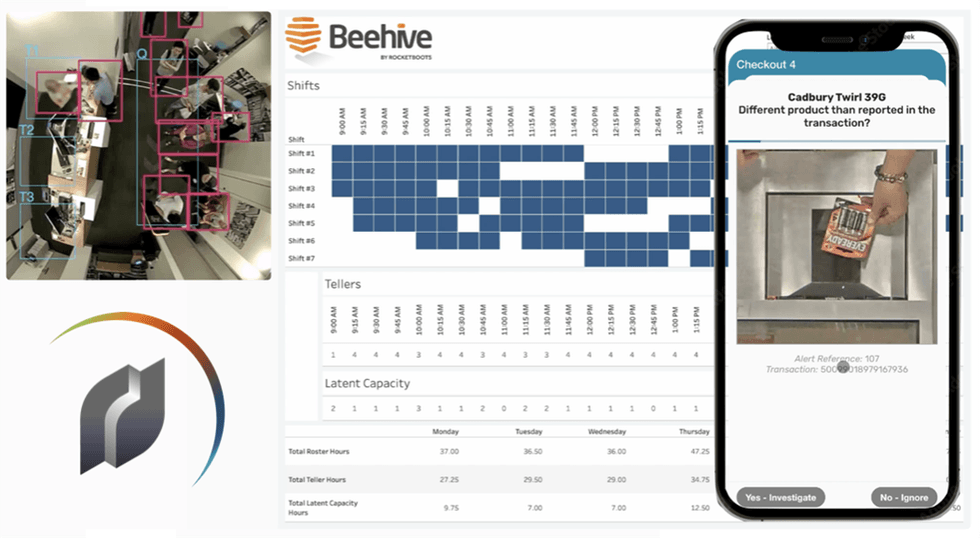

Since its inception in 2004 as an internet application consultancy, RocketBoots has evolved into a leader in AI-powered software, helping businesses enhance operations and elevate customer experiences. The company delivers proprietary solutions that drive measurable impact. Its technology addresses key business challenges—reducing operational costs, preventing self-checkout losses and staff fraud—while simultaneously improving service quality, increasing sales, and strengthening customer loyalty.

RocketBoots offers a unique, all-in-one software platform for loss prevention, workforce management, and customer experience optimization. Its advanced technology empowers retailers to detect potential theft and identify staff fraud at registers.

Company Highlights

- Mission: RocketBoots empowers global retail and banking giants to slash operating expenses and losses while boosting service, sales and customer loyalty.

- Proven Tech: Validated internationally by top retailers and banks, RocketBoots’ AI-powered software delivers a strong ROI and fuels long-term customer retention. Demand is proven.

- The Advantage: The company’s flagship platform uniquely unifies loss prevention, workforce management, and customer experience — a game-changer for integrated store and branch operations.

- Expert team: Led by seasoned executives and AI specialists, RocketBoots has a strong track record of delivering its cutting-edge computer vision and machine learning software internationally.

- Scale Without Limits: The company’s hybrid cloud/on-prem architecture enables rapid scaling across thousands of locations without massive infrastructure investment or staffing increases.

- Explosive Growth Potential: With a more than 35,000-site global enterprise pipeline and nine international trials already completed or nearing completion (including multinational retailers), RocketBoots is primed for global expansion.

- Massive Market: The more than $2.4 billion addressable market (just retail grocery and branch banking in current territories) is only the beginning. The company is eyeing adjacent sectors, new geographies, and expanding its software portfolio.

This RocketBoots profile is part of a paid investor education campaign.*

Click here to connect with RocketBoots (ASX:ROC) to receive an Investor Presentation

ROC:AU

Sign up to get your FREE

RocketBoots Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

17 March 2025

RocketBoots

Superpowers for in-person service businesses using AI

Superpowers for in-person service businesses using AI Keep Reading...

27 February

Half Yearly Report and Accounts

RocketBoots (ROC:AU) has announced Half Yearly Report and AccountsDownload the PDF here. Keep Reading...

29 January

Quarterly Activities/Appendix 4C Cash Flow Report

RocketBoots (ROC:AU) has announced Quarterly Activities/Appendix 4C Cash Flow ReportDownload the PDF here. Keep Reading...

23 December 2025

$7M Placement to Accelerate International Expansion

RocketBoots (ROC:AU) has announced $7M Placement to Accelerate International ExpansionDownload the PDF here. Keep Reading...

21 December 2025

Trading Halt

RocketBoots (ROC:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

17 December 2025

Transformational A$9.1m ARR Global Contract Win

RocketBoots (ROC:AU) has announced Transformational A$9.1m ARR Global Contract WinDownload the PDF here. Keep Reading...

02 March

ASX AI Stocks: 5 Biggest Companies in 2026

Artificial intelligence (AI) continues to evolve and advance rapidly, becoming increasingly integrated in the automation of everyday life and a focal point of growth in the technology sector.Although the AI market is relatively small in Australia, it’s growing.According to a September 2023... Keep Reading...

04 February

AI Infrastructure Moving to the Edge to Transform User Experience

While the first phase of the AI gold rush was defined by massive investments in centralized data centers, 2026 is about proving those billions can translate into fast, reliable AI that people will use every day. One Canadian startup, PolarGrid, is betting that the answer lies at the edge rather... Keep Reading...

29 January

Quarterly Activities/Appendix 4C Cash Flow Report

Unith (UNT:AU) has announced Quarterly Activities/Appendix 4C Cash Flow ReportDownload the PDF here. Keep Reading...

20 January

The Performance Chasm: Is the AI Rally Over or Just Shifting Gears?

The investment landscape of 2025 will be remembered for its historic divide, where the widespread boom in artificial intelligence (AI) created a tale of two worlds in the stock market.On one side, the Magnificent 7 and specialized players like Palantir Technologies (NASDAQ:PLTR) drove massive... Keep Reading...

20 January

Nextech3D.ai Scales National Event Infrastructure to 35 Major U.S. Cities; Launches 58 New AI-Ready Experiences to Meet Enterprise Demand

Strategic Integration of Generative AI 'Semantic Memory' via OpenAI and Pinecone Vector Database Supports Rapid Expansion of Corporate Engagement Platforms TORONTO, ON / ACCESS Newswire / January 20, 2026 / Nextech3D.ai (OTCQB:NEXCF)(CSE:NTAR,OTC:NEXCF)(FSE:1SS), a leader in AI-powered event and... Keep Reading...

16 January

Tech Weekly: Chip Stocks Soar on Taiwan Semiconductor Earnings

Welcome to the Investing News Network's weekly brief on tech news and tech stocks driving the market. We also break down next week's catalysts to watch to help you prepare for the week ahead.Don't forget to follow us @INN_Technology for real-time news updates!Securities Disclosure: I, Meagen... Keep Reading...

Latest News

Sign up to get your FREE

RocketBoots Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00