June 02, 2025

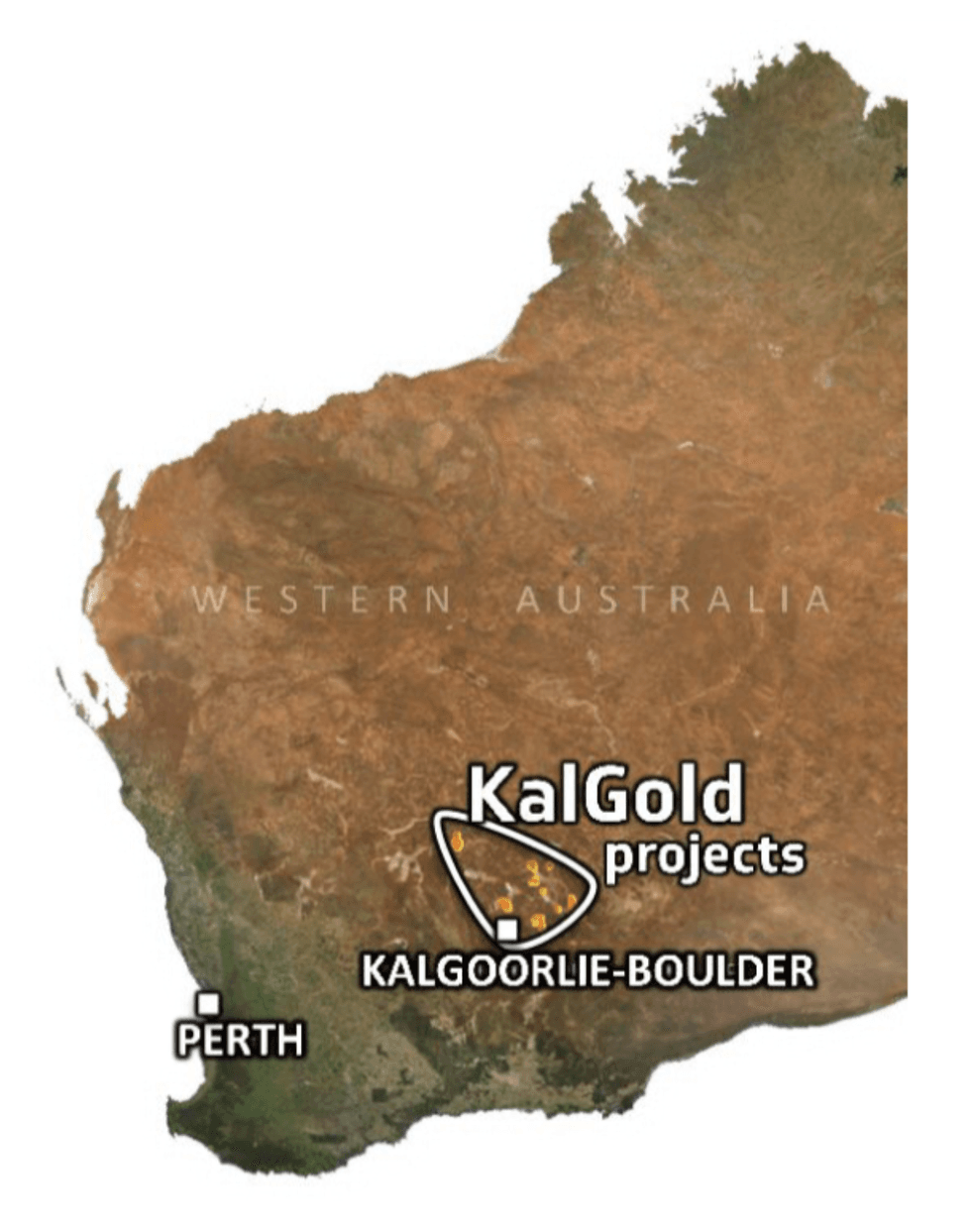

Kalgoorlie Gold Mining (ASX:KAL) is a technically focused gold explorer targeting large-scale, multi-million-ounce gold systems in the Eastern Goldfields of Western Australia. The company employs a modern, methodical approach—combining geophysical interpretation, structural analysis, geochemistry, and systematic aircore and RC drilling—to uncover gold deposits concealed beneath shallow cover in historically overlooked terranes.

Central to this strategy is the flagship Pinjin Project, situated along the underexplored southern extension of the prolific Laverton Tectonic Zone, which has produced over 30 million ounces of gold from world-class operations such as Sunrise Dam, Granny Smith, and Wallaby. Located just 20 km north of Ramelius Resources’ Rebecca Gold Project, Pinjin occupies a highly prospective but underexplored district.

Kalgoorlie Gold has already defined a maiden JORC 2012 Inferred Resource of 76,400 ounces (2.34 Mt @ 1.0 g/t Au) at the Kirgella Gift and Providence prospects. These results confirm shallow mineralization and validate the company’s exploration model. Numerous high-priority structural targets remain untested across the broader project area, offering significant discovery potential.

