Top 10 Copper-producing Companies

ASX Copper Mining Stocks: 5 Biggest Companies

Overview

Demand for copper continues to be driven by the ongoing industrialization and advancement of developing economies, together with global decarbonization trends; whilst the supply-side response and development of new copper projects struggle to keep up with projected demand. Consequently, and further exacerbated by the declining production of many major mines, the supply-side shortfall is expected to continue to widen significantly in the coming years, positively impacting copper prices.

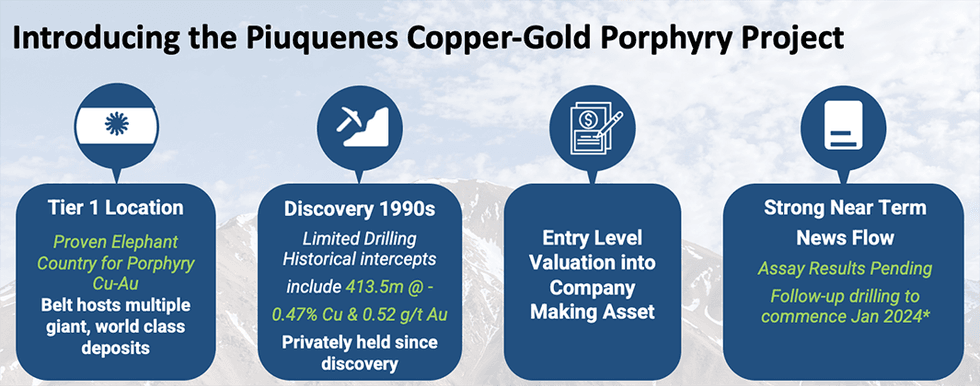

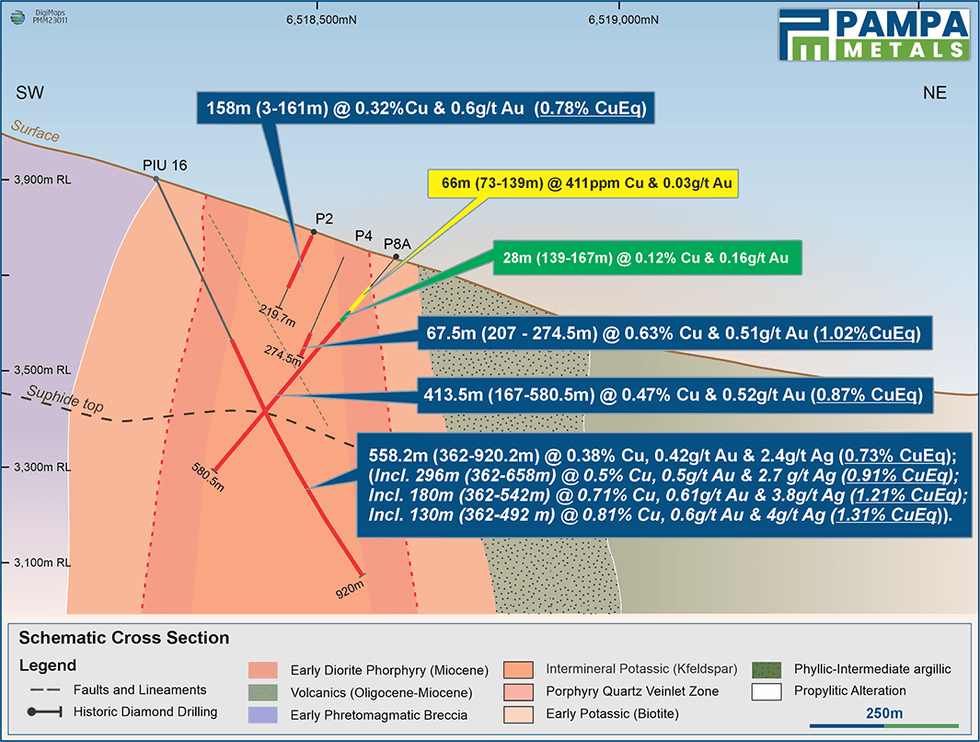

Pampa Metals (CSE:PM, OTCQB:PMMCD, FSE:FIRA) is a post-discovery copper porphyry exploration company with a portfolio of assets within prolific copper belts in Chile and Argentina. In November 2023, the company entered into an option and joint venture agreement for the acquisition of an 80 percent interest in the Piuquenes Copper-Gold Porphyry Project in San Juan Province, Argentina. Historical intervals of significant copper and gold mineralization at Piuquenes Central include:· 413.5 m (167-580.5 m) @ 0.47 percent copper and 0.52 g/t gold (0.87 percent copper equivalent); and

