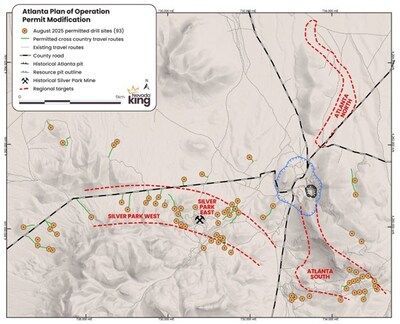

Nevada King Gold Corp. (TSXV: NKG) (OTCQB: NKGFF ) (" Nevada King " or the " Company ") is pleased to announce that it has received approval from the Bureau of Land Management (" BLM ") and the State of Nevada for a minor modification to its 45km 2 Plan of Operations at its 13,000 hectare (130km 2 ), 100% owned Atlanta Gold Mine Project, located in the prolific Battle Mountain Trend 264km northeast of Las Vegas, Nevada . This is the third modification that the Company has successfully permitted which will allow drilling at an additional 93 sites on the property. Approvals of the first plan modification and second plan modification were received in October 2024 and February 2025 respectively.

"The receipt of this permit is another important milestone for Nevada King as we continue our Phase III regional exploration program. We can now begin drilling on highly prospective new targets across the property which have been generated through our recent exploration work, as well as through other tools such as geophysics, rock chip sampling, and a significantly improved understanding of the structural geology of the property. The new drill sites are focused on our most advanced target areas of Silver Park and Atlanta South, while we also have additional permitted drill sites at Atlanta North. We appreciate the ongoing support from the BLM and State of Nevada ," stated John Sclodnick , Chief Executive Officer of Nevada King .

To date the Company has completed 99 drill holes covering 23,000 meters of its planned 30,000 meter Phase III drill program with drilling ongoing at site. Assay results are expected to be released shortly.

Qualified Person

The scientific and technical information in this news release has been reviewed and approved by Calvin R. Herron , P.Geo., who is a Qualified Person as defined in National Instrument 43-101 (" NI 43-101 ").

About Nevada King Gold Corp.

Nevada King is focused on advancing and growing its 100% owned, past producing, 130km 2 Atlanta Gold Mine project located along the Battle Mountain trend in southeast Nevada. The project hosts an NI 43-101 compliant pit-constrained oxide resource of 1,020koz Au in the measured and indicated category ( 27.7M tonnes at 1.14 g/t) plus an inferred resource of 99koz Au ( 3.6M tonnes at 0.84 g/t). See the NI 43-101 Technical Report titled "Technical Report and Estimate of Gold and Silver Mineral Resources for the Atlanta Project, Lincoln County, Nevada , USA" with an effective date of September 6, 2024 , and a report date of July 18, 2025 , as prepared by RESPEC (formerly Mine Development Associates) and filed under the Company's profile on SEDAR+ www.sedarplus.ca .

NI 43-101 Mineral Resources at the Atlanta Mine by RESPEC 2025

| | Tonnes | Au g/t | Au oz | Ag g/t | Ag oz | AuEq g/t | AuEq oz |

| Measured | 3,430,100 | 1.55 | 170,800 | 16.96 | 1,870,200 | 1.65 | 182,000 |

| Indicated | 24,280,200 | 1.09 | 848,800 | 8.73 | 6,817,200 | 1.14 | 887,700 |

| M&I | 27,710,300 | 1.14 | 1,019,600 | 9.75 | 8,687,400 | 1.20 | 1,069,700 |

| Inferred | 3,638,400 | 0.84 | 98,500 | 2.56 | 299,500 | 0.85 | 99,800 |

Please see the Company's website at www.nevadaking.ca .

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statements Regarding Forward Looking Information

This news release contains certain "forward-looking information" and "forward-looking statements" (collectively "forward-looking statements") within the meaning of applicable securities legislation. All statements, other than statements of historical fact, included herein, without limitation, statements relating to the future operations and activities of Nevada King , are forward-looking statements. Forward-looking statements are frequently, but not always, identified by words such as "expects", "anticipates", "believes", "intends", "estimates", "potential", "possible", and similar expressions, or statements that events, conditions, or results "will", "may", "could", or" should" occur or be achieved. There can be no assurance that such statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements. Forward-looking statements reflect the beliefs, opinions and projections on the date the statements are made and are based upon a number of assumptions and estimates that, while considered reasonable by Nevada King , are inherently subject to significant business, economic, technical, geologic, environmental, regulatory, competitive, political and social uncertainties and contingencies. Many factors, both known and unknown, could cause actual results, performance or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward-looking statements and the parties have made assumptions and estimates based on or related to many of these factors. Such factors include, without limitation, the ability to complete proposed exploration work, the results of exploration, continued availability of capital, and changes in general economic, market and business conditions. Readers should not place undue reliance on the forward-looking statements and information contained in this news release concerning these items. Nevada King does not assume any obligation to update forward-looking statements should beliefs, opinions, projections, or other factors, change, except as required by applicable securities laws.

![]() View original content to download multimedia: https://www.prnewswire.com/news-releases/nevada-king-receives-approval-for-93-additional-drill-sites-from-the-bureau-of-land-management-and-state-of-nevada-302531882.html

View original content to download multimedia: https://www.prnewswire.com/news-releases/nevada-king-receives-approval-for-93-additional-drill-sites-from-the-bureau-of-land-management-and-state-of-nevada-302531882.html

SOURCE Nevada King Gold Corp.