October 03, 2024

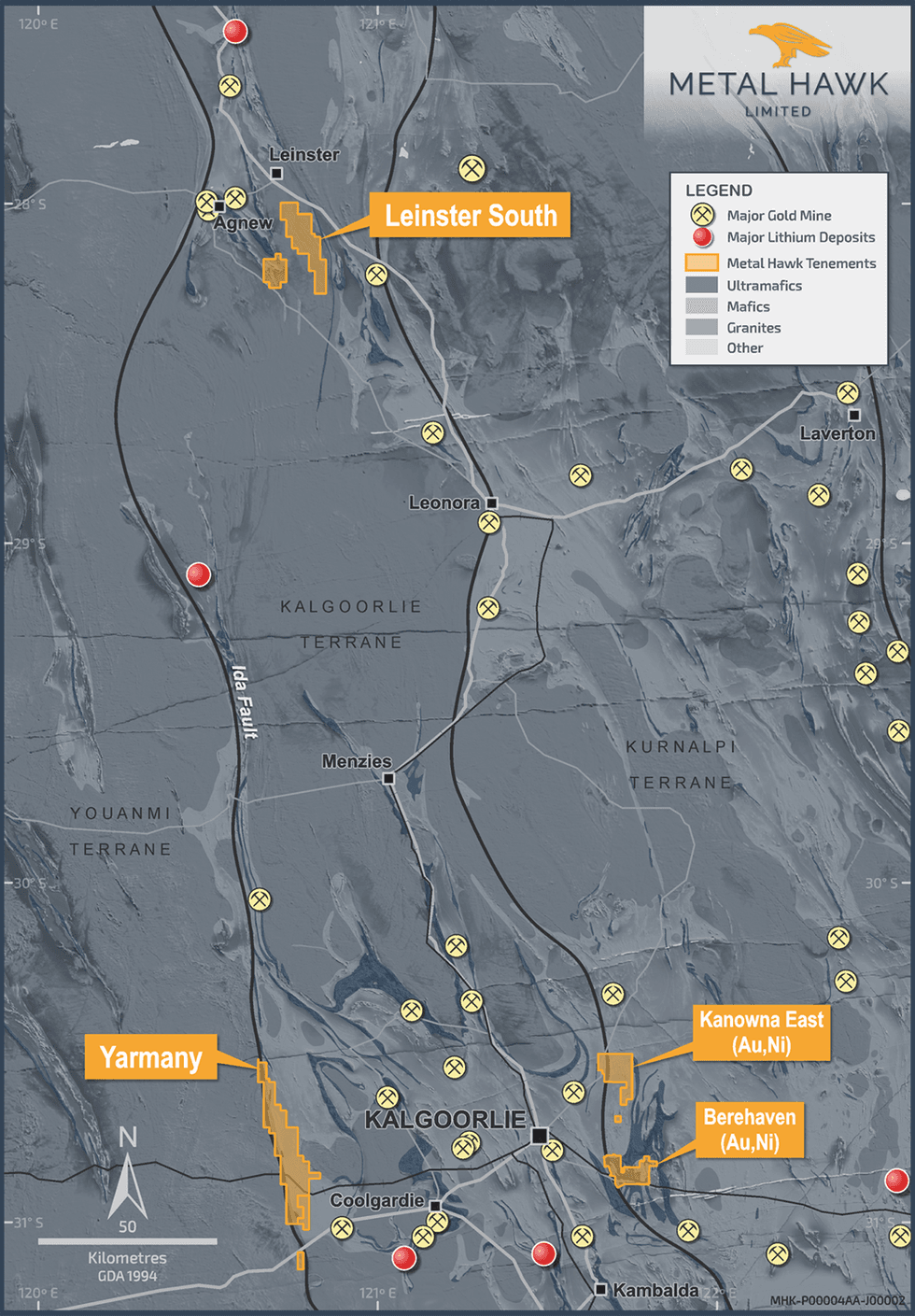

Metal Hawk (ASX:MHK) has a solid strategy to increase shareholder value through early-stage exploration success. The company explores for gold and nickel driven by a technically proficient team with a proven track record of identifying high-potential mineral exploration projects and executing early-stage discoveries.

Metal Hawk’s portfolio is primarily concentrated in the prolific Eastern Goldfields of Western Australia. The company’s exploration strategy combines traditional geological methods with innovative technologies to unlock the full potential of its tenements.

