March 18, 2025

DY6 Metals Ltd (ASX: DY6, “DY6” or the “Company”) is pleased to advise that it has received confirmation from Malawi’s Mining & Minerals Regulatory Authority (MMRA) that the licence area for its Karonga project (previously under application) has now been formally granted as Prospecting Licence No. EL0782/24.

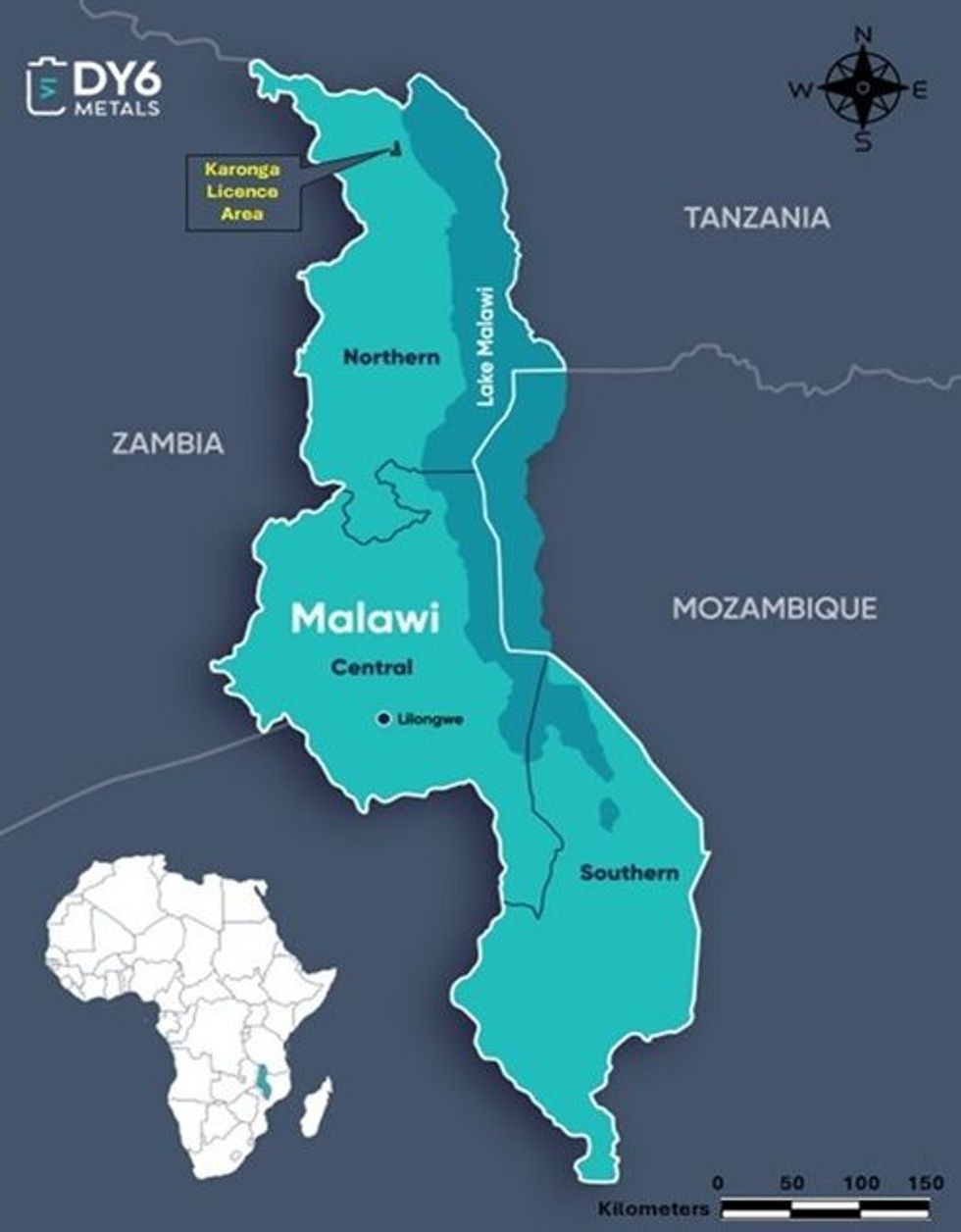

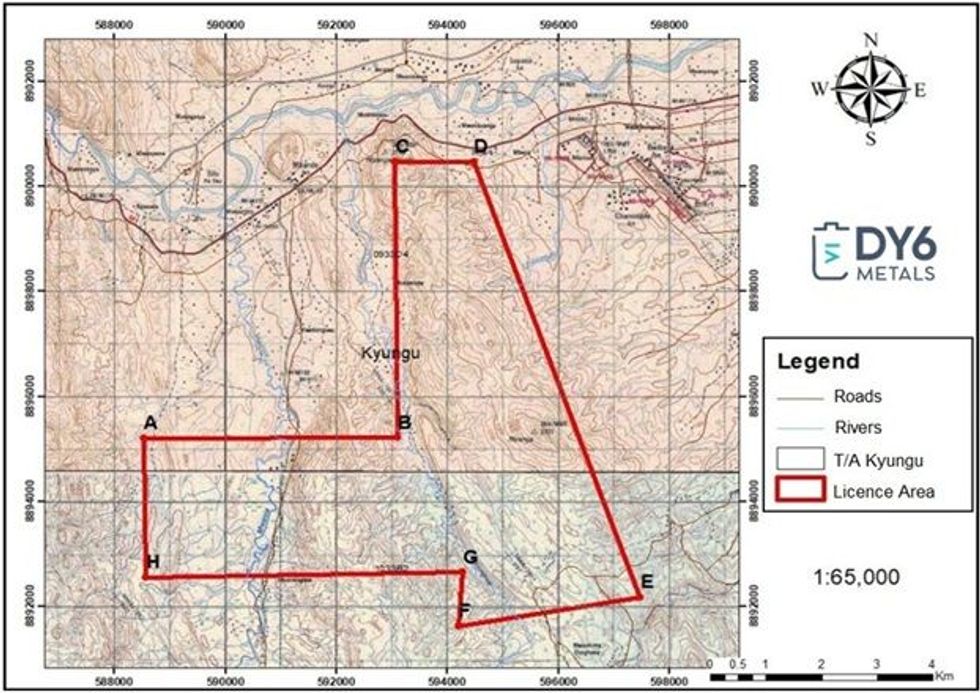

Located in northern Malawi, the licence covers an area of approximately 36km2 and has the potential for copper mineralisation, as confirmed from preliminary reconnaissance/surveillance work undertaken by DY6’s in country technical team.

KEY HIGHLIGHTS

- Karonga Prospecting Licence has been granted over a recently identified high potential Copper (Cu) mineralisation anomalous area in the Karonga district.

- The licence grants to DY6 the exclusive right to prospect for copper, rare earth elements, lithium and other minerals for a term of 3 years with an option to renew the licence for a period not exceeding 2 years.

- Preliminary reconnaissance/ surveillance sampling work on the licence area revealed occurrence of elevated Cu grades, with initial portable XRF results ranging from 1.4 to 7.8% Cu in rock (refer Table 1). Results are to be verified using standard laboratory-based XRF analytical assaying methods*.

- DY6 has recently acquired and completed reprocessing of historic hyperspectral survey data, which has been used to map areas with high probability for copper mineralisation. The results from this exercise correlate well to the mineralisation identified in the sampling work.

- Historic anomalies from regional airborne geophysical radiometric and magnetic data appear to correlate with both the hyperspectral probability copper mineralisation mapping and the preliminary sampling reconnaissance work conducted.

- Exploration for Cu and other minerals will continue on the licence area.

* Cautionary Statement on pXRF – pXRF (Portable X-Ray Fluorescence) results that are announced in this report are from uncrushed, rock-chip samples and are preliminary only. The use of pXRF is an indication only of the order of magnitude of expected final assay results.

The Project is located about 440km north of the capital Lilongwe Figure 1. It can easily be accessed using Karonga-Chitipa M1 Road turning to the west at Kasikisi School signpost along the M1 Road (Figure 2).

Geology and Mineralisation

The Karonga area is associated with a series of NW-SE and N-S trending ridges with metamorphic Basement complex rocks commonly identified as windows within the Karroo System which overlies the basement. The Karroo System units are typically sandstones with carbonaceous shale formations.

