November 24, 2024

Discovery potential grows at Yundamindra, Laverton District, WA

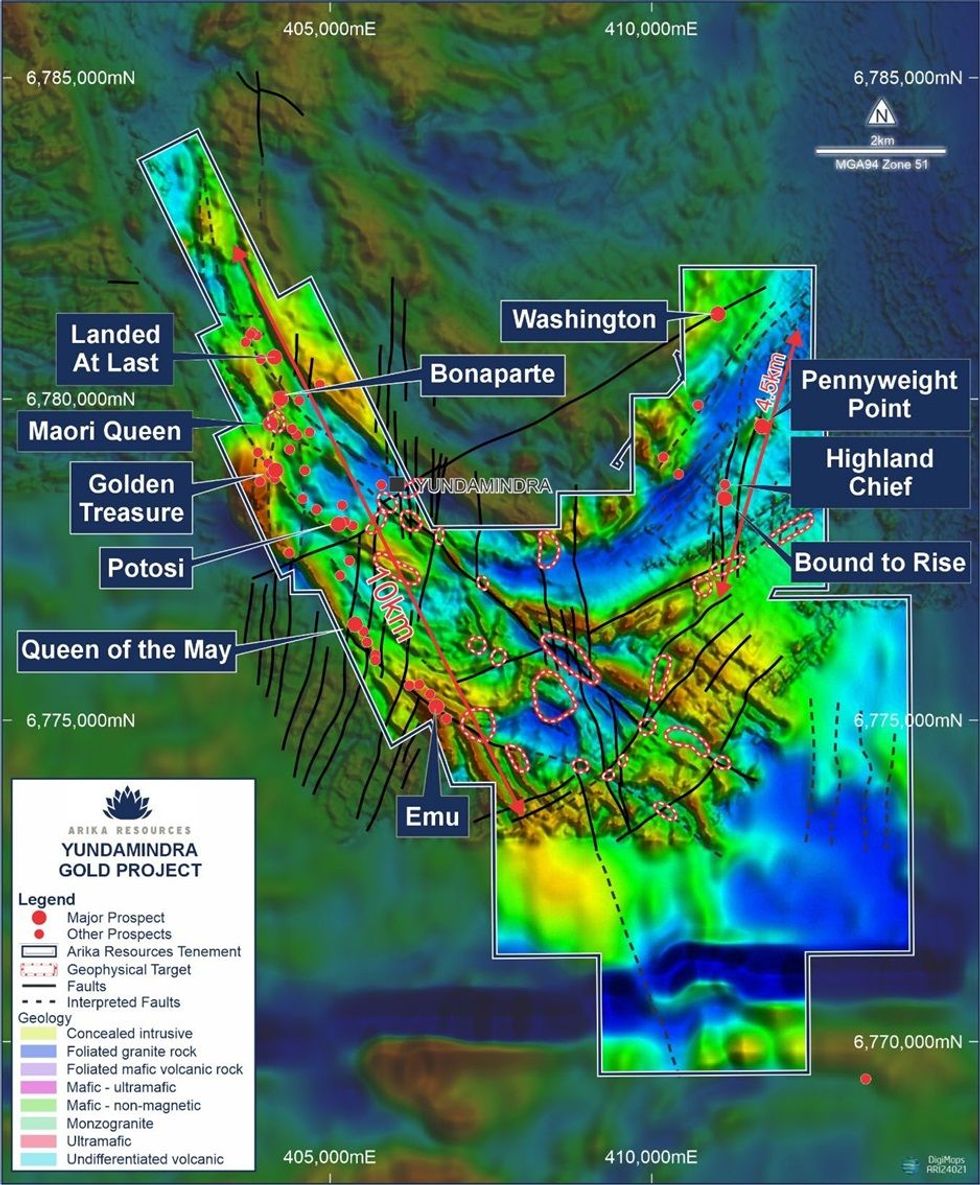

Arika Resources Limited (ASX: ARI) (“Arika” or “Company”) is pleased to announce that it has completed a synthesis of multiple regional and local scale geophysical datasets over its Yundamindra Gold Project (“Yundamindra”) situated 65km southwest of Laverton in the world class eastern goldfields mining district of Western Australia.

KEY HIGHLIGHTS

- Data filtering technology applied to multiple regional and local scale geophysical data sets has identified over 25+ new high priority targets at Arika’s Yundamindra Project beyond the areas where recent drilling has returned a series of spectacular results, including1:

- 14m @15.48 g/t Au from 46m (Hole YMRC077 Pennyweight Point)

- 30m @ 3.86 g/t Au from 64m (Hole YMRC06G Pennyweight Point)

- 14m @ 3.13 g/t Au from 28m (Hole YMRC003 Landed at Last)

- 12m @ 2.G3 g/t Au from 43m (Hole YMRC02G Landed at Last)

- The resulting interpretation shows the project area to be a structurally complex intrusive volcanic and granitic interaction with intense structural disruptions. Key elements which are consistently associated with many of the region’s most significant multi-million ounce gold deposits.

- The analysis has provided an improved understanding of the lithological and structural architecture at Yundamindra enabling a re-interpretation and refinement of the structural controls on the known mineralization at Landed at Last and Pennyweight Point and the identification of new high priority targets.

- Importantly, none of these new targets have been previously drill tested and the results materially expand the potential for new discoveries at Yundamindra.

