May 22, 2024

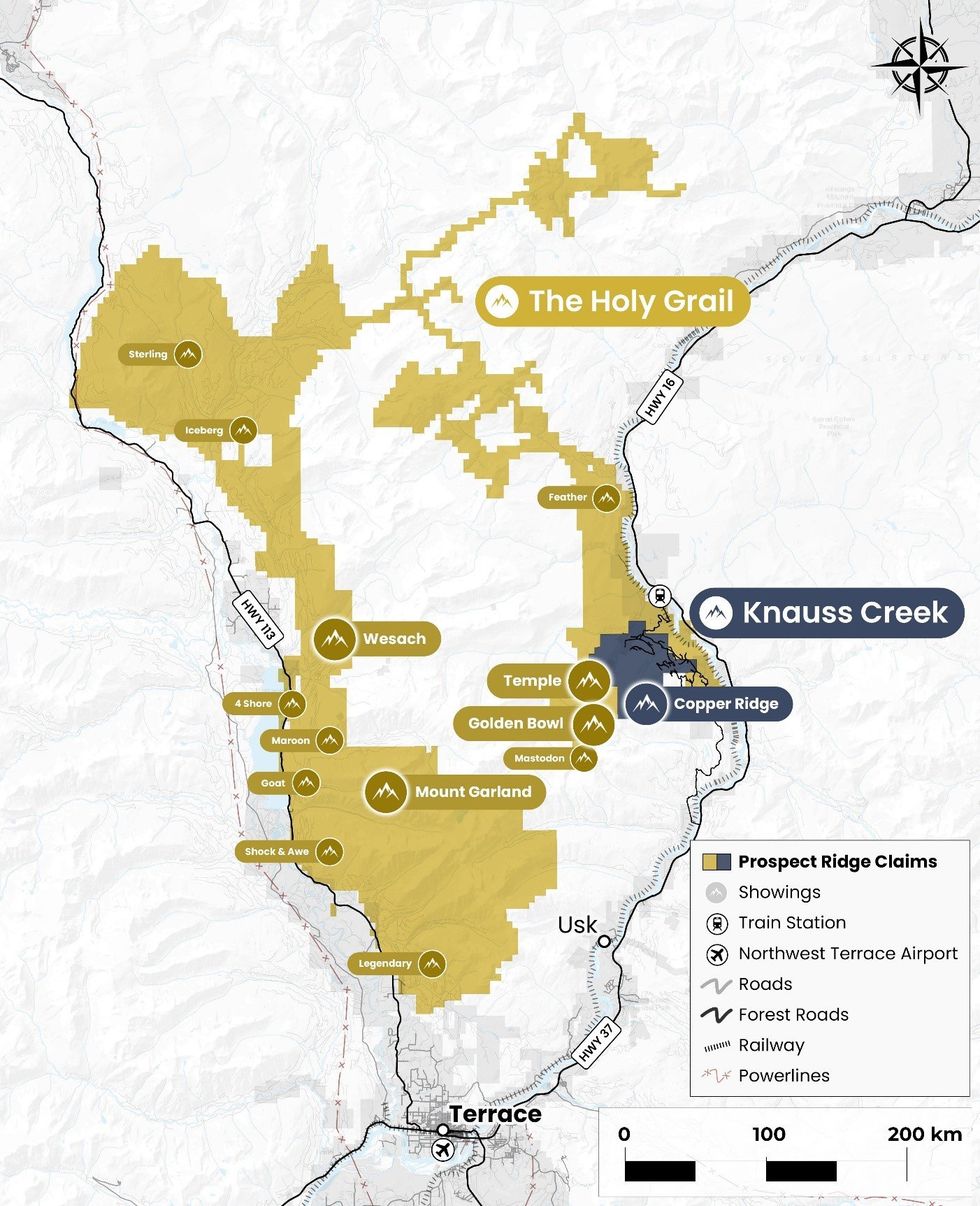

Prospect Ridge Resources Corp. (the "Company" or "Prospect Ridge") (CSE: PRR) (OTC: PRRSF) (FRA: OED) is pleased to announce many new discoveries on the Holy Grail property. High-grade samples were obtained just west of our Knauss Creek property in the vicinity of the Copper Ridge zone and Leon’s Legacy showings. Other high-grade results on the western limb of the property are located on Mount Garland and the Wesach mountain. The fully owned Holy Grail property, starts approximately 10 km north of Terrace, British Columbia.

