- WORLD EDITIONAustraliaNorth AmericaWorld

July 04, 2023

GTI Energy Ltd (ASX: GTR) (GTI or Company) is pleased to declare an initial Inferred Mineral Resource Estimate (MRE) at the Lo Herma Project located in Wyoming’s prolific Powder River Basin uranium production district. The MRE assumes mining by In-Situ Recovery (ISR) methods and is reported at a cut-off grade of 200 ppm U3O8 and a minimum grade thickness (GT) of 0.2 per mineralised horizon as:

4.12 million tonnes of mineralisation at an average grade of 630 ppm U3O8 for 5.71 million pounds (Mlbs) of U3O8 contained metal.

- Inferred Mineral Resource Estimate of 5.71 Mlbs U3O8 at average 630ppm for Lo Herma

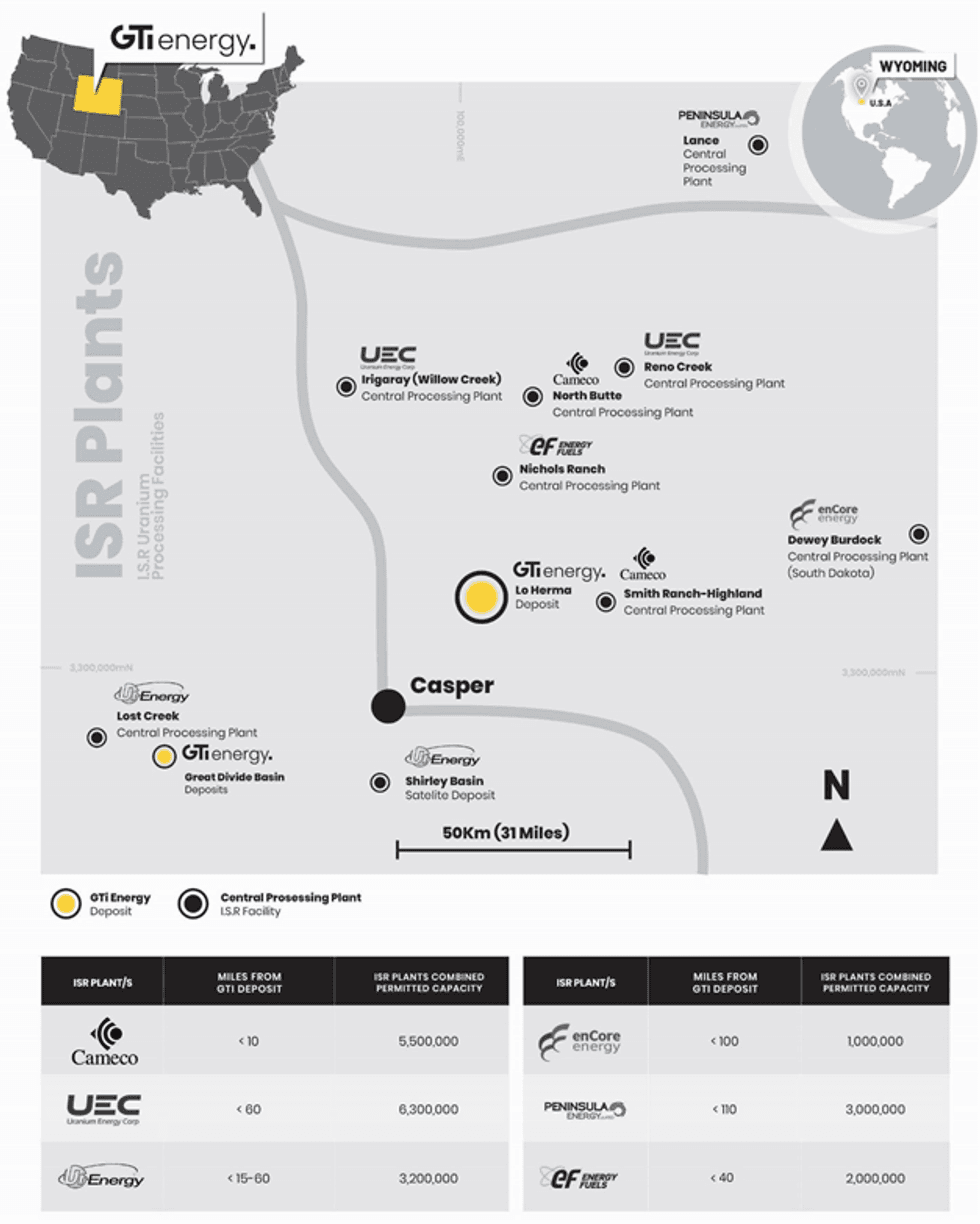

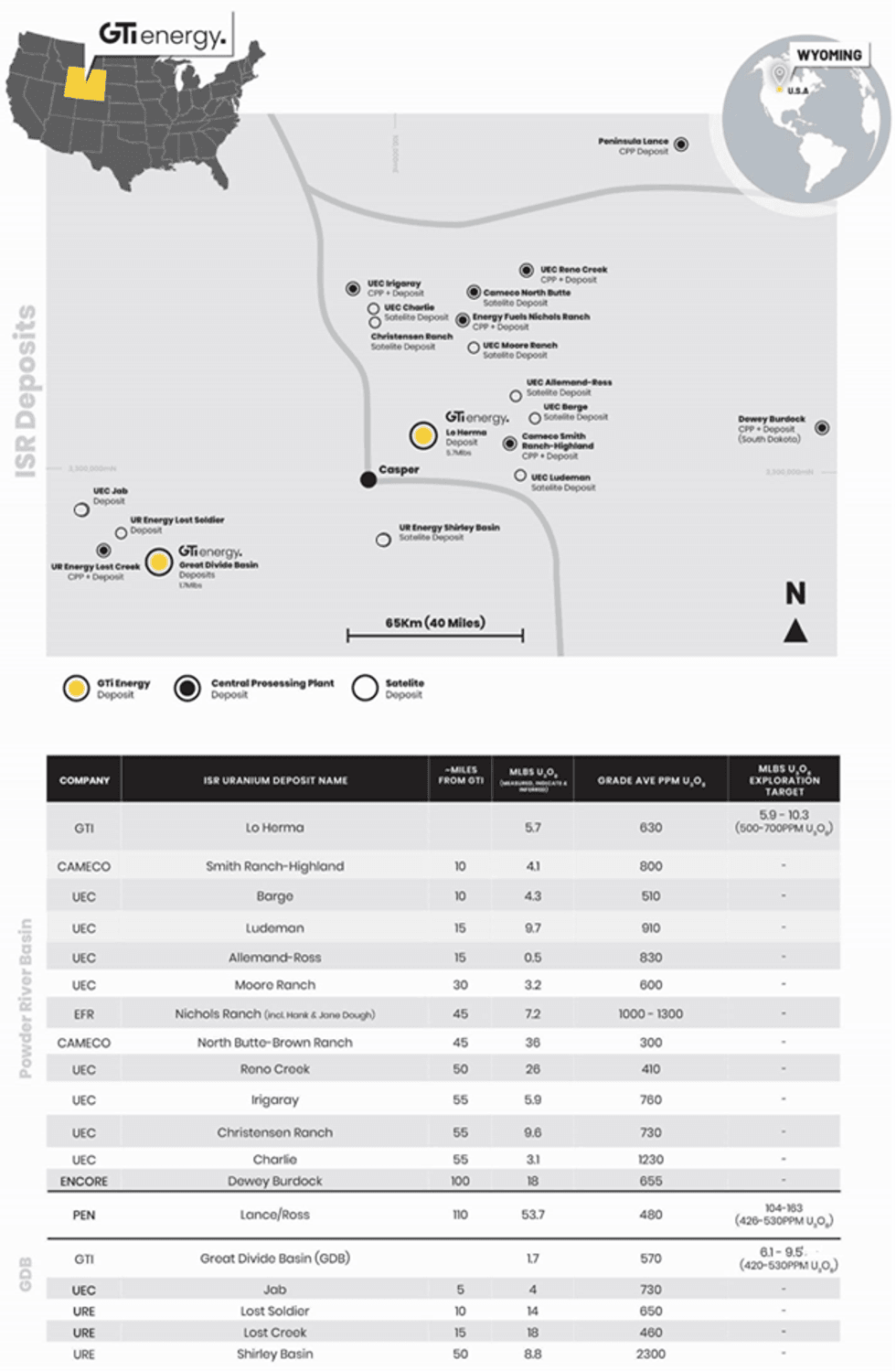

- Lo Herma is ~10 miles from the US’s largest ISR U3O8 production plant at Cameco’s Smith Ranch-Hyland & ~60 miles from UEC’s Irigaray & Energy Fuels’ Reno Creek.

- GTI’s combined Wyoming Inferred Mineral Resources now 7.37 Mlbs U3O8

- Exploration target range updated & increased by ~25% for Lo Herma Project

- Permitting in progress for Lo Herma drill program targeting late 2023/H2 2024

In addition, the initial Lo Herma Exploration Target range is updated & increased (Table 1) since it was reported to ASX on 05 March 2023. The updated Exploration Target Range for the Lo Herma Project is between 5.3 to 6.7 million additional tonnes at a grade range of between 500 ppm to 700 ppm U3O8 containing an estimated 5.9 to 10.3 million pounds of U3O8. The potential quantity and grade of the Exploration Target is conceptual in nature and there has been insufficient exploration to estimate a JORC-compliant Mineral Resource Estimate. It is uncertain if further exploration will result in the estimation of a Mineral Resource in the defined exploration target areas.

