June 12, 2024

Magnetic Resources NL (ASX:MAU) (Magnetic or the Company) is pleased to announce that LJN4 northern zone grows to over 600m down plunge.

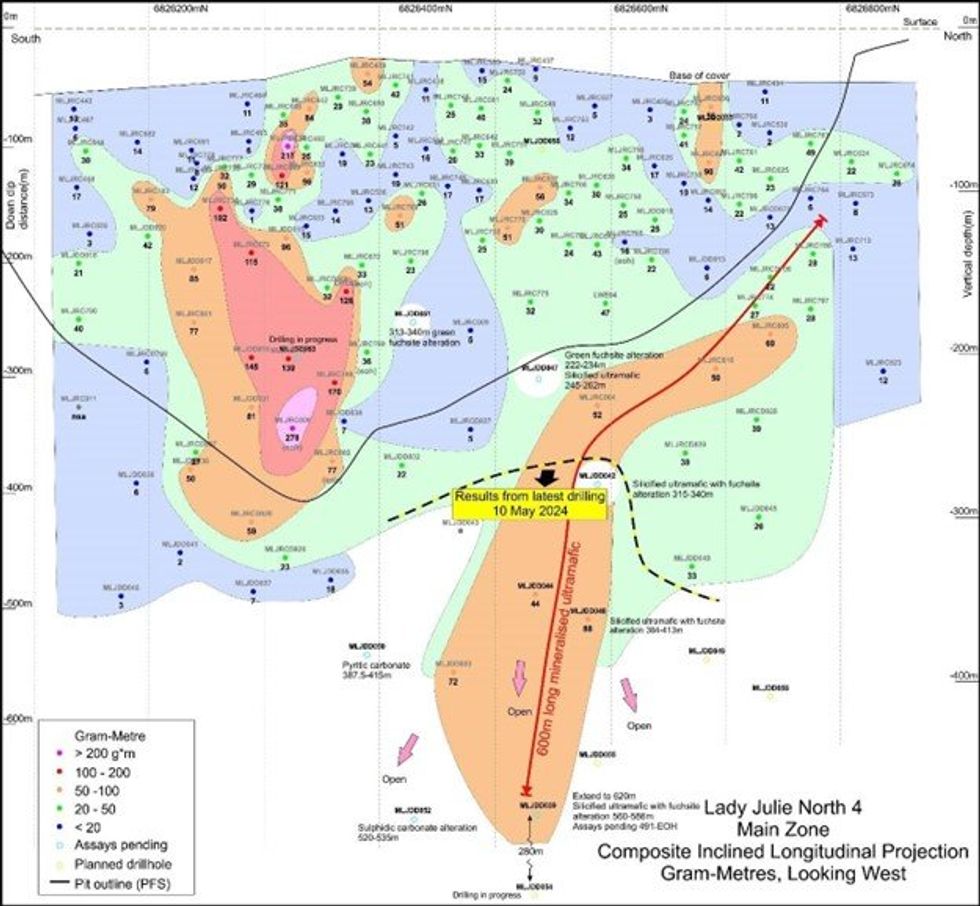

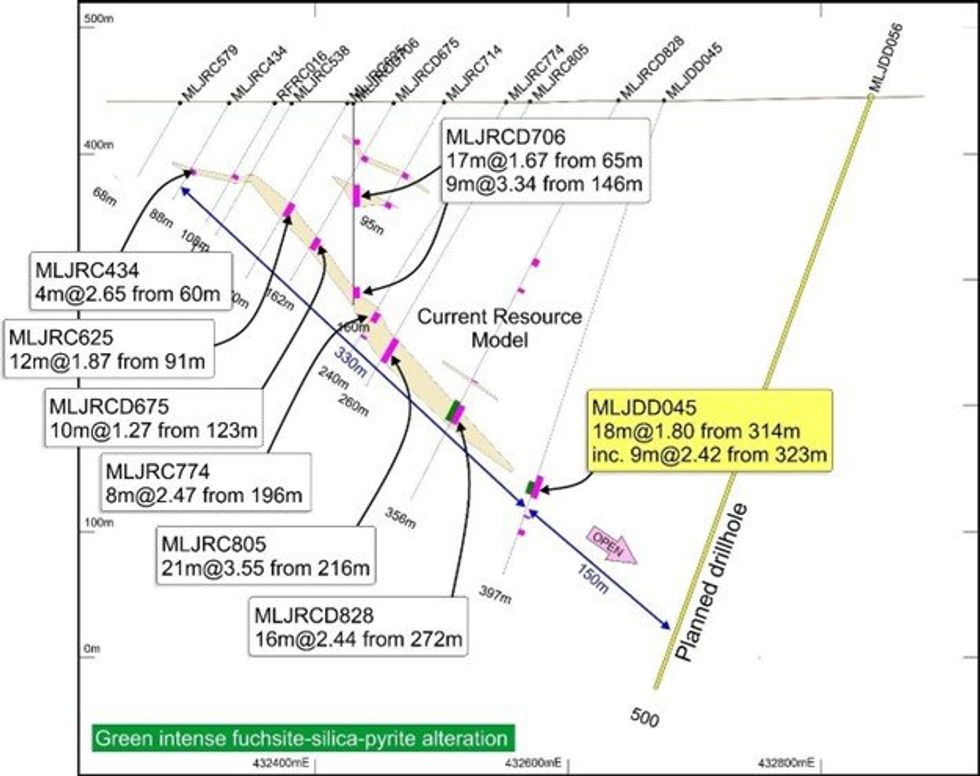

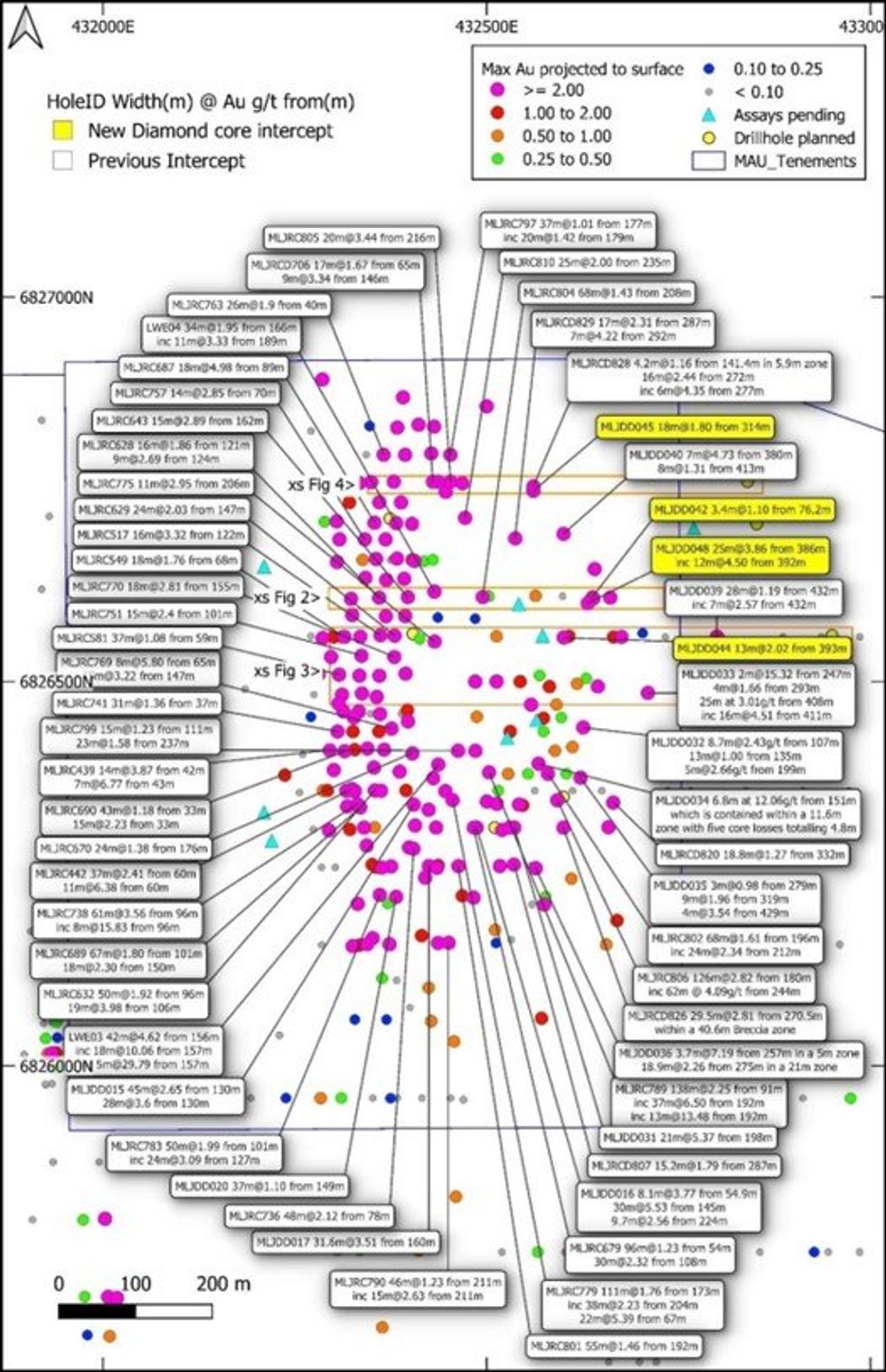

- The 400m northern part of the 750m long LJN4 deposit, has shown after a number of deep drill holes, that it plunges to the SE and is much larger than previously estimated (Figure 1). This northern zone by definition is associated with strong silica and green fuchsite, is also bigger in size than the southern silica pyrite and breccia zone. The dimension of this impressive northern zone is at least 600m down the SE plunge direction, at least 650m down dip and up to 200m long. Additionally it is still open in the down dip and down plunge directions. Deeper drill holes in progress, MLJDD054 and MLJDD055 are designed to test for further down dip extensions by 150m and 100m respectively. This zone keeps expanding and has already grown by 300m since our previous ASX release May 10, 2024(Figure 1).