The last few days of the 2023 prospecting program gave us a surprise when the field team decided to step out of Copper Ridge and go on the Holy Grail property side. This led to the discovery of two new showings named Golden Bowl and Temple located approximately 1.5 km to the west and 2.5 km to the northwest respectively. On the western limb of the property, the summer of 2023 results are outlining two clusters of samples returned high-grade results, one on Mount Garland and one on the Wesach mountain (Figure 1).

Highlights from outcrop samples:

Golden Bowl

- 9.99 g/t Au, 183 g/t Ag, 1.81% Cu, 7.4% Pb and 0.17% Zn (W500082)

- 8.35 g/t Au, 63 g/t Ag, 0.44% Cu, 3.5% Pb and 0.35% Zn (W386369)

Temple

- 8.16 g/t Au, 137 g/t Ag and 14.8% Cu (W500697)

- 0.18 g/t Au, 94 g/t Ag and 4.6% Cu (W500698)

- 0.08 g/t Au, 22 g/t Ag and 5.9% Cu (W500696)

Mount Garland

- 7.9% Cu, 634 g/t Ag and 0.7% Zn (W387642, erratic block)

- 5.1% Cu, 0.11 g/t Au, 14 g/t Ag and (W489403)

- 2.2% Cu and 98 g/t Ag (W489406)

- 2.1% Cu, 61 g/t Ag and 0.23% Zn (W489408)

Wesach mountain

- 5.43 g/t Au, 9 g/t Ag, 0.22% Pb and 0.47% Zn (W501823)

- 1.13 g/t Au, 102 g/t Ag, 3.27% Pb and 2.57% Zn (W502285)

Prospect Ridge CEO Michael Iverson commented, “I’m thrilled with these new discoveries. Our exploration efforts have unveiled remarkable finds throughout the 2023 summer underscoring the richness of our land package and the skills of our field team. These new showings on the Holy Grail are confirming the extraordinary geological potential in the Terrace area south of the Golden Triangle.”

Prospect Ridge President Yan Ducharme added, “The Golden Bowl and Temple new discoveries are adding pieces to the puzzle connecting previously discovered Copper Ridge and Leon’s Legacy. These polymetallic veins stand as a testament to the barely tapped potential of this underexplored land package, hinting numerous future discoveries to be unearthed. All the mountains of the western reaches of the Holy grail have delivered high-grade showings often within a cluster of lower grade rocks. Summer 2024 will see us initiate the first drill holes on the Copper Ridge zone and we will pick up prospection where we left off.”

Eastern part of Holy Grail

Prospection approximately 1.5 km west of the Copper Ridge zone, in a topographic bowl, led to the discovery of a quartz vein containing 9.99 g/t Au, 183 g/t Ag, 1.81% Cu, 7.44% Pb and 0.17% Zn (W500082). Forty meters from it, another vein with 8.35 g/t Au, 63 g/t Ag, 0.44% Cu, 3.5% Pb and 0.35% Zn (W386369) was sampled. More mineralized veins were sampled at the bottom of the bowl, while two erratic blocks and a vein were sampled on the flank of it. The veins of this Golden Bowl showing are hosted in an intrusion.

Approximately 2.5 km northwest of the Copper Ridge zone and 1 km south of the Leon’s Legacy, 8.16 g/t Au, 137 g/t Ag and 14.8% Cu (W500697) was obtained on a quartz vein. Within 50 meters, two other samples gave 0.08 g/t Au, 22 g/t Ag and 5.92% Cu (W500696) and 0.18 g/t Au, 94 g/t Ag and 4.55% Cu (W500698). More mineralized samples were taken in the vicinity and are part of the Temple showing.

Western part of Holy Grail

The northern flank of Mount Garland is easily accessible by logging roads. The prospecting works led to the sampling of many quartz veins with chalcopyrite and malachite which contains mainly copper and silver, but also occasional gold and zinc occurrences. The best results were obtained from an erratic block, taken on a talus, which yield 7.91% Cu and 634 g/t Ag (W387642). Other in situ veins were sampled and gave 5.07% Cu, 0.11 g/t Au, 14 g/t Ag (W489403), 2.20% Cu, 98 g/t Ag (W489406) and 2.09% Cu, 61 g/t Ag (W489408). These samples are part of a cluster covering an area of 3.5 km by 1.5 km of mineralized veins and blocks. The alpine part of Mount Garland has not been prospected yet.

Figure 1: Location map with new showings.

Figure 2: Best new values obtained on the Holy Grail during the summer 2023 field program.