- Mineralisation along the Western Corridor at Landed at Last is highly correlated with the location of two major NW-SE trending faults (C multiple second order linking structures which occur between them) which are identified in the geophysical data extending for over 10km’s along strike.

- Mineralisation along the Eastern Corridor is similarly associated with two major faults but trending NNE-SSW. Mineralisation at Pennyweight Point is now confirmed to sit on the easternmost of these faults, which extend for at least 4.5km’s along strike.

- A confluence of structures is located in the south-central zone where recent field mapping has identified several large outcropping E-W trending quartz veins central to an extensive area of previously unrecorded, historical alluvial gold workings.

- Phase 2 drilling, designed to test extensions at Pennyweight Point along strike and at depth from the recent drill results is scheduled to commence next week with an initial 3,000m (of a wider 6,000m program) to be drilled prior to the end of year break.

The initial phase of work has been very successful in developing an improved understanding of Yundamindra’s place in the regional framework and of refining the lithological and structural architecture at the local scale (Figure 1). Understanding these key elements is critical in guiding effective ongoing exploration at the project.

Note the strong correlation of historical workings and ARI’s recent drilling successes with major faults.

Landed at Last is located at the northern end of the ‘Western Corridor’ and sits on a major fault package that extends for ~10km’s.

Pennyweight Point is located within the ‘Eastern Corridor’ and sits on a well-defined structure visible in geophysical imagery extending over a strike length of at least ~4.5km’s. Refer to Figure 3 INSET for more detail.

Significant historical workings at Highland Chief C Bound to Rise, along with the remains of a multi-head stamp battery/processing facility, occur within the Pennyweight Point mineralised corridor ~2km’s SW of Arikapotos’s recent drilling at Pennyweight Point. These clearly demonstrate the strongly mineralised nature of the host structures and the potential for significant mineralisation to extend well beyond the areas tested to date.

Commenting on the recent analysis, Arika’s Managing Director Justin Barton said:

“We continue to take a methodical and systematic approach to our exploration effort at Yundamindra. We’re off to a great start with the outstanding results recently reported from our first drilling campaigns at Pennyweight Point and Landed at Last, but the work completed by our geophysics consultants in collaboration with our technical team clearly demonstrates the scale of the opportunity across the entire project area. The structures hosting these two deposits continue for kilometres along strike, and host a multitude of other historical alluvial workings, pits, shafts and open stopes which have never been drilled.

In the South-Central Zone, at the confluence of the western and eastern corridors, recent field mapping of several high priority targets has identified multiple large E-W trending quartz veins surrounded by extensive, previously unrecorded alluvial workings. This is another very exciting discovery in a structurally attractive area that has seen little to no exploration and adds to the pipeline of targets lining up for drill testing.

All of this is increasing our belief that Yundamindra has the makings of a very large mineralised system in an area surrounded by significant word-class mines. This work is driving a transformational step change in the project and Company.

Our exploration team is continuing to gather, analyse and interpret as much information as possible as we build a better understanding of the area, as the Company embarks on an extensional drilling program, starting at Pennyweight Point, anticipated to commence next week.”

Click here for the full ASX Release

This article includes content from Arika Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

27 February

Lahontan Gold Eyes Resource Update as Production Nears

Lahontan Gold (TSXV: LG,OTCQB:LGCXF) is drawing investor attention as it advances toward renewed production at its historic Santa Fe Mine in Nevada. A revised mineral resource estimate is expected soon, offering a potential catalyst, according to a recent report by News Financial.... Keep Reading...

27 February

Peruvian Metals Invites Shareholders and Investment Community to Visit Them at Booth 2624B at PDAC 2026 in Toronto, March 3-4

Peruvian Metals Corp (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals" or the "Company") is pleased to invite investors and shareholders to Booth #2624B at the Prospectors & Developers Association of Canada's (PDAC) Convention at the Metro Toronto Convention Centre (MTCC) from Tuesday,... Keep Reading...

27 February

OTC Markets Group Welcomes RUA GOLD INC. to OTCQX

OTC Markets Group Inc. (OTCQX: OTCM), operator of regulated markets for trading 12,000 U.S. and international securities, today announced Rua Gold INC. (TSX: RUA,OTC:NZAUF; OTCQX: NZAUF), an exploration company, has qualified to trade on the OTCQX® Best Market. Rua Gold INC. upgraded to OTCQX... Keep Reading...

27 February

RUA GOLD Begins Trading on the OTCQX Best Market in the United States

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZ: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce that that its common shares have begun trading today on the OTCQX® Best Market under the symbol 'NZAUF'. U.S. investors can find current financial disclosure and Real-Time Level 2... Keep Reading...

27 February

American Eagle Expands South Zone 750 Metres to the East and Further Demonstrates Continuity Within High-Grade Core, Intersecting 618 Metres of 0.77% CuEq from Surface

Highlights: 618 m of 0.77% CuEq from surface in NAK25-80, linking high grade, at-surface gold rich mineralization to high-grade core at depth. Continuity from surface to depth: NAK25-80 builds on prior long-intervals, including NAK25-78: 802 m of 0.71% CuEq from surface, and strengthens... Keep Reading...

26 February

Pause in Trading

Zeus Resources Limited (ZEU:AU) has announced Pause in TradingDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Obonga Project: Wishbone VMS Update

27 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00