- Latest diamond drill results confirm strong gold continuity across the Jagger Shear Zone, with 8.0 m at 2.07 g/t Au and 8.0 m at 2.16 g/t Au

- Improved understanding of structural controls and geology supports expanding mineralised zones at the Jagger Zone target

- All four holes intersected gold-bearing shear structures, validating the Company's exploration model and highlighting near-surface potential

Kobo Resources Inc. (" Kobo" or the " Company ") ( TSX.V: KRI ) is pleased to announce results from the first four diamond drill holes of the Company's current exploration program at its 100%-owned Kossou Gold Project (" Kossou ") in Côte d'Ivoire, West Africa. The new holes targeted the Jagger Zone and returned multiple high-grade gold intercepts while significantly improving the Company's understanding of the geology and structural controls that host mineralisation across this priority target.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20250515086295/en/

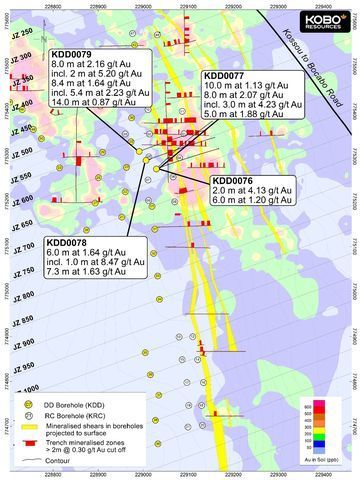

Figure 1: Jagger Zone Diamond Drill Results and Collar Location Map

Jagger Zone Diamond Drill Results Highlights:

- KDD0076

- 2.0 metres ("m") at 4.13 g/t Au from 38.0 m

- 2.0 m at 2.66 g/t Au from 45.0 m

- 6.0 m at 1.20 g/t Au from 54.0 m

- 4.0 m at 0.70 g/t Au from 98.0 m

- KDD0077

- 10.0 m at 1.13 g/t Au from 34.0 m

- 8.0 m at 2.07 g/t Au from 56.0 m , including 3.0 m at 4.23 g/t Au from 61.0 m

- 2.6 m at 1.17 g/t Au from 83.0 m

- 5.0 m at 1.88 g/t Au from 185.0 m

- KDD0078

- 3.0 m at 3.08 g/t Au from 55.0 m, including 1.0 m at 6.95 g/t Au from 56.0 m

- 6.0 m at 1.64 g/t Au from 64.0 m, including 1.0 m at 8.47 g/t Au from 64.0 m

- 7.3 m at 1.63 g/t Au from 95.0 m, including 1.0 m at 8.62 g/t Au from 95.0 m

- KDD0079

- 8.0 m at 2.16 g/t Au from 45.0 m, including 2 m at 5.20 g/t Au from 48.0 m

- 8.4 m at 1.64 g/t Au from 61.0 m, including 5.4 m at 2.23 g/t Au from 64.0

- 7.5 m at 0.99 g/t Au from 108 m

- 14.0 m at 0.87 g/t Au from 198.0 m, including 10 m at 0.96 g/t Au from 199.0 m

Edward Gosselin, CEO and Director of Kobo commented: "We continue to deliver strong results at our Kossou Gold Project . Our latest drill results strengthen our understanding of the continuity of gold mineralisation at the Jagger Zone and continue to validate the broader structural model we've been developing at Kossou. In addition, new intercepts indicate additional mineralisation in the footwall of the Jagger Shear Zone within "Jagger Structure 6" and additional drilling is warranted to further define this target."

He continued: "Gold mineralisation at the Jagger Zone occurs within an approximately 70-m wide zone of shearing and is closely associated with the quartz feldspar porphyry and diorite intrusives within the basalts, part of an overall 200 m wide deformation zone that has been mapped the length of the Jagger-Road Cut Zone area. This improved understanding of the structural controls gives us greater confidence in our ability to define additional mineralised zones and strategically advance the project going forward. As our 2025 diamond drilling campaign progresses, we remain focused on uncovering additional near-surface mineralization as we work to unlock the broader potential of Kossou."

Drill hole KDD0077 , completed on Jagger Section JZ650 , was drilled to test the continuity of mineralisation between previously drilled in holes KRC006 and KRC007 ( see press release July 24, 2023 ). The hole successfully confirmed the predicted continuity of the Jagger Shear Zone and its associated gold-bearing structures. Notably, Jagger Structure 6 (" JS6 ") was intersected near the bottom of the hole, returned 5.0 m at 1.88 g/t Au , highlighting its potential as a significant but relatively underexplored gold-bearing shear zone. JS6 will be prioritized for additional drill testing in future phases. See Figure 2 for cross section JZ650 . Detailed collar information and intercepts for all four holes are provided in Table 1.

