North Arrow Minerals Inc. (TSXV: NAR) (" North Arrow ") is pleased to report channel sample assay results from its 100% owned DeStaffany Lithium Property, Northwest Territories . Highlights include:

- Results have been received for 68 rock sawn channel samples collected from 20 channels testing four pegmatites.

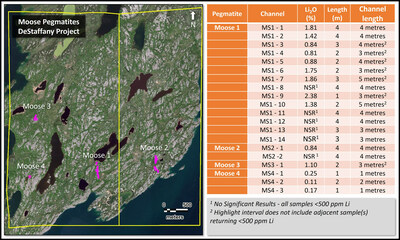

- Significant lithium mineralization has been returned from 9 of 14 channels (54 samples) testing a 260m strike extent of the Moose 1 pegmatite , including 1.81% Li 2 O over 4m and 1.42% Li 2 O over 4m from channels MS1-1 and MS1-2, respectively.

- 0.84% Li 2 O over 4m was returned from Channel MS2-1 in an area of the Moose 2 pegmatite previously mapped as lacking lithium (spodumene) mineralization.

- The Moose 3 pegmatite returned 1.10% Li 2 O over 2m , supporting observations of abundant spodumene mineralization at this newly discovered locality.

- Location and length of individual channels was restricted to available outcrop exposures and do not reflect the full width of each pegmatite. Moose 1 and Moose 2 range up to 11m and over 30m in width, respectively.

Ken Armstrong , President and CEO of North Arrow commented, "Ongoing evaluation work at the DeStaffany property continues to support the significant lithium potential of the Moose pegmatites. Systematic channel sampling of the Moose 1 pegmatite has confirmed extensive zones of spodumene mineralization. Zonation within Moose 1 is very similar in character to the Moose 2 pegmatite, where spodumene mineralization has also been extended southwards into an area that had been previously mapped as unmineralized. We now look forward to receiving results of mineral characterization samples from Moose 1 and Moose 2 that are currently being processed, and North Arrow is also making plans to move forward with a drilling program to test the depth extent and along strike continuity of spodumene mineralization in the Moose 1, 2 and 3 pegmatites."

A summary of compiled assays and pegmatite locations can be found in Figure 2 below. Satellite images showing the Moose pegmatites and the channel sample locations are available here .

The majority of channel samples were collected from the Moose 1 pegmatite, which had seen limited historical evaluation. Moose 1 has been mapped in outcrop over a north-south strike length of approximately 350m . Fourteen channels (54 samples), ranging from 3m to 5m in length, were cut over an approximate 260m strike extent of the pegmatite. Assays confirm that spodumene mineralization is consistent over the southern two thirds of the pegmatite (channels MS1-1 through MS1-10), commonly occurring as abundant, large crystals (megacrysts) tens of centimetres in size.

Two new channel samples were collected from the southern extent of the Moose 2 pegmatite, including channel MS2-1 which returned 0.84% Li 2 O over 4m , in an area where spodumene mineralization had not been previously noted. Spodumene mineralization has now been traced at surface over a 275m strike extent of the Moose 2 pegmatite, which is located approximately 1.2 km to the east of Moose 1.

Sampling of the new Moose 3 and Moose 4 pegmatites (please see North Arrow news release dated July 11, 2023 ) was limited by available bedrock exposures, however collected samples have returned elevated lithium values, particularly at Moose 3 where spodumene crystals in excess of 30 centimetres were noted during mapping and a single channel has returned 1.10% Li 2 O over 2m . The size and orientation of Moose 3 and Moose 4 remain uncertain, but pegmatite exposures have been traced over 75m and 30m , respectively. Three small ( 1m to 2m ) channels from Moose 4 returned anomalous values up to 0.25% Li 2 O and from 176 to 562 ppm Ta 2 O 5

