All currencies expressed as United States dollars unless otherwise stated

i-80 Gold Corp. (TSX: IAU) (OTCQX: IAUCF) ("i-80", or the "Company") is pleased to announce its development plans for 2022 - a catalyst-rich year as the Company commences its plans to build a comprehensive Nevada mining complex. i-80 is in the process of developing multiple mining operations to achieve its objective of building a Nevada focused mining company with a goal of ultimately producing more than 500,000 ounces of gold annually.

i-80 completed multiple strategic transactions in 2021, the first year of it being a publicly traded Company, that position the Company to achieve its goal of becoming a prominent, stand alone, gold producer in the state of Nevada. i-80 acquired the Granite Creek, Lone Tree and Ruby Hill properties to become one of the largest holders of gold and silver resources in Nevada (See Table 4).

Importantly, the Company secured the ability to process all types of gold mineralization, including refractory gold bearing mineralization, through the acquisition of the Lone Tree processing complex and also through interim processing agreements with Nevada Gold Mines (" NGM ") that provide the Company with the flexibility to process material from any of the three planned underground operations until the Lone Tree autoclave is restarted. Processing of refractory mineralization remains one of the biggest barriers to entry in Nevada and i-80 is currently one of only three companies with this capability.

To execute its "Hub and Spoke" development plan, i-80 intends to construct four new mining operations over the next three years, complete multiple large-scale drill programs, advance permitting, build a tier-one exploration, development and mining operations team, and restart the Lone Tree autoclave.

Lone Tree will be the "Hub" of i-80's Nevada operations as the central processing facility, operations office, assay lab and warehouse for all sites. Mineralization from Granite Creek, Ruby Hill, and McCoy-Cove will feed the Lone Tree Autoclave, once restarted, and mineralization from the Buffalo Mountain (and Brooks) open pit will be processed at the Lone Tree heap leach facility. So that investors can better understand deliverables, and track execution progress, the Company is adopting a "Scorecard" as presented in Table 1 below.

"With a strong balance sheet, we are concentrated on achieving our goal of becoming one of Nevada's largest gold producers", stated Ewan Downie , Chief Executive Officer of i-80 Gold. "2021 was a highly successful first year for i-80 where we closed multiple strategic acquisitions that position i-80 as one of the largest holders of gold and silver resources in the State."

"Executing our aggressive growth platform is the key focus for 2022 and management is in the process of building a tier-one management team with a track record of operational excellence in Nevada ", stated Matt Gili , President & Chief Operating Officer of i-80 Gold. "We are targeting peer-best production growth through the development of our portfolio of permitted, road accessible deposits. Additionally, the Company has gained a strategic advantage as one of only three companies in the State with infrastructure to process refractory mineral resources, once the facility has been retrofitted to suit the Company's deposits."

Table 1 - 2022 Scorecard – Key Goals & Catalysts

| Corporate Growth | |

| Goal | Status |

| Build Tier-One Management Team | Underway – Several key positions secured |

| Secure Finances to Execute Growth | Currently ~US$200M in cash and cash equivalents |

| Align with ICMM Principles | Underway |

| Lone Tree Complex | |

| Goal | Status |

| Complete autoclave and metallurgy studies | Underway - Awarding Study Contracts |

| Place long lead time orders for autoclave refurbishment | To be ordered once appropriate studies are completed |

| Residual leaching program | Underway – Gold production expected in 2022 1 |

| Granite Creek | |

| Goal | Status |

| Achieve consistent ramp up mining rate | Ramp up plan underway |

| Commence delivery of mineralization to NGM for processing | Targeting first delivery in H2-2022 |

| Complete 20,000 m drill program | Underway – drill results throughout the year |

| Complete updated mineral resource estimate | To be completed after drill program – update plan YE 2022 |

| Complete underground feasibility study | Targeting completion in H2-2022 |

| Ruby Hill | |

| Goal | Status |

| Complete +20,000 metre surface drilling campaign | Underway – drill results throughout the year |

| Submit permitting for an underground mining operation | Work to initiate permitting underway |

| Heap leach processing of 2021 mined material | Underway – Gold production expected in 2022 |

| Complete updated mineral resource estimate | To be completed after drill program – update plan YE 2022 |

| Complete PEA or Pre-Feasibility study | Targeting completion in H2-2022 1 |

| McCoy-Cove | |

| Goal | Status |

| Initiate underground development program | Award Development Contract Q1-2022 |

| Commence 40,000 metre Underground Drill Program | Targeting H2-2022 start once ramp is sufficiently developed |

