iMetal Resources Inc. (TSXV:IMR)(OTC PINK:ADTFF)(FRA:A7V2) ("iMetal" or the "Company") is pleased to announce that it has received the approval of the TSX Venture Exchange (the "Exchange") for the option to acquire 100% of the 665 hectare Kerrs Gold Deposit, located 90 kilometres east-northeast of Timmins, Ontario, in the Abitibi Greenstone Gold Belt

The Kerrs Gold Deposit is comprised of a series of gold-bearing pyritized quartz vein replacement breccias enveloped by quartz fuchsite carbonate vein breccias averaging 10 metres in thickness. The deposit hosts a historical resource estimate of 7,041,460 tonnes grading 1.71 g/t gold yielding 386,467 ounces at a 0.5 g/t gold cut-off. Drilling subsequent to the historic estimate appears to have extended the mineralized zone along strike and down dip.

"The Kerrs Gold Deposit is the perfect complement to Gowganda West, giving iMetal multiple highly prospective projects in the prolific producing Abitibi Greenstone Gold Belt. The Company's focus remains on closing its up-sized financing to fund sufficient diamond drilling to both bring the Kerrs 386,467 ounce historic resource current and build upon it, as well as undertake follow-up drilling at Gowganda West," commented iMetal CEO Saf Dhillon. "The Company has come a long way under the new management team, continuing to build value for iMetal shareholders and we look forward to a successful 2022," he concluded.

The Kerrs Gold historical resources estimate was disclosed in "NI 43-101 Resource Estimation on the Kerrs Gold Deposit, Matheson, Ontario" prepared for Sheltered Oak Resources Inc. by Garth Kirkham, P. Geo of Kirkham Geosystems Ltd., and dated June 10, 2011. The Company considers the resource estimate relevant as it will drive further exploration by the Company and reliable, as it was completed by a competent Qualified Person to the standards of the day. The resource estimation methods and parameters were as follows:

- Forty-one drill holes were utilized to interpolate the KBX Zone.

- Composite length of 2 m was chosen and composites were weighted by length.

- Sectional interpretations were wire-framed to create 3-D solids of the zones.

- Zones were coded to the composites, and the block model, to constrain the modeling process.

- Composites for the mineralized zone were used to interpolate into the blocks for each zone.

- Ordinary kriging was used as the interpolator.

- Relative elevation modeling was used to guide the ellipse orientation that accounts for the variation in dip due to the synclinal structure.

- A minimum of two composites were used for each block and a maximum of two composites were used per drill hole; a maximum of 12 composites were used per hole.

- A cutting factor was applied for gold with outlier composites limited to 10 g/t Au based on cumulative frequency plots. A zero cut-off grade was used for the manual polygonal method.

- Minesight™ Software was used to perform the block modeling and estimations.

The Kerrs historic estimate is an inferred resource as defined in National Instrument 43-101. The Company is not aware of any more recent resource estimates, though there was further drilling completed after the historic estimate was released. The Company will need to review the historical drilling and analyses and will need to twin a number of the historic holes to bring the historic estimate current. The Company's Qualified Person has not done sufficient work to classify the historic estimate as a current mineral resource. iMetal is not treating the historical estimate as a current mineral resource.