The flagship Leinster South project is located 30 kilometers south of Leinster in Western Australia’s Eastern Goldfields region. Covering approximately 127 square kilometers of granted tenure, this project is highly prospective for gold and nickel mineralization. Its proximity to the Agnew-Lawlers mining center, which has produced over 5 million ounces of gold at an average grade of 5 grams per ton (g/t), further enhances its significance. The project sits within the Agnew-Wiluna greenstone belt and along the eastern limb of the Lawlers Anticline, a key structural feature associated with major gold discoveries in the region.

Company Highlights

- A gold-focused exploration company backed by a highly experienced technical team with a track record of identifying high-potential projects and making early-stage discoveries.

- The company’s flagship project is the Leinster South project, which hosts the high-grade Siberian Tiger gold prospect.

- Recent rock chip sampling at Siberian Tiger returned assays as high as 20.2 g/t gold.

- Metal Hawk has completed a UAV magnetic survey at Leinster South to assist with drill targeting.

- The company is progressing through heritage negotiations and awaiting approval for a maiden RC drilling campaign at Siberian Tiger.

This Metal Hawk profile is part of a paid investor education campaign.*

Click here to connect with Metal Hawk (ASX:MHK) to receive an Investor Presentation

MHK:AU

The Conversation (0)

02 October 2024

Metal Hawk Limited

Gold-focused exploration in Western Australia’s prolific Eastern Goldfields region

Gold-focused exploration in Western Australia’s prolific Eastern Goldfields region Keep Reading...

05 May

MHK Presentation RIU Sydney - May 2025

Metal Hawk Limited (MHK:AU) has announced MHK Presentation RIU Sydney - May 2025Download the PDF here. Keep Reading...

23 April

Quarterly Activities/Appendix 5B Cash Flow Report

Metal Hawk Limited (MHK:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

31 March

Heritage Survey Completed at Leinster South

Metal Hawk Limited (MHK:AU) has announced Heritage Survey Completed at Leinster SouthDownload the PDF here. Keep Reading...

23 March

$2.5m Placement to Fund Extensive Gold Drilling

Metal Hawk Limited (MHK:AU) has announced $2.5m Placement to Fund Extensive Gold DrillingDownload the PDF here. Keep Reading...

20 March

Trading Halt

Metal Hawk Limited (MHK:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

6h

John Feneck: Gold, Silver, "Special Situations" — 7 Stocks to Play These Metals

John Feneck, portfolio manager and consultant at Feneck Consulting, shares his outlook for gold and silver prices and stocks. He also speaks "special situation" companies. "(There's) a change of behavior away from, 'Hey, we're never going to permit your mine.' To, 'Hey, we're really thinking... Keep Reading...

07 November

Top 5 Canadian Mining Stocks This Week: Quarterback Resources Scores with 160 Percent Gain

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian and US news impacting the resource sector.Statistics Canada released October’s job numbers on Friday (November 7). The data showed a... Keep Reading...

07 November

Goldgroup Files Updated Technical Report on Cerro Prieto Project

Goldgroup Mining Inc. ("Goldgroup" or the "Company") (TSXV:GGA)(OTCQX:GGAZF) is pleased to announce that it has filed an updated NI 43-101 technical report on the Cerro Prieto gold project located in Sonora State, Mexico. The report is entitled "Cerro Prieto Project, Heap Leach Project,... Keep Reading...

06 November

Adrian Day: Gold Far from Top, Two Triggers for Next Price Move

Adrian Day, president of Adrian Day Asset Management, shares his thoughts on gold's price pullback, saying he currently sees no evidence of a top. "It's perfectly normal in middle of a bull market to have a significant correction. This really isn't even a correction yet, let's not forget that.... Keep Reading...

06 November

Rick Rule: Gold Strategy, Oil Stocks I Own, "Sure Money" in Uranium

Rick Rule, proprietor at Rule Investment Media, recently sold 25 percent of his junior gold stocks, redeploying the funds into physical gold, as well as Franco-Nevada (TSX:FNV,NYSE:FNV), Wheaton Precious Metals (TSX:WPM,NYSE:WPM) and Agnico Eagle Mines (TSX:AEM,NYSE:AEM). In addition to those... Keep Reading...

Latest News

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00