February 28, 2023

Galan Lithium Limited (ASX: GLN) (Galan or the Company) is pleased to announce further advancements on its 100%-owned Hombre Muerto West Project (HMW Project) in Catamarca Province, Argentina.

Highlights:

- Exploration well completed to a depth of 455 metres.

- 72-hour airlift testing completed; average grade of 829 mg/l Li.

- Gravel and fractured breccia mainly encountered during drilling presenting great potential for a high porosity and permeability setting.

- New geophysical studies further confirm the presence of conductive (low resistivity) units, brine continuity and upside resource potential.

- Construction of 4th brine production well at HMW commenced.

- HMW Reserve model and updated resource estimate on track for DFS

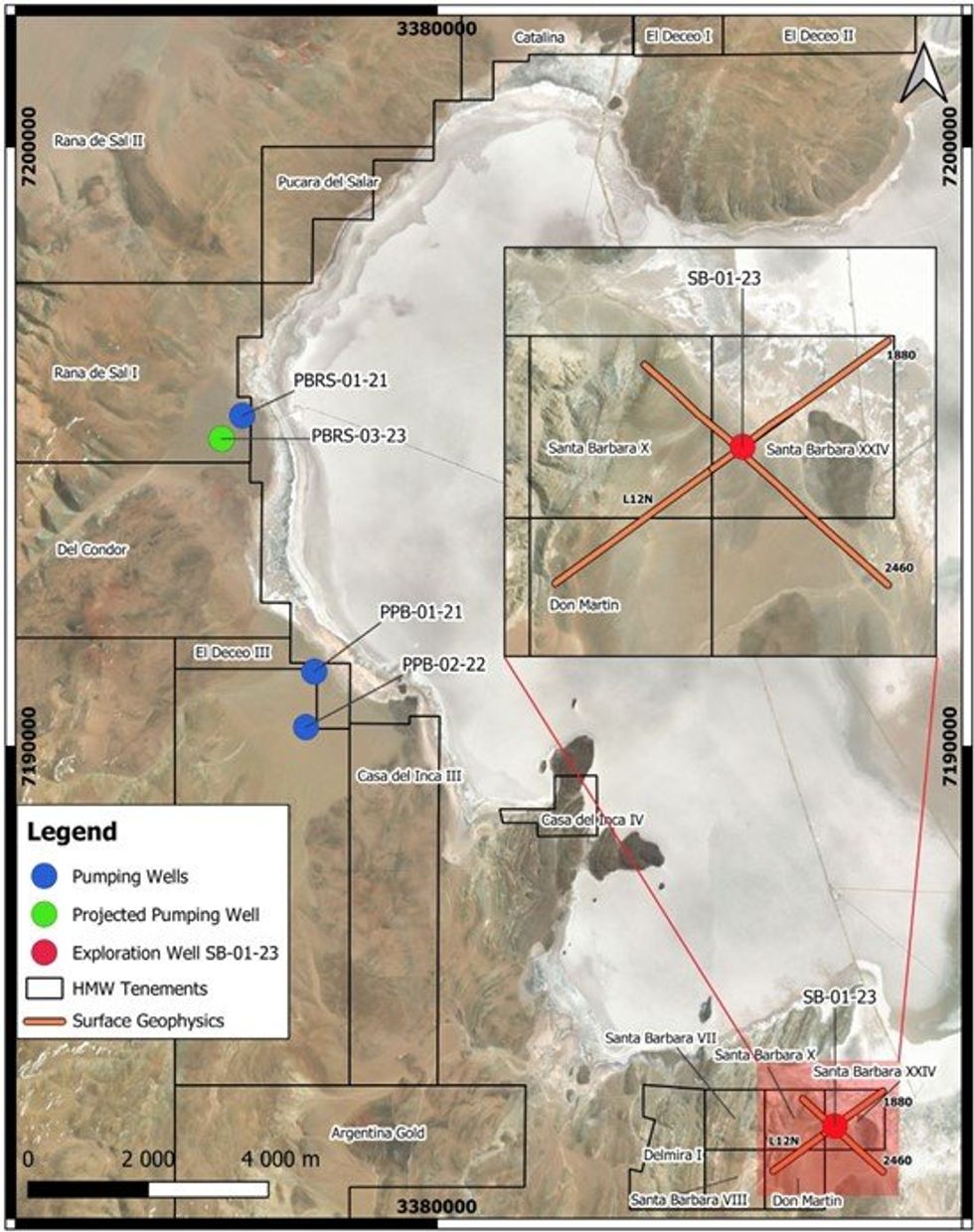

The first exploration diamond drillhole (SB-01-23) at Santa Barbara was completed at a depth of 455 metres through the alluvial sediments and underlying fractured breccia. 72-hour airlift testing of SB-01- 23 delivered an extracted high average lithium brine grade of 829 mg/L, with observed lithium brine grade ranges between 795 and 839 mg/L. New geophysical survey work over the Santa Barbara tenure has also evidenced brine continuity over the entire area.

Drilling activities have also commenced for three (3) new production wells in the current HMW Project resource areas, starting with production well No 4 (PBRS-03-23) at Rana de Sal I. This well is set to be drilled to an expected depth of around 380 metres proximate to a previously explored location. These three new production wells are set to complement the existing wells to ensure full brine flexibility for the extended pilot plant activities. These wells, along with the three completed wells, are expected to be part of the long-term HMW Project production infrastructure.

Galan Exploration Manager, Álvaro Henriquez, commented:

“Drilling and geophysical results from Santa Barbara have exceeded expectations in terms of brine chemistry, sedimentary thickness, and permeable lithologies. Brine continuity has also been readily demonstrated through the additional geophysical campaign conducted across those tenements. These overall Santa Barbara results deliver further strong growth potential in previously unexplored areas of our Hombre Muerto West brine deposit.”

Brine reservoir potential confirmed at Santa Barbara

Initial exploration well completed

Maiden Santa Barbara exploration well, SB-01-23, was drilled in the Santa Barbara XXIV tenement (Figure 1). This diamond drillhole was completed to 455 metres depth.

