May 06, 2022

Premier Health of America (TSXV:PHA) has launched its campaign on the Investing News Network's Medical Device channel.

Premier Health of America (TSXV:PHA) is a modern healthcare staffing platform that gives healthcare workers and facilities access to leading technologies to finally create a truly flexible workforce.

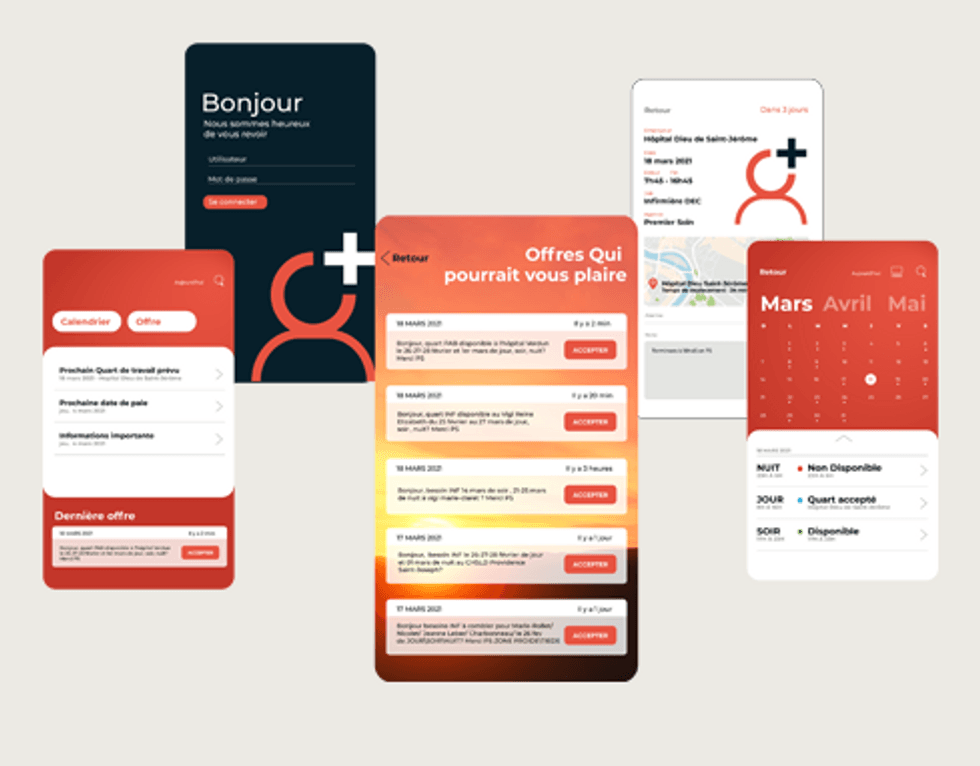

The company’s mobile app technology, PSweb, is at the core of its operations, and the app has been live for over a decade. Artificial intelligence (AI) and big data power the app, delivering a genuinely automated process to healthcare facilities and professionals. The platform serves the healthcare needs of governments, corporations, and individuals. A healthcare facility simply posts an open shift and desired skill set, and providers around the country can claim it.

Company Highlights

- Premier Health of America is a Canadian technology-focused healthcare staffing company that describes itself as an ‘efficient solution for a changing healthcare environment.’

- Its platform leverages artificial intelligence and machine learning through big data to deliver automated solutions to healthcare facilities and providers.

- The company is a true digital disruptor, with most healthcare facilities still relying on manual staffing solutions.

- PSweb is the company’s proprietary technology that powers its services. Its platform provides database management, scheduling, and real-time assignment in the context of complex healthcare working protocols.

- Healthcare workers can use the mobile app to sign up for shifts at healthcare facilities without manual intervention from a staffing agency. Any qualified professional can use the platform to decide where and when they work.

- Premier Health of America has multiple business units that cater to specific needs within the healthcare industry, such as on-demand staffing for remote healthcare.

- The company plans to continue expanding throughout Canada and aims to take its platform to the United States.

- Premier Health of America recently completed its acquisition of 100 percent of Umana Holdings, enabling it to work in regions beyond Quebec.

- An experienced management team leads the company through its continual expansion and technological development.

PHA:LYX

Sign up to get your FREE

AuKing Mining Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

09 February

AuKing Mining

Advancing a diversified portfolio of uranium, copper and critical minerals projects across Australia, Tanzania and North America, with current priorities including the proposed tin acquisition in north-west Tasmania, the Koongie Park copper-zinc project in Western Australia, and the Mkuju uranium project in southern Tanzania.

Advancing a diversified portfolio of uranium, copper and critical minerals projects across Australia, Tanzania and North America, with current priorities including the proposed tin acquisition in north-west Tasmania, the Koongie Park copper-zinc project in Western Australia, and the Mkuju uranium project in southern Tanzania. Keep Reading...

28 January

Seegnal Presents Real-World Evidence on Reducing Fall Risk in Geriatric Patients at Caltcm Summit

Seegnal Inc. (TSXV: SEGN) ("Seegnal" or the "Corporation"), a global leader in AI-enhanced prescription intelligence, today announced real-world clinical results demonstrating how medication governance may reduce fall-risk drivers in older adults -- a significant clinical and financial challenge... Keep Reading...

05 January

Pathways to Commercialising Biotech Innovations

In the medical technology industry, innovation is only the first step. While key to long-term success, innovation is only as good as a company’s commercialisation strategy. Once a technology has been developed and proven, the organisation must then embark on a process to commercialise it for... Keep Reading...

25 February 2025

HeraMED Signs Strategic Collaboration Agreement with Garmin Health

HeraMED Limited (ASX: HMD), a medical data and technology company leading the digital transformation of maternity care, is delighted to announce it has entered into a collaboration agreement with Garmin (NYSE: GRMN), a leading global provider of smartwatches and GPS-enabled products, aimed at... Keep Reading...

23 January 2025

Cyclopharm Signs US Agreement with HCA Healthcare for Technegas®

Cyclopharm Limited (ASX: CYC) is pleased to announce the signing of a major contract with Hospital Corporation of America Healthcare (HCA), one of the largest single healthcare providers in the United States. This agreement marks a significant milestone for the company which will allow the... Keep Reading...

23 January 2025

CONNEQT App Launches in USA as Pulse Deliveries Commence

Cardiex Limited (CDX:AU) has announced CONNEQT App Launches in USA as Pulse Deliveries CommenceDownload the PDF here. Keep Reading...

16 January 2025

Revolutionizing Women's Health: Antifungal Innovation Brings New Investment Opportunities

The intersection of women's health and antifungal innovation represents a pivotal moment in healthcare, offering both transformative medical advancements and compelling investment opportunities. The groundbreaking developments in antifungal treatments specifically targeting women's health issues... Keep Reading...

Latest News

Sign up to get your FREE

AuKing Mining Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00