| Complete mine dewatering strategy | Underway – Targeting completion in 2022 |

| Buffalo Mountain (and Brooks) | |

| Goal | Status |

| Complete permitting of the heap leach open pit operation | Underway – Targeting completion in 2022 |

| Complete resource estimate | Underway – Targeting release in H2-2022 |

| 1 See Cautionary Note Below | |

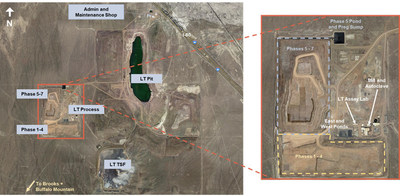

Lone Tree Processing Facilities and Buffalo Mountain Project

Lone Tree is expected to become the hub of i-80's Nevada operations, and the central processing facility for mineralization from the first four planned mining projects. Importantly, Lone Tree is host to infrastructure that, following successful refurbishment efforts, will allow it to process refractory and oxide mineralization. Currently on care and maintenance, the property hosts existing infrastructure that includes a whole ore autoclave with capacity of 1M Tonnes/year, a flotation circuit with capacity of 1.8M Tonnes/year, a CIC circuit & leach pad with 6.5M Tonnes of remaining capacity, a tailings dam with 1.5M Tonnes of remaining constructed capacity and an additional 10 M Tonnes of designed capacity, a waste dump, along with several buildings useful for the development of all i-80's projects including a warehouse, maintenance shop, administration building and assay lab .

In Q1-2022, the Company plans to award the contract to complete a detailed engineering study for the restart of the autoclave and secure key personnel to execute the restart plan. Additionally, permitting for the development of the Buffalo Mountain open pit mine is underway, where gold mineralization is expected to be processed at the Lone Tree leach pad facility. An initial resource for Buffalo Mountain is expected to be complete in H1-2022.

i-80 considers the Lone Tree infrastructure to be the most strategically located processing facility in Nevada , located on Interstate 80 with the Nevada Railway less than two kilometres to the north, and will be the platform from which i-80 intends to grow its business (see Figure 1 below).

Granite Creek Property

The fully permitted Granite Creek underground represents the Company's most advanced project. Initial rehabilitation of the underground workings was completed in 2021 and additional levels are now being constructed and multiple levels are being prepared for mining. A surface and underground drill program, expected to comprise more than 20,000 metres of drilling, is well underway with positive results. Following the 2022 drill campaign, the Company intends to complete a revised resource estimate focused on the underground mineralized zones.

The Granite Creek Mine Project hosts both open pit and underground resources and is strategically located proximal to Nevada Gold Mines' Twin Creeks and Turquoise Ridge mines at the north end of the Battle Mountain-Eureka Trend at its intersection with the Getchell gold belt in Nevada . The underground deposit at Granite Creek represents one of the highest-grade gold deposits in North America with resource grades in excess of 10 grams per tonne ("g/t) gold (see Table 2 below).

| Table 2 – Granite Creek Underground Mineral Resources | ||||

| Resource Class | Tonnes (1000's) | Gold Grade (g/t) | Gold Oz (000's) | |

| Measured | 483 | 10.07 | 156 | |

| Indicated | 525 | 10.70 | 181 | |

| M&I | 1,008 | 10.40 | 337 | |

| Inferred | 741 | 13.41 | 319 | |

| Notes: | | |||

| | | | | |

The primary goal of the 2021/2022 drill program is to advance underground drilling and test mining with a target of ramping up to production in H1-2022. Underground drilling will be focused on delineating sufficient resources for near-term mine development and full production, and a cubex drill was recently added to define initial stoping areas. Initially, material mined from Granite Creek will be trucked for processing at the nearby NGM's Twin Creeks processing facility through the interim processing arrangement that was entered into for processing until the Company's Lone Tree facility is operational.

In addition to the underground program at Granite Creek, the surface drilling program testing near-surface mineralization for metallurgical purposes and open pit definition was completed in 2021. This part of the program was competed primarily to advance permitting for open pit mining including heap leach processing on-site. A Preliminary Economic Assessment for the Granite Creek Mine Project was completed in 2021 and a full feasibility study for the open pit project is planned to be completed in the future.

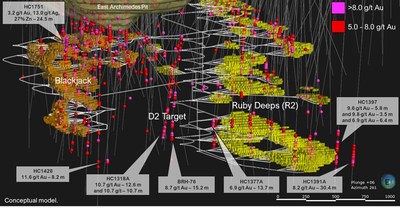

Ruby Hill Project

Ruby Hill includes an open pit mine and related infrastructure (mill / heap leach) and is located immediately west of the town of Eureka proximal to Highway 50. The Ruby Hill Property is host to multiple gold, silver and base metal deposits that collectively comprise one of Nevada's largest mineral endowments that offer substantial upside. In Q4-2021, i-80 launched a multi-drill campaign that will see a minimum of 20,000 metres drilled in 2022 followed by a resource update. All deposits remain open along strike and at depth.