· 558.2 m (362-920.2 m EOH) @ 0.38 percent copper and 0.42 g/t gold and 2.4 g/t silver (0.73 percent copper equivalent), including 130 m (362-492 m) @ 0.81 percent copper and 0.6 g/t gold and 4 g/t silver (1.31 percent copper equivalent)

The Piuquenes Project lies along the San Juan Miocene Belt, which hosts numerous world class deposits, and is proximal to large-scale copper projects, including Glencore’s El Pachon and Aldebaran Resources’ Altar project. The project area consists of nine mining titles spanning 1,880 hectares with excellent access and is about 190 kilometers west of San Juan City. Since its discovery, the Piuquenes Copper-Gold porphyry has remained privately held. Historical intercepts at Piuquenes include 413.5 meters @ 0.47 percent copper and 0.52 grams per ton (g/t) gold. In 2016 Anglo American completed an exploration program at the property in 2016, which included a single, previously unassayed 920-meter diamond drill hole (PIU16 -DDH01). Anglo then reported 258 meters of visual mineralisation from 362 meters and an additional 250 meters from 620 meters.

In December 2023, Pampa Metals reported the results of the PIU16-DDH01 diamond drill hole which include:

- 558.2 m (362-920.2 m EOH) @ 0.38 percent copper and 0.42 g/t gold and 2.4 g/t silver (0.73 percent CuEq)

Including:

- 296 m (362 to 658 m) @ 0.5 percent copper and 0.5 g/t gold and 2.7 g/t silver (0.91 percent CuEq),

- 180 m (362-542 m) @ 0.71 percent copper and 0.61 g/t gold and 3.8 g/t silver (1.22 percent CuEq) and 130 m (362-492 m) @ 0.81 percent copper and 0.6 g/t gold and 4 g/t silver (1.31 percent CuEq )

Pampa’s Chilean properties, Block 4, Morros Blancos and Cerro Buenos Aires, are located along the Domeyko and Palaeocene copper belts in northern Chile. Chile has been the top copper producer globally since the early 1980s, and accounts for roughly 27 percent of global copper supply in 2021. The Domeyko Mineral Belt is the world’s most prolific copper belt and is host to three of the world’s top five copper mining districts. The Paleocene Belt also hosts globally significant deposits and operations.

Pampa controls one of the few significant, junior-owned land packages along the Domeyko Belt, providing its shareholders with unique exposure. The company’s Block 4 copper project lies along the Domeyko Belt and hosts several untested, drill-ready targets, defined by geology, geophysics, geochemistry and age-dating carried out by Pampa in recent years.

Company Highlights

- Pampa Metals is listed on the Canadian Securities Exchange (CSE:PM), Frankfurt (FSE:FIRA) and OTC (OTCQB:PMMCF) exchanges and wholly owns a portfolio of projects highly prospective for copper, gold and molybdenum along proven and highly productive mineral belts in Argentina and Chile.

- In November 2023, Pampa Metals made a game-changing acquisition of a new flagship project in Argentina, the Piuquenes Copper-Gold Project, located along the San Juan Miocene Belt, which hosts numerous world-class deposits, and proximal to large scale copper projects at El Pachon (Glencore) and Altar (Aldebaran Resources).

- Piquenes spans approximately 1,880 hectares with historical intercepts that include 413.5 meters @ 0.47 percent copper and 0.52 grams per ton (g/t) gold.

- In December 2023, Pampa Metals reported at Piuquenes 130 meters from 362 meters @ 1.31 percent copper equivalent (CuEq), within a broader interval of 558 meters from 362 meters @ 0.73 percent CuEq which remains open at depth.

Get access to more exclusive Copper Investing Stock profiles here