Prospecting on the southern side of the Wesach mountain, uphill of the Wesach Creek, led to the discovery of many quartz veins bearing gold, silver, lead and zinc. Sample W501823 contains 5.43 g/t Au, 8.5 g/t Ag, 0.22% Pb and 0.47% Zn and sample W502285 contains 1.13 g/t Au, 102 g/t Ag, 3.27% Pb and 2.57% Zn. A cluster of mineralized samples covers an area of 400 m by 400 m. Some sampled erratic blocks returned copper, gold and silver values. The source has yet to be found.

| Sample | Easting1 | Northing1 | Au (g/t) | Ag (g/t) | Cu (%) | Pb (%) | Zn (%) | AuEq g/t2 |

| Golden Bowl | ||||||||

| W386366 | 537645 | 6070688 | 0.526 | 23.8 | 0.686 | 0.008 | 0.002 | 1.784 |

| W386368 | 537655 | 6070699 | 0.089 | 5.1 | 0.336 | 0.001 | 0.003 | 0.626 |

| W386369 | 537643 | 6070822 | 8.350 | 63.2 | 0.438 | 3.500 | 0.345 | 11.100 |

| W4894713 | 537202 | 6070540 | 0.704 | 2.3 | 0.004 | 0.146 | 0.029 | 0.800 |

| W4894723 | 537273 | 6070565 | 0.018 | 5.1 | 0.385 | 0.001 | 0.007 | 0.625 |

| W489473 | 537274 | 6070607 | 1.130 | 0.8 | 0.016 | 0.147 | 0.005 | 1.216 |

| W497153 | 537570 | 6070674 | 1.940 | 1.6 | 0.002 | 0.001 | 0.005 | 1.964 |

| W500081 | 537650 | 6070693 | 0.022 | 7.5 | 0.421 | 0.000 | 0.005 | 0.708 |

| W500082 | 537628 | 6070782 | 9.990 | 183 | 1.810 | 7.440 | 0.173 | 17.442 |

| Temple | ||||||||

| W489476 | 536364 | 6072676 | 0.026 | 2.2 | 0.107 | 0.000 | 0.006 | 0.206 |

| W4894773 | 536329 | 6072483 | 0.346 | 3.4 | 0.413 | 0.000 | 0.001 | 0.970 |

| W500695 | 536538 | 6072489 | 0.247 | 13.7 | 0.753 | 0.001 | 0.011 | 1.479 |

| W500696 | 536549 | 6072472 | 0.080 | 22 | 5.920 | 0.001 | 0.008 | 8.693 |

| W500697 | 536549 | 6072470 | 8.160 | 137 | 14.800 | 0.010 | 0.008 | 30.682 |

| W500698 | 536586 | 6072438 | 0.180 | 94.1 | 4.550 | 0.002 | 0.008 | 7.734 |

| Golden Bowl and Temple area | ||||||||

| W386365 | 536699 | 6071100 | 0.336 | 5.3 | 0.013 | 0.002 | 0.000 | 0.419 |

| W489470 | 536759 | 6071107 | 0.696 | 7.4 | 0.001 | 0.004 | 0.000 | 0.788 |

| W496077 | 535736 | 6073154 | 0.002 | 0.3 | 0.070 | 0.000 | 0.008 | 0.107 |

| W496079 | 536149 | 6073403 | 0.037 | 1.7 | 0.158 | 0.000 | 0.007 | 0.283 |

| W500651 | 536677 | 6071905 | 0.002 | 1.9 | 0.031 | 0.120 | 0.008 | 0.114 |

| W500652 | 536663 | 6071893 | 0.258 | 45.1 | 0.005 | 1.520 | 0.002 | 1.347 |

| W500657 | 536574 | 6071821 | 0.016 | 6.8 | 0.057 | 0.026 | 0.000 | 0.188 |

| W500658 | 536661 | 6071839 | 0.089 | 17.1 | 0.021 | 0.008 | 0.003 | 0.329 |

| Mount Garland | ||||||||

| W3876423 | 520095 | 6066782 | 0.037 | 634 | 7.910 | 0.083 | 0.703 | 19.153 |

| W387643 | 520155 | 6066561 | 0.008 | 4.3 | 0.079 | 0.002 | 0.008 | 0.175 |

| W3876443 | 520004 | 6066702 | 0.027 | 3.4 | 0.140 | 0.000 | 0.007 | 0.268 |

| W387645 | 520050 | 6066573 | 0.002 | 1.6 | 0.079 | 0.000 | 0.007 | 0.135 |

| W489394 | 521080 | 6067474 | 0.002 | 3.4 | 0.091 | 0.000 | 0.001 | 0.172 |

| W4893953 | 521268 | 6066970 | 0.002 | 4.7 | 0.182 | 0.001 | 0.015 | 0.322 |

| W4893963 | 521266 | 6066972 | 0.017 | 0.8 | 0.067 | 0.000 | 0.002 | 0.122 |

| W489397 | 520566 | 6067623 | 0.087 | 13 | 1.140 | 0.000 | 0.007 | 1.854 |