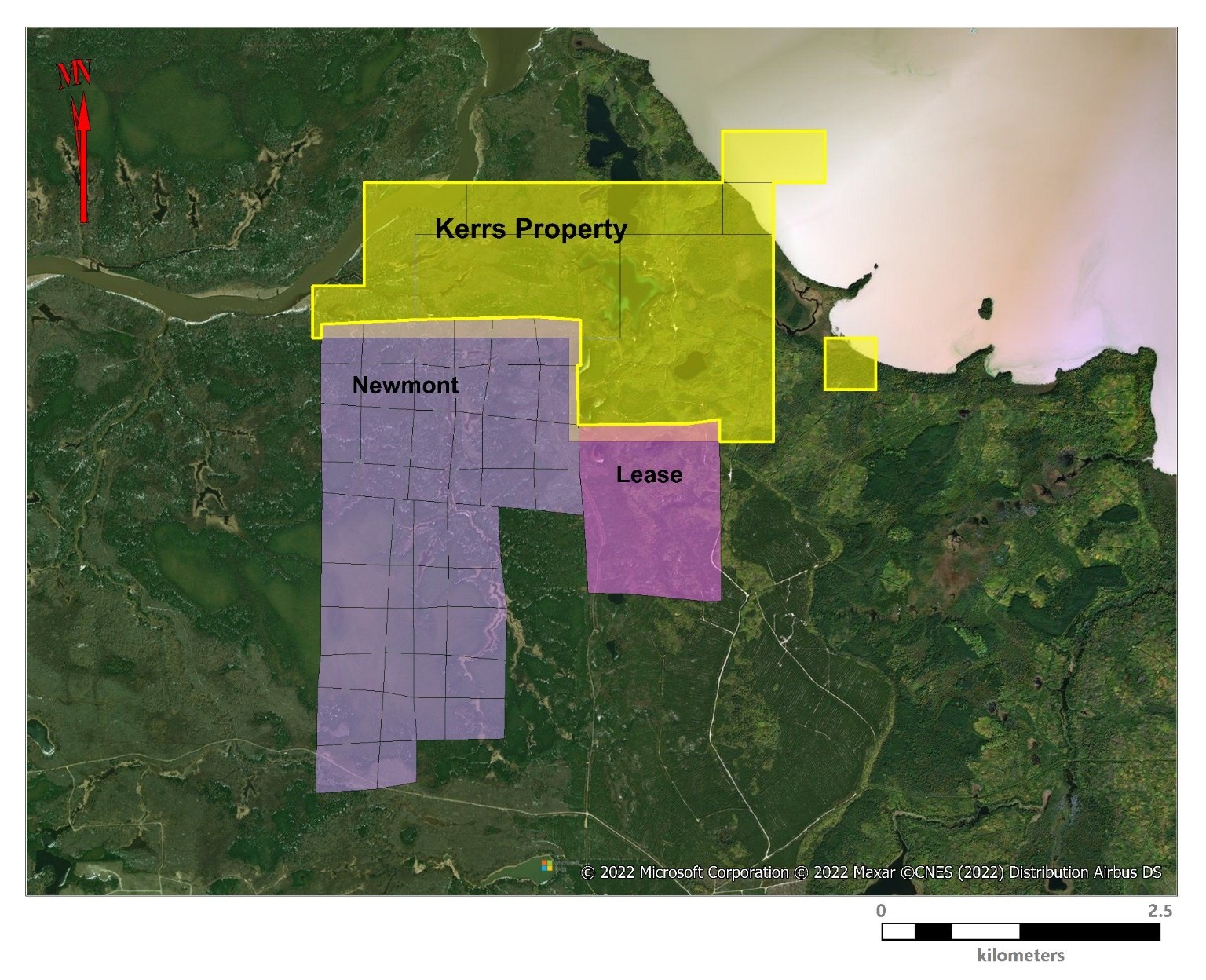

The Kerrs Gold Deposit

Figure 1. Kerrs Gold Deposit

The road accessible Kerrs Gold Deposit consists of 36 units totaling approximately 665 hectares and lies 90 kilometres east-northeast of Timmins, Ontario in the Abitibi Greenstone Gold Belt.

The Deposit was discovered by Noranda in the late 1970's early 1980's by following glacial dispersion trains up-ice to the source. Drilling continued into the late 1980's, with further drilling in the early to late-2000's and early 2011's. The drilling database was used to calculate the 2011 historic resource estimate, with further drilling completed subsequent to the release of the estimate. The Kerrs Gold Deposit consists of a series of gold-bearing pyritized quartz vein replacement breccias enveloped by quartz fuchsite carbonate vein breccias averaging approximately 10 metres and alteration envelopes varying up to 40 metres in thickness. Gold is directly related to pyrite content which ranges to 10% and is commonly found as disseminations and crystal aggregates in the sheeted, quartz vein replacement breccias. These breccias, averaging 31% quartz, exhibit reasonable correlation conforming to volcano-stratigraphic contacts as well as moderate to good continuity in grade correlations at the lower and upper boundaries of the vein breccia and alteration envelope assemblages.

