Natural Gas Prices Under Pressure, but Could Recover Later This Year

Earlier this month, natural gas prices dropped to their lowest level in 18 years, with spot Henry Hub prices hitting $1.57 per million Btu.

While a number of metals and energy commodities have seen a change in fortune in 2016, the same can’t be said for natural gas prices.

On March 1, natural gas prices dropped to their lowest level in 18 years, with spot Henry Hub prices hitting $1.57 per million Btu. According to the Financial Post, Canadian natural gas prices are at risk of dropping below $1 by the end of March.

“With too much gas in Western Canada, we believe prices will deteriorate further to under C$1.00 per mcf and could well persist near this level for a few months,” the news outlet quotes Martin King, analyst at FirstCapital Energy, as saying. “Such prices may also be required to force some wellhead shut-ins.”

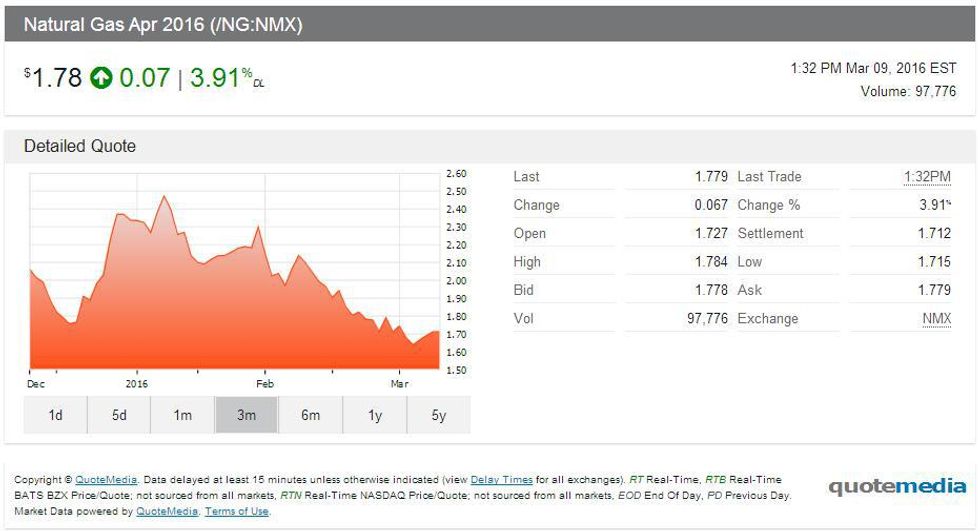

Prices have gained back some ground since King made that statement — as of March 9, natural gas prices were sitting at $1.77. However, they’re still down a fair bit since the start of this year, as the following price chart shows:

According to FocusEconomics, natural gas prices are trending downward due to strong reserves and forecasts for warmer-than-normal seasonal temperatures. Indeed, as of February, prices were down 27.9 percent relative to the same time in 2015.

“Blizzard conditions that kept many Americans homebound in January increased demand for the heating fuel, which caused prices to spike late in the month,” the firm explains in its February commodities consensus forecast. “However, overall demand for heating is still expected to be lower than normal this winter and inventories are currently 20% higher than they were this time last year.”

And natural gas stockpiles are only growing. The latest weekly natural gas storage report from the US Energy Information Administration states that as of February 26, natural gas stocks were sitting at 2,536 billion cubic feet (Bcf). That’s 794 Bcf higher than the same time in 2015, and 666 Bcf higher than the five-year average; it’s also above the five-year historical range for natural gas prices.

On a brighter note, as already mentioned, natural gas prices have gained back some ground recently, and FocusEconomics states that in a survey it completed for its report, many firms said they expect prices to recover as the market adjusts to oversupply.

Still, it’s worth noting that four of the analysts surveyed revised down their Q4 2016 projections, while 10 left their predictions unchanged. None increased their forecasts.

On average, the firms surveyed see natural gas prices at US$2.85 in the fourth quarter of this year. Societe Generale (EPA:GLE) gave the highest prediction, at US$3.45, while Economist Intelligence Unit gave the lowest prediction, at US$2.41. Overall, the firms see natural gas prices at US$2.60 for the full 2016 year.

“Fourth quarter forecasts, which coincide with winter months in the U.S., generally have a larger spread as heating needs tend to be more volatile,” FocusEconomics states. Certainly, natural gas investors will be keeping an eye on the weather over the coming months.

Securities Disclosure: I, Teresa Matich, hold no direct investment interest in any company mentioned in this article.