| W489398 | 520557 | 6067625 | 0.073 | 5.8 | 0.294 | 0.000 | 0.002 | 0.558 |

| W489399 | 521361 | 6066538 | 0.013 | 4.2 | 0.117 | 0.001 | 0.007 | 0.232 |

| W489400 | 521390 | 6066436 | 0.009 | 14.6 | 0.673 | 0.000 | 0.002 | 1.135 |

| W4894023 | 521647 | 6066024 | 0.025 | 3.7 | 0.196 | 0.000 | 0.007 | 0.349 |

| W489403 | 521717 | 6065912 | 0.112 | 13.9 | 5.070 | 0.000 | 0.011 | 7.430 |

| W489405 | 522375 | 6067175 | 0.002 | 4.3 | 0.055 | 0.011 | 0.015 | 0.141 |

| W489406 | 522612 | 6066938 | 0.011 | 98.4 | 2.200 | 0.035 | 0.053 | 4.334 |

| W489407 | 522667 | 6066898 | 0.005 | 40 | 0.305 | 0.013 | 0.303 | 1.042 |

| W489408 | 522725 | 6066802 | 0.035 | 60.6 | 2.090 | 0.051 | 0.232 | 3.822 |

| W496060 | 520312 | 6067914 | 0.006 | 2.3 | 0.134 | 0.000 | 0.003 | 0.224 |

| W496061 | 520318 | 6067908 | 0.002 | 8.6 | 0.191 | 0.000 | 0.002 | 0.376 |

| W496064 | 519201 | 6067566 | 0.108 | 2.7 | 0.124 | 0.000 | 0.002 | 0.316 |

| W5000533 | 522163 | 6067074 | 0.008 | 55.1 | 0.011 | 0.032 | 0.010 | 0.705 |

| W500055 | 520461 | 6067513 | 0.026 | 5.3 | 0.004 | 0.021 | 0.012 | 0.108 |

| W500635 | 520166 | 6067722 | 0.002 | 31.1 | 0.358 | 0.019 | 0.052 | 0.910 |

| W5022773 | 521175 | 6066358 | 0.002 | 7.8 | 0.001 | 0.009 | 0.000 | 0.101 |

| W502278 | 521097 | 6066216 | 0.002 | 1.8 | 0.105 | 0.001 | 0.009 | 0.176 |

| W5022793 | 521088 | 6066208 | 0.002 | 2.3 | 0.135 | 0.001 | 0.010 | 0.224 |

| W5022813 | 521040 | 6066269 | 0.005 | 4.5 | 0.320 | 0.000 | 0.006 | 0.513 |

| W502283 | 521121 | 6066020 | 0.006 | 4.3 | 0.334 | 0.005 | 0.005 | 0.532 |

| W502284 | 521110 | 6065993 | 0.006 | 2.0 | 0.076 | 0.003 | 0.002 | 0.139 |

| Wesach mountain | ||||||||

| W3847943 | 519537 | 6076197 | 0.009 | 4.8 | 0.254 | 0.002 | 0.002 | 0.427 |

| W387610 | 519186 | 6076179 | 0.008 | 9.6 | 0.002 | 0.602 | 0.208 | 0.420 |

| W387611 | 519185 | 6076186 | 0.043 | 14.1 | 0.002 | 0.573 | 0.145 | 0.475 |

| W387613 | 519182 | 6076193 | 0.031 | 20 | 0.003 | 1.155 | 0.375 | 0.831 |

| W387614 | 519253 | 6076226 | 0.360 | 36.5 | 0.033 | 1.760 | 0.478 | 1.655 |

| W387615 | 519260 | 6076230 | 0.169 | 69.7 | 0.007 | 4.380 | 0.998 | 2.955 |

| W387617 | 518206 | 6075523 | 0.622 | 2.9 | 0.011 | 0.115 | 0.147 | 0.771 |

| W489359 | 519204 | 6076204 | 0.011 | 4.2 | 0.005 | 0.202 | 1.210 | 0.614 |

| W489360 | 519186 | 6076204 | 0.073 | 19.6 | 0.003 | 1.150 | 0.568 | 0.942 |

| W4894093 | 518304 | 6075043 | 0.107 | 10.8 | 0.291 | 0.001 | 0.020 | 0.656 |

| W4894113 | 519368 | 6075852 | 0.481 | 48.6 | 0.289 | 1.970 | 0.061 | 2.194 |

| W5006073 | 519194 | 6076234 | 0.079 | 1.8 | 0.261 | 0.002 | 0.005 | 0.471 |

| W501809 | 519180 | 6075923 | 0.040 | 7.4 | 0.001 | 0.426 | 0.080 | 0.312 |

| W501823 | 518209 | 6075519 | 5.430 | 8.5 | 0.014 | 0.223 | 0.465 | 5.813 |

| W502285 | 519190 | 6075944 | 1.130 | 102 | 0.009 | 3.270 | 2.570 | 4.534 |

| W502287 | 519249 | 6075965 | 0.088 | 0.5 | 0.017 | 0.003 | 0.010 | 0.123 |

| W502288 | 519238 | 6075961 | 0.028 | 1.2 | 0.020 | 0.027 | 0.064 | 0.105 |

| W502289 | 519300 | 6075960 | 0.019 | 5.0 | 0.003 | 0.351 | 0.006 | 0.210 |