The eastern part of the licence area is overlain by several patches of Karoo sediments and Cretaceous to recent lacustrine sediments, the interrelations of which are complex due to unconformities and faulting (Figure 3A). This area is part of the northern sub-province of the Malawi Province of the Mozambique belt, active between about 700-400 million years ago. The major lithological components are gneisses and intrusives of the Misuku Belt, representing the south-eastern extension of the Ubendian Mobile Belt of south-western Tanzania into Malawi.

On a more local scale, the licence area is comprised of a suite of quartzite rocks, pegmatitic rocks and amphibole gneisses that intrude into the basement gneissic rocks forming the wall rock of the project area. The lithologies have a general NW-SE trend and are dipping west / south-west at very steep angles ranging from 600 to 850.

The presence of base metals and other related metal mineralisation is evident in the pegmatitic rocks and quartz zone (quartzite) group. The quartzite unit have clear malachite and azurite coexisting with sulphides minerals indicating the presence of copper and other base metals.

Click here for the full ASX Release

This article includes content from DY6 Metals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

DY6:AU

The Conversation (0)

10 July 2024

DY6 Metals

Developing new sources of critical minerals to power the green energy transition

Developing new sources of critical minerals to power the green energy transition Keep Reading...

24 July 2024

Quarterly Activities Report for the Period Ended 30 June 2024

Heavy rare earths and critical metals explorer DY6 Metals Ltd (ASX: DY6) (“DY6”, “the Company”) is pleased to present its quarterly activities report for the June 2024 quarter. Tundulu (REE)Historical high-grade drill intercepts reported at Tundulu including1:101m @ 1.02% TREO, 3.6% P2O5 from... Keep Reading...

02 July 2024

Reconnaissance Sampling Program Commences at Ngala Hill PGE Project to Follow up Historical Targets

DY6 Metals Ltd (ASX: DY6, “DY6” or the “Company”), a strategic metals explorer targeting Heavy Rare Earths (HREE) and Niobium (Nb) in southern Malawi, is pleased to report it is preparing for commencement of a reconnaissance program at the Company’s highly prospective PGE project at Ngala Hill... Keep Reading...

29 June 2023

Heavy Rare Earths & Niobium Explorer DY6 Metals Lists On ASX Following Successful $7M IPO

Heavy rare earths and niobium explorer DY6 Metals Limited (ASX: DY6) (“DY6”, “the Company”) is pleased to announce that its shares will begin trading on the Australian Securities Exchange at 9am Perth today. $7 million successfully raised via IPO, including $2.5 million from Hong Kong- based... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00