Drill hole KDD0078 , completed on section JZ625 , demonstrated continuity of the Jagger Shear Zone and higher-grade mineralisation, similar to what has been observed in previous drilling. The hole is projected onto section JZ600 (see Figure 3), and demonstrates strike continuity of gold mineralisation across the zone. Importantly, KDD0078 also intersected significant mineralisation within JS6 , returning 4.0 m at 2.39 g/t Au, reinforcing the structure's potential as a key mineralized target.

Drill hole KDD0079 , completed on section JZ575 , continued to demonstrate strong correlation between the overall Jagger Shear Zone and associated higher-grade gold mineralized intervals. Consistent with previous drilling, KDD0079 intersected JS6 , returning a broad zone of 14.0 m grading 0.87 g/t Au .

Additional shear zones with anomalous gold values were encountered in all four diamond drill holes on the footwall side of JS6, suggesting potential for additional mineralised shear zones within the volcanic package approaching the first order Contact Fault Zone .

Understanding Gold Controls at the Kossou Gold Project

The gold mineralisation at Kossou is localized within a broad, north-south–trending and steeply west-dipping deformation corridor with an estimated width of approximately 200 m, consisting of anastomosing second- and third-order fault zones in close proximity to the first-order Contact Zone Fault that separates basaltic volcanics from volcano-sedimentary rocks.

The brittle-ductile shears and faults in the area serve as the primary structural controls on gold mineralization. The development of shears at the Jagger Zone is strongly influenced by lithological competency contrasts between basalt and diorite/quartz feldspar porphyry dykes within the volcanic package.

The main zone of shearing at the Jagger Zone occurs within an approximately 70-m wide corridor and is closely associated with the quartz feldspar porphyry and diorite intrusives within the basalts.

The primary vein types intersected in the drill core are V1 quartz veins and veinlets, which are parallel to the S1 foliation and are gold-bearing within the main shear zones. The dominant gold-bearing veins are V2A veins, which trend WNW to NW and are prominent within and in close proximity to the shears. A relatively minor set of sub-horizontal V2B veinlets and hairline fractures contains sporadic mineralization.

Recent drilling has shown that JS6, situated approximately 100 m in the footwall of the main Jagger Shear Zone, contains a consistent and laterally persistent shear zone, with all four of the latest diamond drill holes intersecting this structure .

The results of these four diamond drill holes demonstrate that gold intersections occurred where predicted, providing evidence of relatively good along-strike continuity within this part of the shear zone.

Drilling Orientation Testing Completed

Drill hole KDD0076 was completed using an azimuth of 045° to test the effectiveness of the current drill orientation. In contrast, drill holes KDD0077 through KDD0079 were completed at the standard 070° azimuth. Results from this test confirm that the 070° orientation remains optimal for targeting the mineralized structures at Jagger, and that no adjustments to the current drilling pattern are necessary.

Table 1: Summary of Significant Diamond Drill Hole Results

| BHID | East | North | Elev. | Az. | Dip | Depth | From (m) | To (m) | Int. (m) | Au g/t | Target |

| KDD0076 | 229029 | 775272 | 354 | 45 | -50 | 244.05 | 38.0 | 40.0 | 2.0 | 4.13 | Jagger |

|

| 45.0 | 47.0 | 2.0 | 2.66 | Jagger | ||||||

| 54.0 | 60.0 | 6.0 | 1.20 | Jagger | |||||||

| 88.0 | 91.0 | 3.0 | 0.63 | Jagger | |||||||

| 98.0 | 102.0 | 4.0 | 0.70 | Jagger | |||||||

| 192.0 | 197.0 | 5.0 | 0.58 | Jagger | |||||||

| KDD0077 | 229029 | 775272 | 354 | 70 | -50 | 221.05 | 34.0 | 44.0 | 10.0 | 1.13 | Jagger |

|

| 56.0 | 64.0 | 8.0 | 2.07 | Jagger | ||||||

| incl. 61.0 | 64.0 | 3.0 | 4.23 | Jagger | |||||||

| 83.0 | 85.6 | 2.6 | 1.17 | Jagger | |||||||

| 90.9 | 92.6 | 1.8 | 0.57 | Jagger | |||||||

| 106.0 | 109.0 | 3.0 | 0.43 | Jagger | |||||||

| 185.0 | 190.0 | 5.0 | 1.88 | Jagger | |||||||

| KDD0078 | 229006 | 775291 | 351 | 70 | -50 | 242.05 | 55.0 | 58.0 | 3.0 | 3.08 | Jagger |

|

| 64.0 | 70.0 | 6.0 | 1.64 | Jagger | ||||||

| incl. 64.0 | 65.0 | 1.0 | 8.47 | Jagger | |||||||

| 95.0 | 102.3 | 7.3 | 1.63 | Jagger | |||||||

| 105.9 | 109.0 | 3.1 | 0.48 | Jagger | |||||||

| 197.0 | 201.0 | 4.0 | 2.39 | Jagger | |||||||

| KDD0079 | 228991 | 775311 | 344 | 70 | -50 | 242.05 | 45.0 | 53.0 | 8.0 | 2.16 | Jagger |