The Kerrs Gold Deposit is stratabound, occurring at the contact of a thick, mafic pillow flow sequence overlying an ultramafic, magnetite-rich flow sequence. Quartz feldspar porphyry sills are spatially located above and below the breccia zones. This stratigraphy is synclinally folded with the deposit lying 350 m to 425 m below surface. Drilling has traced the main zone 800 metres and remains open in both directions and at depth.

The Company continues to review the historical database to define target areas to both significantly expand the historic resource and to test for additional structures. The Company has yet to verify the historical data.

The Kerrs Agreement

iMetal entered into a purchase option agreement (the "Option Agreement"), dated January 24th, 2022, with Gravel Ridge Resources Ltd. and 1544230 Ontario Inc. (collectively, the "Vendors") pursuant to which was granted the right to acquire the Kerrs Gold Deposit.

To acquire the Deposit, the Company is required to issue 3,500,000 common shares (the "Consideration Shares") and complete a series of four cash payments totaling $210,000 to the Vendors as follows:

- A cash payment of $60,000 and the issuance of the Consideration Shares, upon receipt of the approval (the "Exchange Approval") of the Exchange.

- A further cash payment of $50,000 upon the one-year anniversary of the Exchange Approval.

- A further cash payment of $40,000 upon the two-year anniversary of the Exchange Approval.

- A final cash payment of $60,000 upon the three-year anniversary of the Exchange Approval.

Following completion of the above cash payments and share issuances, the Company will acquire the Deposit and will grant to the Vendors a three percent royalty (the "Royalty") on net smelter returns from the Deposit. The Company may acquire two percent of the Royalty from the Vendors at any time by completing a one-time cash payment of $2,000,000.

The Company is at arms-length from each of the Vendors. No finders' fees or commissions are payable in connection with the Option Agreement. The Consideration Shares are subject to a statutory hold period until August 2, 2022, in accordance with applicable securities laws.

The scientific and technical information contained in this news release has been reviewed and approved by R. Tim Henneberry, P.Geo (British Columbia), a director of iMetal and a qualified person as defined in National Instrument 43-101.

About iMetal Resources Inc.

A Canadian based junior exploration company focused on the exploration and development of its portfolio of resource properties in Ontario and Quebec. iMetal is focused on advancing its Gowganda West Project that borders the Juby Project, an advanced exploration-stage gold project located within the Shining Tree Camp area in the southern part of the Abitibi Greenstone Gold Belt about 100 km south-southeast of the Timmins Gold Camp.

ON BEHALF OF THE BOARD OF DIRECTORS,

Saf Dhillon

President & CEO

CONTACT:

iMetal Resources Inc.

saf@imetalresources.ca

Tel. (604-484-3031)

Suite 550, 800 West Pender Street, Vancouver, British Columbia, V6C 2V6.

https://imetalresources.ca

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release may include forward-looking statements that are subject to risks and uncertainties. All statements within, other than statements of historical fact, are to be considered forward looking. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in forward-looking statements. Factors that could cause actual results to differ materially from those in forward-looking statements include results of exploration, variations in results of mineralization, relationships with local communities, market prices, continued availability of capital and financing, and general economic, market or business conditions. There can be no assurances that such statements will prove accurate and, therefore, readers are advised to rely on their own evaluation of such uncertainties. We do not assume any obligation to update any forward-looking statements except as required under the applicable laws.

SOURCE: iMetal Resources, Inc.

View source version on accesswire.com:

https://www.accesswire.com/695756/iMetal-Receives-TSXV-Approval-for-Option-of-the-Advanced-Kerrs-Gold-Deposit-in-Ontarios-Prolific-Abitibi-Greenstone-Gold-Belt