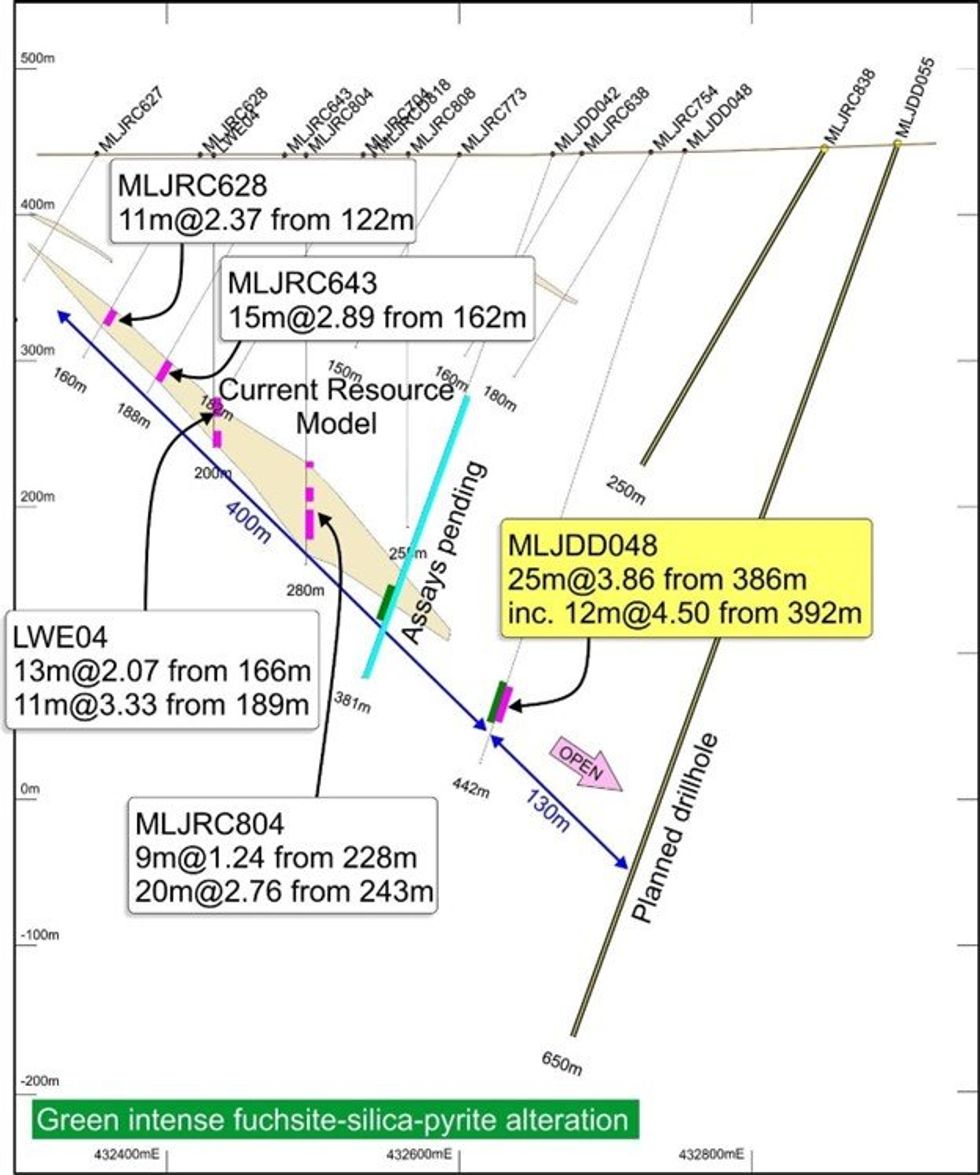

- These impressive intersections continue, MLJDD048 has 25m at 3.86g/t from 386m, which was a very large 200m step out below MLJRC804 of 20m at 2.76g/t from 243m depth (Figure 2). An infill hole within this cross section MLJDD042 has also intersected 25m of fuchsite alteration from 315-340m and results are pending.

