Ready Set Gold Corp. (CSE: RDY) (FSE: 0MZ) (OTC Pink: RDYFF) ("Ready Set Gold" or the "Company") is pleased to announce the results of the first six drill holes from its recently completed 13-hole, 2,900 metre, Phase 1 diamond drilling program at its 100%-owned flagship Northshore Gold project, located in the Schreiber-Hemlo greenstone belt in Ontario.

Highlights:

- Hole RSG-21-059, drilled in the B Zone Structure, intersected gold mineralization in three separate zones: 94.25m @ 1.00 g/t, 20.45m @ 1.26 g/t and 20.00m @ 0.99 g/t. Within these intercepts were high-grade gold zones including: 2.90m @ 8.36 g/t and 1.65m @ 9.17 g/t.

- The drill program was designed to test areas which had limited or no historical drilling with all holes intersecting significant gold mineralization.

- Ready Set Gold has developed a new geological model for the Northshore project which has re-defined the structure and orientation of the gold zones and increased the exploration potential along strike and to depth. The Phase 1 program results to date have confirmed this new interpretation.

- Results from the remaining 7 holes will be released when assays are available. The company expects this will be within the next 3 to 4 weeks.

- The Northshore project remains underexplored with approximately only 5% of the area systematically evaluated. Additionally, the depth potential of the gold mineralized zones remains untested with the deepest drill intercepts at 250m. The company believes that the Northshore property shows excellent potential to depth including potential high-grade gold zones.

"The first 6 holes of our Maiden drill program at Northshore have all intersected robust gold mineralization over significant widths. The broad nature of these zones along with the evidence of higher-grade lenses are a very encouraging sign for a large gold system. These initial results not only confirm historical exploration, but they also identify new areas of high-grade mineralization and confirm our new geological model, which opens up the discovery and growth potential at Northshore," states Brad Lazich, VP Exploration.

Intersection Highlights Table:

| Hole ID | From | To | Length (m) | Au (g/t) | Zone |

| RSG-21-059 | 26.4 | 46.85 | 20.45 | 1.26 | B |

| including | 42.75 | 46.85 | 4.10 | 4.51 | |

| including | 42.75 | 44.4 | 1.65 | 9.17 | |

| | |||||

| and | 153.25 | 173.25 | 20.00 | 0.99 | B |

| including | 153.25 | 159.85 | 6.60 | 1.35 | |

| | |||||

| and | 189.65 | 283.9 | 94.25 | 1.00 | B |

| including | 228.75 | 283.9 | 55.15 | 1.30 | |

| including | 232.3 | 254 | 21.70 | 1.88 | |

| including | 228.75 | 233.6 | 4.85 | 4.90 | |

| including | 250 | 255.65 | 5.65 | 3.01 | |

| including | 281 | 283.9 | 2.90 | 8.36 | |

| including | 281 | 281.4 | 0.40 | 55.17 | |

| | |||||

| RSG-21-060 | 144 | 148.4 | 4.40 | 1.54 | |

| | |||||

| and | 161.65 | 174.3 | 12.65 | 0.73 | |

| | |||||

| RSG-21-062 | 147.7 | 149.2 | 1.50 | 1.23 | A |

| | |||||

| RSG-21-063 | 95.5 | 112.3 | 16.80 | 1.30 | B |

| including | 95.5 | 103 | 7.50 | 2.08 | |

| | |||||

| and | 172.5 | 179.95 | 7.45 | 1.60 | B |

| | |||||

| RSG-21-064 | 48.45 | 53.4 | 4.95 | 1.71 | B |

| | |||||

| and | 97.95 | 112.25 | 14.30 | 1.62 | B |

| including | 97.95 | 102.25 | 4.30 | 2.45 | |

| | |||||

| RSG-21-067 | 65.2 | 144.95 | 79.75 | 0.92 | A |

| including | 65.2 | 112 | 46.80 | 1.19 | |

| including | 65.2 | 94.55 | 29.35 | 1.54 | |

| including | 65.2 | 76.5 | 11.30 | 1.99 | |

| including | 65.2 | 68 | 2.80 | 4.88 | |

| including | 92 | 94.55 | 2.55 | 4.10 |

*Lengths reported are drill-core lengths, as insufficient drilling has been completed to determine true-widths at this time. All grades are calculated with un-capped gold assays, as insufficient drilling has been completed to determine cap levels for higher-grade intersects.