Multiple gold and polymetallic exploration targets exist on the property and i-80 will begin permitting for the construction of a decline to access the high-grade Ruby Deeps deposit and the Blackjack Zone with the intent of trucking refractory mineralization for processing at Lone Tree (see Figure 2). In H1-2022, i-80 will continue with processing of material mined in H2-2021 at the heap leach facility on the property. Ruby Hill also includes crushing and CIL processing infrastructure (see Figure 3).

McCoy-Cove Property

In November 2021 , i-80 announced that it intended to proceed with its planned underground, advanced–exploration, program at the Company's 100%-owned McCoy-Cove Property. The underground plan will include the construction of a decline, and a level that will include multiple drill bays in order to upgrade resources and complete a Feasibility Study. The Cove deposit on the Property represents one of North America's highest grade gold deposits with grades in excess of 10 grams per tonne gold (g/t Au) (see Table 3). The deposit remains open for expansion down-dip.

| Table 3 – McCoy Cove Mineral Resources | |||||

| Resource Classification | Tonnes (000's) | Gold Grade (g/t) | Silver Grade (g/t) | Gold Ounces (000's) | Silver Ounces (000's) |

| Indicated | 1,007 | 10.9 | 29.1 | 351 | 943 |

| Inferred | 3,867 | 10.9 | 20.6 | 1,353 | 2,565 |

| Notes: | |||||

In the coming weeks, the Company will engage contractors to proceed with the initial underground development plan and drilling of approximately 40,000 metres that is expected to commence in the second half of 2022 followed by a Feasibility Study.

The McCoy-Cove Property is strategically located approximately 50 km south of the Company's Lone Tree Complex, and immediately south of Nevada Gold Mines' Phoenix Mine within the Battle Mountain-Eureka Trend. The Property is accessed via all-season road from Highway 55 in Nevada .

ESG Initiative

The Company is focused on achieving industry best ESG practices. Since i-80's inception in April 2021 , the Company completed an ESG Assessment with a third-party consultant which highlighted key areas of focus going forward. The Company intends to grow on this success in 2022 with the goal of aligning with the ICMM Guidelines and has set out a plan to achieve this.

Financial Strength

In 2021, i-80 closed financings that will result in the Company having a strong balance sheet including nearly US$200 Million in cash and cash equivalents following funding of the previously announced financing package.

About i-80 Gold Corp.

i-80 Gold Corp. is a well-financed, Nevada-focused, mining company with a goal of achieving mid-tier gold producer status through the development of four new open pit and underground mining operations that will ultimately process ore at the Company's central Lone Tree complex that includes an Autoclave.

| Table 4 - i-80 Mineral Resources | ||||||||||||||

| Resource Classification | Tonnes (000's) | Au Grade (g/t) | Ag Grade (g/t) | Au Ounces (000's) | Ag Ounces (000)'s | |||||||||