| W502292 | 519217 | 6075941 | 1.860 | 1.0 | 0.071 | 0.000 | 0.005 | 1.974 |

| W5022933 | 519270 | 6075964 | 0.052 | 4.5 | 0.004 | 0.247 | 0.262 | 0.302 |

| W502294 | 519283 | 6075967 | 0.019 | 6.8 | 0.025 | 0.413 | 0.259 | 0.383 |

Table 1: Best Results from the Holy Grail surface sampling of summer 2023.

1: Coordinates in meters UTM Nad83 Zone 9N

2: Gold equivalents were calculated with a gold price of $1,750/oz, silver at $21/oz, copper at $3.60/lbs, lead at $0.90/lbs and zinc at $1.00/lbs.

3: Erratic block.

Cautionary statements

Outcrop samples are selective by nature and grades may not be representative of mineralized zones. True thickness or mineralization style and geological models cannot be determined with the information currently available.

Quality control

Rock samples were assayed for gold by standard 50 g fire-assaying with atomic absorption finish (Au-AA24) or gravimetric finish (Au-GRA22) or 1000g metallic screening (Au-SCR24) at ALS Canada in Terrace, British Columbia. The samples were also assayed for 35 metals from an aqua regia digestion with ICP-AES finish (ME-ICP41). For samples with overlimit results in silver, copper, lead and zinc, aqua regia with ICP finish was used (OG46 ore grade). A quality assurance/quality control program has been implemented and consists of inserting standards on a regular basis in the samples stream.

Qualified Person

All scientific or technical information included in this news release has been reviewed, verified and approved by Yan Ducharme, P.Geo., President of the Company and a qualified person as defined by National Instrument 43-101. This news release was written by Yan Ducharme.

About the Holy Grail property

The fully owned Holy Grail starts approximately 10 kilometres north of the town of Terrace in the Province of British Columbia, Canada. It is easily accessible by the Transcanadian highway, the Nisga’a highway and a network of logging roads. It covers about 700 square kilometres and is contiguous to our fully owned Knauss Creek property.

Several gold, silver, copper, lead and zinc occurrences were discovered in the past. Almost all the creeks draining the property were exploited at some point and alluvial gold was recovered.

During the 2023 field season, the Company continued exploring this huge land package which contains many showings of interest.

The southern tip of the Golden Triangle is located immediately northwest of the PRR properties. The Bowser Lake and the Hazelton Groups hosting most of the deposits and mines of this area are also underlying the Knauss Creek and Holy Grail properties.

About Prospect Ridge Resources Corp.

Prospect Ridge Resources Corp. is a British Columbia based exploration and development company focused on gold, silver and copper exploration. Prospect Ridge’s management and technical team cumulate over 100 years of mineral exploration experience and believes the Knauss Creek and the Holy Grail properties, near the town of Terrace BC, to have the potential to extend the boundaries of the Golden Triangle to cover this vast under-explored region.