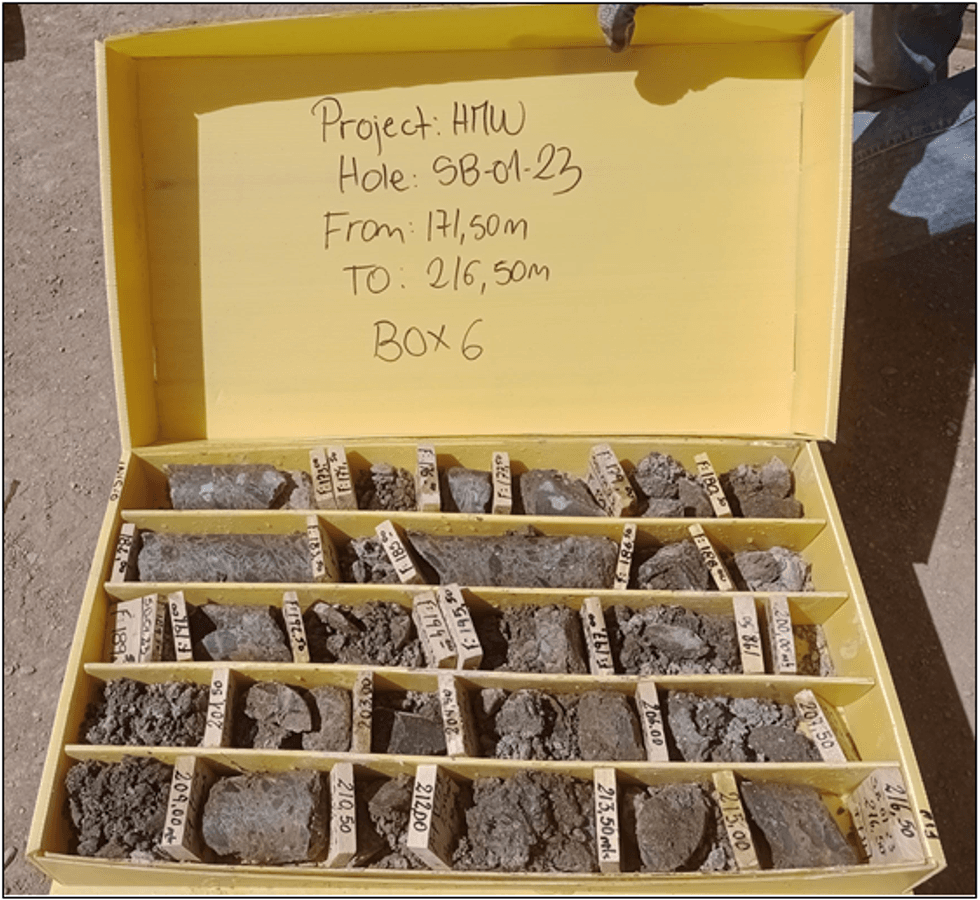

The recovered cores indicate the presence of thick gravel, sand and fractured breccia succession (Figure 2 and Table 1). These lithologies are likely associated with a high permeability aquifer.

Airlift testing delivers high-grade brine

A 72-hour airlift test was conducted on well SB-01-23 over the period 10 - 13 February 2023. A total of six (6) samples were recovered during the airlift test and chemical analysis was undertaken at Alex Stewart NOA laboratory in Jujuy, Argentina.

The average extracted lithium brine grade was 829 mg/L, with observed lithium brine grade ranges between 795 and 839 mg/L (Figure 3 and Table 2).

Click here for the full ASX Release

This article includes content from Galan Lithium, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

GLN:AU

The Conversation (0)

20 April 2025

Galan Lithium

Developing high-grade lithium brine projects in Argentina

Developing high-grade lithium brine projects in Argentina Keep Reading...

24 August 2025

Successful Due Diligence Ends - $20M Placement To Proceed

Galan Lithium (GLN:AU) has announced Successful Due Diligence Ends - $20m Placement To ProceedDownload the PDF here. Keep Reading...

01 August 2025

Final At-The-Market Raise for 2025

Galan Lithium (GLN:AU) has announced Final At-The-Market Raise for 2025Download the PDF here. Keep Reading...

30 July 2025

Quarterly Activities and Cash Flow Report

Galan Lithium (GLN:AU) has announced Quarterly Activities and Cash Flow ReportDownload the PDF here. Keep Reading...

25 July 2025

Incentive Regime for HMW Project in Argentina

Galan Lithium (GLN:AU) has announced Incentive Regime for HMW Project in ArgentinaDownload the PDF here. Keep Reading...

24 July 2025

Trading Halt

Galan Lithium (GLN:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

08 January

Top 5 US Lithium Stocks (Updated January 2026)

The global lithium market enters 2026 after a punishing 2025 marked by oversupply, weaker-than-expected EV demand and sustained price pressure, although things began turning around for lithium stocks in Q4. Lithium carbonate prices in North Asia fell to four-year lows early in the year,... Keep Reading...

07 January

5 Best-performing ASX Lithium Stocks (Updated January 2026)

Global demand for lithium presents a significant opportunity for Australia and Australian lithium companies.Australia remains the world’s largest lithium miner, supplying nearly 30 percent of global output in 2024, though its dominance is easing as other lithium-producing countries such as... Keep Reading...

05 January

CEOL Application for Laguna Verde Submitted

CleanTech Lithium PLC ("CleanTech Lithium" or "CleanTech" or the "Company") (AIM: CTL, Frankfurt:T2N), an exploration and development company advancing sustainable lithium projects in Chile, is pleased to announce it has submitted its application (the "Application") for a Special Lithium... Keep Reading...

29 December 2025

SQM, Codelco Seal Landmark Lithium Joint Venture in Salar de Atacama

Sociedad Quimica y Minera (SQM) (NYSE:SQM) and Codelco have finalized their long-awaited partnership, forming a new joint venture that will oversee lithium production in Chile’s Salar de Atacama through 2060.SQM announced on Saturday (December 27) that it has completed its strategic partnership... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00