| Measured | | | | | | |||||||||

| Granite Creek - Open Pit | 20,857 | 1.47 | | 988 | | |||||||||

| Granite Creek -Underground | 483 | 10.07 | | 156 | | |||||||||

| Lone Tree -Open Pit | | | | | | |||||||||

| McCoy-Cove - Underground | | | | | | |||||||||

| Ruby Hill - Open Pit | | | | | | |||||||||

| Ruby Hill - Underground | | | | | | |||||||||

| Indicated | | | | | | |||||||||

| Granite Creek - Open Pit | 7,448 | 1.27 | | 304 | | |||||||||

| Granite Creek - Underground | 525 | 10.70 | | 181 | | |||||||||

| Lone Tree - Open Pit | 7,223 | 1.77 | | 410 | | |||||||||

| McCoy-Cove - Underground | 1,007 | 10.90 | 29.1 | 351 | 943 | |||||||||

| Ruby Hill - Open Pit | 224,400 | 0.54 | 14.3 | 3,874 | 103,335 | |||||||||

| Ruby Hill - Underground | 1,200 | 5.22 | 0.6 | 202 | 22 | |||||||||

| Measured & Indicated | 263,144 | 0.76 | 12.33 | 6,465 | 104,300 | |||||||||

| Inferred | | | | | | |||||||||

| Granite Creek - Open Pit | 1,531 | 1.26 | | 62 | | |||||||||

| Granite Creek - Underground | 741 | 13.41 | | 319 | | |||||||||

| Lone Tree - Open Pit | 50,734 | 1.69 | | 2,764 | | |||||||||

| McCoy-Cove - Underground | 3,867 | 10.90 | 20.6 | 1,353 | 2,565 | |||||||||

| Ruby Hill - Open Pit | 162,700 | 0.39 | 14.0 | 2,062 | 73,472 | |||||||||

| Ruby Hill - Underground | 8,210 | 6.02 | 1.7 | 1,588 | 439 | |||||||||

| Inferred | 227,783 | 1.11 | 10.4 | 8,148 | 76,476 | |||||||||

| Notes: | ||||||||||||||

| | | | | | | | | | | | | | | |

Technical Information

The scientific and technical information contain in this press release has been reviewed by Tim George, PE, Manager of Engineering Services of i-80 and a Qualified Person within the meaning of NI43-101.

Certain statements in this release constitute "forward-looking statements" or "forward-looking information" within the meaning of applicable securities laws, including but not limited to, , completion of refurbishment and development activities at the Long Tree project, commencement of mining operations at the Lone Tree project or the Ruby Hill mine development activities at the Company's projects and resource updates in respect of certain properties, the objectives set out under 2022 Scorecard – Key Goals & Catalysts in this press release and the ESG initiatives. Such statements and information involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of the company, its projects, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements or information. Such statements can be identified by the use of words such as "may", "would", "could", "will", "intend", "expect", "believe", "plan", "anticipate", "estimate", "scheduled", "forecast", "predict" and other similar terminology, or state that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved. These statements reflect the Company's current expectations regarding future events, performance and results and speak only as of the date of this release.

Forward-looking statements and information involve significant risks and uncertainties, should not be read as guarantees of future performance or results and will not necessarily be accurate indicators of whether or not such results will be achieved. A number of factors could cause actual results to differ materially from the results discussed in the forward-looking statements or information, including, but not limited to: failure to obtain the relevant regulatory approvals, material adverse changes, exercise of termination rights by any relevant party, unexpected changes in laws, the failure of parties to contracts with the company to perform as agreed; social or labour unrest; changes in commodity prices; and the failure of exploration, refurbishment, development or mining programs or studies to deliver anticipated results or results that would justify and support continued exploration, studies, development or operations.

Cautionary Note to U.S. Investors Concerning Estimates of Resources: This press release uses the term "inferred resources." "Inferred resources" have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. Under Canadian rules, estimates of inferred mineral resources may not form the basis of a feasibility study or prefeasibility study, except in rare cases. Information contained in the press release containing descriptions of any mineral deposits may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements under the United States federal securities laws and the rules and regulations thereunder that disclose mineral reserves and mineral resources in accordance with Industry Guide 7 or the SEC's new mining disclosure rules in Regulation S-K 1300. SEC Industry Guide 7 does not recognize the existence of resources. Under Regulation S-K 1300, reserve and resource definitions are substantially similar to the corresponding CIM Definition Standards; however, there are differences between NI 43-101 and Regulation S-K 1300 and therefore information contained in the press release may not be comparable to similar information made public by public U.S. companies pursuant to the Regulation S-K 1300 or SEC Industry Guide 7.

Cautionary Statement:

A production decision at each of the Ruby Hill Mine and Lone Tree projects was made by previous operators of the mines, prior to the completion of the acquisition of each such project by the Company and the Company made a decision to continue production subsequent to the acquisitions at each of the projects. This decision by the Company to continue production and, to the knowledge of the Company, the prior production decision at each of the projects were not based on a feasibility study of mineral reserves, demonstrating economic and technical viability, and, as a result, there may be an increased uncertainty of achieving any particular level of recovery of minerals or the cost of such recovery, which include increased risks associated with developing a commercially mineable deposit. Historically, such projects have a much higher risk of economic and technical failure. There is no guarantee that anticipated production costs will be achieved. Failure to achieve the anticipated production costs would have a material adverse impact on the Company's cash flow and future profitability. Readers are cautioned that there is increased uncertainty and higher risk of economic and technical failure associated with such production decisions.

![]() View original content to download multimedia: https://www.prnewswire.com/news-releases/i-80-launches-comprehensive-plan-to-create-nevada-focused-gold-mining-company-301459301.html

View original content to download multimedia: https://www.prnewswire.com/news-releases/i-80-launches-comprehensive-plan-to-create-nevada-focused-gold-mining-company-301459301.html

SOURCE i-80 Gold Corp

![]() View original content to download multimedia: https://www.newswire.ca/en/releases/archive/January2022/12/c4833.html

View original content to download multimedia: https://www.newswire.ca/en/releases/archive/January2022/12/c4833.html