(TheNewswire)

Vancouver, B.C. TheNewswire - July 7, 2021 CMC Metals Ltd. (TSXV:CMB) (OTC :CMCXF ) ("CMC") is pleased to announce that drilling has commenced at its flagship Silver Hart Property, Yukon.

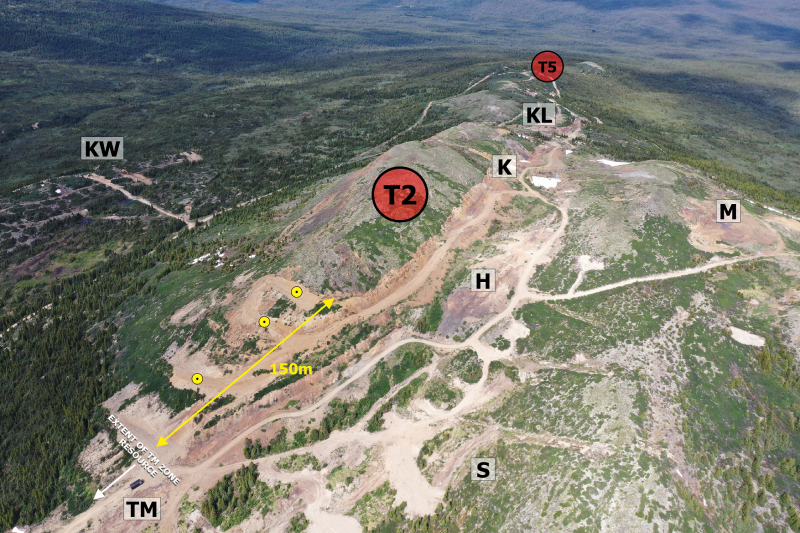

The first 3 holes of the 2021 drill campaign have been planned to target a 150-meter extension of the TM area within the Main Zone which has currently been defined along a 250-meter strike length. This area was previously drilled by Silver Hart Mines Ltd. in the mid 1980's but due to lack of records and certified assays, this part of the zone could not be included in the recent resource estimation.

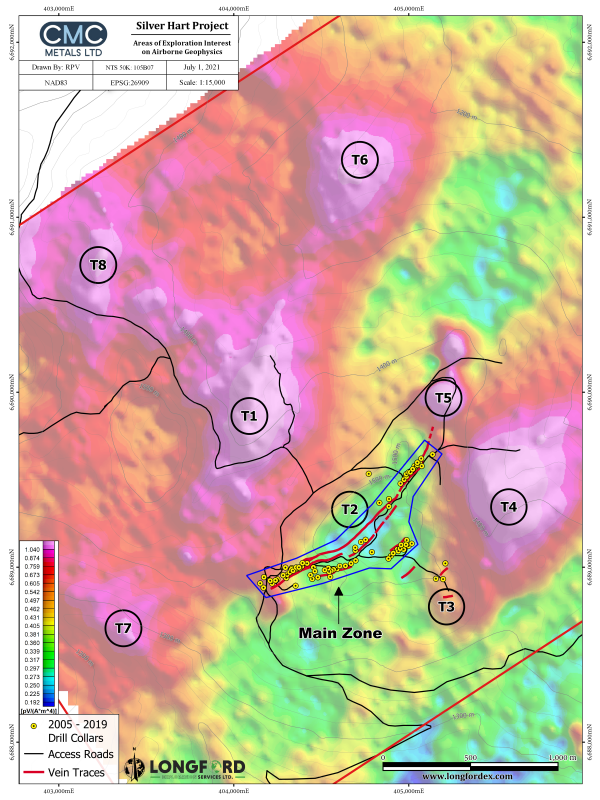

Drilling will then target an extension of the Main Zone to the northwest currently referred to as "T5". This significant possible extension of the Main Zone is associated with a geophysical anomaly in excess of 600 meters in strike length. The dominant mineralizing structure through the Main Zone trends directly towards T5. In addition, recent prospecting and trenching in the T5 area has also identified mineralization at surface in this area. This possible extension could add up to an additional 50% of strike length to the known mineralized Main Zone.