Company Highlights

- District-scale Positioning: Kalgoorlie Gold controls an expansive, underexplored land package in the Laverton Tectonic Zone, south of major operations like Sunrise Dam and Wallaby and just 20 km north of the planned Rebecca gold mine.

- Lighthorse Discovery: Thick, high-grade gold intercepts under shallow cover confirm a significant greenfields discovery, with potential for resource definition and scale.

- JORC Resource Established at Pinjin: An initial 76,400 oz gold resource at Kirgella Gift and Providence validates the company’s targeting strategy.

- Systematic Exploration Success: >10 targets tested, ~50 percent hit rate with anomalous high-grade gold. Over 90 percent of the company’s target inventory remains untested.

- Experienced Leadership: Matt Painter, managing director, brings deep structural geology expertise and a strong history of generating successful exploration targets globally.

- Favorable Market Tailwinds: With gold trading near all-time highs, Kalgoorlie Gold offers leveraged upside through discovery-driven valuation re-rates.

This Kalgoorlie Gold Mining profile is part of a paid investor education campaign.*

Click here to connect with Kalgoorlie Gold Mining (ASX:KAL) to receive an Investor Presentation

KAL:AU

Sign up to get your FREE

Kalgoorlie Gold Mining Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

30 May

Kalgoorlie Gold Mining

Unlocking gold deposits hidden under shallow cover in the heart of Western Australia’s Eastern Goldfields

Unlocking gold deposits hidden under shallow cover in the heart of Western Australia’s Eastern Goldfields Keep Reading...

27 October

Quarterly Activities/Appendix 5B Cash Flow Report

Kalgoorlie Gold Mining (KAL:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

02 October

Option Exercise Nets $2.3M to Expand Exploration at Pinjin

Kalgoorlie Gold Mining (KAL:AU) has announced Option exercise nets $2.3M to expand exploration at PinjinDownload the PDF here. Keep Reading...

21 August

SAM Results Support Upcoming RC and Diamond Drilling

Kalgoorlie Gold Mining (KAL:AU) has announced SAM results support upcoming RC and diamond drillingDownload the PDF here. Keep Reading...

30 July

Quarterly Activities/Appendix 5B Cash Flow Report

Kalgoorlie Gold Mining (KAL:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

14 July

Aircore Doubles Lighthorse Strike Prompts RC Drilling

Kalgoorlie Gold Mining (KAL:AU) has announced Aircore doubles Lighthorse strike prompts RC drillingDownload the PDF here. Keep Reading...

14 November

Gold’s Long Game: New Orleans Panelists See More Upside Ahead

During the Mining Share Panel at the New Orleans Investment Conference, participants underscored that the gold bull market will continue — however, just where we are in that bull run was up for debate. For conference host and Gold Newsletter editor Brien Lundin, there is still some way to go.... Keep Reading...

14 November

Editor's Picks: Gold and Silver Prices Rise as Government Shutdown Ends, Then Pull Back

The gold price was back in action this week, breaking above the US$4,200 per ounce level after spending about two weeks trading at lower price points.Silver was on the rise again as well, pushing briefly past US$54 per ounce.Both precious metals saw their biggest gains midway through the week as... Keep Reading...

14 November

Mike Maloney: Gold, Silver Bull Run in Final Phase, I Expect "Spectacular" Prices

Mike Maloney, founder of GoldSilver.com, explains why this time really is different for gold and silver, pointing to factors including growing mainstream adoption. "This to me signals the beginning of the third and final phase of the bull market — and that is where you have the greatest amount... Keep Reading...

14 November

Dana Samuelson: Gold, Silver in Global Bank Run, Prices on Hair Trigger

Dana Samuelson, president of American Gold Exchange, discusses this year's unusual market dynamics for gold and silver, saying there have been three big moves of physical metal. "To me, this is literally a run on the bank of gold globally — it's global, it's widespread and it's deep, and I don't... Keep Reading...

14 November

Canadian Gold Resources to Expand Maiden Diamond Drill Program & Provides Update on Bulk Sampling Program at Lac Arsenault, LIFE Offering Update; Disclosure Corrections

Canadian Gold Resources Ltd. (TSXV: CAN) ("Canadian Gold" or the "Company") provides an operational update regarding its maiden diamond drill program and the planned 5,000-tonne bulk sampling program at the 100%-owned Lac Arsenault Project in Québec's Gaspé Peninsula, as well as recent changes... Keep Reading...

14 November

China’s Gold Market Enters Turbulent Transition as New VAT Rules Take Effect

China’s gold industry is entering a period of rapid adjustment after Beijing implemented a major overhaul of value-added tax (VAT) rules on physical gold. The reform, which took effect on the first of November run through December 31, 2027, ending the long-standing practice of allowing full tax... Keep Reading...

Latest News

Sign up to get your FREE

Kalgoorlie Gold Mining Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Latest Press Releases

Syntheia Announces Shares for Debt Transaction

14 November

E-Power Provides Update on Management Changes

14 November

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00