June 27, 2022

First RC Assays Increases Confidence and Prospectivity at Depth as Diamond Drilling Commences at Manna

The Manna Lithium Project hosts a maiden Inferred Mineral Resource of 9.9Mt @ 1.14% Li2O (100% basis)1. After acquiring an 80% interest in Manna from Breaker Resources (ASX: BRB) in December 2021, GL1 engaged Snowden Optiro to undertake a Mineral Resource estimate using data compiled by Breaker Resources, including RC and DD results.

Highlights

- Significant intervals of lithium mineralisation intersected from early reverse circulation (RC) drilling at the Manna Lithium Project (Manna)

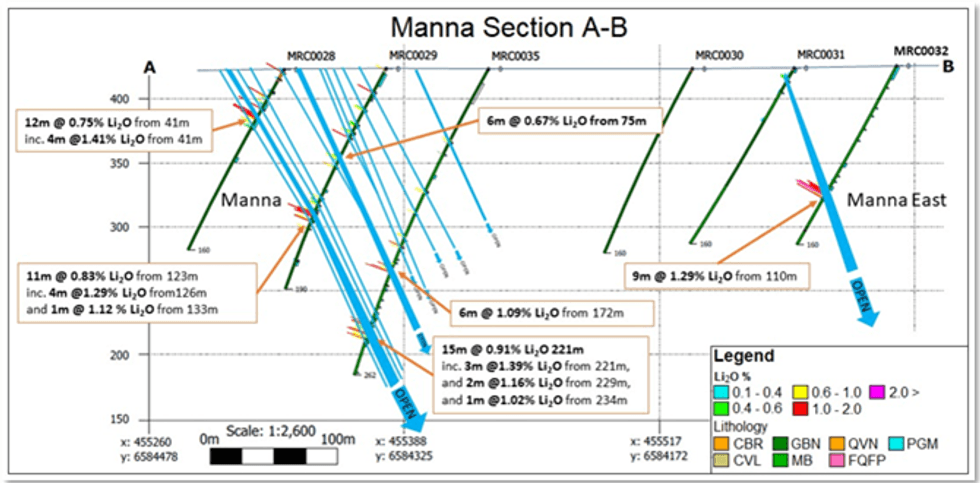

- The program validates previous drilling and resource information, further extending the orebody at depth which remains open (refer Figure 2.).

- Drilling intercepts across the same Pegmatite shows continuity with depth:

- MRC0028 returned 12m @ 0.75% Li2O from 41m

- inc. 4m @ 1.41% Li2O from 41m

- MRC0029 returned 11m @ 0.83% Li2O from 123m

- inc. 4m @ 1.29% Li2O from 126m

- and 1m @ 1.12% Li2O from 133m

- MRC0035 returned 15m @ 0.91% Li2O from 221m

- inc. 3m @ 1.39% Li2O from 221m

- and 2m @ 1.16% Li2O from 229m

- and 1m @ 1.02% Li2O from 234m

- Additional pegmatite intercepts showing continuity with depth:

- MRC0034 returned 13m @ 0.84% Li2O from 46m

- MRC0035 returned 6m @ 1.09% Li2O from 172m

- Manna East Pegmatite showing increasing width with depth:

- MRC0032 9m @ 1.29% Li2O from 110m

- Ongoing drilling will further target lithium mineralised pegmatites both along strike and at depth

- Experienced drilling contractor, Mt Magnet Drilling (Mt Magnet), commences diamond drilling (DD) program at Manna

- Initial 4,000m program will be GL1’s first DD campaign at Manna since acquisition of project in December 2021

- The diamond core drilling is specifically targeting the Pegmatites at depths below the RC drilling program currently underway

- MRC0028 returned 12m @ 0.75% Li2O from 41m

Growing multi-asset West Australian lithium company Global Lithium Resources Limited (ASX: GL1, “Global Lithium” or “the Company”) is pleased to announce the first lithium assay results from its initial RC drilling program at the Manna Lithium Project, located 100km east of Kalgoorlie.

Whilst they are early-stage results from this program, the assays provide GL1 with significant confidence in the Manna Lithium Project and confirm the findings from previous drilling undertaken by Breaker in 2018.

The assay results highlighted above are the first to be reported from the Company’s maiden 20,000m RC program at Manna, which commenced in May and is being undertaken by experienced contractor Profile Drilling Services.