A total of 8 areas of exploration interest have been identified on the property by means of the 2020 IP survey and the 2021 SkyTEM survey. Targets T2 and T3 were generated from the IP survey and correspond to zones of relatively low resistivity and high chargeability. T5 occurs at the boundary of the IP survey and demonstrates very low resistivity and very high chargeability and is by far the strongest conductor on the property as revealed by the SkyTEM survey.

The remainder of the targets identified by the SkyTEM survey correspond to known, or presumed, sedimentary units which are in close proximity to the intrusive heat source. Also encouraging is the fact that these anomalies trend northeast which is the dominant mineralizing structure of the Rancheria Silver District and suggests that feeder structures into the schists and limestones may be present. All targets will be mapped and prospected during the 2021 season, some will be evaluated by means of soil geochemical survey, and time and financing permitting, it is the hope of the Company to complete preliminary drill testing of most of these targets.

John Bossio, Chairman noted, "This is the most significant exploration program ever completed by CMC at Silver Hart to date. We are excited about the potential to increase known resources in the Main Zone along strike and at depth and test most of these new targets. We are optimistic this will add resources at Silver Hart."

Kevin Brewer, President and CEO noted, "Our airborne geophysics program was very successful in identifying targets in our known mineralized areas, confirming targets in new areas that we had delineated in our 2020 exploration efforts, and to provide us with new targets where no previous work has been conducted. Phase 1 of our drill program will provide us with considerable insight into the overall potential to expand resources at Silver Hart. An examination of past assays has also identified the potential for copper and gold to be included as elements within future resource estimates although this requires additional study. Our assaying this year will be documenting the content of these elements to see if they can positively contribute to the project."

Qualified Person

Kevin Brewer, a registered professional geoscientist in BC and Yukon, is the Company's President and CEO, and Qualified Person (as defined by National Instrument 43-101). He has approved the technical information reported herein. The Company is committed to meeting the highest standards of integrity, transparency and consistency in reporting technical content, including geological reporting, geophysical investigations, environmental and baseline studies, engineering studies, metallurgical testing, assaying and all other technical data.

ON BEHALF OF THE BOARD

"John Bossio"

Chairman

For further information concerning CMC or its various exploration projects please visit our website at www.cmcmetals.ca or contact:

| Corporate and Investor Inquiries |

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

"This news release may contain certain statements that constitute "forward-looking information" within the meaning of applicable securities law, including without limitation, statements that address the timing and content of upcoming work programs, geological interpretations, receipt of property titles and exploitation activities and developments. In this release disclosure regarding the potential to undertake future exploration work comprise forward looking statements. Forward-looking statements address future events and conditions and are necessarily based upon a number of estimates and assumptions. While such estimates and assumptions are considered reasonable by the management of the Company, they are inherently subject to significant business, economic, competitive and regulatory uncertainties and risks, including the ability of the Company to raise the funds necessary to fund its projects, to carry out the work and, accordingly, may not occur as described herein or at all. Actual results may differ materially from those currently anticipated in such statements. Factors that could cause actual results to differ materially from those in forward looking statements include market prices, exploitation and exploration successes, the timing and receipt of government and regulatory approvals, the impact of the constantly evolving COVID-19 pandemic crisis and continued availability of capital and financing and general economic, market or business conditions. Readers are referred to the Company's filings with the Canadian securities regulators for information on these and other risk factors, available at www.sedar.com . Investors are cautioned that forward-looking statements are not guarantees of future performance or events and, accordingly are cautioned not to put undue reliance on forward-looking statements due to the inherent uncertainty of such statements. The forward-looking statements included in this news release are made as of the date hereof and the Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as expressly required by applicable securities legislation."

NOT FOR DISSEMINATION OR DISTRIBUTION INTO THE UNITED STATES OR THROUGH UNITED STATES NEWSWIRE SERVICES

Copyright (c) 2021 TheNewswire - All rights reserved.