| Hole ID | Easting | Northing | Elevation | Azimuth | Dip |

| RSG-21-059 | 480077 | 5401323 | 275 | 310 | -60 |

| RSG-21-060 | 480054 | 5401292 | 263 | 310 | -45 |

| RSG-21-062 | 479762 | 5401335 | 258 | 355 | -45 |

| RSG-21-063 | 479887 | 5401403 | 270 | 5 | -55 |

| RSG-21-064 | 480056 | 5401313 | 269 | 350 | -45 |

| RSG-21-067 | 479876 | 5401294 | 259 | 345 | -50 |

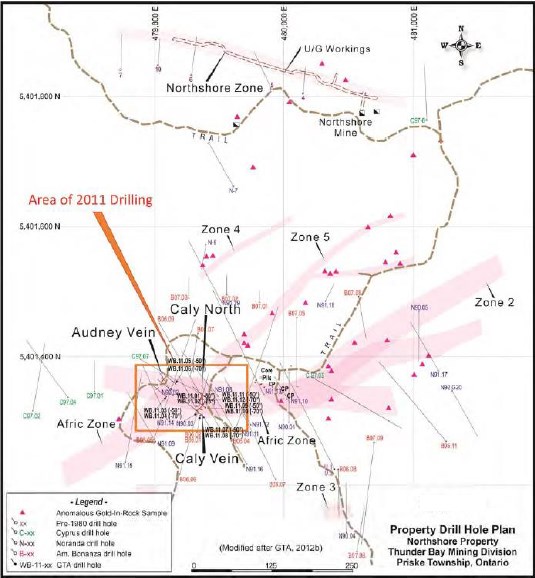

As previous reported by Ready Set Gold, historical holes at Northshore were mainly drilled in a northwest-southeast direction based on a geological model used by previous operators of the project. Ready Set Gold's exploration team has drilled most holes in a near south to north direction to test the new interpretation of the gold zones generally east-west strike direction. The drilling was focused on key areas with low, or no, historic drilling, with the aim of defining higher-grade gold mineralization and validating our model.

"We are very pleased with the initial results of the Phase 1 drill program. Most importantly, the development of a new geological model for Northshore and the successful testing of the model with this program opens the mineralized zones in many directions, which we believe opens the potential for increasing the size of the zones along strike and at depth," said Christian Scovenna, CEO & Director.

Figure 1 - Overview of Northshore geological model showing sub-parallel east-west gold structures with supporting magnetics

To view an enhanced version of Figure 1, please visit:

https://orders.newsfilecorp.com/files/7393/79500_edf1ecb38490a832_002full.jpg

Figure 2 - Exploration plan map showing new orientation of mineralized zones at Northshore with reported results

To view an enhanced version of Figure 2, please visit:

https://orders.newsfilecorp.com/files/7393/79500_edf1ecb38490a832_003full.jpg

Figure 3 - Cross-section A-B showing vertical sub-parallel zones with known mineralization and reported results

To view an enhanced version of Figure 3, please visit:

https://orders.newsfilecorp.com/files/7393/79500_edf1ecb38490a832_004full.jpg

Figure 4 - Cross-section C-D showing vertical sub-parallel zones with known mineralization and reported results

To view an enhanced version of Figure 4, please visit:

https://orders.newsfilecorp.com/files/7393/79500_edf1ecb38490a832_005full.jpg

Figure 5 - Previous (historical) interpretation of Gold zones at Northshore

To view an enhanced version of Figure 5, please visit:

https://orders.newsfilecorp.com/files/7393/79500_edf1ecb38490a832_006full.jpg

"A" Zone - hosts the Afric and is a wide, potentially open pit target, with pervasive gold mineralization over significant widths with multiple higher grade-lenses. The zone is characterized by brittle-ductile shearing hosting pervasive quartz-carbonate veining with sulphide mineralization in stock-work veins, disseminated in host lithologies, and in shear-extensional and extensional quartz veins. The A zone has only been explored within the Afric (tested to approximately 200-250m depth) and is believed to be open along strike for more than 1km.

"B" Zone - a newly modelled zone that hosts similar widths and grades to Zone A with potential for high-grade lenses. It is 150m north of the A Zone and is interpreted as a parallel structure with a generally east-west strike. The zone is characterized by areas of intense alteration and brittle-ductile shearing defined by pervasive quartz-carbonate veining which hosts sulphide mineralization disseminated in host lithologies and in shear-extensional and extensional quartz veins. The zone remains underexplored and is believed to remain open along strike for more than 1km.

Zones to be Explored: At least three zones to the north of the A and B zones remain underexplored. The C, Gino and Main zones are modelled to be sub-parallel to the A and B zones and have the potential to increase the scope of the Northshore project.

Ready Set Gold's - Special Investor Presentation

"Today, we released our first batch of drill results from our maiden drill program at the Northshore Project. We welcome you to join us later today for a live presentation about the Northshore Project and a discussion about today's drill results, what they mean for the Company's new interpretation of the project, what's the difference between the previous interpretation and ours, and where we see our near-term upside catalysts."

Tuesday, April 6th, 2021 at 1:00pm Eastern Standard Time (10:00am PST)

Any questions may be emailed to our investor email address outlined below prior to the presentation. You may also submit questions during the investor webinar. For all other inquiries regarding Ready Set Gold please call our CEO Christian Scovenna at 416-453-4708 or Investor Relations at 236-513-GOLD (4653) or email info@readysetgoldcorp.com

Meeting Information:

Hi there, you are invited to a Zoom webinar.