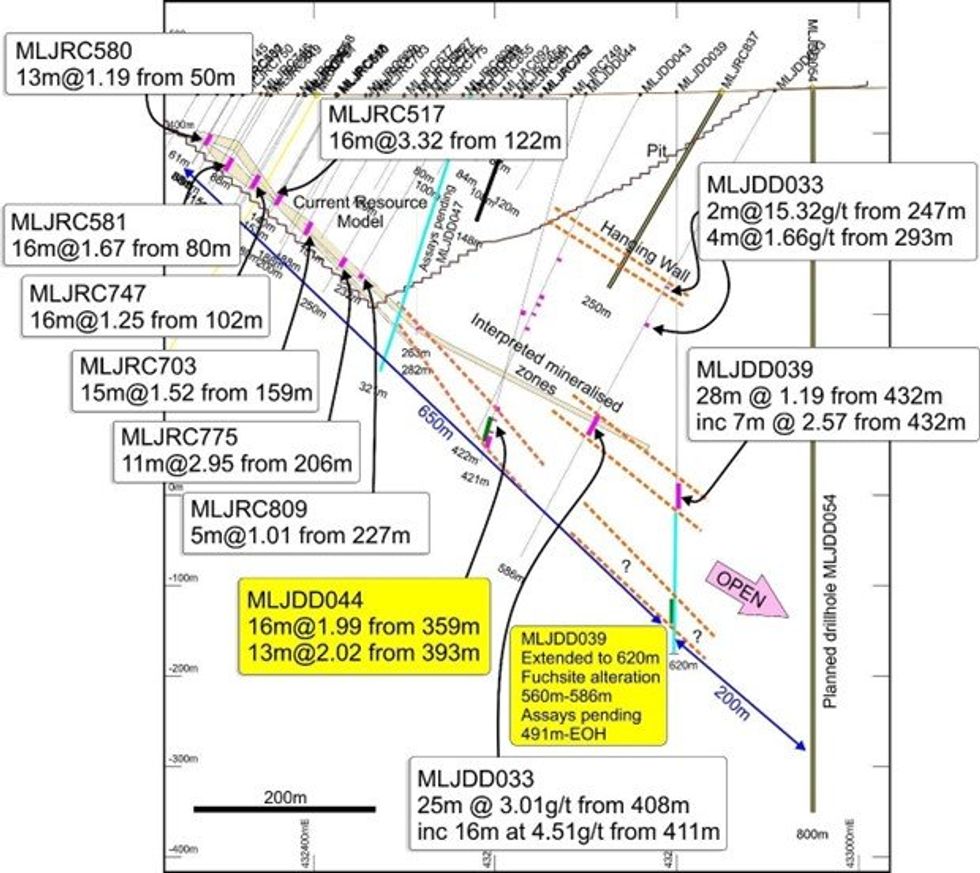

- MLJDD044 intersected 16m at 1.99g/t from 359m and 13m at 2.02g/t from 393m this is all within the green fuchsite northern zone. MLJDD039 which is a 250m down dip step out, has also intersected 26m of green fuchsite alteration. We are also waiting on these results (Figure 3).

