March 18, 2025

Follow-up drilling aimed at establishing a maiden resource, enabling Nimy to capitalise on western demand for this critical metal, which is now subject to Chinese export controls

Nimy Resources (ASX: NIM) is pleased to announce that it is preparing to start the Phase 2 drilling program at its Block 3 gallium discovery in WA after securing Raglan Drilling to conduct the program.

The drilling is aimed at growing the extent of the known mineralisation over a further 400m strike length while also infilling the established mineralised area.

Nimy aims to complete a maiden JORC resource on Block 3 as soon as possible following completion of this program.

The resource will in turn assist the Company with its strategy to advance its collaboration agreement with US minerals specialist M2i Global.

The drilling will be funded by the proceeds of Nimy’s recently-completed share placement (see ASX release dated February 26, 2025).

M2i specialises in the development and execution of a complete global value supply chain for critical minerals for the US Government and US free trade partners.

Samples from the upcoming drilling will be used for metallurgical test work, including technical studies to test gallium extraction methods.

Nimy Managing Director Luke Hampson said:

"Block 3 is clearly a significant high-grade discovery with mineralisation already outlined over a substantial area.

“We have tested only a small portion of the highly prospective strike length, which gives us every reason to believe we stand to grow the size of the discovery.

“Gallium is a critical metal used in many cutting-edge technologies, including top- level military applications.

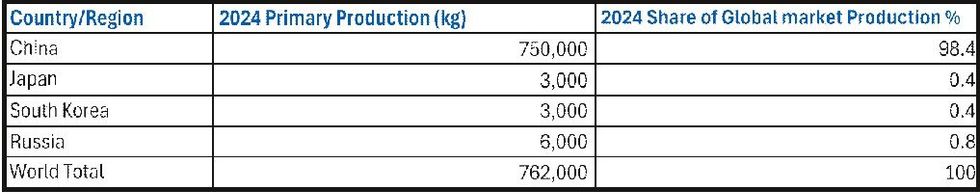

“Given that China supplies virtually all the world’s gallium and recently imposed restrictions on it, there is a huge opportunity for Nimy to play a role as a provider to the western world”.

Why the focus on Gallium?:

- Nimy Resources has, to our knowledge the highest grade non-aligned gallium project in the Western World;

- China has for the foreseeable future stopped the export of gallium to the US;

- Nimy is working with US minerals specialist M2i Global with the objective of providing a sustainable supply of gallium to the US government and Defense Industrial Base in support of the Department of Defense;

- Gallium has a rapidly evolving focus on the world stage, with exponential growth in the usage of: Semiconductors; 5G Technology; Power Charging; Green Technologies; Telecommunications; Medical Uses; Radar and Military Applications

- US and European Defence company stock prices have risen sharply amid growing calls for Europe to re-build its military capability;

- The US governments strategy to slash spending on Ukraine's defence has led European Governments to prepare for big increases in military spending;

- Estimates of the coming military spending boom extend into hundreds of billions of dollars;

- Europe will need to secure substantial supplies of critical metals in markets currently controlled by China;

- Australian gallium could be expected to be in strong demand as European military expenditure grows;

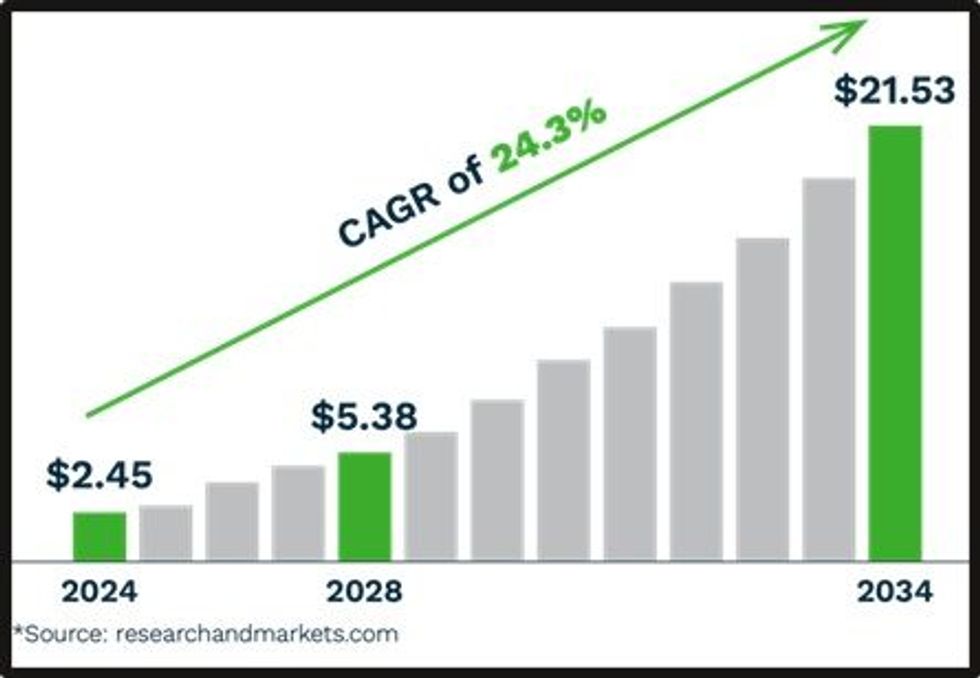

- Gallium prices are expected to follow demand with some projections for compound annual growth rate (CAGR) of 24.3% (*Source: researchandmarkets.com - Gallium Global Market Report 2024 – January 2024).

Click here for the full ASX Release

This article includes content from Nimy Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

NIM:AU

The Conversation (0)

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00