When: Apr 6, 2021 01:00 PM Eastern Time (US and Canada)

Topic: Ready Set Gold - Investor Presentation Webinar

Register in advance for this webinar:

https://zoom.us/webinar/register/WN_EwOoztbDQGGEIJ3vi63E0Q

After registering, you will receive a confirmation email containing information about joining the webinar.

Webinar Speakers

Christian Scovenna (CEO & Director @Ready Set Gold Corp.)

Brad Lazich (VP of Exploration, Qualified Person @Ready Set Gold Corp.)

----------

QA/QC and Core Sampling Protocols

Drill core is logged and sampled in a secure core storage facility in Schreiber, Ontario. All samples are cut in half using a diamond saw and shipped to SGS in Sudbury, Ontario for sample preparation. All samples are analysed for gold by SGS using standard Fire-Assay AA techniques. Samples identified with visible gold are also analyzed with up to 1kg metallic screen fire assay. Certified standards and blanks are inserted routinely as part of Ready Set Gold's quality assurance/quality control (QA/QC) program. No QA/QC issues were noted in the results referenced in this release.

Qualified Person and NI-43-101 Disclosure

Brad Lazich, P.Geo. (ON), VP Exploration of Ready Set Gold Corp, and a Qualified Person as defined by National Instrument 43-101, Standards of Disclosure for Mineral Projects, has verified the disclosed data and has approved the scientific and technical disclosure in this news release.

About Ready Set Gold Corporation

Ready Set Gold Corp. is a precious metals exploration company listed on the Canadian Securities Exchange under symbol RDY and the Bourse Frankfurt Exchange as 0MZ. The Company has consolidated and now owns a 100% interest in the Northshore Gold Property, located in the Schreiber-Hemlo Greenstone Belt near Thunder Bay, Ontario which is prospective for gold and silver mineralization. The Company also owns a 100% interest in two separate claim blocks totaling 4,453 hectares known as the Hemlo Eastern Flanks Project. The Company also holds an option to acquire a 100% undivided interest in a continuous claim block totaling 1,634 hectares comprising the Emmons Peak Project located 50 km south of Dryden, Ontario that is near the Treasury Metals Goliath and Goldlund advanced gold development projects.

On Behalf of the Board of Directors,

Ready Set Gold Corporation

"Christian Scovenna"

Chief Executive Officer & Director

Email: info@readysetgoldcorp.com

CEO Direct Line: +1 (416) 453-4708

For further information please contact:

Investor Relations

Sean Kingsley - Vice President, Corporate Communications Tel: +1 (604) 440-8474

Email: skingsley@readysetgoldcorp.com

www.readysetgoldcorp.com

Neither the Canadian Securities Exchange nor its Regulation Services Provider (as that term is defined in the policies of the CSE) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

This news release contains statements that constitute "forward-looking statements" within the meaning of Canadian Securities laws, including that statements related to exploration potential and timing for the remaining assay results. Such forward looking statements involve known and unknown risks, uncertainties and other factors that may cause Ready Set Gold's actual results, performance or achievements, or developments in the industry to differ materially from the anticipated results, performance or achievements expressed or implied by such forward-looking statements. Forward looking statements are statements that are not historical facts and are generally, but not always, identified by the words "expects," "plans," "anticipates," "believes," "intends," "estimates," "projects," "potential" and similar expressions, or that events or conditions "will," "would," "may," "could" or "should" occur.

Forward-looking statements are based on certain material assumptions and analyses made by the Company and the opinions and estimates of management as of the date of this press release including that the Company will complete the drilling program and on the timeline as anticipated by management and that information will allow Ready Set Gold to gain more confidence in its geological model and to design additional drill programs. Although Ready Set Gold believes the forward-looking information contained in this news release is reasonable based on information available on the date hereof, by their nature forward-looking statements involve assumptions, known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements.

Examples of such assumptions, risks and uncertainties include, without limitation, assumptions, risks and uncertainties associated with general economic conditions; the Covid-19 pandemic; adverse industry events; future legislative and regulatory developments in the mining sector; the Company's ability to access sufficient capital from internal and external sources, and/or inability to access sufficient capital on favorable terms; mining industry and markets in Canada and generally; the ability of Ready Set Gold to implement its business strategies; competition; the Company will not complete the remainder of the Phase 1 drilling program on the timeline as anticipated by management or at all and other assumptions, risks and uncertainties.

Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements and forward-looking information. Readers are cautioned that reliance on such information may not be appropriate for other purposes. The Company does not undertake to update any forward-looking statement, forward-looking information or financial outlook that is incorporated by reference herein, except in accordance with applicable securities laws. We seek safe harbor.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/79500