- In addition, the assays are pending for a further 5 DDH diamond drillholes. MLJDD042 extended from 119 to 381m, MLJDD047, 50, 51 and 52 and 7 RC drillholes totalling 823m (MLJRC866-872). Diamond holes MLJDD054 and 55 are in progress and MLJDD049, 56-58 are planned.

- These intersections in MLJDD039, 44 and 48 are far below the open pit from our PFS study (ASX release 7 March 2024) and are also not included in our current resource, this auger well for the enlargement of the resource, increasing both the potential size of the open pit and now for the first time looking at the underground mining potential of LJN4. An updated economic study is planned.

- As described in the 5 March 2024 ASX release there was a 7.7% increase in overall resource in the Laverton Project to 24.9Mt @1.66g/t totalling 1.33moz of gold at 0.5g/t cut off and LJN4 has increased 11% to 948,200 oz (Table 1). Due to the promising enlargement of the northern zone, we have commenced a resource upgrade.

- Interestingly, similarly to other world class multi- million-dollar deposits in the Laverton region, we have already identified 8 stacked lodes in the central part of LJN4. We have now completed a 714m hole below these stacked lodes and results are pending.

The central and northern part of the 750m long LJN4 deposit has been drilled with very promising results. Highlights of this drilling are shown in Table 4, Figures 1-5.

The follow up deeper diamond holes have tested and are looking to extend up to two and in some cases eight, stacked lodes mainly found in the central parts of LJN4. Hole MLJDD053 is a 714m deep hole and is designed to investigate for further stacked lodes below the current bottom stacked lode. Many of these are outside the existing resource and have potential for the enlargement of the LJN4 (Indicated and Inferred) of 15.4mt at 1.92g/t for 948,200oz at a 0.5g/t cutoff (Table 1).

Click here for the full ASX Release

This article includes content from Magnetic Resources NL, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

MAU:AU

The Conversation (0)

13 December 2023

Magnetic Resources NL

An Exciting Gold Development Play in Western Australia

An Exciting Gold Development Play in Western Australia Keep Reading...

06 February

Editor's Picks: Is Gold and Silver's Price Correction Over?

It's been a wild couple of weeks for gold and silver. After surging to record highs at the end of January, prices for both precious metals saw significant corrections, creating turmoil for market participants.This week brought some relief, with gold bouncing back from its low point and even... Keep Reading...

06 February

Blackrock Silver to Present at the Precious Metals and Critical Minerals Virtual Investor Conference on February 10th 2026

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce that Andrew Pollard, President & Chief Executive Officer of the Company, will present live at the Precious Metals & Critical Minerals Virtual Investor Conference hosted... Keep Reading...

05 February

Experts: Gold's Fundamentals Intact, Price Could Hit US$7,000 in 2026

Gold took center stage at this year's Vancouver Resource Investment Conference (VRIC), coming to the fore in a slew of discussions as the price surged past US$5,000 per ounce. Held from January 25 to 26, the conference brought together diverse experts, with a focus point being the "Gold... Keep Reading...

05 February

Barrick Advances North American Gold Spinoff After Record 2025 Results

Barrick Mining (TSX:ABX,NYSE:B) said it will move ahead with plans to spin off its North American gold assets after a strong finish to 2025.The Toronto-based miner said its board has authorized preparations for an IPO of a new entity that would house its premier North American gold operations,... Keep Reading...

05 February

Peruvian Metals Secures 6 Year Agreement with Community at Mercedes Project

Peruvian Metals Corp. (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals or the "Company") is pleased to announce that the agreement between San Maurizo Mines Ltd. ("San Maurizo"), a private Manitoba company which holds a 100% direct interest in the Mercedes Property, and Comunidades... Keep Reading...

05 February

TomaGold Borehole EM Survey Confirms Berrigan Deep Zone

Survey also validates significant mineralization and unlocks new targets Highlights Direct correlation with mineralization : The modeled geophysical plates explain the presence of semi-massive to massive sulfides intersected in holes TOM-25-009 to TOM-25-015. Priority target BER-14C :... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Equity Metals Exhibiting at the 2026 PDAC

06 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00