September 29, 2025

Locksley Resources (ASX:LKY,OTCQB:LKYRF,FSE:X5L) is a US-focused critical minerals company advancing high-grade rare earth elements (REEs) and antimony at its flagship Mojave project in California. Located just 1.4 kilometers from Mountain Pass — North America’s only producing REE mine — Locksley is strategically positioned to support the U.S. drive to onshore critical mineral supply chains, reduce dependence on China, and secure essential inputs for defense, clean energy, and advanced technologies.

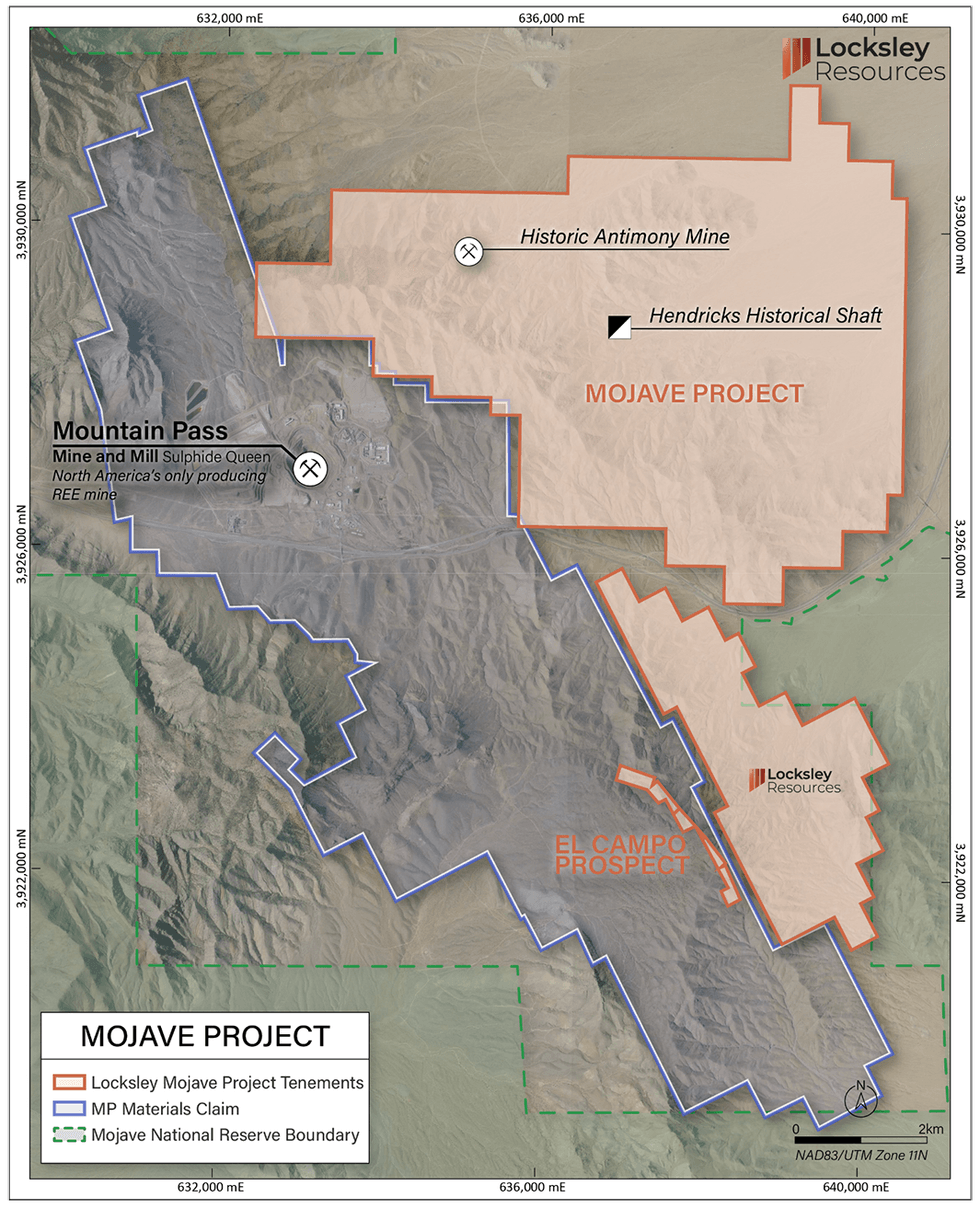

The Mojave Project, Locksley’s flagship asset, is among the most strategically located critical minerals projects in the US Spanning 491 claims adjacent to MP Materials’ world-class Mountain Pass mine, Mojave offers Tier-1 infrastructure with highway access and proximity to Las Vegas. Drilling permits for REE and antimony targets are approved, and the 2025 exploration program is fully funded.