GTI Executive Director Bruce Lane commented “We are very pleased to declare an initial JORC inferred U3O8 mineral resource estimate with an updated exploration target at Lo Herma in the Powder River Basin. The reported estimates are based solely on significant historical drilling information. This initial MRE highlights the exciting potential at Lo Herma with an initial inferred resource of 5.7 Mlbs at average grade of 630 ppm. The exploration target for the project has also been updated with an additional 5.87 to 10.26 Mlbs potential at average grade of 500 – 700 ppm. This initial resource validates our belief that Lo Herma, which is located within 60 miles of ISR production plants owned by Cameco, UEC & Energy Fuels, holds real potential to become a producing deposit. GTI’s immediate goal is to integrate the results of our ariel geophysics survey into the exploration targeting model and to secure approvals for a drilling program timed for late 2023 or H2 of 2024. Drilling will aim to verify, upgrade and extend the resource. As highlighted by the exploration target, there appears to be material potential to increase the resource along trend but also possibly at depth within the highly productive Fort Union formation.”

LO HERMA URANIUM PROJECT – LOCATION & BACKGROUND

The Lo Herma ISR Uranium Project (Lo Herma) is located in Converse County, Powder River Basin (PRB), Wyoming (WY). The Project lies approximately 15 miles north of the town of Glenrock and within ~60 miles of five (5) permitted ISR uranium production facilities. These facilities include UEC’s Willow Creek (Irigaray & Christensen Ranch) & Reno Creek ISR plants, Cameco’s Smith Ranch-Highland ISR facilities and Energy Fuels Nichols Ranch ISR plant (Figure 1). The Powder River Basin has extensive ISR uranium production history with numerous defined ISR uranium resources, central processing plants (CPP) and satellite deposits (Figures 1 & 2). The Powder River Basin has been the backbone of Wyoming uranium production since the 1970s.

As reported to ASX on 14 March 2023, a comprehensive historical data package, with an estimated replacement value of ~$15m, was purchased for the Lo Herma project in March of 2023. The data package includes original drill data for roughly 1,771 drill holes pertaining to the Lo Herma region. The original drill data has been used to prepare an inferred mineral resource estimate for the Lo Herma Project using the original exploration results.

Click here for the full ASX Release

This article includes content from GTI Energy, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

GTR:AU

Sign up to get your FREE

American Uranium Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

15 December 2025

American Uranium

Disrupting the uranium supply chain through highly prospective ISR projects in Wyoming

Disrupting the uranium supply chain through highly prospective ISR projects in Wyoming Keep Reading...

11 August 2025

Snow Lake Completes Due Diligence and Confirms Placement

GTI Energy (GTR:AU) has announced Snow Lake Completes Due Diligence and Confirms PlacementDownload the PDF here. Keep Reading...

28 July 2025

Quarterly Activities/Appendix 5B Cash Flow Report

GTI Energy (GTR:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

23 July 2025

Lo Herma Drilling Permit & Contract Confirmed

GTI Energy (GTR:AU) has announced Lo Herma Drilling Permit & Contract ConfirmedDownload the PDF here. Keep Reading...

14 July 2025

Company Update - Name Change to 'American Uranium Limited'

GTI Energy (GTR:AU) has announced Company Update - Name Change to 'American Uranium Limited'Download the PDF here. Keep Reading...

10 July 2025

Placement Shares Issued & Drilling Approval Expected August

GTI Energy (GTR:AU) has announced Placement Shares Issued & Drilling Approval Expected AugustDownload the PDF here. Keep Reading...

02 February

Eagle Energy Metals Corp. and Spring Valley Acquisition Corp. II Announce Effectiveness of Registration Statement and Record and Meeting Dates for Extraordinary General Meeting of Shareholders to Approve Proposed Business Combination

Eagle, a next-generation nuclear energy company with rights to the largest open pit-constrained measured and indicated uranium deposit in the United States, and SVII, a special purpose acquisition company, today announced that the SEC has declared effective the Registration Statement, which... Keep Reading...

30 January

Spot Uranium Passes US$100, Extends Year-Long Rally

Uranium prices surged back above US$100 a pound this week, extending a year-long rally that is reshaping the uranium market after more than a decade of underinvestment.Spot price of uranium climbed US$7.75 to US$101 a pound after the Sprott Physical Uranium Trust... Keep Reading...

29 January

Quarterly Activities/Appendix 5B Cash Flow Report

Basin Energy (BSN:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

29 January

Quarterly Appendix 5B Cash Flow Report

Basin Energy (BSN:AU) has announced Quarterly Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

27 January

Basin Energy Eyes Uranium Growth in Europe After Sweden Policy Shift

Basin Energy (ASX:BSN) is positioning for growth following Sweden’s significant shift in uranium policy, a move the company’s managing director, Pete Moorhouse, says has major implications not only for the company, but also for Europe’s broader energy strategy. In an interview with the Investing... Keep Reading...

27 January

American Uranium Exec Outlines Lo Herma ISR Progress, Resource Update

American Uranium (ASX:AMU,OTCID:AMUIF) Executive Director Bruce Lane says recent test work at the company’s Lo Herma uranium project in Wyoming has delivered an important proof of concept for its in situ recovery (ISR) development plans. The testing focused on validating aquifer performance, a... Keep Reading...

Latest News

Sign up to get your FREE

American Uranium Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00