|

| incl. 48.0 | 50.0 | 2.0 | 5.20 | Jagger | ||||||

| 61.0 | 69.4 | 8.4 | 1.64 | Jagger | |||||||

| incl. 64.0 | 69.4 | 5.4 | 2.23 | Jagger | |||||||

| 108.5 | 116.0 | 7.5 | 0.99 | Jagger | |||||||

| 120.0 | 129.0 | 9.0 | 0.44 | Jagger | |||||||

| 198.0 | 212.0 | 14.0 | 0.87 | Jagger | |||||||

| incl. 198.0 | 208.0 | 10.0 | 0.96 | Jagger | |||||||

| incl. 198.0 | 204.0 | 6.0 | 1.33 | Jagger | |||||||

| Notes:

| |||||||||||

An accurate dip and strike and controls of mineralisation are unconfirmed at this time and the true width of mineralisation are unconfirmed at this time. Drill holes are planned to intersect mineralised zones perpendicular to interpreted targets. All intercepts reported are downhole distances.

Sampling, QA/QC, and Analytical Procedures

Drill core (HQ/NQ) was logged and sampled by Kobo personnel at site. Drill cores were sawn in half, with one half remaining in the core box and the other half secured into new plastic sample bags with sample number tickets. Samples are transported to the SGS Côte d'Ivoire facility in Yamoussoukro by Kobo personnel where the entire sample was prepared for analysis (prep code PRP86/PRP94). Sample splits of 50 grams were then analysed for gold using 50g Fire Assay as per SGS Geochem Method FAA505. QA/QC procedures for the drill program include insertion of a certificated standards every 20 samples, a blank every 20 samples and a duplicate sample (split of the 1 m original sample) every 20 samples. All QAQC control samples returned values within acceptable limits.

Review of Technical Information

The scientific and technical information in this press release has been reviewed and approved by Paul Sarjeant, P.Geo., who is a Qualified Persons as defined in National Instrument 43-101. Mr. Sarjeant is the President and Chief Operating Officer and Director of Kobo.

About Kobo Resources Inc.

Kobo Resources is a growth-focused gold exploration company with a compelling new gold discovery in Côte d'Ivoire, one of West Africa's most prolific and developing gold districts, hosting several multi-million-ounce gold mines. The Company's 100%-owned Kossou Gold Project is located approximately 20 km northwest of the capital city of Yamoussoukro and is directly adjacent to one of the region's largest gold mines with established processing facilities.

With over 15,000 metres of diamond drilling, nearly 5,900 metres of reverse circulation (RC) drilling, and 5,900 metres of trenching completed since 2023, Kobo has made significant progress in defining the scale and prospectivity of its Kossou's Gold Project. Exploration has focused on multiple high-priority targets within a 9+ km strike length of highly prospective gold-in-soil geochemical anomalies, with drilling confirming extensive mineralisation at the Jagger, Road Cut, and Kadie Zones. The latest phase of drilling has further refined structural controls on gold mineralisation, setting the stage for the next phase of systematic exploration and resource development.

Beyond Kossou, the Company is advancing exploration at its Kotobi Permit and is actively expanding its land position in Côte d'Ivoire with prospective ground, aligning with its strategic vision for long-term growth in-country. Kobo remains committed to identifying and developing new opportunities to enhance its exploration portfolio within highly prospective gold regions of West Africa. Kobo offers investors the exciting combination of high-quality gold prospects led by an experienced leadership team with in-country experience. Kobo's common shares trade on the TSX Venture Exchange under the symbol "KRI". For more information, please visit www.koboresources.com .

Twitter: @KoboResources | LinkedIn: Kobo Resources Inc.

NEITHER THE TSXV NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSXV) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

Cautionary Statement on Forward-looking Information:

This news release contains "forward-looking information" and "forward-looking statements" (collectively, "forward-looking statements") within the meaning of the applicable Canadian securities legislation. All statements, other than statements of historical fact, are forward-looking statements and are based on expectations, estimates and projections as at the date of this news release. Any statement that involves discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as "expects", or "does not expect", "is expected", "anticipates" or "does not anticipate", "plans", "budget", "scheduled", "forecasts", "estimates", "believes" or "intends" or variations of such words and phrases or stating that certain actions, events or results "may" or "could", "would", "might" or "will" be taken to occur or be achieved) are not statements of historical fact and may be forward-looking statements Forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable, are subject to known and unknown risks, uncertainties, and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking statements. Such factors include, but are not limited to: general business, economic, competitive, political and social uncertainties; and the delay or failure to receive board, shareholder or regulatory approvals. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on the forward-looking statements and information contained in this news release. Except as required by law, Kobo assumes no obligation and/or liability to update the forward-looking statements of beliefs, opinions, projections, or other factors, should they change, except as required by law.

View source version on businesswire.com: https://www.businesswire.com/news/home/20250515086295/en/

For further information, please contact:

Edward Gosselin

Chief Executive Officer and Director

1-418-609-3587

ir@kobores.com