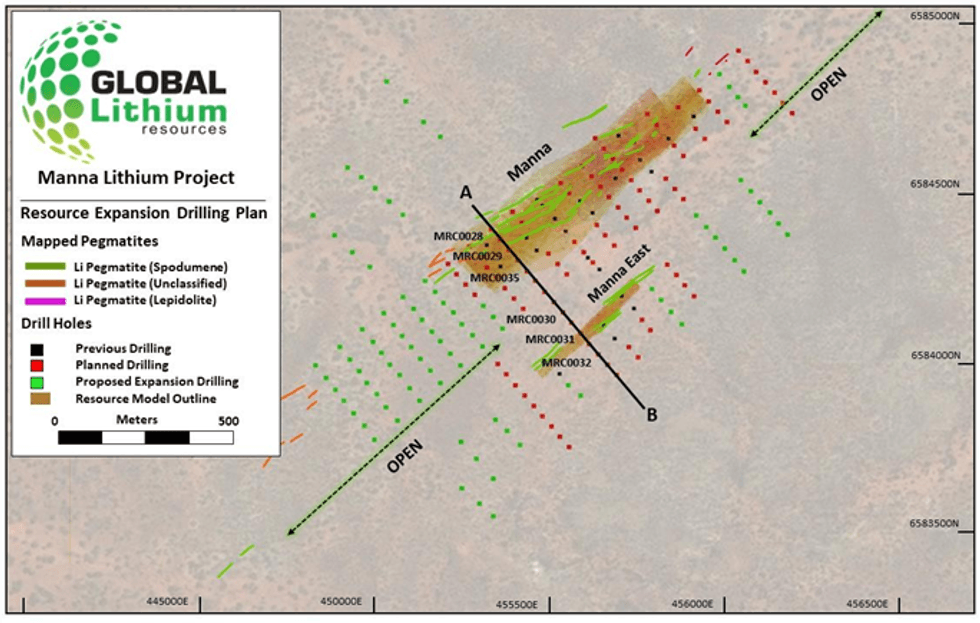

Figure 1 – Showing the resource expansion drilling plan.

Figure 2 – Cross Section A-B showing the interpreted pegmatites projected against assay results along the drill trace line.

Diamond Drilling Commences at MannaIn addition, the Company is pleased to report that diamond drilling (DD) has commenced at the Manna Lithium Project on schedule. Earlier this year, experienced contractor Mt Magnet Drilling was appointed to undertake the DD program which will initially comprise 4,000m of drilling. Mt Magnet is a Western Australian-based drilling services company which specialises in DD mineral exploration drilling.

The DD program has been designed to test and expand the deposit at depth below the RC program. GL1 will progress the DD program in parallel with ongoing RC drilling program and intends to update shareholders with further results in Q3, 2022. A geotechnical logging program of the core will run in parallel with the metallurgical test program to enable the potential commencement of feasibility study work on the deposit.

The Company anticipates a Mineral Resource update at the Manna Lithium Project to follow the completion of the RC and DD programs along with additional metallurgical test work in Q4 2022.

Click here for the full ASX Release

This article includes content from Breaker Resources NL (ASX: BRB), licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

BRB:AU

The Conversation (0)

29 June 2022

Breaker Resources

Transitioning From Explorer to Developer in Western Australia

Transitioning From Explorer to Developer in Western Australia Keep Reading...

18h

Aurum Hits High-Grade Gold at Napie, Cote d'Ivoire

Aurum Resources (AUE:AU) has announced Aurum Hits High-Grade Gold at Napie, Cote d'IvoireDownload the PDF here. Keep Reading...

19h

Precious Metals Price Update: Gold, Silver, PGMs Fall on Escalating US-Iran War

Precious metals prices are down on potential for economic fallout from escalating US-Iran War.Volatility has returned to the precious metals market this past week. All eyes are on the breakout of a full-scale war across the Middle East prompted by a coordinated assault on Iran by the United... Keep Reading...

04 March

SSR Mining to Sell Çöpler Gold Mine Stake in US$1.5 Billion Deal

SSR Mining (NASDAQ:SSRM,TSX:SSRM,OTCPL:SSRGF) has agreed to sell its majority stake in the Çöpler gold mine in Turkey for US$1.5 billion in cash, shifting the company’s portfolio towards the Americas as the yellow metal continues to surge amid rising geopolitical tensions.The Denver-based miner... Keep Reading...

04 March

Blackrock Silver Announces the Appointment of Bernard Poznanski and Susan Mathieu to the Board of Directors

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce the appointment of Bernard Poznanski and Susan Mathieu as independent directors to the Board of Directors of the Company (the "Board of Directors").In conjunction with... Keep Reading...

03 March

Fortune Bay: Exploration Underway, Fully Funded Program at the Goldfields Project in Saskatchewan

While Saskatchewan has long been recognized for uranium, its geology and historical exploration also make it a promising place for gold. Canadian company Fortune Bay (TSXV:FOR,OTCQB:FTBYF) seeks to maximize this potential with its flagship Goldfields project. Fortune Bay’s 100 percent owned... Keep Reading...

03 March

RUA GOLD Files 43-101 Technical Reports for the Reefton and Glamorgan Projects in New Zealand

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZX: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce the filing on SEDAR+ of independent Technical Reports for its Reefton Project ("Reefton Technical Report") on the South Island and Glamorgan Project ("Glamorgan Technical Report") on... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00