August 19, 2024

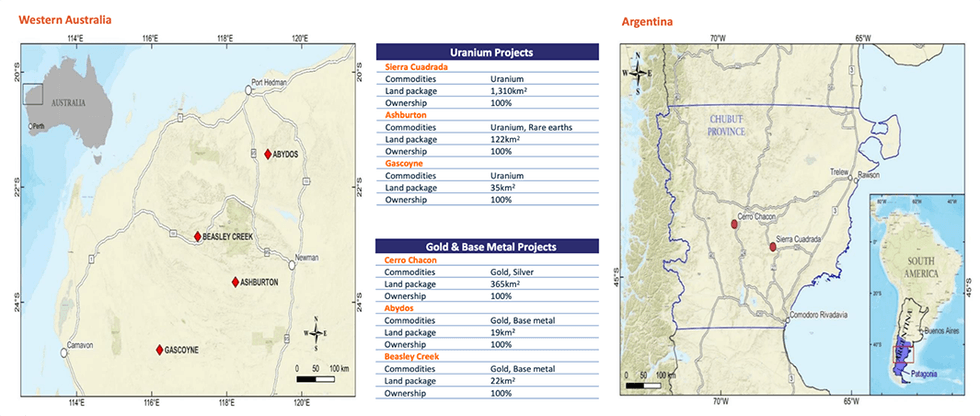

With high-quality, drill-ready assets, with world-class discovery potential, Piche Resources (ASX:PR2) is a compelling business case for investors looking to leverage a bull market for uranium and gold. The company holds a portfolio of drill-ready uranium and gold assets in Argentina and Australia which include the Ashburton uranium project in the Pilbara region; the Sierra Cuadrada uranium project in Argentina; and the Cerro Chacon gold project which shares geological similarities with the Cerro Negro mine.

The Ashburton uranium project comprises three exploration licences and has the potential to host uranium mineral deposits similar to the Pine Creek Geosyncline in Australia’s Northern Territory, and the Athabasca Basin in Saskatchewan, Canada.

iche has an internationally recognized board focused on creating long-term shareholder value, and an in-country technical team in Argentina with a proven track record of taking projects from discovery through to development.

Company Highlights

- The company’s Australian asset is the Ashburton uranium project which has been drilled previously and recorded high-grade uranium intersections over significant widths.

- In Argentina, the company’s Sierra Cuadrada uranium project in the San Jorge Basin has a significant history of high-grade, near-surface uranium mining operations.

- The company is currently drilling one of its prospects at Sierra Cuadrada and has announced visible uranium in numerous holes. Multiple other prospects are drill-ready and have the potential to host tier 1 uranium deposits.

- Exposure to gold with high-quality precious metal projects in Argentina that boast surface outcrop samples with gold grade up to 13 g/t gold.

- Internationally renowned board and management team with extensive uranium and gold exploration and development experience.

This Piche Resources profile is part of a paid investor education campaign.*

Click here to connect with Piche Resources (ASX:PR2) to receive an Investor Presentation

PR2:AU

Sign up to get your FREE

Piche Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

30 July

Piche Resources

Targeting globally significant uranium and gold discoveries in Australia and Argentina

Targeting globally significant uranium and gold discoveries in Australia and Argentina Keep Reading...

06 November

$2million placement to advance Argentine exploration

Piche Resources (PR2:AU) has announced $2million placement to advance Argentine explorationDownload the PDF here. Keep Reading...

06 November

Reinstatement to Quotation

Piche Resources (PR2:AU) has announced Reinstatement to QuotationDownload the PDF here. Keep Reading...

30 October

Quarterly Appendix 5B Cash Flow Report

Piche Resources (PR2:AU) has announced Quarterly Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

30 October

Quarterly Activities Report

Piche Resources (PR2:AU) has announced Quarterly Activities ReportDownload the PDF here. Keep Reading...

29 October

Trading Halt

Piche Resources (PR2:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

3h

Top 5 Canadian Mining Stocks This Week: Quarterback Resources Scores with 160 Percent Gain

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian and US news impacting the resource sector.Statistics Canada released October’s job numbers on Friday (November 7). The data showed a... Keep Reading...

8h

Goldgroup Files Updated Technical Report on Cerro Prieto Project

Goldgroup Mining Inc. ("Goldgroup" or the "Company") (TSXV:GGA)(OTCQX:GGAZF) is pleased to announce that it has filed an updated NI 43-101 technical report on the Cerro Prieto gold project located in Sonora State, Mexico. The report is entitled "Cerro Prieto Project, Heap Leach Project,... Keep Reading...

06 November

Adrian Day: Gold Far from Top, Two Triggers for Next Price Move

Adrian Day, president of Adrian Day Asset Management, shares his thoughts on gold's price pullback, saying he currently sees no evidence of a top. "It's perfectly normal in middle of a bull market to have a significant correction. This really isn't even a correction yet, let's not forget that.... Keep Reading...

06 November

Rick Rule: Gold Strategy, Oil Stocks I Own, "Sure Money" in Uranium

Rick Rule, proprietor at Rule Investment Media, recently sold 25 percent of his junior gold stocks, redeploying the funds into physical gold, as well as Franco-Nevada (TSX:FNV,NYSE:FNV), Wheaton Precious Metals (TSX:WPM,NYSE:WPM) and Agnico Eagle Mines (TSX:AEM,NYSE:AEM). In addition to those... Keep Reading...

Latest News

Sign up to get your FREE

Piche Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00