Sample Collection, Laboratory Procedures and QA/QC

Samples were collected from 20 cut channels testing the Moose 1, 2, 3, and 4 pegmatites. Channel lengths were determined by available, relatively flat, exposed outcrop, rather than pegmatite/country rock contacts, and range from 1m to 5m in length. Where possible, channels were oriented perpendicular to locally mapped or inferred contacts. Channels were cut using a portable rock saw, with sampled material chipped from between parallel incisions cut nominally 3-4 cm apart and 3-4 cm deep. Individual samples were collected at 1m intervals into plastic polymer bags, with regular insertion of blanks, duplicates and certified reference materials. Samples were transported from the field to ALS Global, where sample preparation and analytical work was conducted. Samples were prepared using ALS method CRU-31 (crushing to 70% passing through a 2mm screen), SPL-21 (split sample - riffle split), and PUL-31 (pulverize up to 250g to 85% passing through a 75-micron screen). A 0.2g subsample of the pulverized material was analyzed for 52 elements using a sodium peroxide fusion by ICP-MS (ALS method ME-MS89L). Samples returning >500ppm Li were also assayed using a 0.2g subsample dissolved in a sodium peroxide solution and analyzed for lithium according to ALS method Li-ICP81. Lithium results are reported by the lab as % Li and have been multiplied by 2.153 to convert to % Li 2 O. Results passed QA/QC screening at ALS and North Arrow's inserted standards and blanks returned results within acceptable limits.

North Arrow's exploration programs are conducted under the direction of Kenneth Armstrong , P.Geo., President and CEO of North Arrow and a Qualified Person under NI 43-101. Mr. Armstrong has reviewed and approved the technical contents of this press release.

About the DeStaffany Lithium Project

The DeStaffany Lithium Project is located on the shore of Great Slave Lake, approximately 115 km east of Yellowknife , NWT. The property hosts four lithium-tantalum-niobium pegmatites, which form part of the Yellowknife Pegmatite Province. The Moose 2 pegmatite was briefly mined in the 1940's for tantalum and niobium. Despite the exposure of very large spodumene crystals up to one metre in length within historic mine workings, the Moose pegmatites have never been subject to a focused evaluation of their lithium potential. Spodumene is the primary lithium-bearing mineral of interest in these deposits, and sampling of exposed mineralization has allowed for spodumene recovery and characterization samples to be collected and processed in 2023. The property's location on Great Slave Lake allows for barge access from Yellowknife and railhead at Hay River . Planning is in progress to conduct initial delineation drilling in 2024.

About North Arrow Minerals

North Arrow is a Canadian based exploration company focused on the identification and evaluation of lithium and other exploration opportunities in Canada . North Arrow's management, board of directors and advisors have significant successful experience in the global exploration and mining industry. North Arrow is evaluating three, 100% owned spodumene pegmatite projects in the NWT (the DeStaffany, LDG and MacKay Lithium Projects) , is also exploring for lithium in Nunavut at the Bathurst Inlet pegmatite field and continues work to identify additional lithium exploration opportunities in northern Canada . North Arrow also owns interests in the Naujaat (NU), Pikoo (SK), and Loki (NWT) Diamond Projects and maintains a 100% interest in the Hope Bay Oro Gold Project, located approximately 3 km north of Agnico Eagle's Doris Gold Mine , Nunavut .

/s/ "Kenneth A. Armstrong"

Kenneth Armstrong

President and CEO

Neither the TSX Venture Exchange nor its Regulation Services Provider accepts responsibility for the adequacy or accuracy of this release.

This news release contains "forward-looking statements" including but not limited to statements with respect to North Arrow's plans, the estimation of a mineral resource and the success of exploration activities. Forward-looking statements, while based on management's best estimates and assumptions, are subject to risks and uncertainties that may cause actual results to be materially different from those expressed or implied by such forward-looking statements, including but not limited to: risks related to the successful integration of acquisitions; risks related to general economic and market conditions; closing of financing; the timing and content of upcoming work programs; actual results of proposed exploration activities; possible variations in mineral resources or grade; failure of plant, equipment or processes to operate as anticipated; accidents, labour disputes, title disputes, claims and limitations on insurance coverage and other risks of the mining industry; changes in national and local government regulation of mining operations, tax rules and regulations. Although North Arrow has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. North Arrow undertakes no obligation or responsibility to update forward-looking statements, except as required by law.

SOURCE North Arrow Minerals Inc.

![]() View original content to download multimedia: https://www.newswire.ca/en/releases/archive/August2023/28/c9489.html

View original content to download multimedia: https://www.newswire.ca/en/releases/archive/August2023/28/c9489.html