Company Highlights

- US-focused Critical Minerals Strategy: Targeting antimony and rare earths, both on the US critical minerals list, at the Mojave project in California, within a federally prioritized supply chain hub.

- Tier-1 Location: Just 1.4 km from the Mountain Pass mine, the only REE producer in the US, with highway access, infrastructure and proximity to major defense and technology industries.

- Drill-ready and Fully Funded: Approvals secured for both antimony and REE drilling programs, with initial campaigns set for 2025.

- Downstream Innovation: Partnership with Rice University to advance DeepSolv™ solvent-based processing technology for antimony and investigate applications in next-generation energy storage.

- Government and Institutional Pathways: Positioned to benefit from US policies, Department of Defense initiatives, EXIM Bank financing and Department of Energy funding.

This Locksley Resources profile is part of a paid investor education campaign.*

LKY:AU

Sign up to get your FREE

Locksley Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

29 September 2025

Locksley Resources

High-grade antimony and rare earths prospects for a strategic, US critical minerals play

High-grade antimony and rare earths prospects for a strategic, US critical minerals play Keep Reading...

19h

Underground Mapping Reveals Major New Target at Mojave

Locksley Resources (LKY:AU) has announced Underground Mapping Reveals Major New Target at MojaveDownload the PDF here. Keep Reading...

02 February

High Grade Antimony Results from Batch Sampling Program

Locksley Resources (LKY:AU) has announced High Grade Antimony Results from Batch Sampling ProgramDownload the PDF here. Keep Reading...

29 January

Quarterly Activities Report and Appendix 5B

Locksley Resources (LKY:AU) has announced Quarterly Activities Report and Appendix 5BDownload the PDF here. Keep Reading...

05 January

High Grade Mineralised Corridor at the Mojave Project

Locksley Resources (LKY:AU) has announced High Grade Mineralised Corridor at the Mojave ProjectDownload the PDF here. Keep Reading...

07 December 2025

U.S. Investors Lead Oversubscribed $17m Placement

Locksley Resources (LKY:AU) has announced U.S. Investors Lead Oversubscribed $17m PlacementDownload the PDF here. Keep Reading...

7h

Southern Silver Intersects 5.8 metres averaging 781g/t AgEq at Cerro Las Minitas Project in Durango, México

Southern Silver Exploration Corp. (TSXV: SSV,OTC:SSVFF) (the "Company" or "Southern Silver") reports additional assays from drilling which continues to outline extensions of mineralization on the recently acquired Puro Corazon claim and identified further thick intervals of high-grade and... Keep Reading...

06 February

After Major Gold Payout, Bian Ximing Turns Bearish Sights on Silver

A Chinese billionaire trader known for profiting from gold’s multi-year rally has turned sharply bearish on silver, building a short position now worth nearly US$300 million as the metal's price slides. Bian Ximing, who earned billions riding gold’s multi-year rally and later turned aggressively... Keep Reading...

03 February

Silver Supply Tight, Demand Rising — What's Next? First Majestic's Mani Alkhafaji

Mani Alkhafaji, president of First Majestic Silver (TSX:AG,NYSE:AG), discusses silver supply, demand and price dynamics, as well as how the company is positioning for 2026.He also shares his thoughts on when silver stocks may catch up to the silver price: "You've got to give it a couple of... Keep Reading...

03 February

Rio Silver’s Path to Near-Term Cashflow

Rio Silver (TSXV:RYO,OTCPL:RYOOF) President and CEO Chris Verrico outlines the company’s transition into a pure-play silver developer. With the silver price reaching historic highs, Rio Silver is capitalizing on its strategic position in Peru — the world’s second largest silver producer — to... Keep Reading...

Latest News

Sign up to get your FREE

Locksley Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00