Contact Information

Prospect Ridge Resources Corp.

Mike Iverson

Email: mike.iverson@prospectridgeresources.com

Telephone: 604-351-3351

Neither the Canadian Securities Exchange nor its Regulation Services Provider (as that term is defined in the policies of the Canadian Securities Exchange) accepts responsibility for the adequacy or accuracy of this release.

This release includes certain statements and information that may constitute forward-looking information within the meaning of applicable Canadian securities laws. Forward-looking statements relate to future events or future performance and reflect the expectations or beliefs of management of the Company regarding future events. Generally, forward-looking statements and information can be identified by the use of forward-looking terminology such as “intends” or “anticipates”, or variations of such words and phrases or statements that certain actions, events or results “may”, “could”, “should”, “would” or “occur”. This information and these statements, referred to herein as "forward-looking statements", are not historical facts, are made as of the date of this news release and include without limitation, statements regarding discussions of future plans, estimates and forecasts and statements as to management's expectations and intentions with respect to, among other things, positive exploration results at the Knauss Creek and Holy Grail projects and the Company’s use of proceeds from the Private Placement. These forward-looking statements involve numerous risks and uncertainties and actual results might differ materially from results suggested in any forward-looking statements. These risks and uncertainties include, among other things, that future exploration results at the Knauss Creek and Holy Grail projects will not be as anticipated and that the Company will use the proceeds from the Private Placement as anticipated.

In making the forward-looking statements in this news release, the Company has applied several material assumptions, including without limitation, that future exploration results at the Knauss Creek and Holy Grail projects will be as anticipated and that the Company will use the proceeds from the Private Placement as anticipated.

Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements and forward-looking information. Readers are cautioned that reliance on such information may not be appropriate for other purposes. The Company does not undertake to update any forward-looking statement, forward-looking information or financial out-look that are incorporated by reference herein, except in accordance with applicable securities laws. We seek safe harbor.

PRR:CC

The Conversation (0)

21 November 2024

Prospect Ridge Resources

Emerging precious metals explorer near the prolific Golden Triangle

Emerging precious metals explorer near the prolific Golden Triangle Keep Reading...

13 February

WALKER LANE PROVIDES UPDATE ON LATE FILING OF FINANCIAL STATEMENTS

TSX-V: WLRFrankfurt: 6YL Walker Lane Resources Ltd. (TSXV: WLR,OTC:CMCXF) (Frankfurt: 6YL) (the "Company") announces that the Company continues to work diligently toward the completion and filing of the Company's annual audited financial statements and management's discussion and analysis for... Keep Reading...

13 February

WALKER LANE PROVIDES UPDATE ON LATE FILING OF FINANCIAL STATEMENTS

TSX-V: WLRFrankfurt: 6YL Walker Lane Resources Ltd. (TSXV: WLR,OTC:CMCXF) (Frankfurt: 6YL) (the "Company") announces that the Company continues to work diligently toward the completion and filing of the Company's annual audited financial statements and management's discussion and analysis for... Keep Reading...

13 February

WALKER LANE PROVIDES UPDATE ON LATE FILING OF FINANCIAL STATEMENTS

TSX-V: WLRFrankfurt: 6YL Walker Lane Resources Ltd. (TSXV: WLR,OTC:CMCXF) (Frankfurt: 6YL) (the "Company") announces that the Company continues to work diligently toward the completion and filing of the Company's annual audited financial statements and management's discussion and analysis for... Keep Reading...

12 February

Gold Mineral Resources Update

Horizon Minerals (HRZ:AU) has announced Gold Mineral Resources UpdateDownload the PDF here. Keep Reading...

12 February

RUA GOLD Announces Uplisting to Toronto Stock Exchange

Rua Gold INC. (TSXV: RUA,OTC:NZAUF) (OTCQB: NZAUF) ("Rua Gold" or the "Company") is pleased to announce that the Company will be uplisting to the Toronto Stock Exchange (the "TSX"). The common shares of the Company (the "Common Shares") will be voluntarily delisted from the TSX Venture Exchange... Keep Reading...

12 February

RUA GOLD Announces Uplisting to Toronto Stock Exchange

Rua Gold INC. (TSXV: RUA,OTC:NZAUF) (OTCQB: NZAUF) ("Rua Gold" or the "Company") is pleased to announce that the Company will be uplisting to the Toronto Stock Exchange (the "TSX"). The common shares of the Company (the "Common Shares") will be voluntarily delisted from the TSX Venture Exchange... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00